Chainalysis: Crypto Thrives in Low-Income Countries

Chainalysis' recent study indicates a notable uptick in cryptocurrency adoption among the world's economically disadvantaged nations.

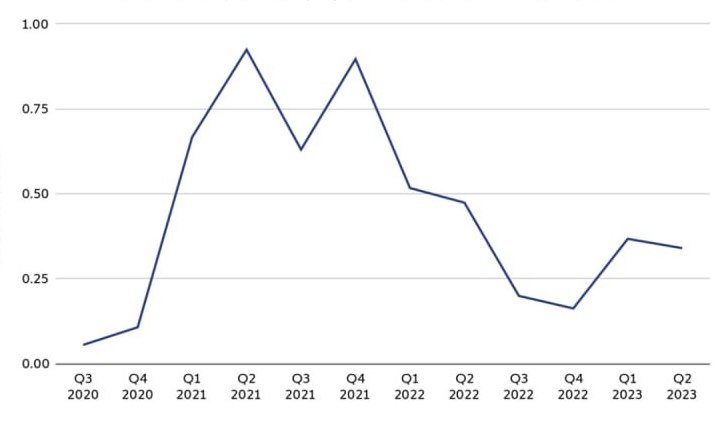

However, the broader global picture is somewhat lukewarm. Cryptocurrency adoption has been on a declining trend throughout this year. The most recent data indicates figures slightly below those at the year's outset. On a more positive note, the market has rebounded from its low point following the FTX crash.

Global Cryptocurrency Adoption Index 2020-2023. Source: Chainalysis

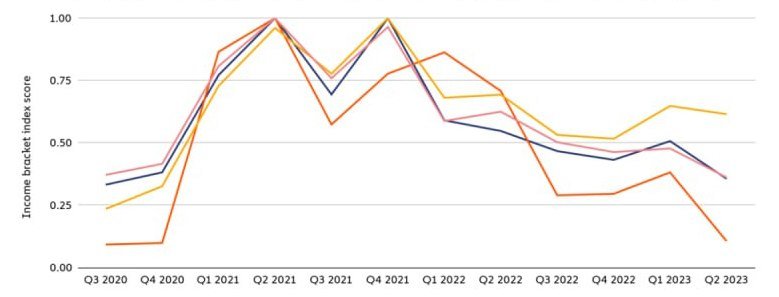

As the world grappled with the chill of the crypto winter, a specific group of nations emerged as a hopeful beacon. These are countries classified as lower middle-income (LMI) by the World Bank, with GDP per capita ranging from $1,086 to $4,255. Notable among them are India, Ukraine, and Nigeria. Data from Chainalysis indicates that these countries are amid a crypto resurgence. Their levels of crypto adoption currently surpass those recorded in the third quarter of 2020, which marked the beginning of the previous bullish trend. On the provided chart, these LMI nations are delineated with a yellow line.

Interestingly, the countries boasting the highest income levels (tagged as High Income or HI, with a GDP per capita exceeding $13,205) show a slightly less enthusiastic embrace of crypto, as represented by the blue line on the graph.

Mass Adoption Index Across Different Income Levels. Source: Chainalysis

To be frank, it's too early to proclaim that LMI countries are completely soaring in the crypto sphere. A detailed observation reveals that their crypto adoption began waning as 2023 kicked off. So, one could argue two things: firstly, these less affluent nations are outperforming many others in terms of crypto adoption; and secondly, they're not quite reaching their January benchmarks from the same year. Broadly speaking, the mass adoption of crypto has seen a downturn worldwide. Yet, the trend line for LMI countries appears more gradual and steady.

The inclination of low-income (LI, below $1,085) and middle-income countries towards cryptocurrency bears significant repercussions for the digital currency market. Characterized by burgeoning economies, thriving private business sectors, demographic expansion, and other propitious conditions, these nations collectively house around 40% of the world's population. This makes them a prime audience concerning the prospective trajectory of cryptocurrencies.

It's intriguing to observe that while LI and LM countries are charting robust paths in the mass adoption of cryptocurrencies, high-income nations are predominantly veering toward institutional integration. To put it differently, the global crypto landscape is flourishing both from grassroots levels and top-tier echelons. Should these patterns hold, we could be on the precipice of a cohesive amalgamation of cryptocurrencies, addressing the financial aspirations of people from diverse societal backgrounds.

Cryptocurrency Mass Adoption Map. Source: Chainalysis

Recommended