Many technical analysis traders prefer these basic yet powerful strategies that can be combined. Using two or three indicators can be far more effective than using numerous tools that can be confusing.

In general, it all comes down to your skills, experience, and ability to “read the chart” and apply crypto trading strategies. These factors altogether increase the possibility of making money rather than losing money. Even the most organized and talented person is not 100% protected from the risk of suffering losses in the crypto market. Crypto trading is more suitable for people with a steady nervous system and a reserve of funds that they can afford to lose, rather than for those who are prone to fear and greed.

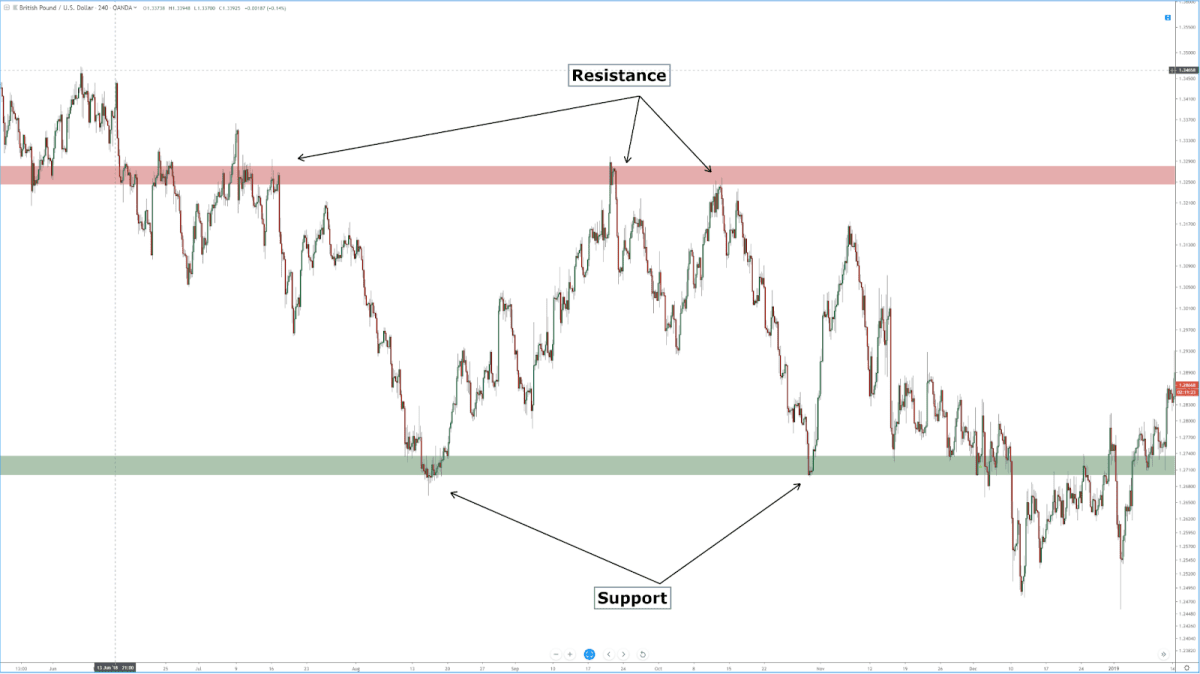

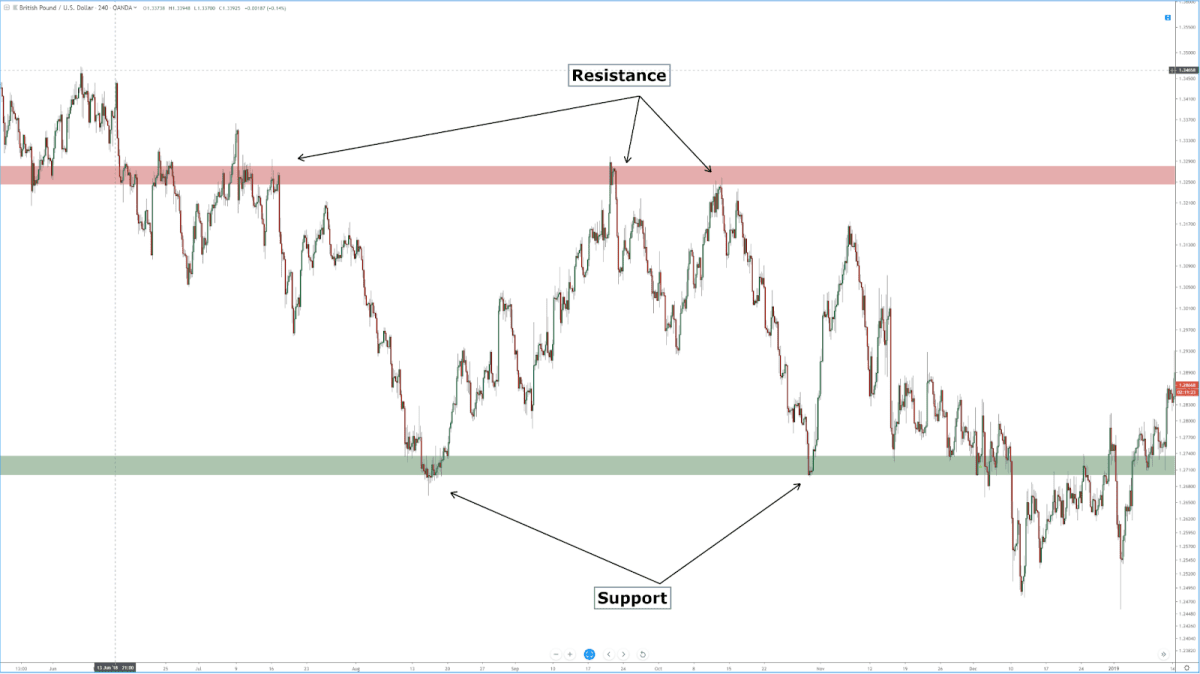

Buy support, and sell resistance

Support and resistance levels are the main elements of technical analysis. They serve as the basis for one of the most accessible and effective trading strategies for both beginners and advanced traders.

The support level is the area where the price shifts from the downward trend to the upward trend. If the price breaks through this level and starts to rise, this indicates that many traders have placed buy orders, and bulls control the market. The support level is the right time to open long-term positions and close short-term positions.

The resistance level is the area where the price of crypto rebounds from the reached ceiling and a downtrend starts. This level indicates the dominance of bears in the market due to the big number of sell orders. The resistance level is the right time to close long-term positions and open-short term positions at the resistance level.

Support and resistance levels on the chart. Source: Forex.academy

The most difficult aspect of this method is to define these levels. In traditional trading, they are built horizontally using previous extremes (upper and lower price limits on the chart). The lower horizontal line is the support level, and the upper horizontal line is the resistance level.

It is better to build them on at least three local extremes (they should be close to each other within a short period).

When setting levels, you should capture approximately a few points when working on the H1 timeframe, or several tens of points when using a daily interval. It is advisable to build support and resistance at high time intervals, such as daily, weekly and monthly periods. They are more precise as compared to hours and minutes.

RSI below 30 is a buy signal, RSI above 70 is a sell signal

RSI (Relative Strength Index) is a graphical indicator that can be used to determine if a cryptocurrency is overbought or oversold.

The RSI above 70 indicates that the asset is overbought, and generates a sell signal. The index below 30 suggests that the crypto is oversold and generates a buy signal.

The indicator shows more accurate data on longer time frames. If the analysis shows that the asset is overbought on monthly timeframes, this may be a signal to start selling.

RSI on the chart (blue curve at the bottom). Source: Investopedia

The index may occasionally diverge from the market situation. Divergence is the name given to this state. The RSI will indicate that the cryptocurrency is overbought, yet the price will drop even more. As a result, the indicator can be applied to the previous strategy as an additional signal.

Prices often go approximately in the same direction as this indicator, but it also happens that they start to spread in other directions. This indicates that the market's trading volume has changed, which is an obvious sign of a potential price reversal.

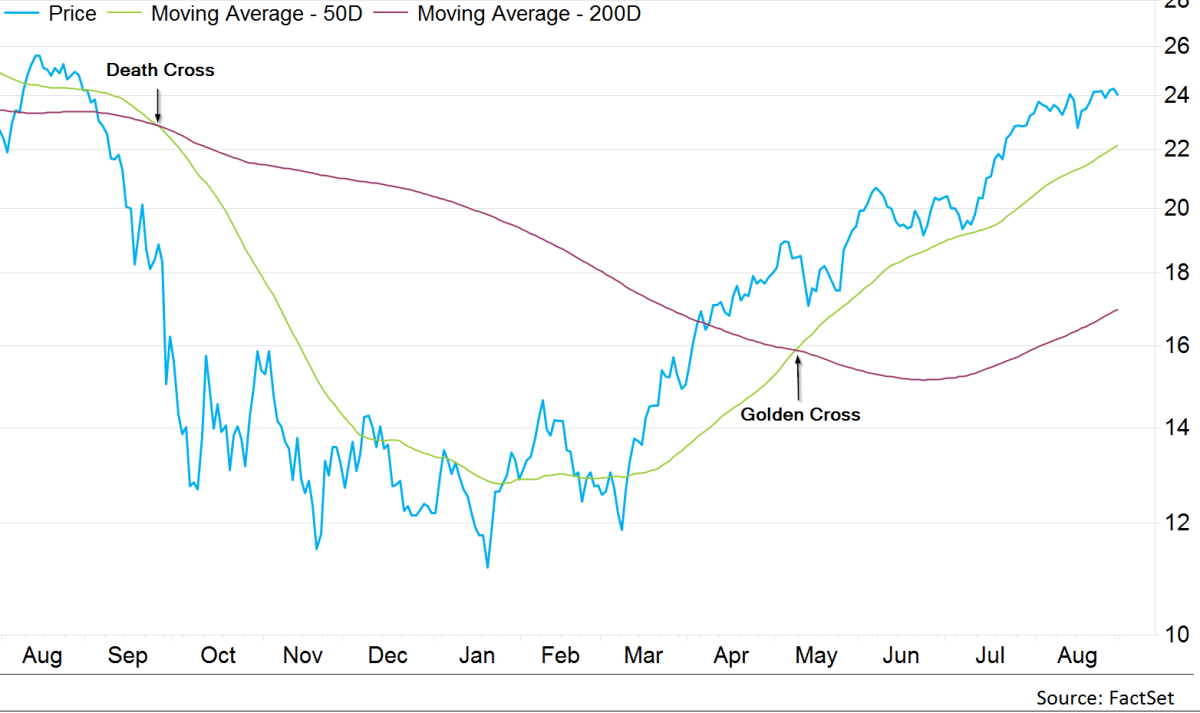

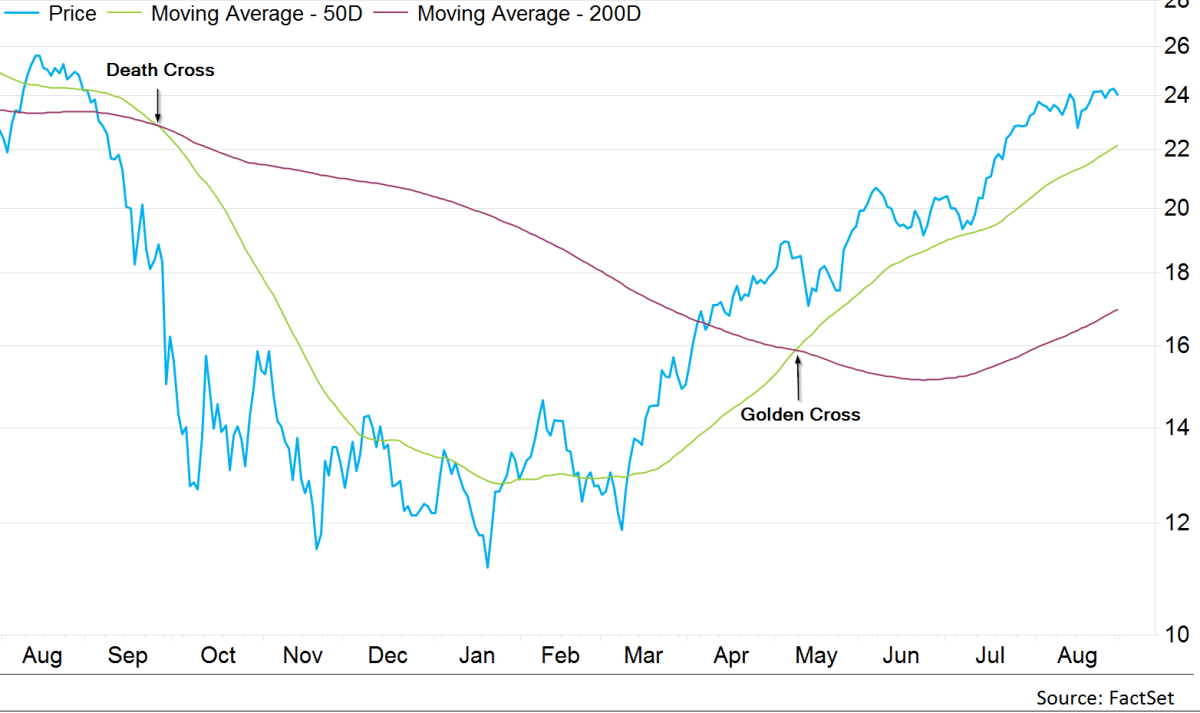

Moving average: golden cross and death cross patterns

It’s a long-term (18 months minimum) crypto trading strategy that works best for a volatile market. It works perfectly with the RSI indicator, as well as support and resistance levels. A simple moving average (SMA) allows traders to track price trends, and patterns in price behavior.

The main models of this strategy are the “death cross”, which indicates that bears dominate the market, and the “golden cross”, which shows that buyers dominate the market.

The death cross and the golden cross on the chart. Source: FactSet

When the 50-day SMA falls below the 200-day moving average, a downtrend (a death cross) occurs, signaling to sell. When the 50-day SMA rises above the 200-day SMA, an uptrend (a golden cross) occurs, indicating to buy.

Buy the rumor, sell the news

A trading crypto strategy refers to using price changes before and after an important event for a certain asset. A recent example of this trading method is the active purchase of ETH before it switched to the new consensus algorithm (The Merge) and then a subsequent sale after the actual blockchain update. Positive expectations of any changes are thought to cause the price to rise; however, after the event has happened, it is believed that the price will fall, as interest and attention to the asset wane.

The processes that may affect the crypto price in the short term include:

✔️ company reorganization;

✔️ takeover, cooperation;

✔️ new projects and updates;

✔️ bankruptcy.

The most essential aspect of this strategy is to differentiate regular daily news from fundamental events that can affect the asset’s price. This trading method is relatively subjective, as it is mostly based on the trader's assumption, which may be wrong.

You can apply all the trading strategies covered in this article, but keep in mind that we do not offer financial advice. This content is for educational and entertainment purposes only.