10 biggest DeFi hacks in 2022

According to PeckShield, there were 135 attacks in 2022 during which DeFi protocols lost a total of more than $2.3 billion. This is 50% more than in 2021.

The top 10 DeFi protocol hacks as of December 2022 are listed below.

1. Ronin Bridge ($620 million)

The hack is believed to have been carried out by hackers from the Lazarus group, who are linked to the North Korean government.

Source: Twitter

2. Wormhole Bridge ($326 million)

The hacker managed to escape with all the money while remaining anonymous.

Source: Twitter

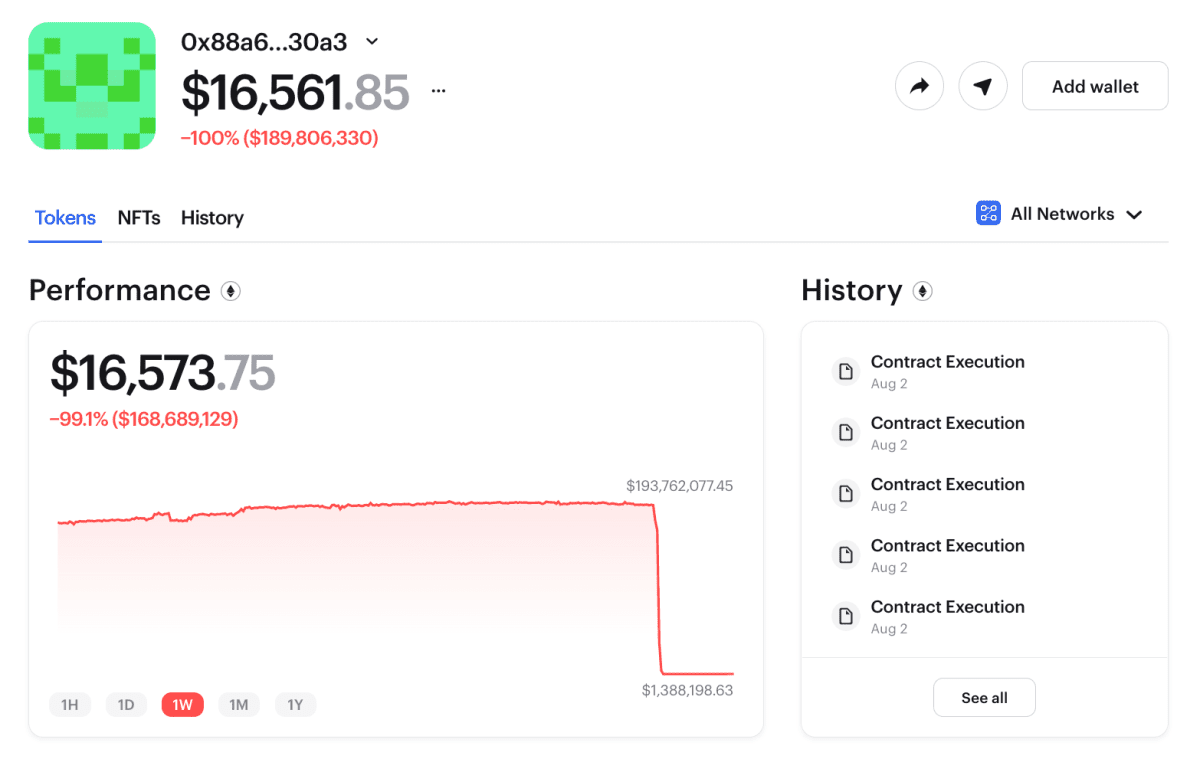

3. Nomad Bridge ($190 million)

Immediately after he began withdrawing money, hundreds of people followed his example, since this method was so simple: they just copied and pastes the hacker's transaction calldata and replaced the original address with their own.

In a couple of hours, the TVL of the project fell from $190 million to $16,000.

Source: Coinmarketcap

4. Beanstalk farms ($182 million)

He managed to get the required number of tokens using the bXZ lending protocol. After the hacker paid off his creditors, he got about $76 million in actual profit.

Source: Twitter

5. Wintermute ($160 million)

According to Wintermute CEO, the hack was caused by a serious bug in Profanity, an Ethereum address generation tool. Although he offered the attacker to return the money for a 10% reward, this never happened.

Source: Twitter

6. Maiar Exchange ($113 million)

In a single day, ELGD's price fell by 92% – from $62 to $5. It is noteworthy that ELGD soon recovered to its previous levels, and the token is currently trading at just above $40.

Source: Twitter

7. Horizon Bridge ($100 million)

The hackers moved about $35 million through Tornado Cash and vanished.

Source: Twitter

8. Rari Capital and Fei Protocol ($80 million)

The Rari and Fei teams attempted to contact the hackers and offered them a $10 million reward for the money returned. However, the hackers chose to launder the money through Tornado Cash and keep it all for themselves.

Source: Twitter

9. Qubit Finance ($80 million)

The attackers managed to steal 206,000 BNB, worth $80 million at that time.

Source: Twitter

10. Cashio ($48 million)

The total damage is estimated at $48 million. The price of CASH, which was previously pegged to the dollar at a rate of 1:1, fell to zero after the hack.

The hacker returned the money to the users that held less $100,000. In addition, he promised to donate the remaining funds to charity.

Source: Twitter

In 2022, the decentralized finance (DeFi) sector experienced several significant hacks. Here are the 10 biggest DeFi hacks in 2022: 1) Ronin Network - hackers stole over $600 million from the gaming-focused blockchain. 2) Wormhole - a cross-chain bridge, lost $320 million due to a security breach. 3) Qubit Finance - suffered a $80 million loss in a hack targeting its protocol. 4) Beanstalk Farms - experienced a $182 million exploit through the manipulation of its governance protocol. 5) Fei Protocol - lost $80 million in a reentrancy attack. 6) Rari Capital - hackers exploited vulnerabilities and took $79.3 million. 7) Inverse Finance - a DeFi lending protocol, faced a $15.6 million hack. 8) Horizon Bridge - a theft of $100 million via a compromised private key. 9) Saddle Finance - lost $10 million in a flash loan attack. 10) Mirror Protocol - suffered a $90 million exploit involving fake asset minting. These incidents highlight the need for improved security measures in the DeFi space.