Chainlink will not support the Ethereum fork on PoW

The closer Merge is, the more questions about what Ethereum miners will do, being essentially out of work.

There are two most likely solutions for this regard: working with the Ethereum fork on the Proof-of-Work algorithm or transferring their capacity to other blockchains running on PoW.

All existing projects are obliged to determine their strategies for migrating to the updated Ethereum network, which implies their position towards those forks that may continue to operate on the previous algorithm.

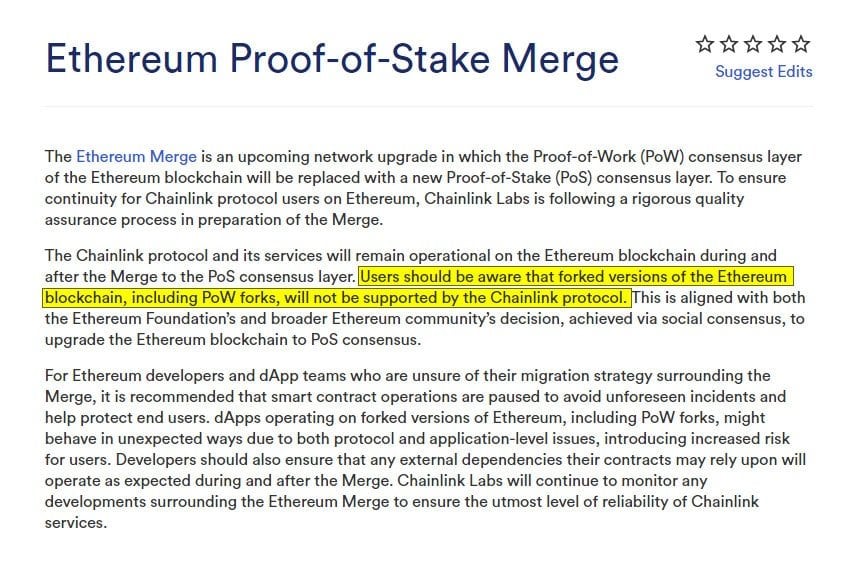

One blockchain that will definitely not work with PoW forks is Chainlink. According to the communiqué on the project’s website, this decision is in full compliance with the general consensus on Merge between the Ethereum Foundation and the community.

To protect end users and avoid unforeseen incidents, it is recommended to suspend smart contracts for those Ethereum developers and dApp teams unsure of their migration strategy. This is due to possible problems at the protocol and application levels of dApps running on Ethereum forks, including PoW forks.

Chainlink has positioned itself as the largest oracle provider to support advanced smart contracts “on any blockchain”. Does such a radical position on PoW mean that “now not on any”? Interestingly, will Chainlink writers change the project description to something like “on any blockchain approved by Vitalik Buterin”? By the way, although Vitalik tries to maintain media neutrality, he does not hide his point of view that the authors of PoW forks are aimed solely at making money, not at the industry’s progress.

Oracle protocols are vital to the DeFi industry, giving blockchains a reliable and secure way to update data from other networks as they interact. Not only is Chainlink the industry leader, but it also solves the so-called “oracle problem”, which involves the risks of possible misuse by an oracle of the blockchain’s trust in its data (including non-malicious errors or failures). For example, some decentralized platforms have been hacked because of erroneous data from oracles, allowing the withdrawal of assets at an invalid market rate.