DRAM: The World's First Dirham-Backed Stablecoin

Former SoftBank top executive Akshay Naheta embarked on his DeFi journey with DTR (Distributed Technologies Research Ltd) at the outset of 2023. By October, he unveiled the DRAM stablecoin, backed by the UAE's national currency.

The decision to peg DRAM to the UAE dirham is strategic, asserts Akshay Naheta. He believes the UAE is rapidly emerging as a global financial hub and a crypto hotspot. The nation's ability to attract top-tier talents positions it as the ideal foundation for DRAM. The country's resilient economy further enhances trust in this new stablecoin.

We’re moving into a whole new and rewired financial system where the dirham will be a big player. I’m extremely bullish on the UAE. It’s the new Switzerland – geopolitically neutral, a great transportation hub and a top tourism destination,Naheta explains.

Naheta envisions DRAM as an attractive choice for those in the crypto realm who are keen on investing in stablecoins. The UAE dirham has a strong link with the U.S. dollar. In the initial ten days of October, its exchange rate hovered around $0.27 per dirham. What's more, in the eyes of DRAM's initiators, the UAE currency's macroeconomic prospects currently outshine those of the US dollar. Moreover, Naheta asserts that DRAM seamlessly integrates into the prevalent Swiss system.

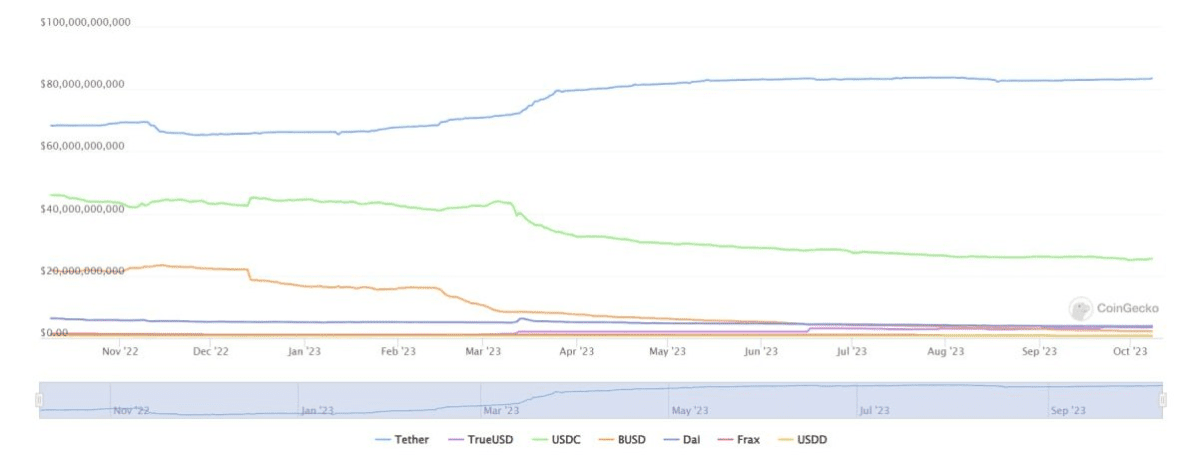

That's why the team at DTR is ardently hoping to swiftly secure a position in the stablecoin landscape, which has been traditionally overshadowed by coins backed by the US dollar. Naheta's aspiration isn't modest; he's aiming for as much as 10% of this lucrative $130 billion sector. This optimism stems largely from the UAE's progressive stance on crypto and Web3, especially when juxtaposed with other legal frameworks. Each token is intended to mirror the value of 1 USD. The dirham reserves that bolster this novel stablecoin will be safeguarded by the DRAM Trust, based in Hong Kong. Presently, DRAM is listed on a majority of decentralized trading platforms, with the expectation that mainstream crypto exchanges will soon follow suit.

Popular stablecoins like USDT and USDC already account for a $105 billion share of the market. Source: CoinGecko

Despite their ambitious aspirations, DTR approaches the market with caution. Although initial conversations with potential collaborators were optimistic, the startup is planning a modest beginning, aiming for investments of up to $10 million. Such a restrained strategy arises from a commitment to ensure all operations are compliant with existing regulations.

Akshay Naheta distinctly highlights the differences between stablecoins and Central Bank Digital Currencies (CBDCs). He firmly believes that in democratic societies, the mass adoption of CBDCs will never gain widespread support.

Stablecoins shouldn’t be compared to CBDCs. If you look at the general sentiment, whether it is in the US (or anywhere else), it is vehemently negative around CBDCs. It is because people inherently don’t want the invisible hand of the government in their wallets,says Naheta.

Moreover, Naheta points to the pivotal role of stablecoins in economies that face soaring inflation rates. He references countries like Turkey, Egypt, and Lebanon, where the formal exchange rates of local currencies to the dollar often deviate considerably from actual market conditions.

“What that means is that as an individual, you have to go to another person who has access to these dollar-based facilities outside of the country, who charges 15-20% for a service,” elaborates Naheta. In contrast, stablecoins can circumvent these steep charges, providing a more democratized and trustworthy method for cross-border financial transactions.

Recommended