BTC and TRX Technical Analysis for November 9, 2023

This morning, Bitcoin rose by 4.5%, setting a new annual high at $36,850. Here's an overview of the market situation for Bitcoin (BTC) and Tron (TRX) as of Thursday, November 9.

Bitcoin (BTC)

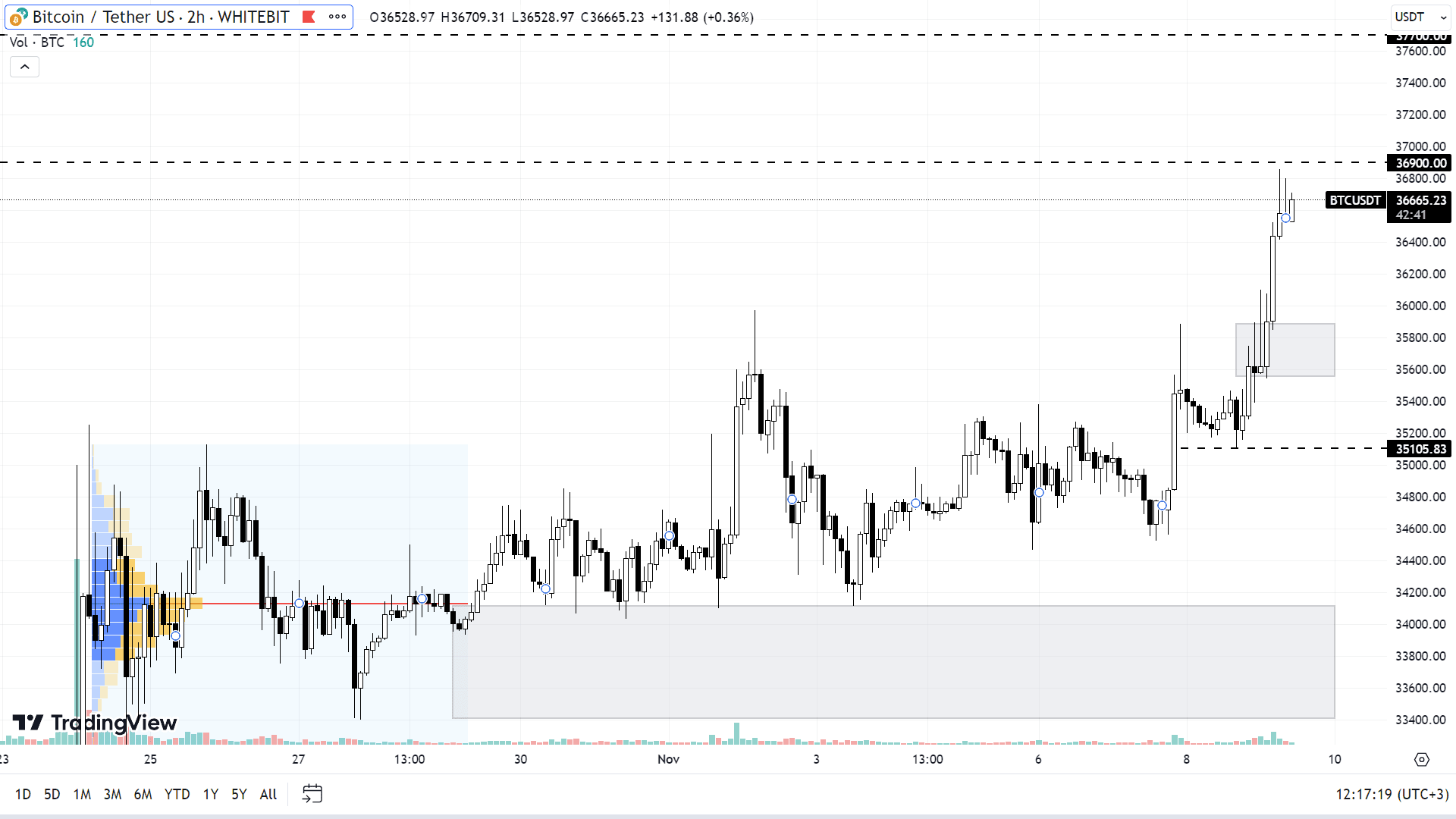

After an extended period of trading above the $35,000 mark, Bitcoin has continued its upward trajectory, which is consistent with our predictions in the previous analysis.

The next targets for buyers are the resistance levels at $37,700 and $38,400. Bitcoin might need to consolidate at these levels before achieving these milestones. However, with no significant selling pressure in the market at the moment, the coin has the potential to smoothly extend its gains. A secure foothold above the $36,000 mark would be preferable to prevent any unwanted downturns.

In case of a corrective movement, BTC could test the support ranges of $35,500-$35,800, $35,100, and $33,400-$34,100. Given the absence of any significant pullbacks during the recent rally, a short-term setback of 5-10% is likely at some point, but for now, sellers seem reticent to place their orders.

BTC chart on the H2 timeframe

Tron (TRX)

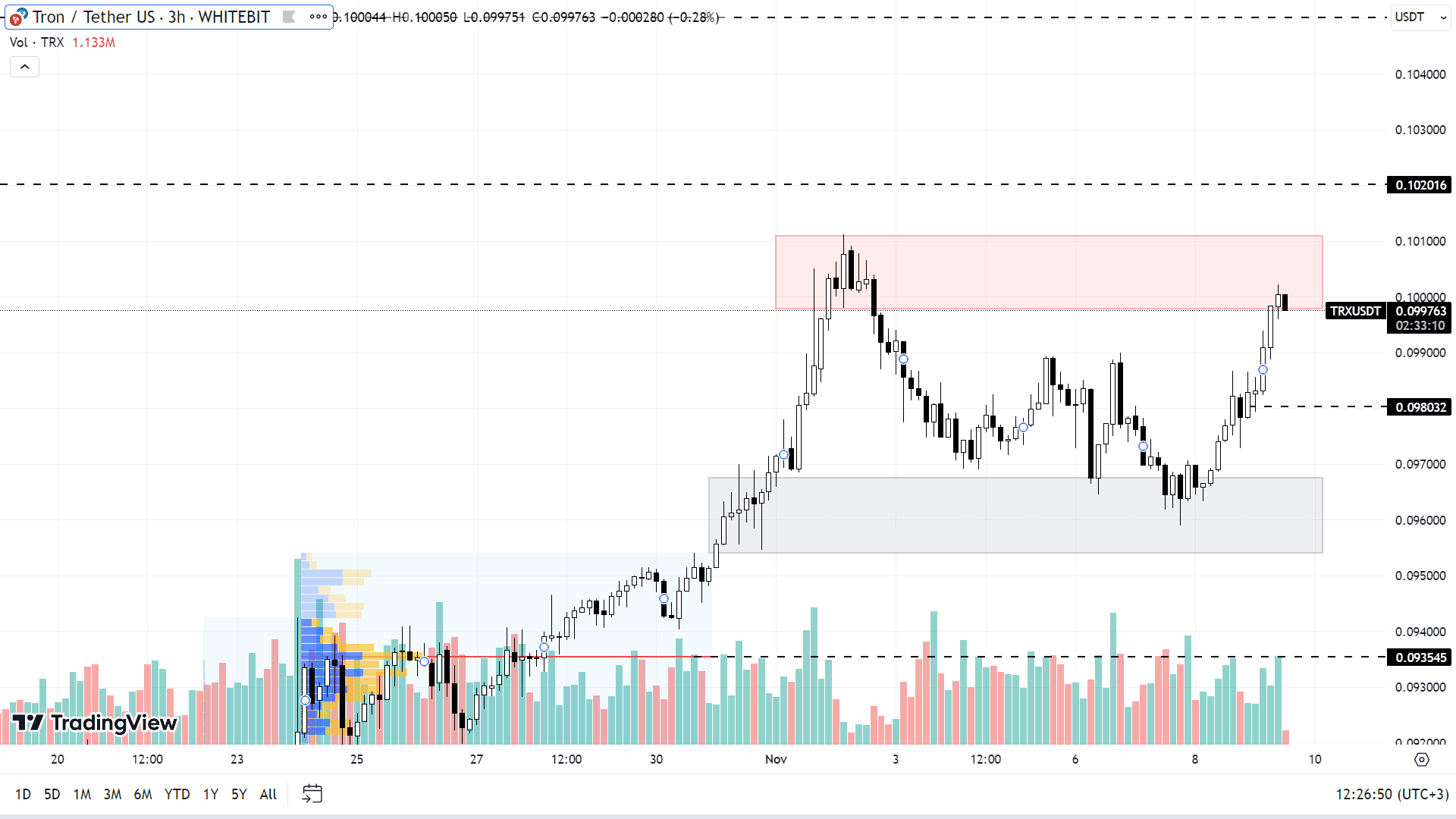

TRON is arguably the only one among the old guard of altcoins that continues to show positive dynamics on both the local and global charts. In five months, the asset has surged by 55%, with this growth being quite steady and punctuated by necessary corrections.

As of now, TRX is trading close to the resistance zone of $0.0997-$0.1010. The primary expectation is that the growth will persist, potentially renewing the annual high at the marks of $0.102 and $0.105. Further ascent could also be on the horizon, assuming Bitcoin's price remains steady.

Should Bitcoin undergo a correction, it could similarly affect the TRX trajectory. Under those circumstances, the asset might revisit the support levels around $0.0980, $0.0950-$0.0960, and $0.0935.

TRX chart on the H3 timeframe

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the price movement between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K – $23,400).

Gray range on the chart — a support zone.Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended