BTC and LTC Price Analysis for November 15, 2023

Bitcoin failed to hold above $37,000, falling to $34,800. Here's an analysis of the market situation for Bitcoin (BTC) и Litecoin (LTC) as of Wednesday, November 15.

Bitcoin (BTC)

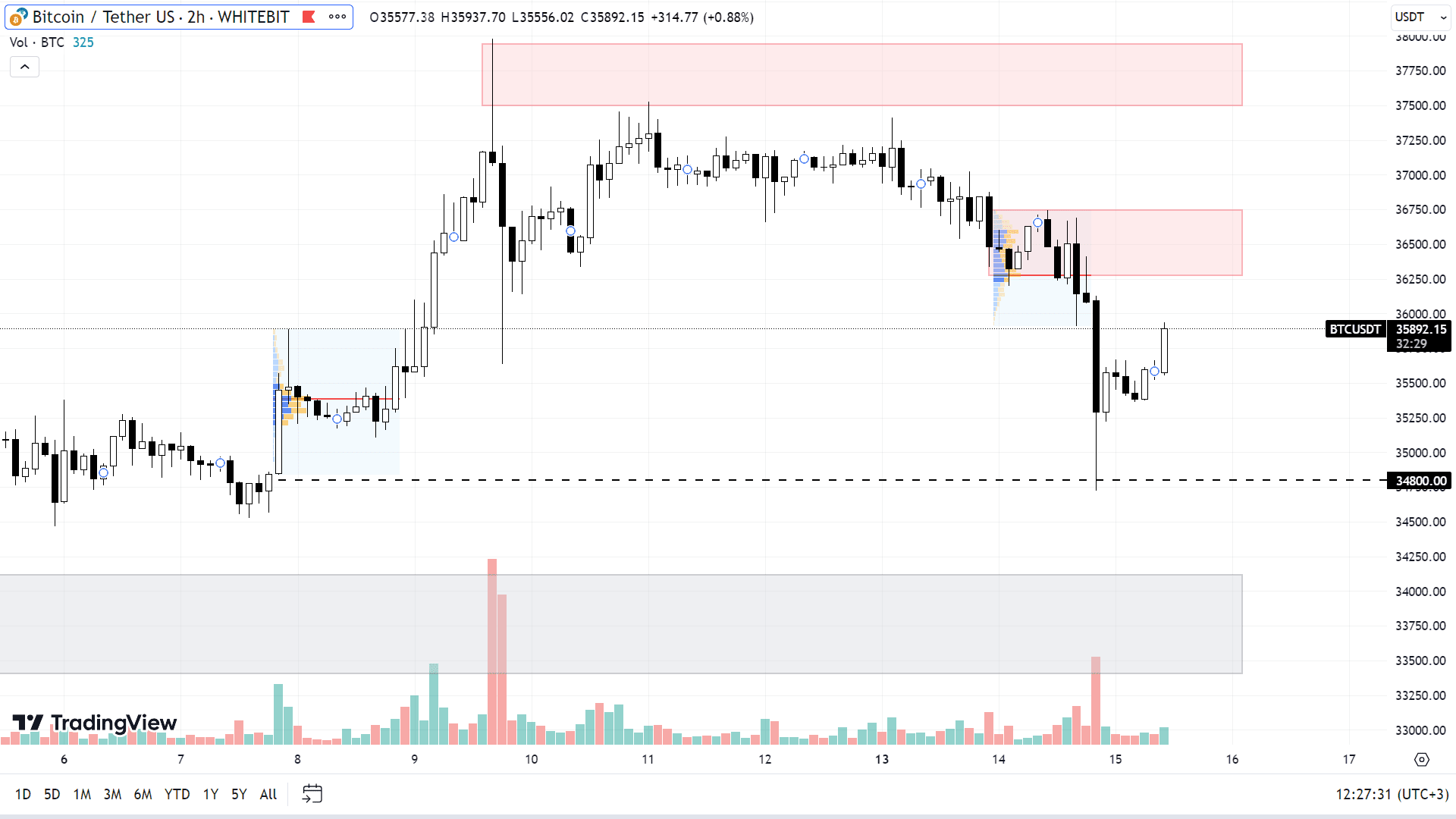

Yesterday's decline in Bitcoin precisely matched the support levels highlighted in our previous analysis. Currently, Bitcoin is trading in a range, bounded by a buyer's level at $34,800 and a resistance zone between $36,250 and $36,700.

For Bitcoin to regain its upward momentum, it needs to break through this existing resistance soon and aim to retest the higher resistance zone at $37,500-$38,000. These movements should ideally occur on significant trading volumes to confirm the buyers' continued strength.

If Bitcoin fails to break through, we could witness a deeper correction. The next potential support levels for BTC might be set at $33,400-$34,100, $31,500-$32,600, and as low as $30,700. Considering the correlation between the cryptocurrency market and Bitcoin, a 10% fall in the BTC price could lead to a 15-25% drop in altcoins.

BTC chart on the H2 timeframe

Litecoin (LTC)

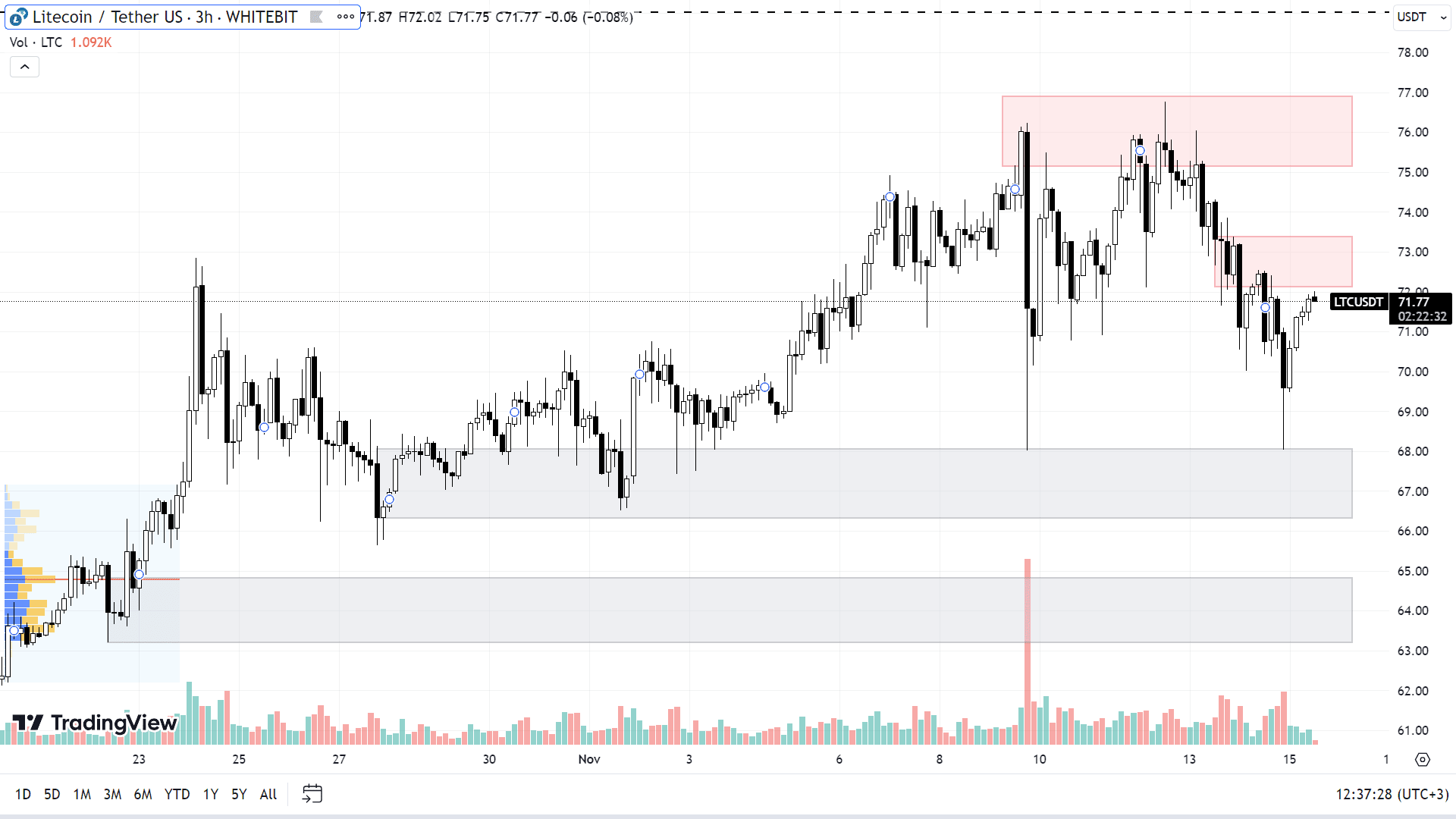

Bitcoin's recent downturn has also influenced Litecoin's price. The asset has repeatedly tested the $66-$68 support zone, five times in the last two weeks, with the price rebounding relatively quickly each time. Litecoin is currently hovering around the resistance zone of $72.1-$73.3.

For LTC, continuing its upward trend remains a priority, but this is contingent on Bitcoin exhibiting a similar pattern. The immediate goal for buyers is to retest the seller's zone at $75.1-$76.9 and attempt to reach a new local high of around $79.

Should the correction persist, it could have a substantial negative impact on Litecoin. The cryptocurrency might decline to the $63.2-$64.8 zone, and if Bitcoin falls to $30,000, LTC could hit a new local low below $60, effectively nullifying its gains over the past month. Thus, short-term investments in LTC currently carry a significant risk.

LTC chart on the H3 timeframe

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the price movement between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K – $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended