Cryptocurrencies Trapped by High Interest Rates

Analytical company Nansen has issued a report examining the impact of inflation on both the traditional and cryptocurrency markets. Their experts forecast global growth following the conclusion of the era marked by interest rate hikes and the implementation of transparent regulation.

Surely, seasoned traders and analysts might label the Nansen team as "Masters of the Obvious." Therefore, it's more crucial to determine when a softening of monetary policy could kick in. For example, numerous Asian countries, originally adopting a different economic strategy, are already grappling with serious difficulties and a decline in certain indicators. The Chinese government, in its hunt for extra monetary stimuli, has reduced its interest rate to 3.55% after youth unemployment soared to 20.8%.

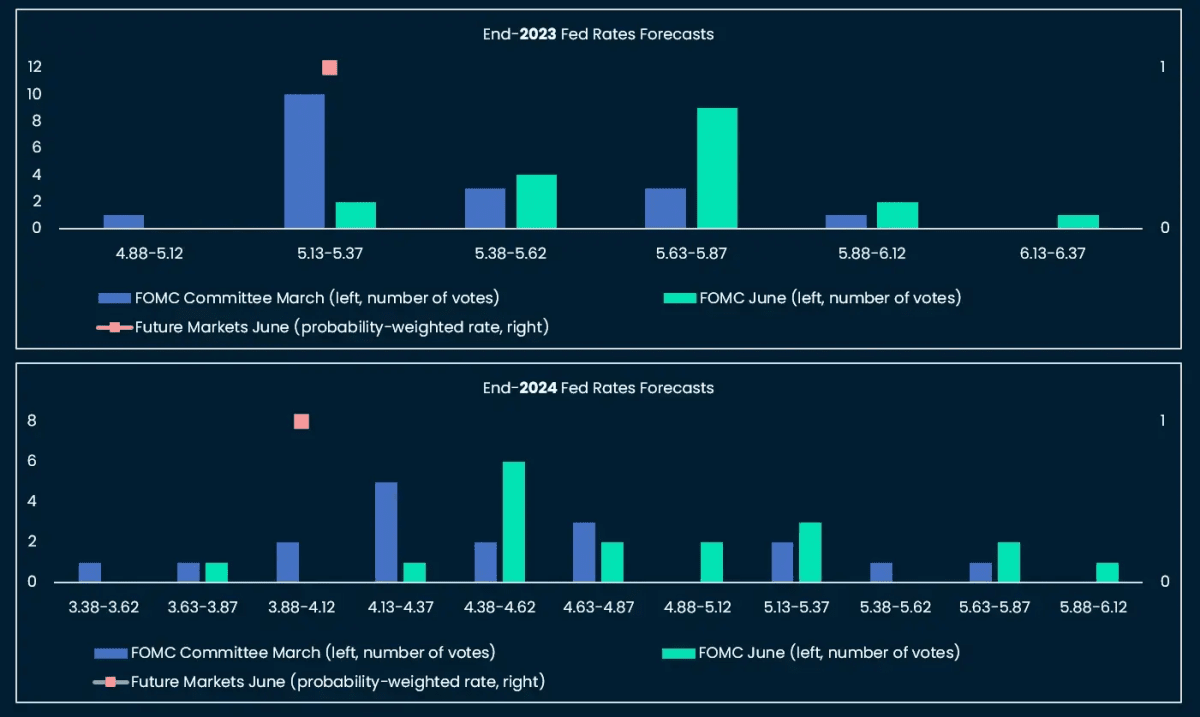

However, in Western countries, there's an absence of a credit mania and a persistently high inflation rate (5–6% per annum), sparking discontent among politicians and investors. Consequently, the leading central banks (USA, EU, UK) are maintaining and, in some places, raising interest rates. According to the forecast by the Federal Open Market Committee (FOMC), the American interest rate will see two more bumps up to 5.75% in the next nine months, followed by a gradual annual lowering to 4.5%.

FOMC forecast for the US interest rate. Source: official Nansen report.

Analysts attribute such steadfast inflation to the economic stimulation policies deployed in the aftermath of the pandemic. Despite the readings of numerous technical indicators, it has managed to push back a significant downfall until around February 2024, based on the relationship between a recession and the inversion of the US yield curve, where short-term bonds exhibit the highest returns. Essentially, the traditional market is also signaling the avoidance of an immediate crisis scenario: commodity prices have stabilized, cyclical stocks have rebounded, and the risk premium on equity assets has dipped to 2019 levels. This points to a decrease in macroeconomic risks for cryptocurrencies as well, given their connection.

However, at Nansen, they believe that the current interest rates will continue to restrain high-risk assets, as governments and investors worry more about inflation than about potential growth. After all, it's considerably more profitable to invest in treasury bonds with a guaranteed annual return of 5% than to engage in ETH staking, which offers similar percentages but fluctuating prices. This is precisely why the cryptocurrency market is likely to endure a period of low volatility, with the onset of long-term growth only kicking off once clear regulations are in place and inflation is decisively tackled.

Recommended