BSV Price Doubles: What Are the Driving Factors Behind the Surge?

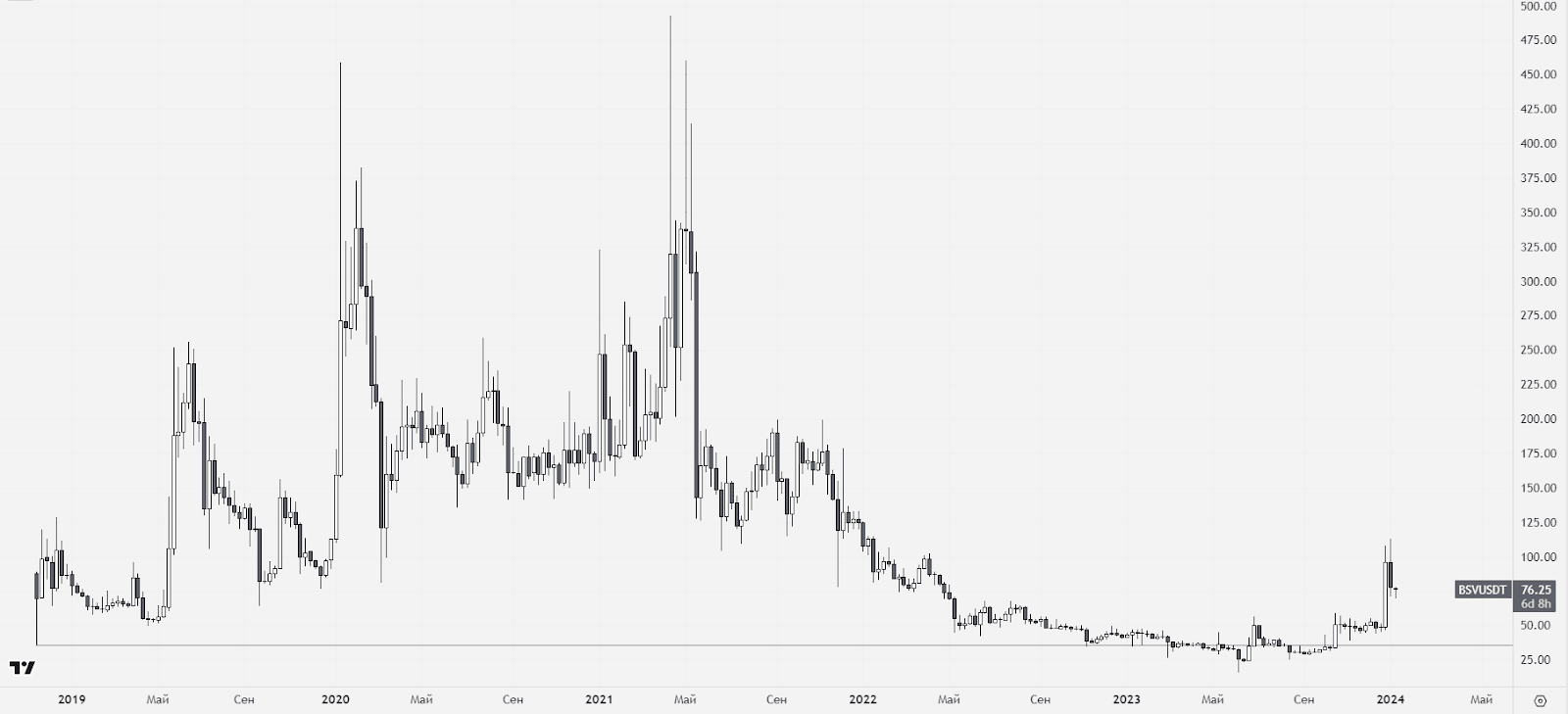

Bitcoin SV, the hard fork of Bitcoin Cash, diverged from the main network in 2018. Its value hovered between $150 and $250 for three years until it dipped below its historic low in November 2022. After 11 months of gradual build-up, BSV began an upward trend, which became more pronounced towards the end of the year.

BSV/USDT weekly chart. Source: tradingview.com

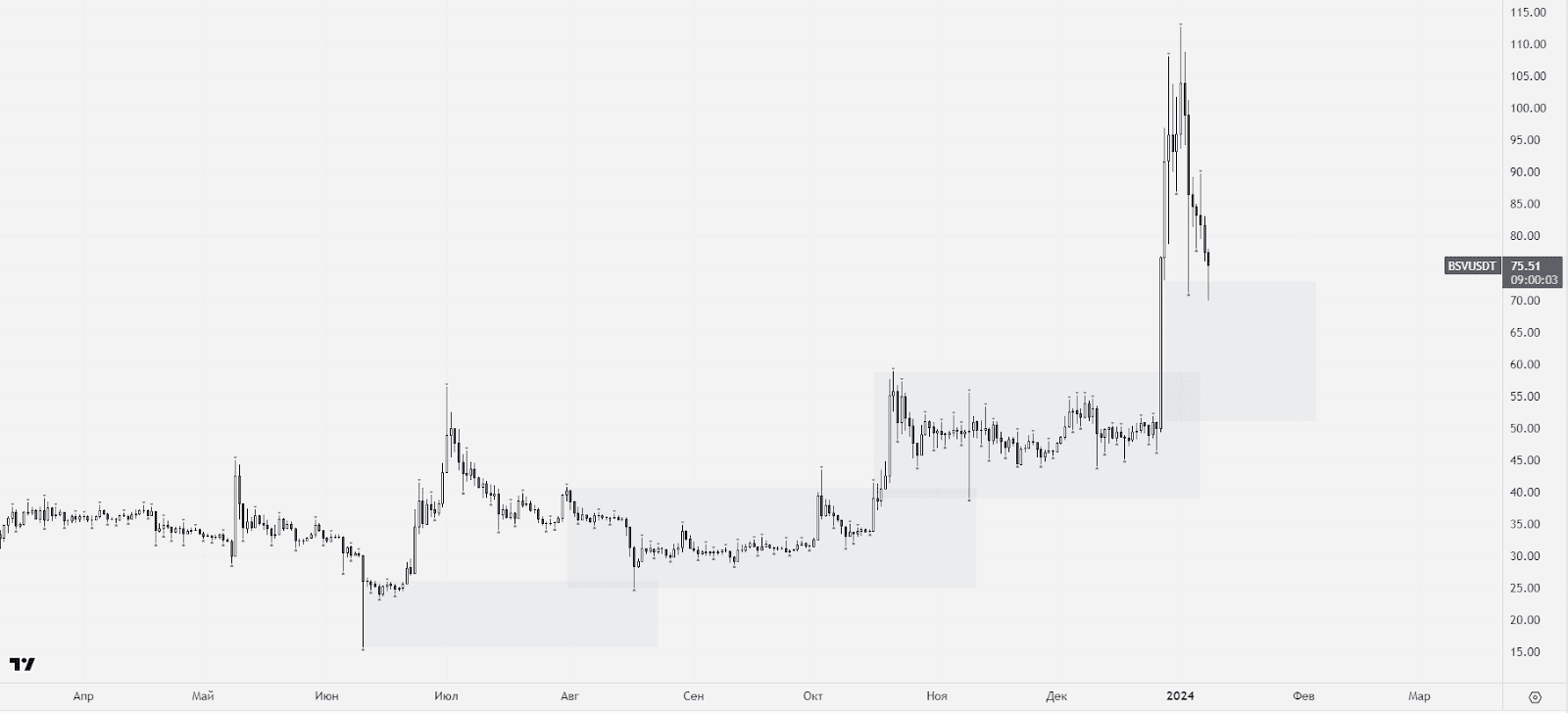

Despite Bitcoin's temporary downturn, Bitcoin SV saw a remarkable 132% increase in its value in the last week of 2023, hitting the $112 mark. This rise caught many off guard, though there is a discernible pattern behind it..

What is Bitcoin SV?

Initially, Bitcoin's framework matched the market's demands. Yet, the community knew more scalable solutions were needed for wider adoption. Since its 2009 launch, Bitcoin has been upgraded and modified several times.

One notable endeavor to enhance Bitcoin was the introduction of the Bitcoin Cash hard fork in August 2017, which split the blockchain into incompatible branches. The primary distinction between BCH and BTC lies in the block size, expanded to 32 MB in BCH, enabling more transactions per block and thereby boosting network efficiency.

BCH's deviation from Bitcoin's original principles, including the addition of anonymity features, led to a faction of the community, including Craig Wright, forming a new fork: Bitcoin SV, in 2018. The 'SV' stands for 'Satoshi's Vision,' aligning with the ideology of adhering to the developmental ethos Bitcoin's creator set in 2009.

The South Korean Trading Frenzy

The year-end rally of BSV is largely attributable to a surge in interest from South Korean traders. On December 28, 2023, Upbit, a South Korean exchange, accounted for 65% of the daily trading volume of BSV. Remarkably, BSV/KRW (South Korean won) transactions constituted 13% of the exchange's total operations.

Upbit's trading volume significantly outpaced that of other exchanges for BSV. For example, Bitcoin SV's trading volume was only 9% on OKX and 7% on BiONE.

The boost in BSV’s popularity among South Korean traders is linked to a December 27 announcement of eased cryptocurrency regulations. The government disclosed plans to simplify the process for officials to report crypto earnings in the following year through the Public Service Ethics Information System (PETI).

Crypto Market's Upbeat Sentiment

In the final four months of 2023, the leading cryptocurrency saw a 79% increase. Investor anticipation of potential ETF approval is a key factor driving this trend. The strong correlation between Bitcoin and Bitcoin SV exerts a more pronounced influence on the latter compared to other cryptocurrencies.

BSV's Key Daily Support Zones. Source: tradingview.com

Technically, the price trend seems rational, establishing multiple support zones that act as buffers for momentum. Following significant trading activities in these zones by major players, the price is likely to continue its upward trajectory toward more ambitious goals.

Will Bitcoin SV Experience Growth in 2024?

The trajectory of Bitcoin SV in 2024 will likely mirror the general crypto market trend. On a fundamental level, the project is less stable compared to Bitcoin or BCH. Notably, in August 2021, it suffered a 51% attack, temporarily fragmenting the network into three chains. This 12-hour incident, however, caused no user harm.

The delisting of BSV from Coinbase on January 9, 2024, is also noteworthy. The loss of confidence from one of the leading crypto exchanges undeniably casts a shadow over the asset's future value prospects.

Recommended