BTC and XRP Technical Analysis for October 12, 2023

Bitcoin continues its local downtrend, experiencing a 2% drop yesterday. Let’s explore the market dynamics of cryptocurrencies Bitcoin (BTC) and Ripple (XRP) for Thursday, October 12.

Bitcoin (BTC)

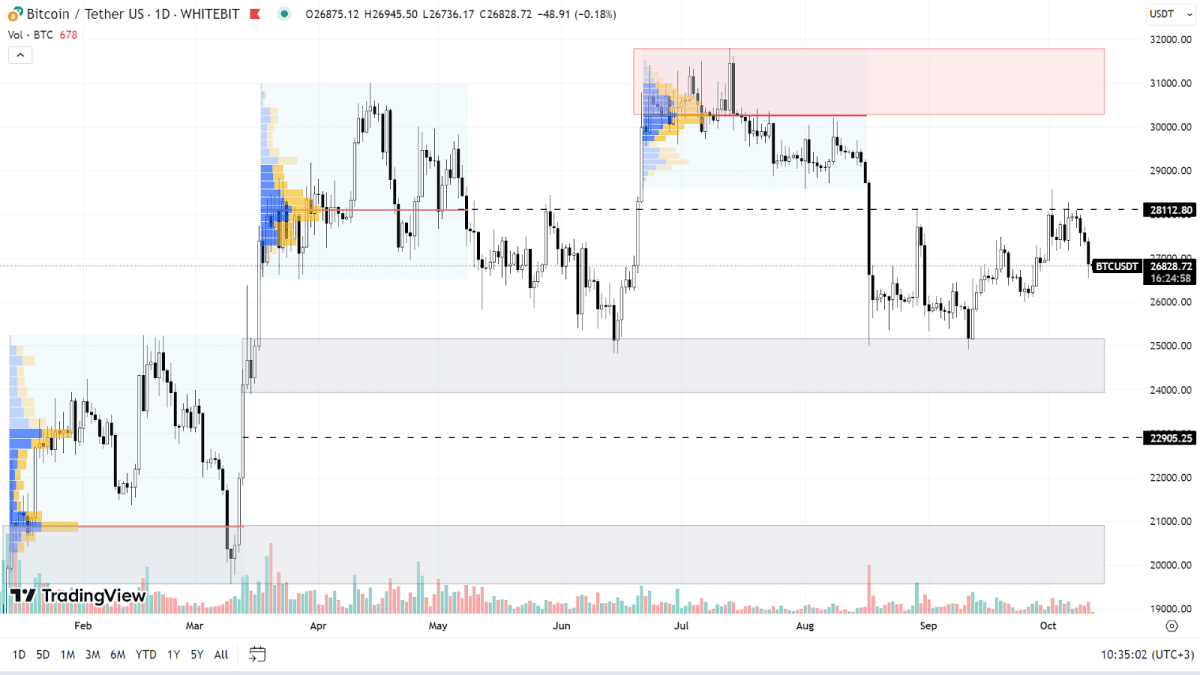

To discern the BTC global trend, it's prudent to review a broader Daily timeframe. Throughout 2023, Bitcoin has sustained its bullish momentum, hitting a summertime high of about $31,800.

At present, the leading cryptocurrency is trading within a support range of $24,000-$25,100 and a resistance level of around $28,100. The anticipated move leans towards maintaining its bullish trajectory, aiming to retest the $30,300-$31,800 range with an eye on surpassing this year's high.

Conversely, a more profound price dip remains a feasible outcome. Should this unfold, sellers might drive the price toward the $22,900 mark, where it'll be crucial to gauge buyer response.

BTC chart on the Daily timeframe

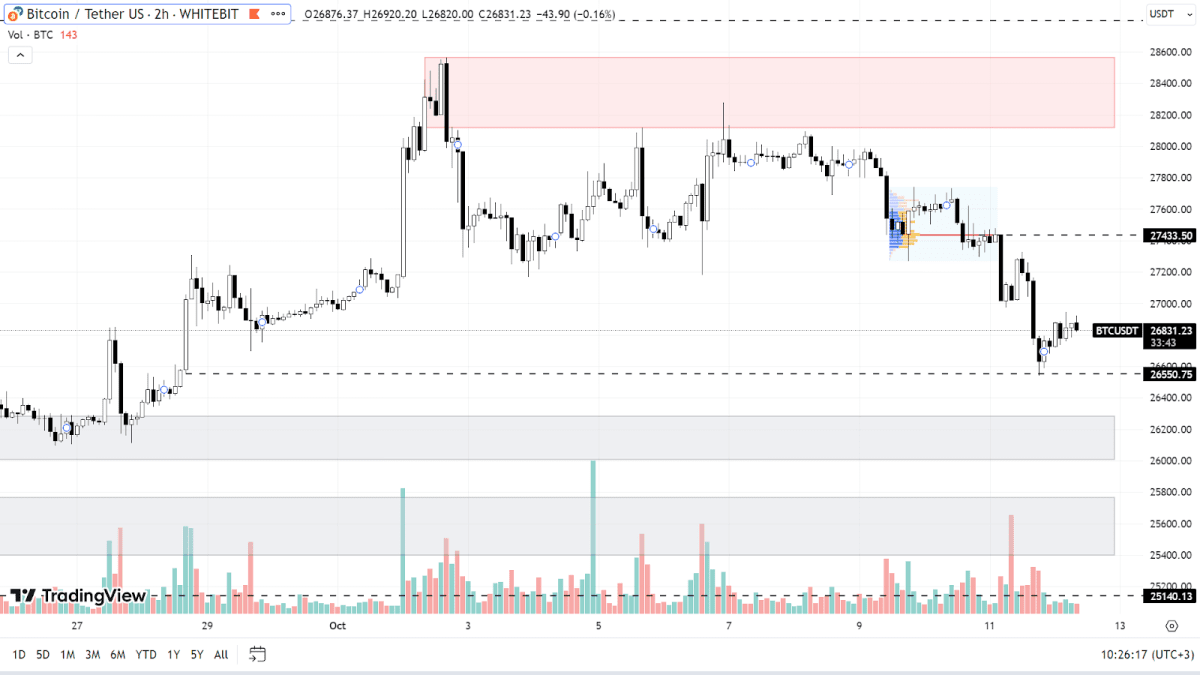

On the H2 timeframe, Bitcoin continues its recent downturn that began on October 9. At the moment, BTC hovers around the $26,550 support level, which managed to stem the decline from yesterday. To break out from this decline, Bitcoin would need to stabilize above the $27,000 mark, meaning it should close above this threshold on either the H2 or H4 charts.

Beyond $27,000, sell orders have been placed at $27,440 and between the $28,100-$28,500 range.

If Bitcoin fails to show a positive trend soon, we might see a deeper correction. The next notable buy orders are situated within the support ranges of $26,000-$26,300 and $25,400-$25,750, and at the psychological level of $25,000.

BTC chart on the H2 timeframe

Ripple (XRP)

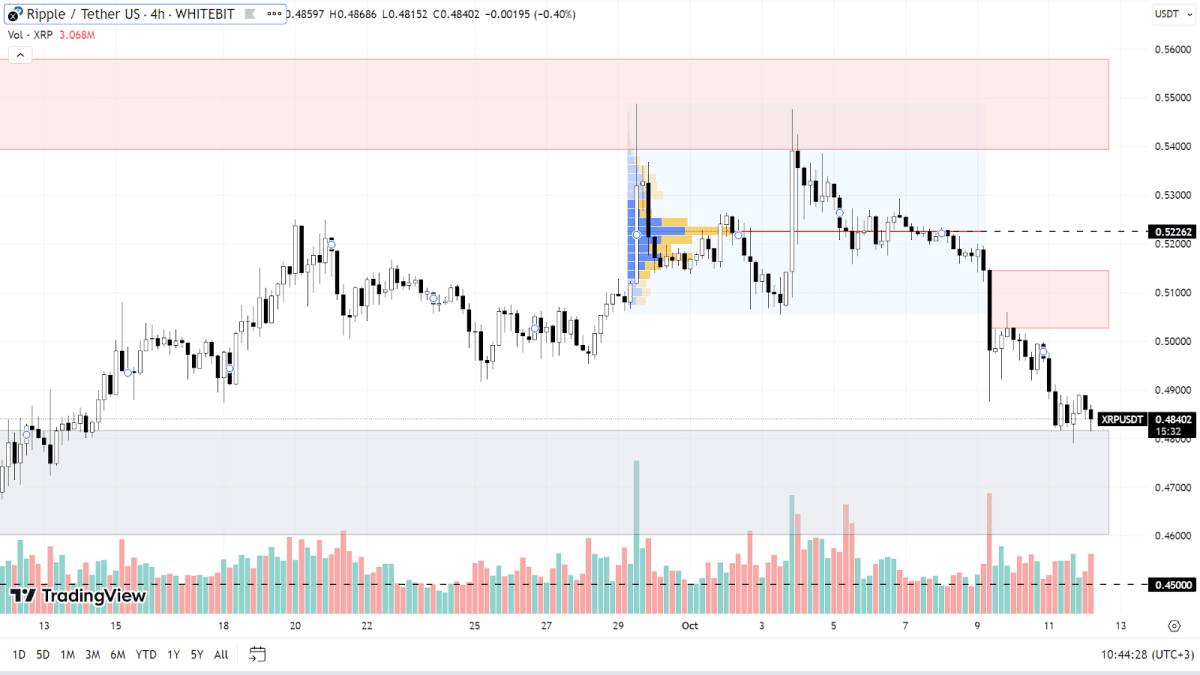

Ripple's surge on July 13, sparked by its provisional legal win against the SEC, has since been entirely negated. Currently, the cryptocurrency trades between a support range of $0.46-$0.48 and a resistance range of $0.50-$0.515.

Should buyers step in with force, XRP has the potential to test the resistance at $0.522 and further to the $0.540-$0.557 range. There's a possibility of forming a sideways trading channel between this range and the $0.46-$0.48 support zone.

If Ripple experiences a drop, it could revisit the previous lows at $0.450 and $0.423, which were established on August 17.

XRP chart on the H4 timeframe

Today, market participants await the release of the Consumer Price Index, which gauges the inflation level in the US. The influence of this indicator on the crypto market can be explored in a dedicated article.

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. These are solely the opinions of the GNcrypto editorial board regarding the market situation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the movement of price between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K – $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended