Can cryptopunks become the Bitcoin among NFTs?

Even if you’re new to the crypto market, you’ve probably heard of these weird 8-bit pixelated cartoon characters that cost mind-blowing money. Yes, we are talking about “crypto punks.”

Punks can be classified as collectibles. It was issued only 10,000 of them (and there will never be more). They are all different (like Mini Cooper cars), have other attributes (like mustaches, glasses, beards, earrings, etc.), and have a steady demand.

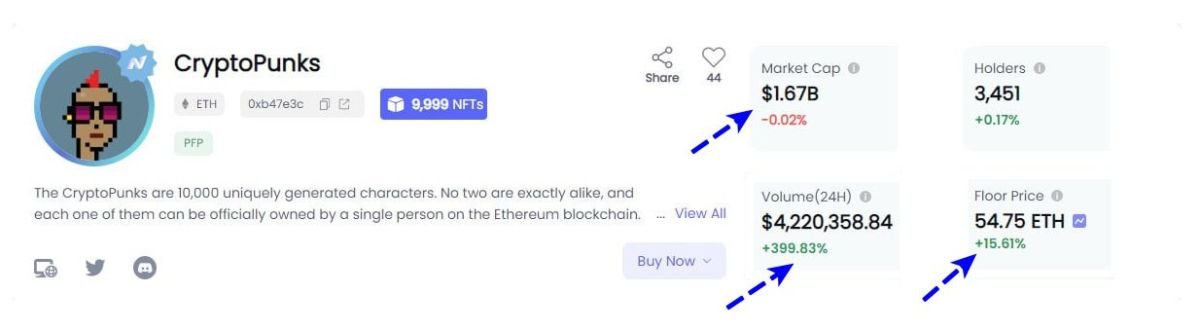

In the last week, the growth in cryptopunk trading volumes has increased by almost 400%, exceeding $4.2 million! And the floor-price (or “bottom price”) for these NFTs reaches nearly 55 ETH (more than $110,000).

The capitalization of the entire collection at today’s prices is $1.67 billion, which is more than, for example, the market value of such top projects as Tezos or The Sandbox.

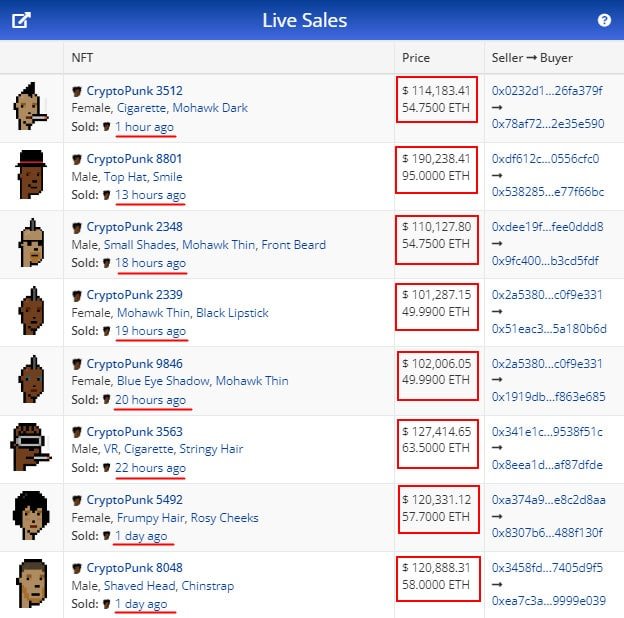

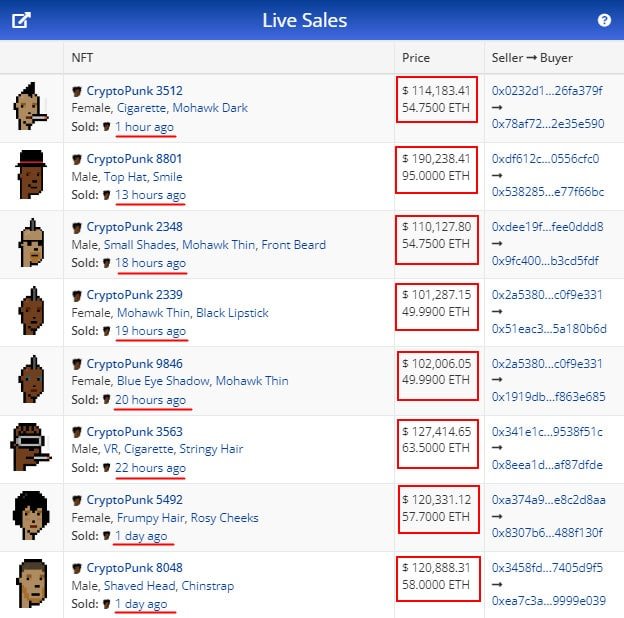

Cryptopunks are sold more often than you might think: every day, one or another token changes its owner, and we have rarely heard of someone selling their punks for a worse price than they bought.

Cryptopunks are sold more often than you might think: every day, one or another token changes its owner, and we have rarely heard of someone selling their punks for a worse price than they bought.

Many researchers of the cryptopunk phenomenon have noticed an important investment feature of these NFTs: they are able to preserve the value, sometimes even better than bitcoin.

It’s all about volatility. Due to substantial price fluctuations, many short-term investors can’t appreciate the benefits of Bitcoin as an investment instrument. Ethereum, on the other hand, is almost always correlated with Bitcoin, so investing in ETH similarly involves a high risk of a correction.

Thus, the constantly soaring cryptopunks look like a solution to the problem: after all, the investor “locks” the capital not in the Ethereum cryptocurrency itself but in the punk quoted in Ethereum. If, for example, ETH falls in price from $2,500 to $2,300 over some subsequent period, then punk may rise in price from 60 to 80 ETH over the same time.

As you can see, on the one hand, such a token dampens a floating loss expressed in dollar equivalent, and on the other hand, it allows you to make a profit even with a simple recovery of ETH quotes to the previous level.

Given that both USD and Ethereum are inflationary currencies, this way of risk diversification looks very reasonable and promising.

Bitcoin, despite price fluctuations, is a deflationary tool: its emission is finite, limited, and scarce, and mining will become more difficult as the network’s computing power grows.

Are cryptopunks like bitcoin if you look at things from another perspective? Are they just another temporary and trendy project? Will we see demand for them in 5 or 10 years? Each of us will have to answer these questions on our own.

Many researchers of the cryptopunk phenomenon have noticed an important investment feature of these NFTs: they are able to preserve the value, sometimes even better than bitcoin.

It’s all about volatility. Due to substantial price fluctuations, many short-term investors can’t appreciate the benefits of Bitcoin as an investment instrument. Ethereum, on the other hand, is almost always correlated with Bitcoin, so investing in ETH similarly involves a high risk of a correction.

Thus, the constantly soaring cryptopunks look like a solution to the problem: after all, the investor “locks” the capital not in the Ethereum cryptocurrency itself but in the punk quoted in Ethereum. If, for example, ETH falls in price from $2,500 to $2,300 over some subsequent period, then punk may rise in price from 60 to 80 ETH over the same time.

As you can see, on the one hand, such a token dampens a floating loss expressed in dollar equivalent, and on the other hand, it allows you to make a profit even with a simple recovery of ETH quotes to the previous level.

Given that both USD and Ethereum are inflationary currencies, this way of risk diversification looks very reasonable and promising.

Bitcoin, despite price fluctuations, is a deflationary tool: its emission is finite, limited, and scarce, and mining will become more difficult as the network’s computing power grows.

Are cryptopunks like bitcoin if you look at things from another perspective? Are they just another temporary and trendy project? Will we see demand for them in 5 or 10 years? Each of us will have to answer these questions on our own.

Recommended