ETH and MATIC: Altcoin Analysis for January 11, 2024

Despite the SEC's official green light for spot Bitcoin ETFs yesterday, Bitcoin's response was muted compared to the movements of certain altcoins. Here’s an overview of the market situation for Ethereum (ETH) and Polygon (MATIC) on Thursday, January 11.

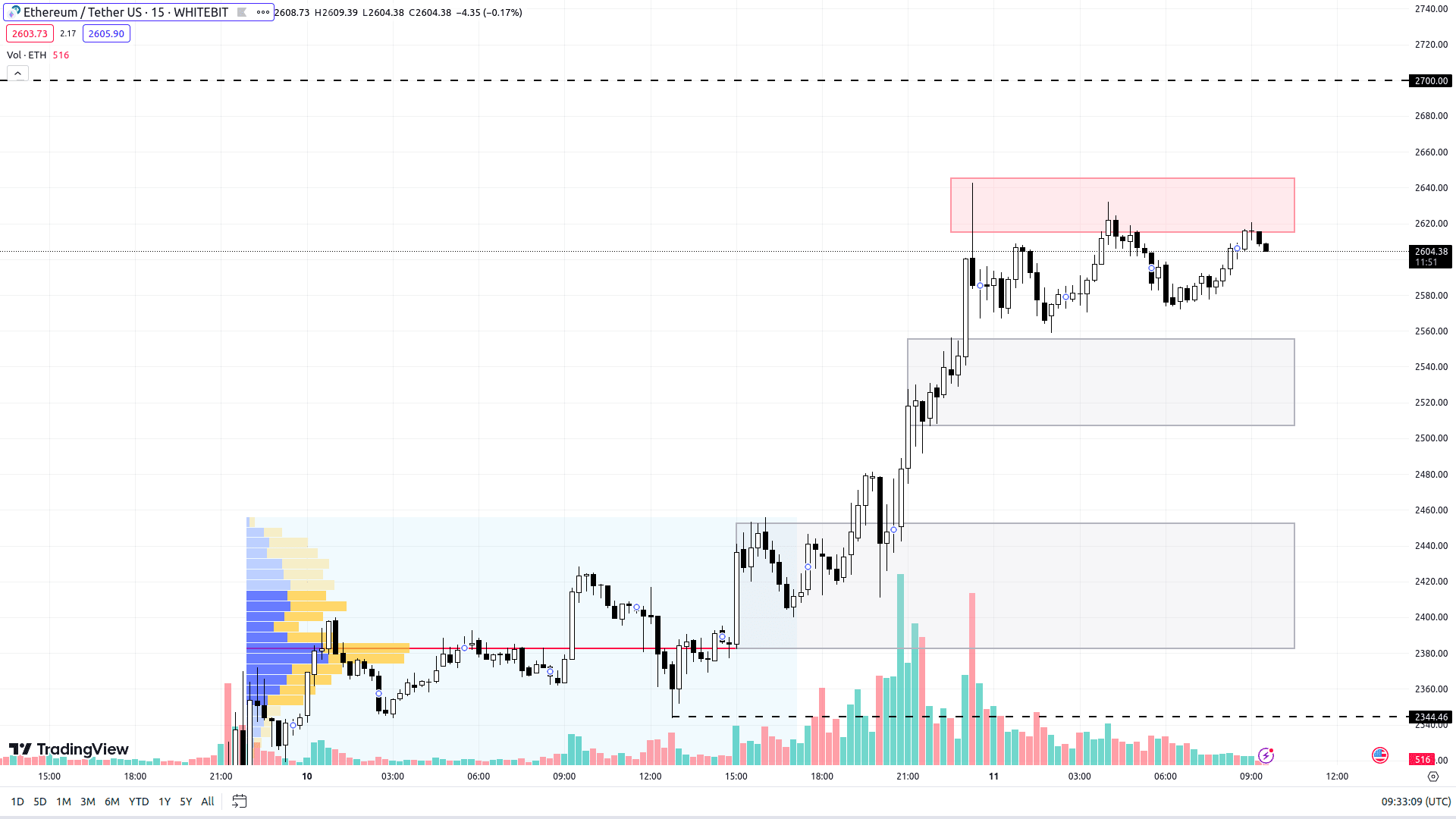

Ethereum (ETH)

The recent ETF approval has cast a positive impact not only on ETH but also across the broader Ethereum ecosystem. In just two days, ETH surged by 16%, marking a new local high at $2642.

ETH's growth trajectory seems poised to continue. Despite a resistance zone forming between $2614 and $2645, this range might prove challenging to maintain due to the prevailing upward momentum. Buyers are now eyeing higher levels, potentially reaching $2700 and $2750.

While a pullback in ETH prices is a possibility, a significant downturn seems unlikely. In the local timeframe, initial buy zones are identified between $2507 and $2555. Below these, support is found in the ranges of $2382 to $2482 and at the $2344 mark. These levels could be tested by the market as part of a natural ebb and flow before a general uptrend resumes.

ETH chart on the M15 timeframe

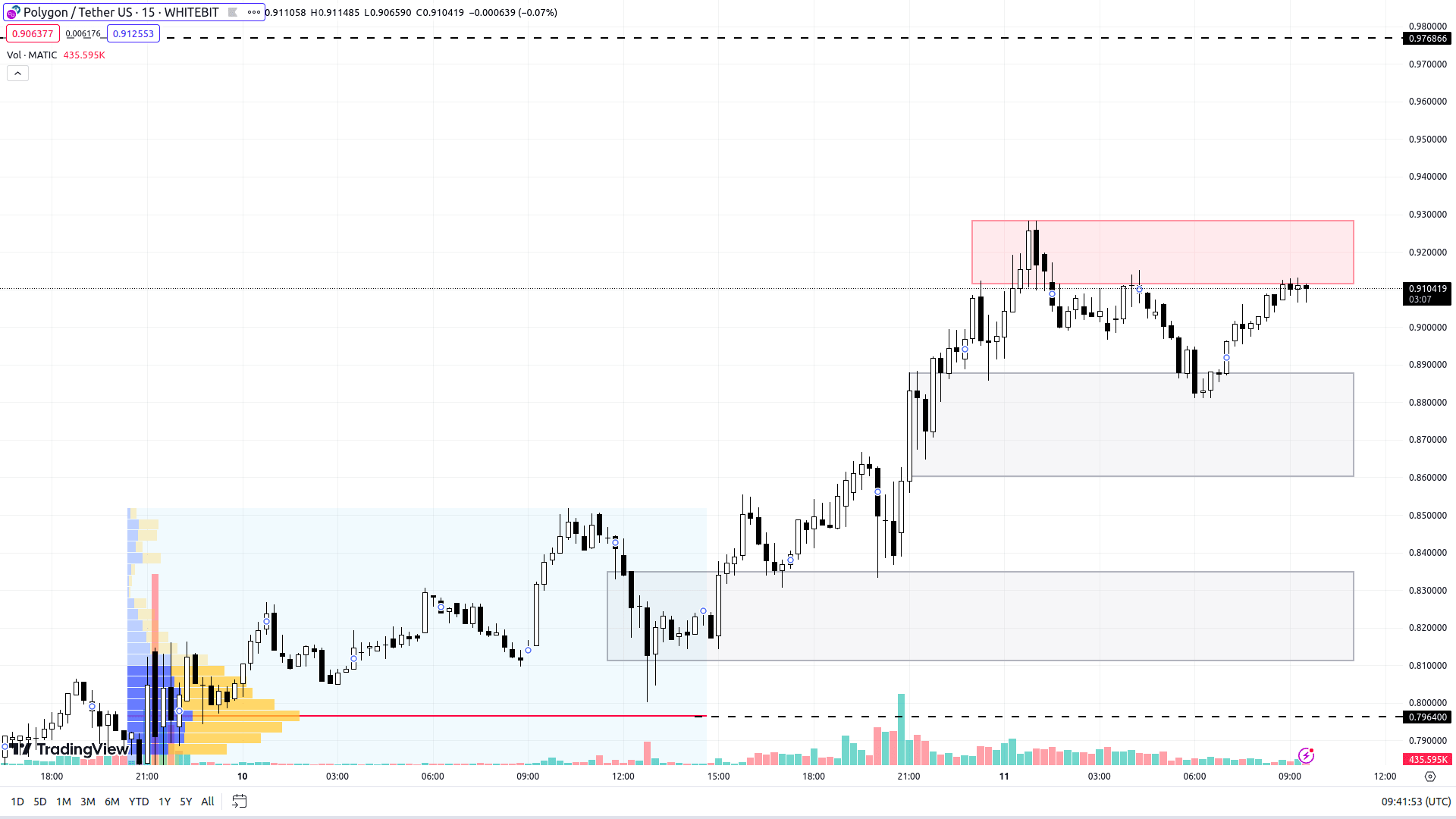

Polygon (MATIC)

MATIC is exhibiting trends similar to Ethereum. Currently, it's trading between support levels of $0.86–$0.887 and resistance at $0.91–$0.928, though this may not last long.

An upward movement for Polygon seems more probable. Buyers are eyeing the $0.97 price point and the key psychological level of $1. Overcoming this level could significantly accelerate MATIC's growth.

A temporary correction might bring MATIC down to support zones at $0.811–$0.834 and further to $0.796. Any further downward movement would depend on the overall market trends, particularly those of Bitcoin.

MATIC chart on the M15 timeframe

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the price movement between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K – $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended