BTC, ETH and PAXG Price Analysis for December 4, 2023

Over the weekend, Bitcoin sustained its upward trajectory, achieving a new annual high at $41,735 on Monday morning. Here's an overview of the current market situation for Bitcoin (BTC), Ethereum (ETH), and Pax Gold (PAXG) as of December 4.

Bitcoin (BTC)

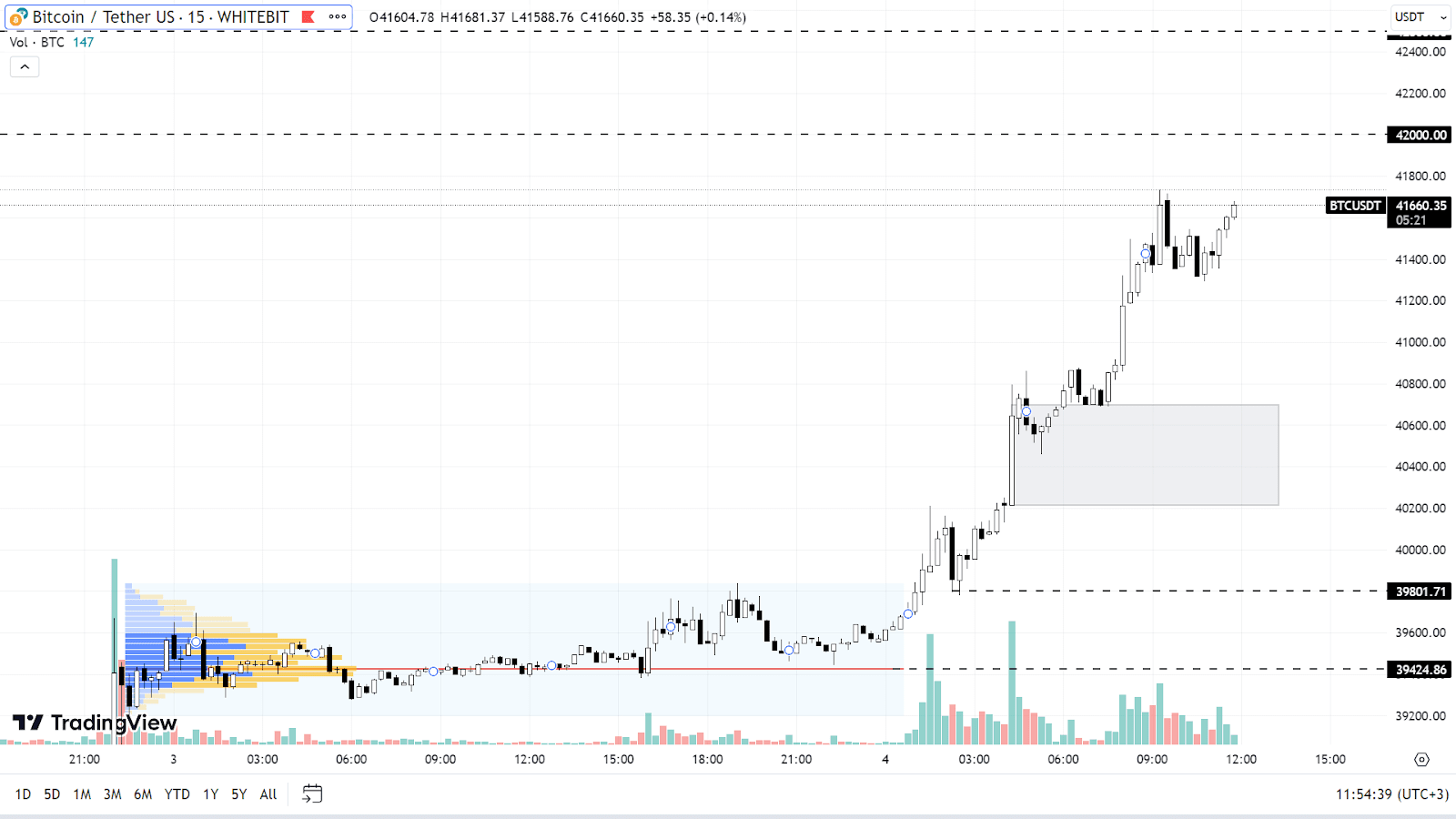

In the past three days, BTC has increased by 8%, breaking the crucial psychological barrier of $40,000, where many sell orders were placed.

At present, maintaining the upward trend and further positive momentum for BTC is the primary scenario. Buyers are likely to quickly move past the next resistance levels at $42,000 and $42,500. The key target for this trend is around the $45,000 mark, where a substantial concentration of sell positions is located.

Significant corrections in the BTC chart are not anticipated. If there is a temporary dip, the asset might test support zones at $40,200-$40,700, $39,800, and $39,400. A general correction could be considered if BTC's price decisively breaks below the $39,000 level on substantial trading volumes.

BTC chart on the M15 timeframe

Ethereum (ETH)

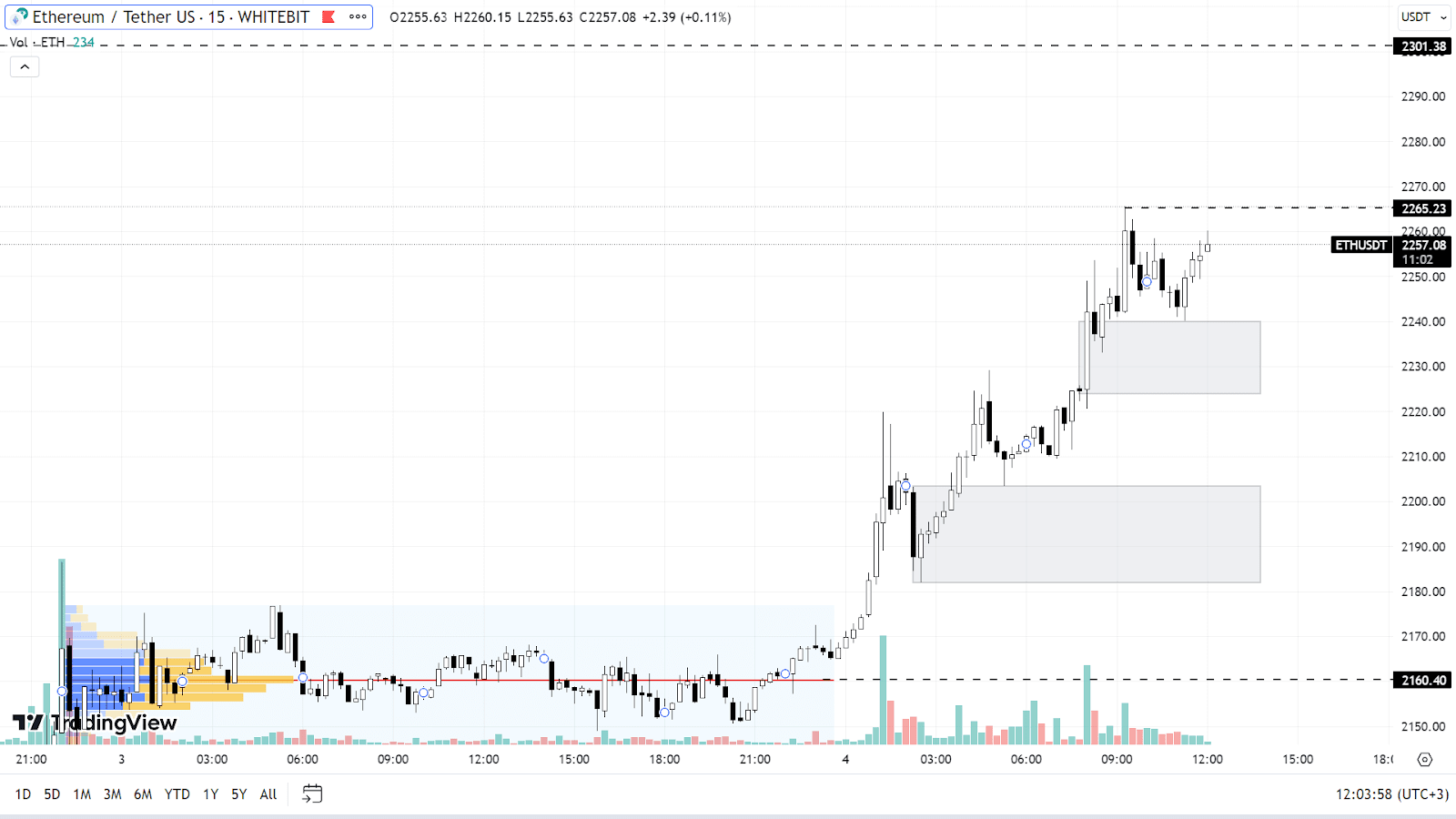

In comparison to BTC, the ETH price is rising more slowly, which suggests the potential for the asset to reach new annual highs. Since December 1, ETH has appreciated by 9%, currently trading near the price level of $2,265.

Buyers are likely to keep pushing the price up this week. Consequently, a rapid increase in growth could occur, potentially triggering a brief altcoin season. This scenario might unfold if Bitcoin's growth stalls and it enters a period of sideways trading.

A correction in Ethereum's chart, akin to Bitcoin, appears unlikely. Current buyer orders are situated within the support zones of $2,224-$2,240 and $2,182-$2,205. Ethereum's price could also reach $2,160. A significant correction may only start if the asset's price firmly drops below $2,000.

ETH chart on the M15 timeframe

Pax Gold (PAXG)

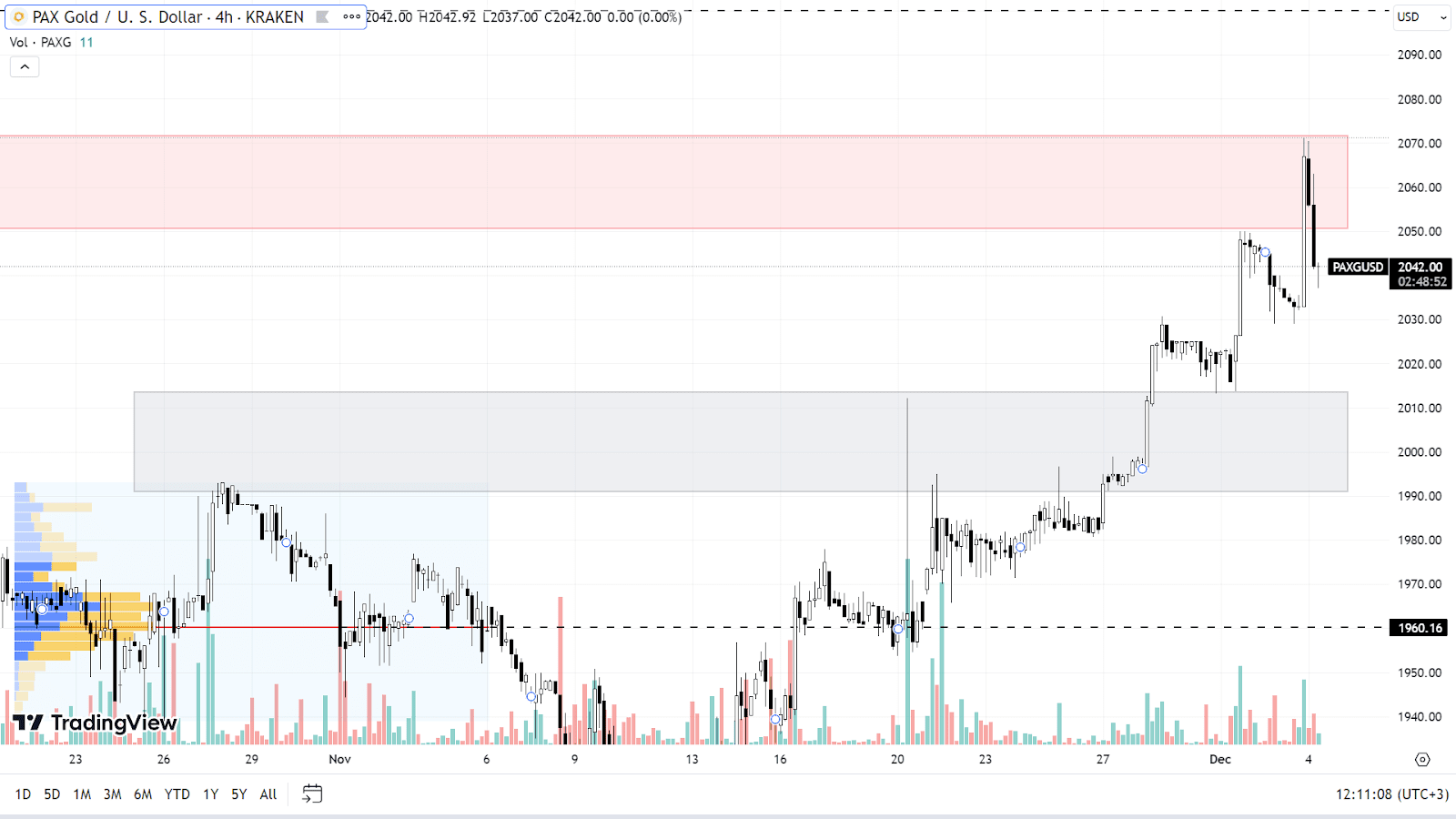

The price of gold recently reached a new annual high of $2,071, as predicted in a previous PAXG analysis. The asset is currently near a sell zone ranging between $2,050 and $2,072, and it's unlikely to break through this range immediately.

A local correction in the PAXG chart seems probable but is expected to be shallow. Key buying orders are positioned within the $1,990-$2,115 range, with a further support level at $1,960. These points might present favorable entry opportunities for long positions in gold.

If the overall positive trend in the market persists, PAXG has the potential to continue its upward movement. The next target for buyers could be the $2,100 level, potentially reached within this week.

PAXG chart on the H4 timeframe

The upcoming week will see the release of several important economic reports, including the U.S. Services Business Activity Index (Tuesday, December 5), crude oil inventories (Wednesday, December 6), initial jobless claims (Thursday, December 7), U.S. unemployment rate, and average earnings (Friday, December 8). While these events are not expected to fundamentally impact cryptocurrency prices, they may temporarily increase the volatility of crypto assets due to their connection with the U.S. dollar's fluctuations.

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the price movement between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K – $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto: