Cryptocurrency loses appeal in eastern Asia

Since 2019, the rate of crypto usage in eastern Asia has declined. Foremost due to the widely-imposed bans by China. But do the new trends in Hong Kong offer a glimmer of hope?

A new research by Chainalysis sheds light on the latest trends crypto trends in

Eastern Asia and beyond.

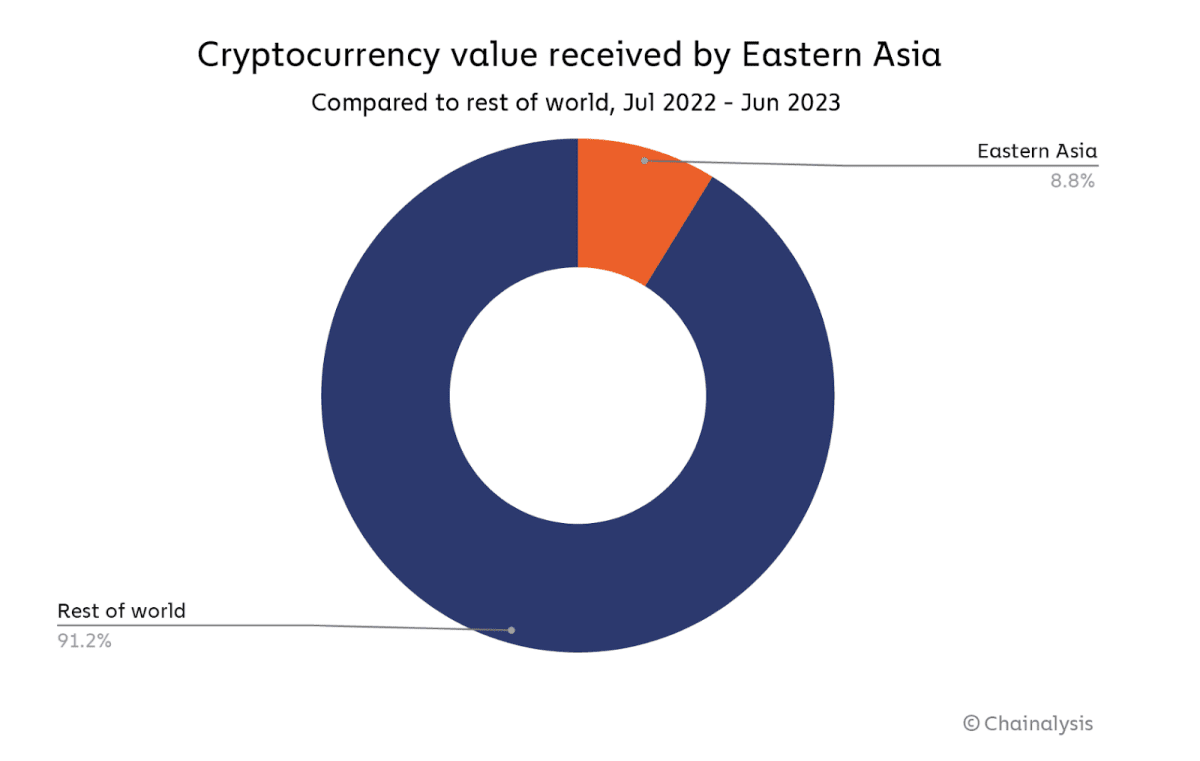

Identifying it as “the fifth most active crypto market we study”, the company notes that it accounts for 8.8% of global crypto activity between July 2022 and June 2023.

Cryptocurrency valueSource: Chainalysis

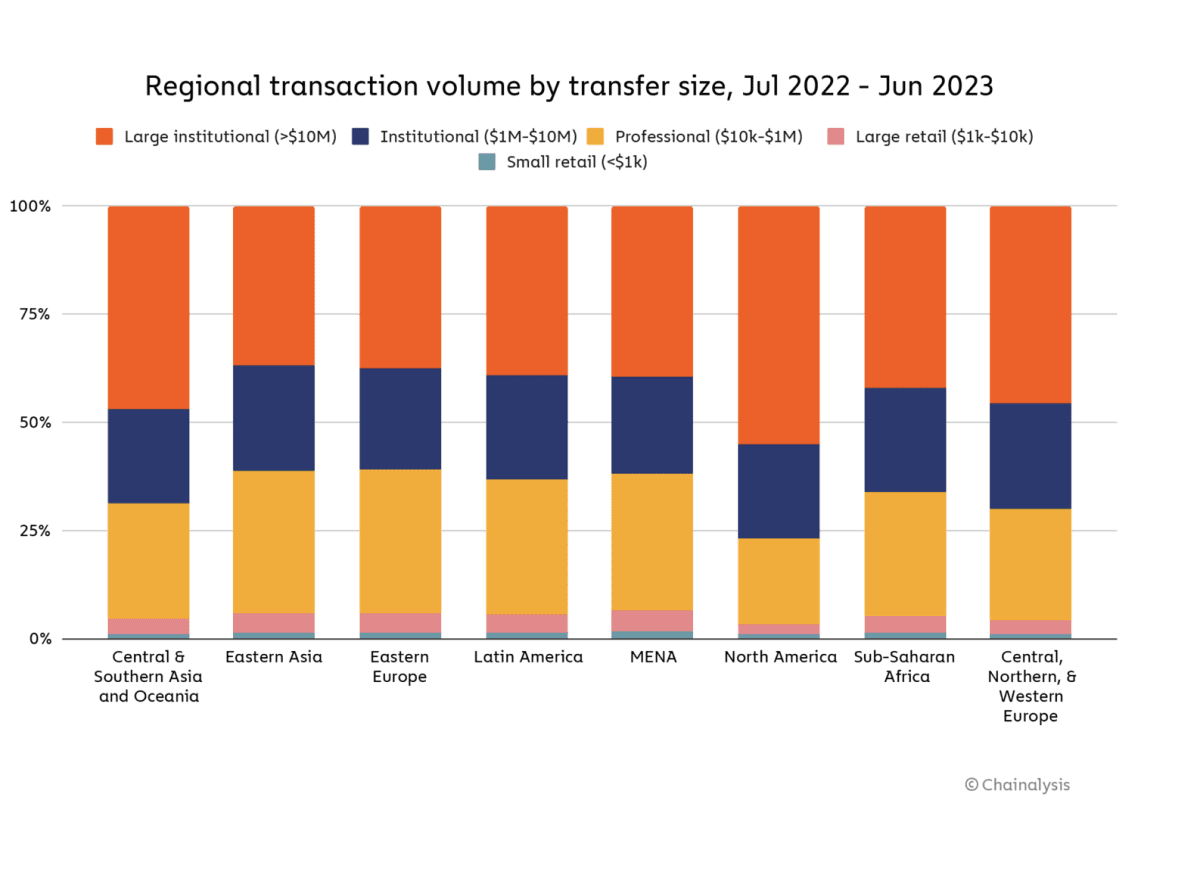

Chainalysis also notes that Eastern Asia’s cryptocurrency market appears to be less driven by institutional activity in the region. At the same time, it shows a higher propensity for DeFi than similarly sized markets like MENA and Latin America.

To compare, institutional activity is significantly higher in North America, Central and Southern Asian and Oceania.

Regional transaction volume by transfer size, Jul.22-Jun.23 Source: Chainalysis

The research group also describes Eastern Asia’s decline in cryptocurrency activity since 2019 as “notable”.

“As recently as 2019, Eastern Asia was one of crypto’s top markets by transaction volume, largely powered by China’s huge trading activity and mining sector. But while still substantial, crypto activity in the region at large and China specifically has declined in the last two years, due perhaps in part to a series of bans on virtually all things crypto by the Chinese government,” the report reads.

Yet, while Beijing is fervently opposed to cryptocurrencies, it seems like there’s a potential tailwind for East Asia coming from Hong Kong, a city and a special administrative region in China.

Over the past year, several crypto initiatives and industry-friendly regulations have been launched there, fostering “bubbling optimism.” Between July 2022-June 2023, Hong Kong, according to the company, has been an extremely active crypto market by raw transaction volume, with an estimated $64.0 billion in crypto received.

“The increasingly close relationship between China and Hong Kong leads some to speculate that Hong Kong’s growing status as a crypto hub may signal that the Chinese government is reversing course on digital assets, or at least becoming more open to crypto initiatives,” Chainalysis writes

Much of this is driven by Hong Kong’s highly active OTC market. Over-the-counter trade desks, or OTCs, are specialized platforms that interact directly with cryptocurrency buyers or sellers. These make trading possible outside of the conventional exchanges.

Commenting on whether there is a link between Hong Kong’s crypto flourishing and the Chinese government’s stance on crypto, one expert, Dave Chapman of OSL Digital Securities, says that it is not necessarily so.

“However, we are seeing a number of Chinese state-backed entities indirectly supporting Hong Kong’s web3 ventures, and this could be viewed as an exploratory approach to understanding digital assets without loosening mainland policies,” he said.

Previously, GN reported that crypto exchanges should segment users.

Recommended