BTC and MATIC Chart Analysis for August 23, 2023

BTC briefly dipped to a local low at $25,354 yesterday but swiftly recovered within its trading range. Here's an in-depth look at the market dynamics for Bitcoin (BTC) and Polygon (MATIC) as of August 23.

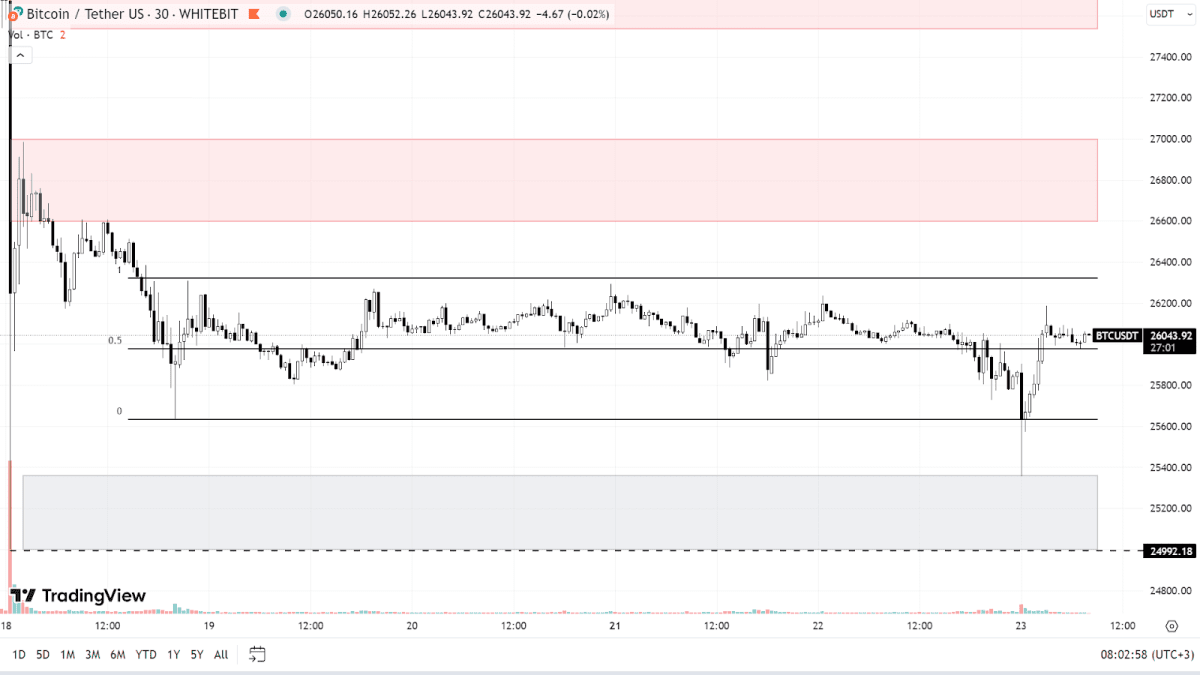

Bitcoin (BTC)

Bitcoin continues to trade sideways, fluctuating between a support level of $25,600 and a resistance level of $26,300. In the Smart Money concept, a brief price movement outside this range is termed as a "divergence." Such an event suggests the potential for the asset's price to shift in the opposite direction, essentially forming a divergence mirror.

In line with this notion, we could anticipate BTC probing the $26,580-$27,000 bracket soon to sense the response from sellers. A step further from this resistance brings us to the $27,500-$28,100 range; holding ground above this would signal the winding down of the ongoing bearish phase.

If the BTC price drop below $25,600, there's potential for an extended downtrend. In this scenario, Bitcoin may target the support zone of $24,600-$25,300, possibly setting a new local low.

BTC chart on the 30M timeframe

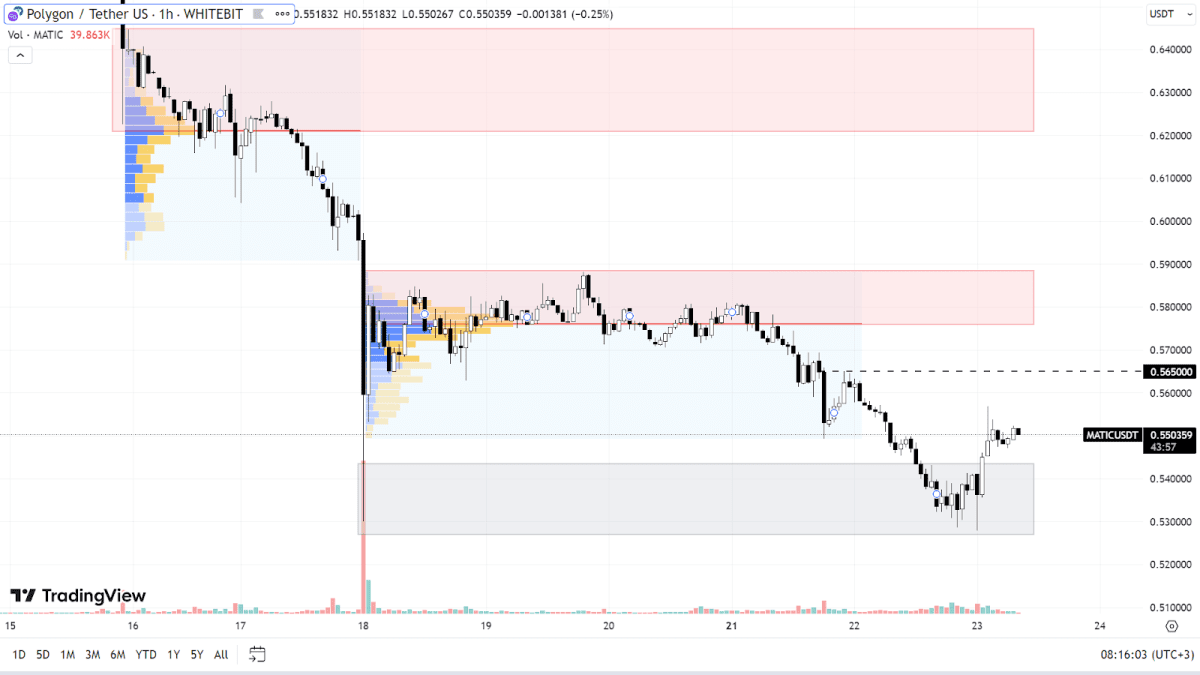

Polygon (MATIC)

MATIC is highly sensitive to BTC's movements. Last night, the coin hit a local low at $0.528, narrowly missing its yearly low from January 10 at $0.513. Currently, it's hovering in the support zone of $0.527-$0.543. If the correction continues, MATIC might test the psychological mark of $0.5, where the buyers' genuine intentions will become apparent.

On a lower timeframe, a key resistance stands at $0.565. Beyond this, there are selling zones from $0.576-$0.588 and $0.62-$0.644. The overarching trend will lean bearish until the asset surpasses $0.700.

Additionally, MATIC's price could be adversely influenced by fundamental factors, such as the reconsideration of Ripple's case in court. If the SEC's appeal succeeds, it would override the previous court decision, putting several altcoins, including MATIC, at risk.

MATIC chart on the H1 timeframe

This week, besides the announcement of the U.S. initial jobless claims on Thursday and a scheduled speech by Fed Chair Jerome Powell on Friday, there aren't any significant economic updates expected. Consequently, market volatility might remain subdued through the end of August.

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. These are solely the opinions of the GNcrypto editorial board regarding the market situation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the movement of price between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K - $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended