2023 Trend: Liquid Staking & Top 4 Tokens to Watch

Platforms for liquid staking have emerged as a solution to the limitations of traditional staking, which prevent the use of locked assets. Essentially, this is a new sector of decentralized finance that allows you to release your liquidity without sacrificing rewards.

The liquidity offered through these platforms is a derivative instrument of the staked tokens, which can be exchanged for other cryptocurrencies or used as collateral on crypto lending platforms. For more detailed information on liquid staking, be sure to check out our separate article on the website.

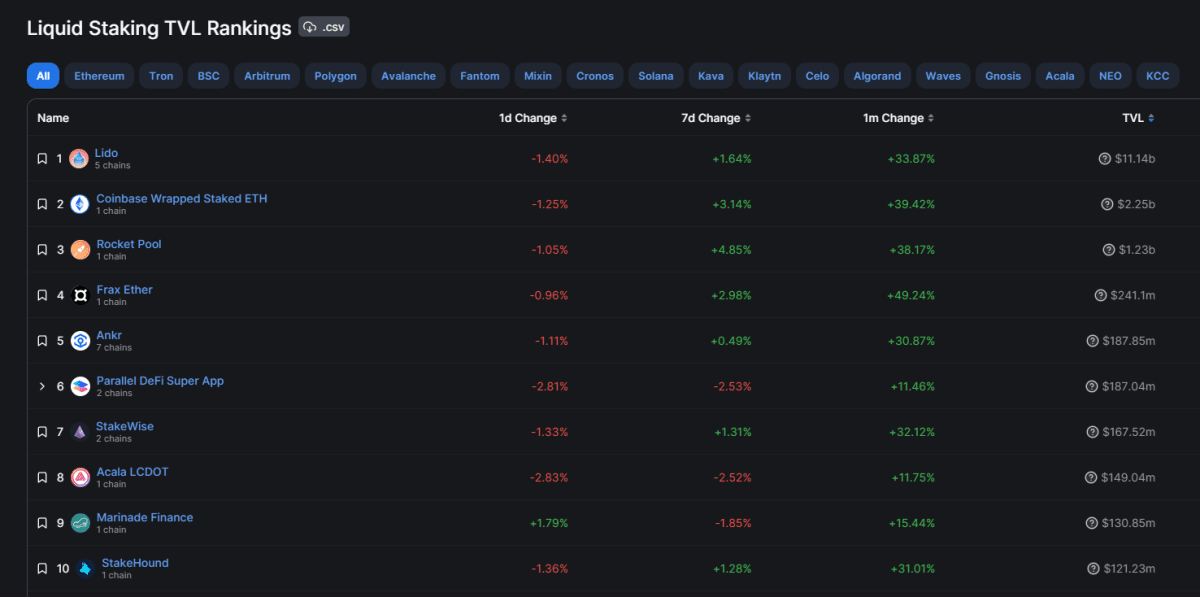

Ranking of Most Liquid Staking Platforms by TVL Source: DefiLlama

Lido (LDO)

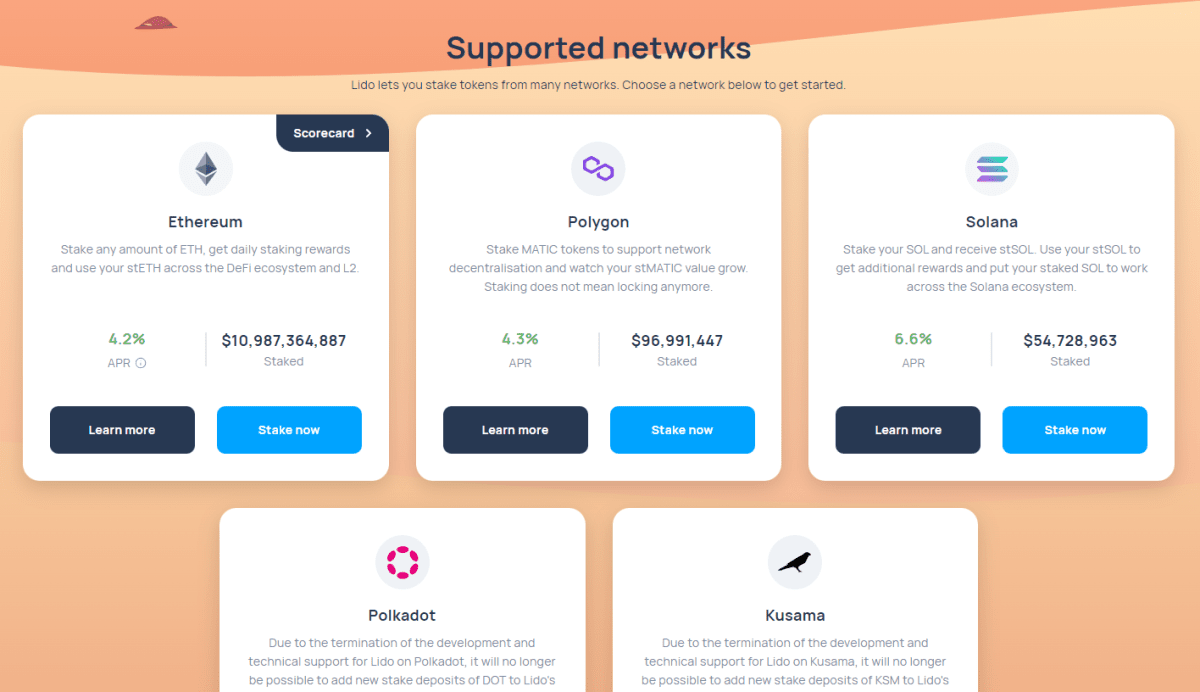

Lido is the market leader in liquid staking, occupying over a quarter of this sector on the Ethereum network. The total value locked (TVL) on the platform is over $11 billion, and it supports the following blockchains: Ethereum, Polygon, Solana, Polkadot, and Kusama. The APR for ETH is 4.2%, and it has two models of derivative instruments:

1) the staking reward is added to the derivatives separately;

2) the reward is included in the price of the derivatives, meaning their price increases relative to the staked tokens.

LDO is the governance token of Lido DAO. Its issuance is limited, with 87% of the maximum supply of 1 billion tokens currently in circulation. It is ranked 30th on CoinMarketCap (CMC) by market capitalization.

Lido Platform Source: lido.fi

Rocket Pool (RPL)

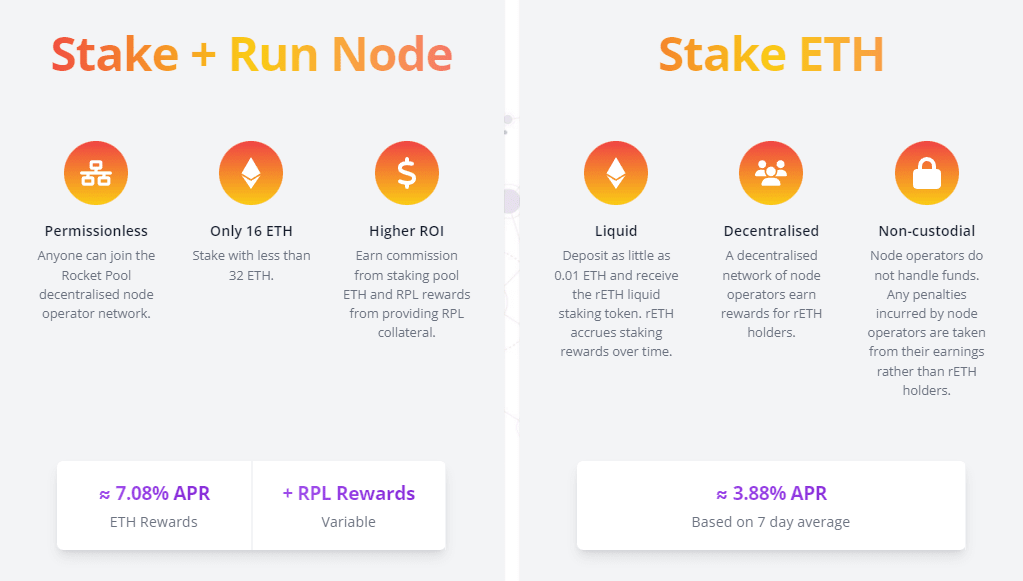

Rocket Pool has been operating since 2016. It is the third-largest platform by the amount of value locked ($1.2 billion), trailing behind the centralized exchange Coinbase, which also provides liquid staking services. The platform's distinctive feature is the ability to become a node operator (validator) and thus receive higher income (around 8% APR with RPL rewards). The standard APR is approximately 3.9%. It is supported only on the Ethereum network and follows a derivative model that includes the income from staking in the price.

RPL is the native token of the platform, which is required to become a node operator through Rocket Pool. It is also paid out as a reward to validators and gives voting rights in the Oracle DAO, which manages the project's decentralized organization. Its issuance is semi-limited and has an annual inflation rate of 5%. RPL is ranked 58th on CMC.

Rocket Pool Platform Source: rocketpool.net

Frax Finance (FXS)

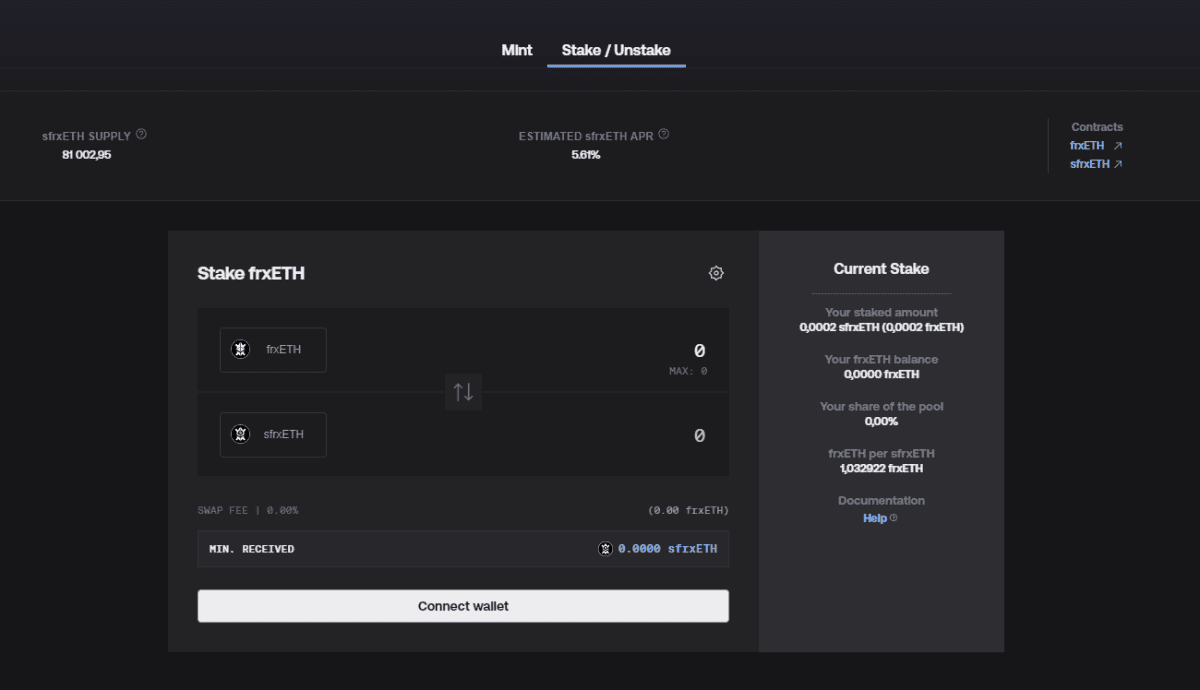

Frax Finance is a platform for liquid staking that offers one of the highest APRs in the market, around 5.6%. Both derivative instrument models mentioned in the Lido paragraph are supported, and the platform is only available on the Ethereum network. At the time of writing, the TVL is approximately $241 million.

Frax Shares (FXS) is the governance token that accrues fees, seigniorage revenue, and excess collateral value. Its issuance is unlimited, and it ranks 72nd in the CMC capitalization rating.

The project also has its stablecoin FRAX, which you can read more about in our separate article on the website.

Frax Finance Platform Source: app.frax.finance

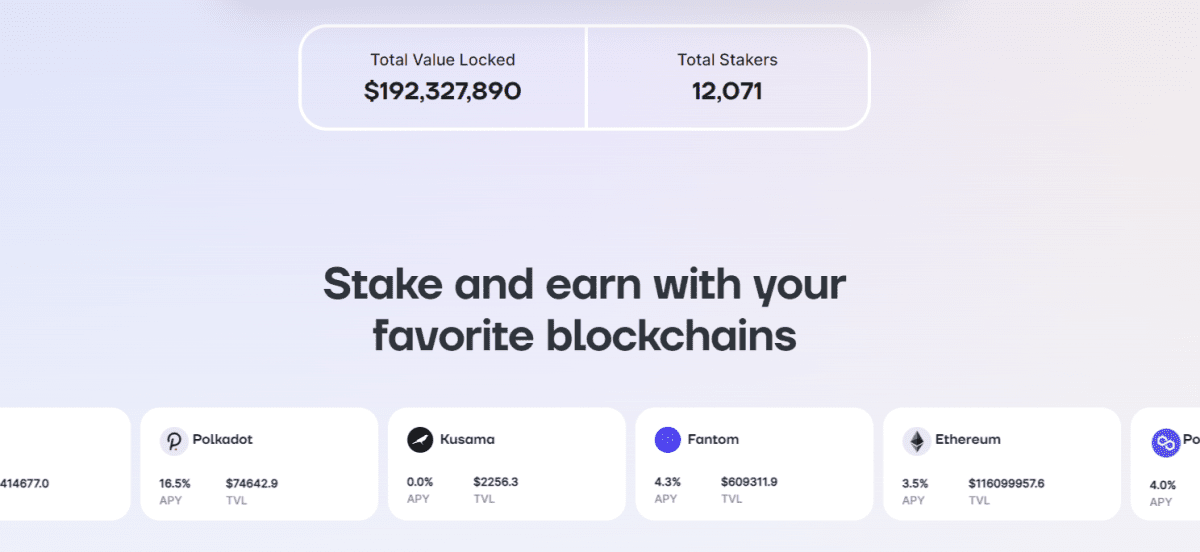

Ankr

Founded in 2017, Ankr offers liquid staking services and supports a wide range of blockchains, including Ethereum, BNB Smart Chain, Avalanche, Fantom, Polkadot, Gnosis, and Kusama. The APR for ETH coins is approximately 3.5%, and the platform uses a derivative model that includes staking income in its price. The total TVL on the platform is $188 million.

ANKR is the project's native token, necessary for using Ankr's various services. It also grants voting rights in platform governance and allows validators to monetize excess portions of their nodes. ANKR's issuance is limited, and approximately 97% of the tokens issued, which totals 10 billion tokens, are currently in circulation. It ranks 111th in the CMC capitalization rating.

Ankr Platform Source: ankr.com