30 billion USDT are connected to Alameda Research and FTX exchan

Alameda Research and FTX Exchange Market Maker issued 70% USDT as of 2021.

The friendship between Tether and FTX

According to Protos, as of 2021, 70% of the total supply of USDT (at that time around 30 billion coins) was directly sold to the investment fund Alameda Research and Cumberland company, which was the market maker of the FTX exchange. Back then, these two companies were doing a tremendous amount of work in the crypto market and they needed a lot of stablecoins.

In order to minimize exchange commissions, avoid slippage on the DEX, and prevent unnecessary questions from the regulator, Tether issued 30 billion USDT and transferred it to Alameda Research and Cumberland, in return receiving (or not receiving) payment in USD in the ratio 1:1.

Has Sam paid off?

Protos’ experts citing insiders say that Tether did not receive full payment for the issued USDT. It is likely that companies committed to paying off debt from future operating profits.

This version may turn out to be true for several reasons. There was another depeg of USDT after the FTX collapse when the stablecoin lost its peg to the US dollar and fell by 5%.

According to some insiders, the main reason behind the depeg was the short position opened by Sam Sam Bankman-Fried. That means that after his failure, the CEO of FTX began to short USDT to make some money. Seems like a logical move, assuming he knew that FTX subsidiaries didn't pay Tether for last year's deal. SBF (Sam-Bankman Fried) could not announce this publicly due to NDA, but this does not apply to opening a short position in USDT.

It also can not be classified as insider trading (making a profit using closed or confidential information), because if Tether accused Sam of insider shorting of USDT, it would confirm the rumor that the stablecoin is not backed by the dollar 1 to 1. Thus, Sam’s short would be open based on that rumor.

What’s next for USDT?

Court hearings will soon begin in the FTX bankruptcy case, and it is very interesting to hear what former employees of the exchange have to say. However, the potential damage can be estimated based on Tether's reserve data. According to the 01.01.2022 report, the stablecoin collateral consists of the following assets:

- 44% - short-term US government bills (Treasury Bills);

- 9% - cash and bank deposits;

- 31% - corporate bonds for up to 1 year;

- 16% - long-term bonds, precious metals, undisclosed investments marked "including digital assets".

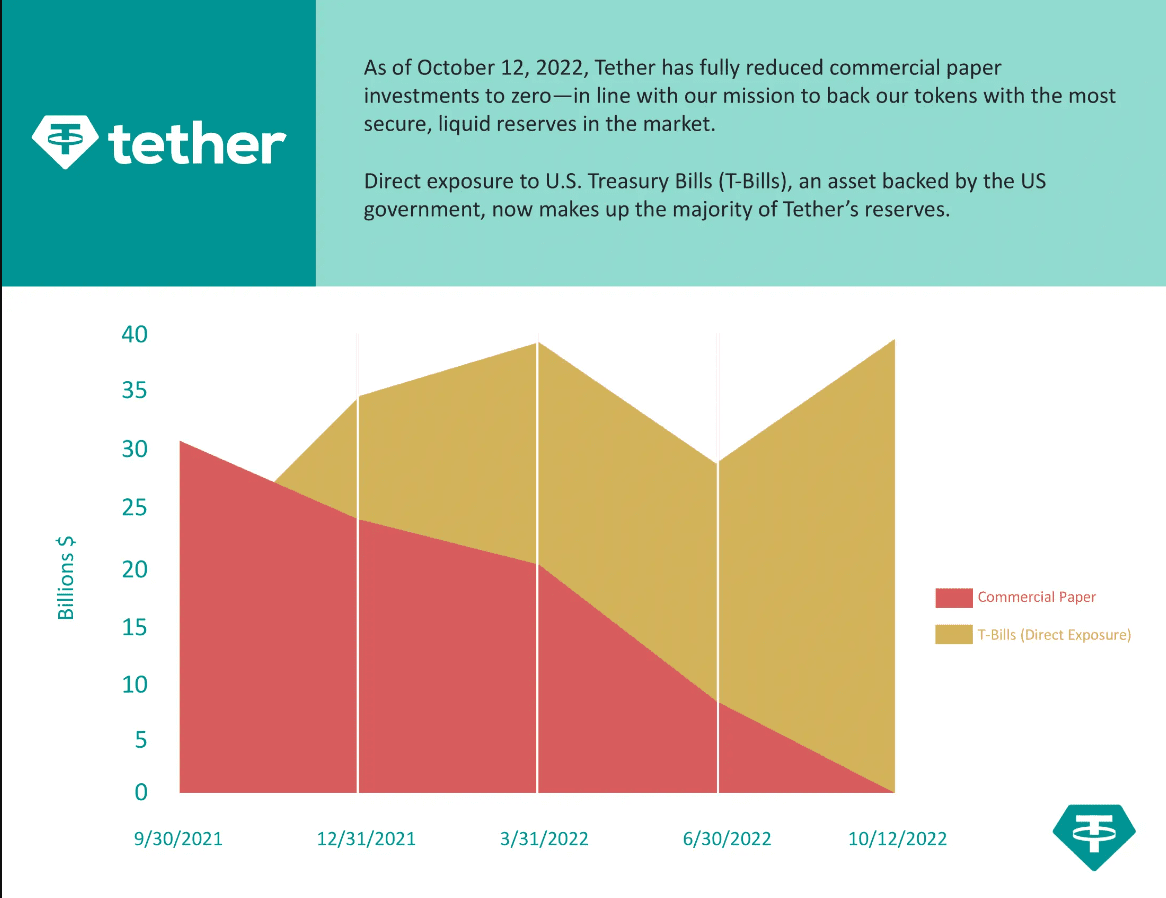

In October 2022, Tether updated its collateral to completely eliminate commercial paper, which was replaced by US government bills and fiat money.

Share of commercial paper in USDT collateral as of October 2022

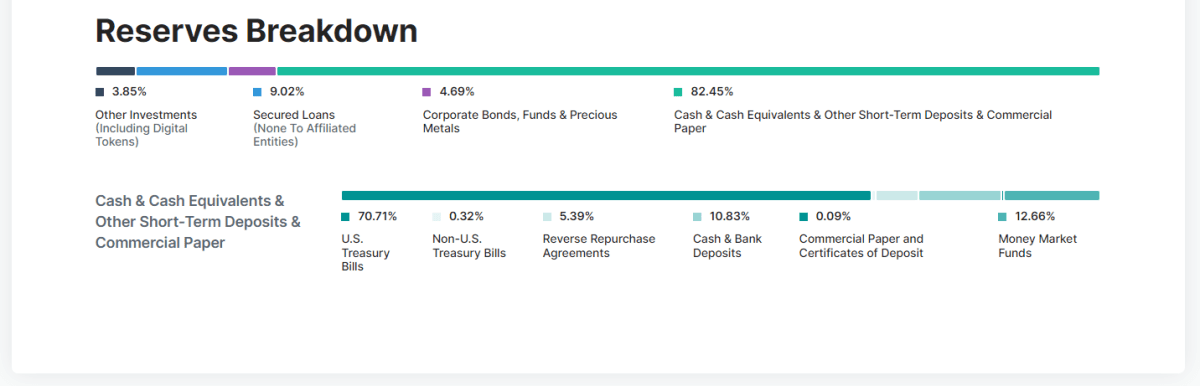

October 2022 USDT Reserve Report (https://tether.to/)

As stated in the report, Treasury Bills take about 70% of collateral, and fiat assets take no more than 11%.

USDT scam is very unlikely

In the worst-case scenario, Tether’s bank and cash accounts will be compromised. Probably, most of these funds would be immediately repaid in cash, so the "potential hole" would be reduced to 1-2%. Given that Alameda Research and FTX successfully completed another year and a half after the USDT mint, they had enough time to close their obligations.

It takes more than a rumor about missing $500-600 million in collateral for Tether to collapse. In the meantime, any USDT depeg looks like a good opportunity to earn 4-5%.

Recommended