Analyzing Altcoins SOL and LTC for August 4, 2023

Litecoin halving went off without a hitch, and BTC surpassed the $29,000 mark. Let's take a closer look at the market situation for Solana (SOL), and Litecoin (LTC).

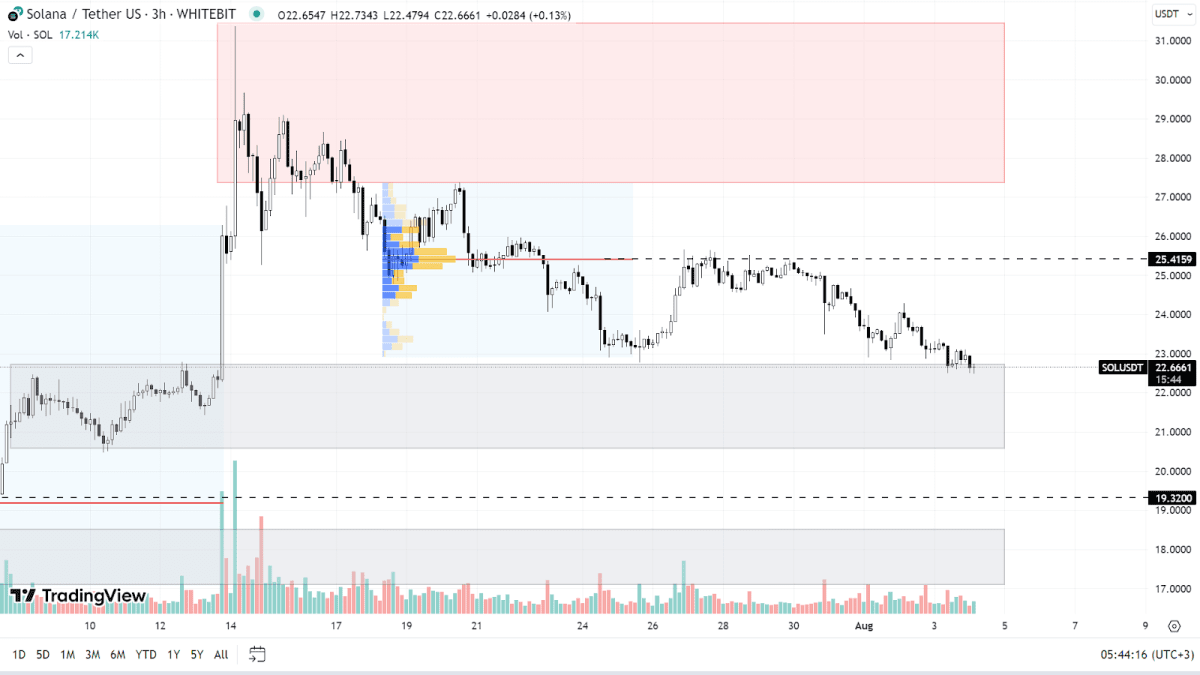

Solana (SOL)

Solana is trading around a broad support zone of $20.58-$22.70. To maintain its upward trajectory, it needs to push past the resistance threshold at $25.41 and then revisit the seller's domain ranging from $27.3 to $31.4. Since SOL often moves in lockstep with BTC, its future course will largely hinge on the performance of the main cryptocurrency.

If the correction continues, the next buyers' orders may be encountered within the support ranges of $19.32 and $17.1-$18.55.

SOL chart on the H3 timeframe

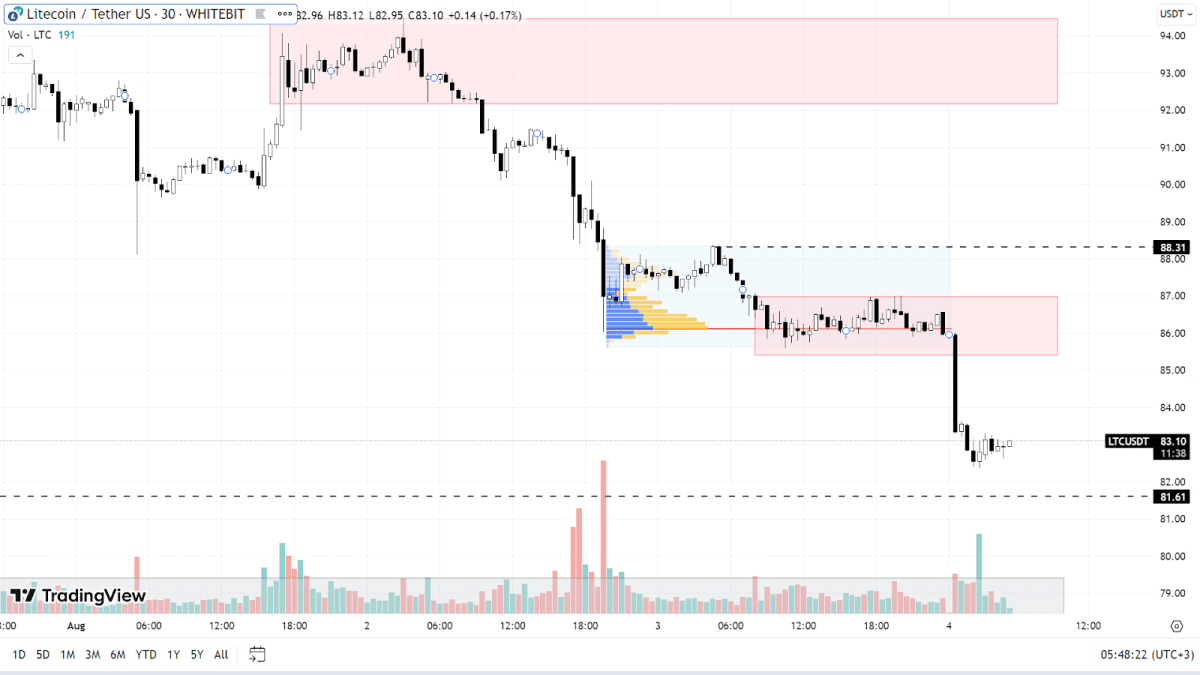

Litecoin (LTC)

As foreseen in our previous analysis of LTC, the market overestimated the impact of the halving. This event, which reduced miners' rewards by half, resulted in the LTC price sinking almost 10% in two days, hitting a new local at $82.4.

The asset is currently trading near the $81.61 mark, a level that might become the next destination if the downward drift continues. If this level is also breached, we could only expect more buying activity within the $74-$79.4 range.

To escape the current downtrend, LTC must traverse the $85.4-$87.0 resistance level and establish a foothold above the $88.3 level. In such a scenario, a trajectory towards $90 and the resistance zone of $92.1-$94.4 becomes a plausible path for buyers.

Even though the halving took place a mere two days prior, its effects on local timeframes are still highly pronounced. This aspect should be factored in when strategizing LTC trades.

LTC chart on the 30m timeframe

The landscape outlined in the BTC chart has remained consistent since yesterday. The crypto market typically experiences limited fluctuations over the weekend, and we anticipate a similar trend this time.

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. These are solely the opinions of the GNcrypto editorial board regarding the market situation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the movement of price between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K - $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended