Crypto Projects Raise $1 Billion in May 2024

In May 2024, investments in crypto projects hit $1 billion, according to CryptoRank. Considering that some investment rounds remain undisclosed, the actual fundraising amount could reach between $1.3 and $1.5 billion.

In the final month of spring, investment distribution by category was as follows:

Other significant areas of investor interest included CeFi projects ($100.5 million), the GameFi segment ($64.8 million), L1, L2, L3 blockchains ($60.7 million), and NFTs ($10 million).

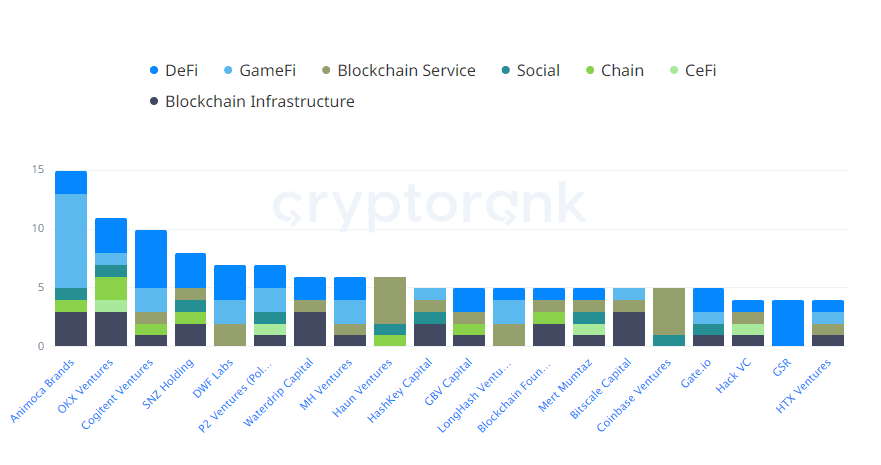

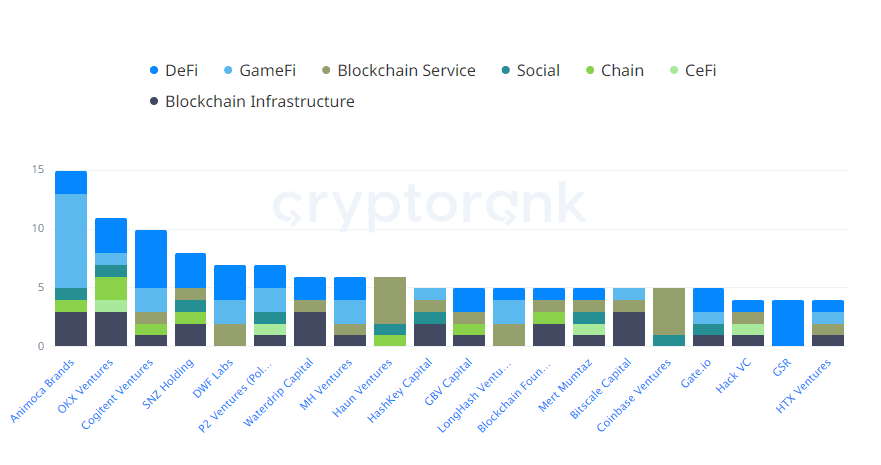

The most active in terms of funding rounds were Tier 2 funds Animoca Brands (15 rounds) and OKX Ventures (11 rounds), as well as Tier 2 Cogitent Ventures (10 rounds). Tier 1 investors were less active than in April, participating in 33 rounds and investing $482 million compared to 41 rounds and $628 million the previous month.

In May 2024, the distribution of investment rounds by size was as follows:

In total, 110 rounds were recorded. Details for another 46 rounds were not publicly disclosed. However, finding this information isn't impossible, and tools for uncovering such data will be discussed at the end of this article. For now, let's get a closer look at the standout funding rounds of May.

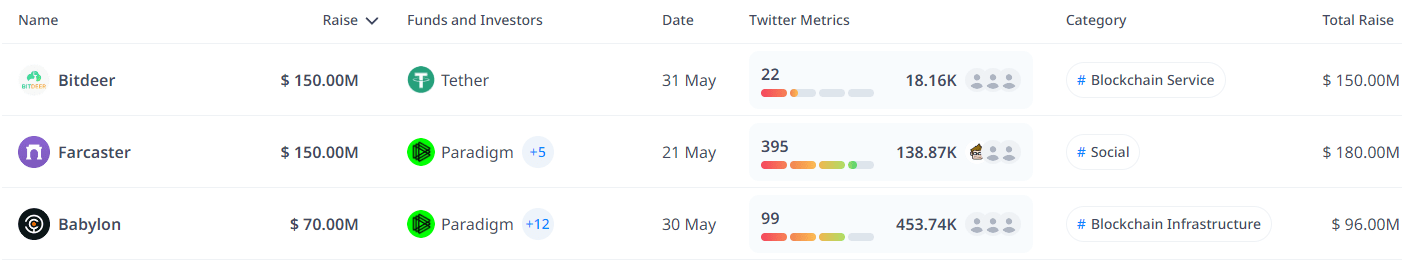

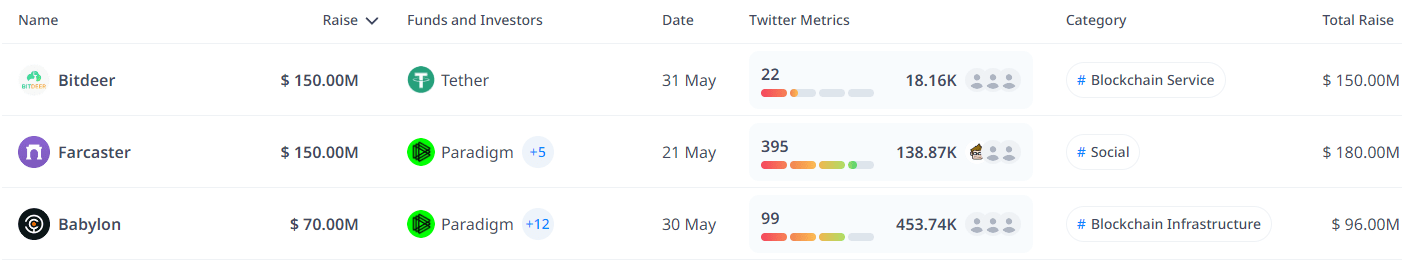

On May 31, Bitdeer secured $150 million from Tether International Limited. This strategic investment will enable the expansion of data centers and hasten the development of ASIC-based mining platforms.

Farcaster — $150 million. A Web-3 social media platform reminiscent of X (formerly Twitter), Farcaster offers users full control over their data, content monetization, and social graph building.

On May 21, the project completed a Series A funding round, drawing investments from Tier 1 fund Paradigm (lead investor), a16z, and four lesser-known venture capitalists. Following this round, Farcaster's total fundraising reached $180 million.

Babylon — $70 million. A community-driven asset management protocol that allows users to establish investment clubs known as Gardens to participate collectively in DeFi activities.

On May 30, Babylon carried out its 4th funding round, raising $70 million from prominent Tier 1 funds including Paradigm, Polychain Capital, HashKey Capital, Galaxy, and nine other capitalists. After this funding, Babylon’s cumulative fundraising amounted to $96 million.

Notable among projects with undisclosed investment volumes are Aevo (May 21 round led by Binance Labs), Movement Labs (May 1 round led by the same fund), Toncoin (May 2 round led by Pantera Capital), and STON.fi (May 15 round led by Delphi Digital and other venture capitalists).

The difficulty in tracking these transactions arises because VCs often conceal their operations. To fund projects, they may use wallets from exchanges and hide large investments behind numerous small transactions.

Identifying such activities can be facilitated by on-chain analysis. For this purpose, both public blockchain explorers and specialized tools like Arkham and Nansen can be used.

- Blockchain Services: $219.5 million. This includes AI applications, crypto wallets, analytic web platforms, and decentralized domain name systems.

- Blockchain Infrastructure: $213.6 million. This category covered oracles, decentralized data storage tools, and staking providers.

- SocialFi: $194 million. Investments here bolstered the blockchain's social capabilities, including social media platforms, media holdings, and crypto encyclopedias.

- DeFi: $157.3 million. Funds flowed into projects that provide access to decentralized finance, such as DEXs, stablecoins, liquid staking platforms, and cross-chain bridges.

Other significant areas of investor interest included CeFi projects ($100.5 million), the GameFi segment ($64.8 million), L1, L2, L3 blockchains ($60.7 million), and NFTs ($10 million).

The total number of investment rounds in May reached 156, compared to 126 in January and 132 in February.

The most active in terms of funding rounds were Tier 2 funds Animoca Brands (15 rounds) and OKX Ventures (11 rounds), as well as Tier 2 Cogitent Ventures (10 rounds). Tier 1 investors were less active than in April, participating in 33 rounds and investing $482 million compared to 41 rounds and $628 million the previous month.

Investment Rounds by Investors and Categories. Source: cryptorank.io

Projects with the Highest Investment Volume

Simply knowing the total amount invested doesn't fully capture the venture capital activity. The nature of fundraising varies widely: it could be spread across hundreds of smaller deals, suggesting no dominant narrative in the market, or concentrated in a few large rounds, indicating a few sectors driving most of the interest.

In May 2024, the distribution of investment rounds by size was as follows:

- Under $1 million: 11 rounds;

- $1–$3 million: 31 rounds;

- $3–$10 million: 53 rounds;

- $10–$20 million: 8 rounds;

- $20–$50 million: 4 rounds;

- Over $50 million: 3 rounds

In total, 110 rounds were recorded. Details for another 46 rounds were not publicly disclosed. However, finding this information isn't impossible, and tools for uncovering such data will be discussed at the end of this article. For now, let's get a closer look at the standout funding rounds of May.

Bitdeer — $150 million. This project, specializing in Bitcoin mining, boasts some of the lowest operational costs in the market according to investment banking firm Benchmark.

On May 31, Bitdeer secured $150 million from Tether International Limited. This strategic investment will enable the expansion of data centers and hasten the development of ASIC-based mining platforms.

Farcaster — $150 million. A Web-3 social media platform reminiscent of X (formerly Twitter), Farcaster offers users full control over their data, content monetization, and social graph building.

On May 21, the project completed a Series A funding round, drawing investments from Tier 1 fund Paradigm (lead investor), a16z, and four lesser-known venture capitalists. Following this round, Farcaster's total fundraising reached $180 million.

Babylon — $70 million. A community-driven asset management protocol that allows users to establish investment clubs known as Gardens to participate collectively in DeFi activities.

On May 30, Babylon carried out its 4th funding round, raising $70 million from prominent Tier 1 funds including Paradigm, Polychain Capital, HashKey Capital, Galaxy, and nine other capitalists. After this funding, Babylon’s cumulative fundraising amounted to $96 million.

Top 3 Funding Rounds in May 2024. Source: cryptorank.io

Other noteworthy projects include:

- Securitize — $47 million;

- Polymarket — $45 million;

- Humanity Protocol — $30 million;

- Arbelos — $28 million;

- Circular Protocol — $15 million.

Notable among projects with undisclosed investment volumes are Aevo (May 21 round led by Binance Labs), Movement Labs (May 1 round led by the same fund), Toncoin (May 2 round led by Pantera Capital), and STON.fi (May 15 round led by Delphi Digital and other venture capitalists).

How to Find Information on Private Investments?

Most investment funds acquire stakes in crypto projects by purchasing their native tokens, which are deployed on public blockchains. Theoretically, this allows anyone interested to find related funding transactions.

The difficulty in tracking these transactions arises because VCs often conceal their operations. To fund projects, they may use wallets from exchanges and hide large investments behind numerous small transactions.

Identifying such activities can be facilitated by on-chain analysis. For this purpose, both public blockchain explorers and specialized tools like Arkham and Nansen can be used.

Recommended