GameFI Market Analysis and Statistics

In 2023, the GameFI industry and its crypto projects faced a downturn, mainly due to liquidity constraints and turbulent market conditions.

GameFI operates at the intersection of cryptocurrency and gaming, built on blockchain foundations. A majority of these projects incorporate an internal economy bolstered by their native token, enabling players to earn tokens and assets, like NFTs. This approach is known as the Play-to-Earn concept.

In this article, we'll examine the current state of the GameFI sector, spotlight its major projects, and try to predict the future of GameFI in the upcoming bull cycle.

Overall Statistics

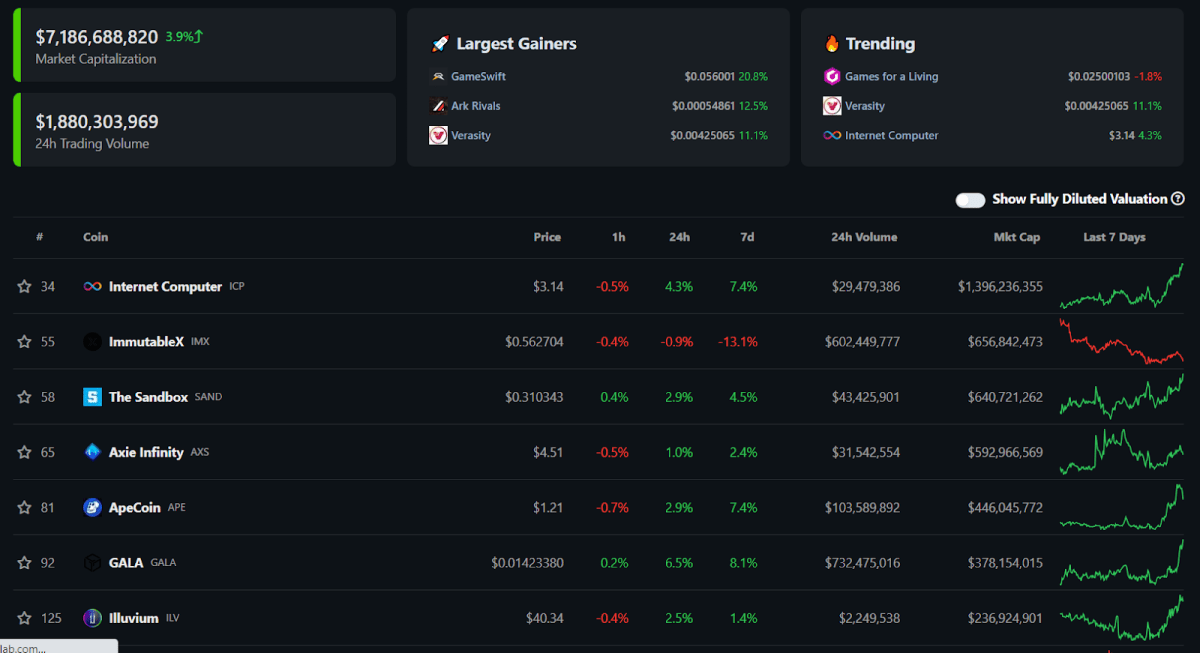

The cryptocurrency platform CoinGecko estimates the GameFI sector's worth at $7.2 billion. Topping their list of gaming projects is the Internet Computer (ICP), whose connection to GameFI is debatable, suggesting it might not be entirely fitting for this statistic:

GameFI's TVL and leading projects, as per CoinGecko (coingecko.com)

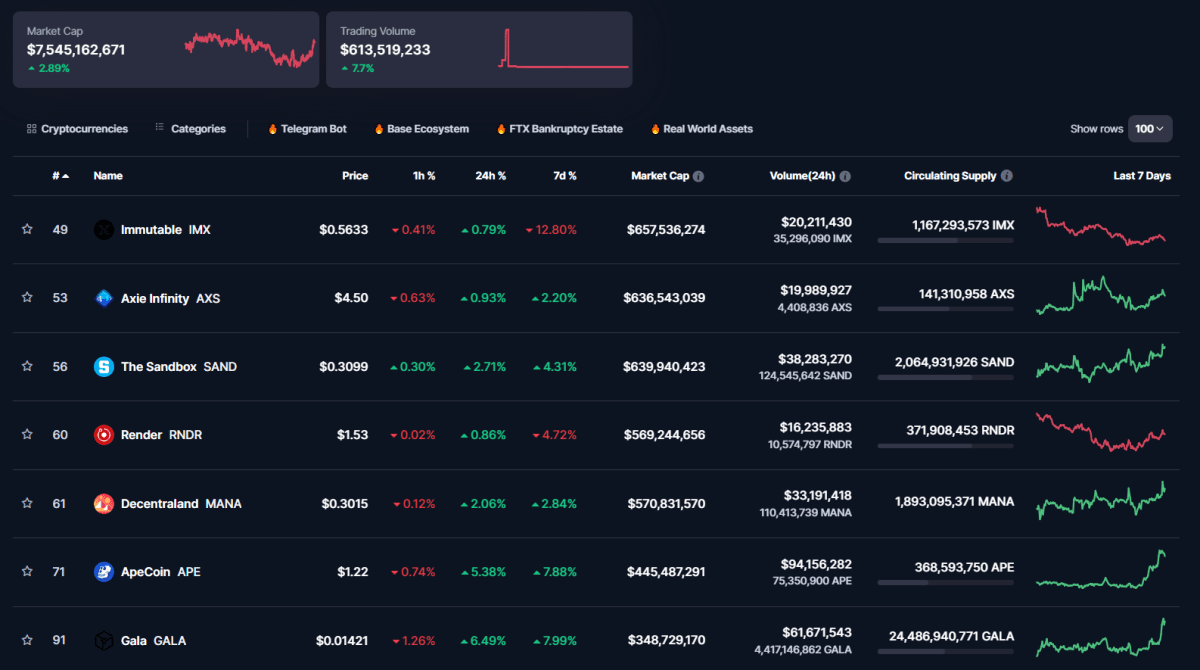

Contrastingly, CoinMarketCap excludes the Dfinity project but counts a broader range of cryptocurrencies and tokens, pushing the GameFI sector's TVL on their platform to just over $7.5 billion:

GameFI's TVL and leading projects, as per CoinGecko (coingecko.com)

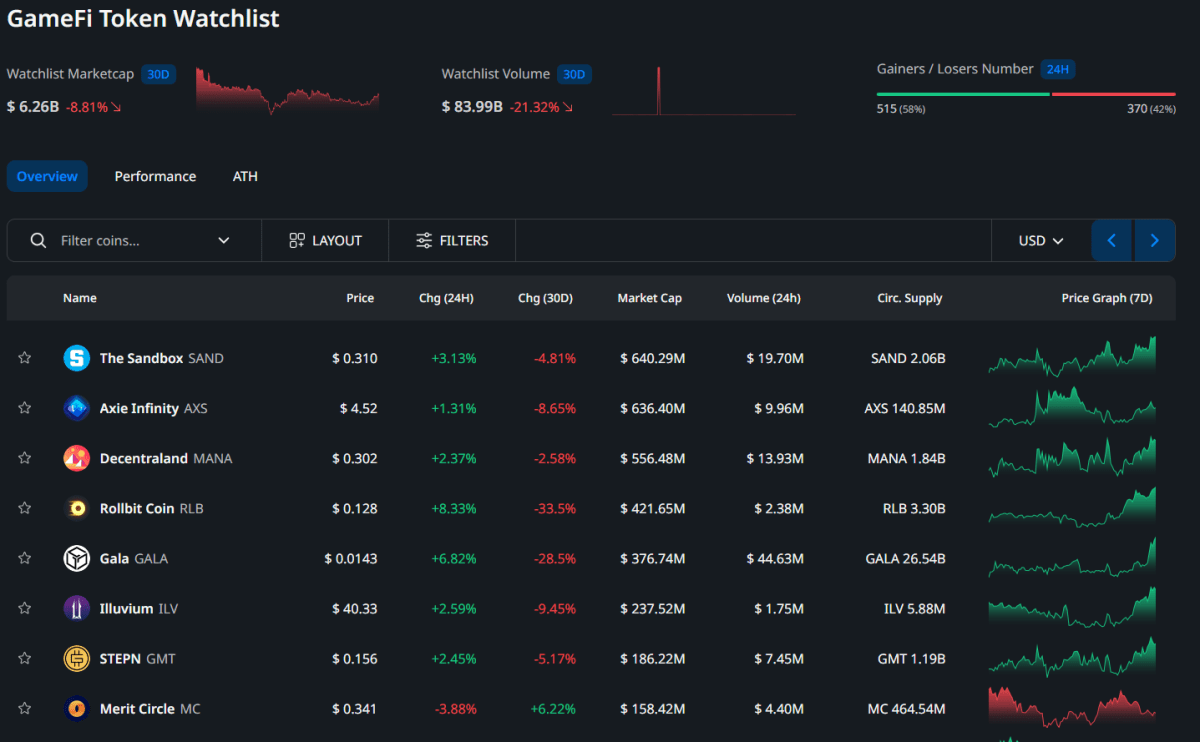

Cryptorank provides a fairly detailed representation of the GameFI sector. This information hub monitors dozens of gaming projects, with a total TVL of $6.25 billion at the time of the article's writing. Additionally, the platform sheds light on the price trends of GameFI-affiliated cryptocurrencies and tokens.

GameFI's TVL and leading projects, as per Cryptorank (cryptorank.io)

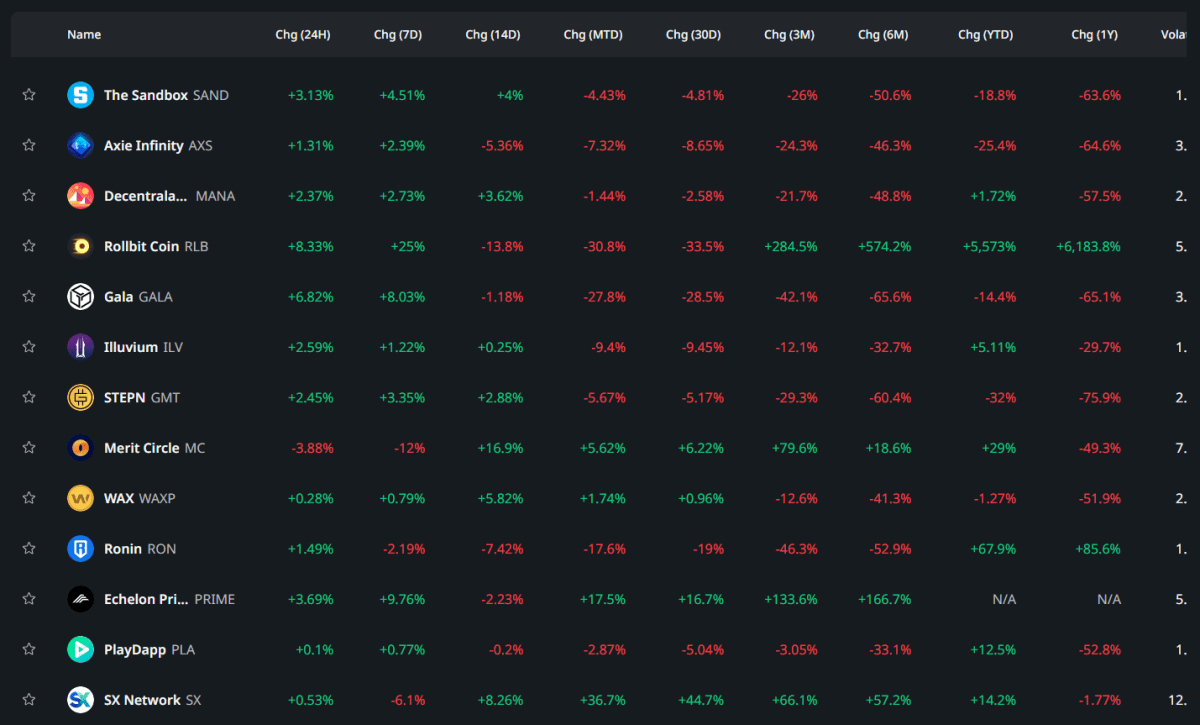

In the span of 3–6 months and even over a year, the tokens of major gaming ecosystems have witnessed a decline in their value, dropping to nearly 10% of their peak prices. Nonetheless, there are a few crypto projects that stand out with a positive trend. These include Rollbit Coin (RLB), Merit Circle (MC), Ronin (RON), SX Network (SX), and Echelon Prime (PRIME), among other lesser-known projects.

Token Price Trends in the GameFI Sector (cryptorank.io)

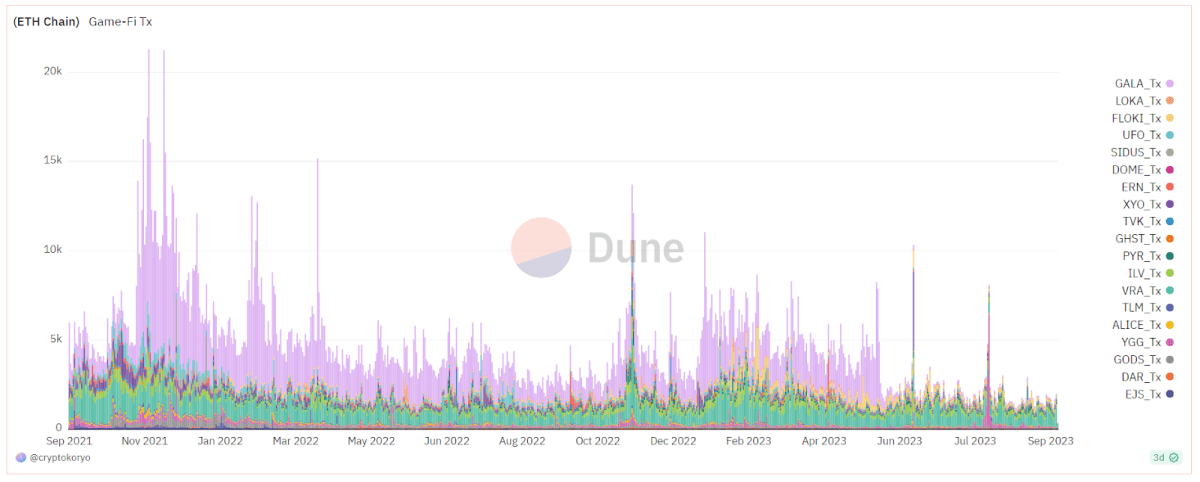

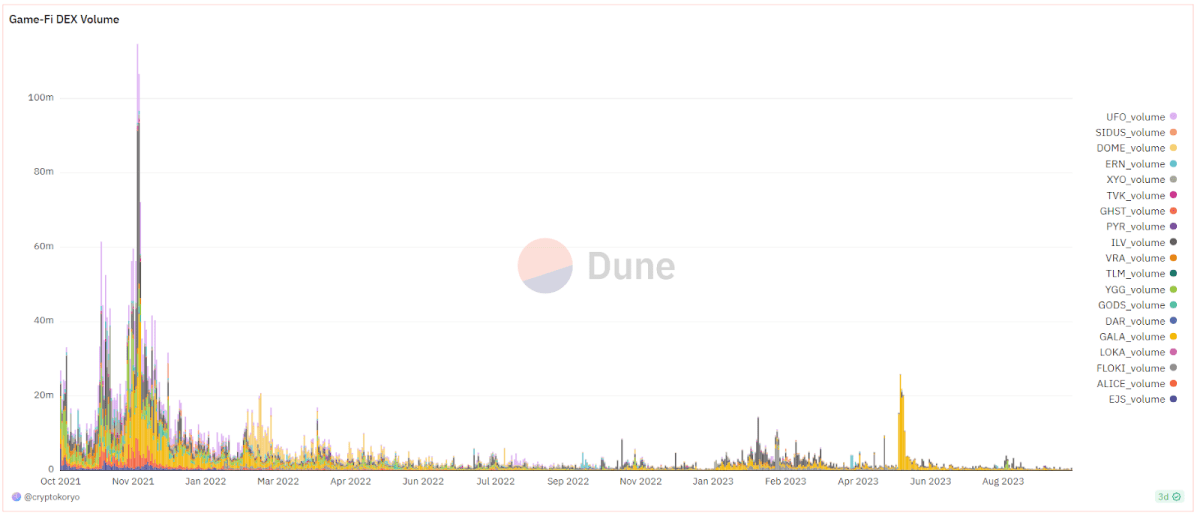

Analytical platform Dune offers various insightful dashboards about the GameFI sector. Notably, the “cryptokoryo/Game-Fi" dashboard presents stats of the top 20 gaming ecosystems. Constructed using 2021 data, it accurately portrays the prevailing P2E trends. In the past two years, indicators in the GameFI arena, whether transaction counts or trading volumes associated with native tokens, have decreased 2–3 times.

Daily Transaction Count for GameFI Projects (dune.com)

Average Trading Volume of GameFI Tokens on Decentralized Exchanges (dune.com)

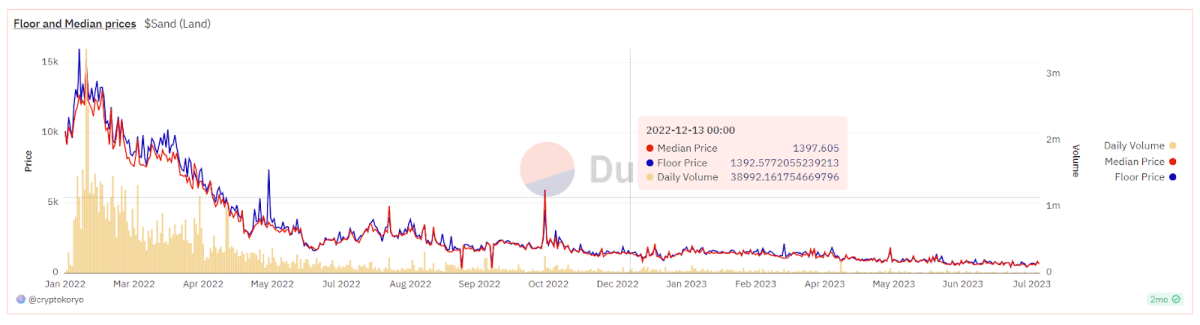

The stats of specific gaming projects are particularly telling. For instance, the asset value within The Sandbox has dropped fifteen-fold in two years:

Price Trend for Gaming Lands (LAND) in The Sandbox (dune.com)

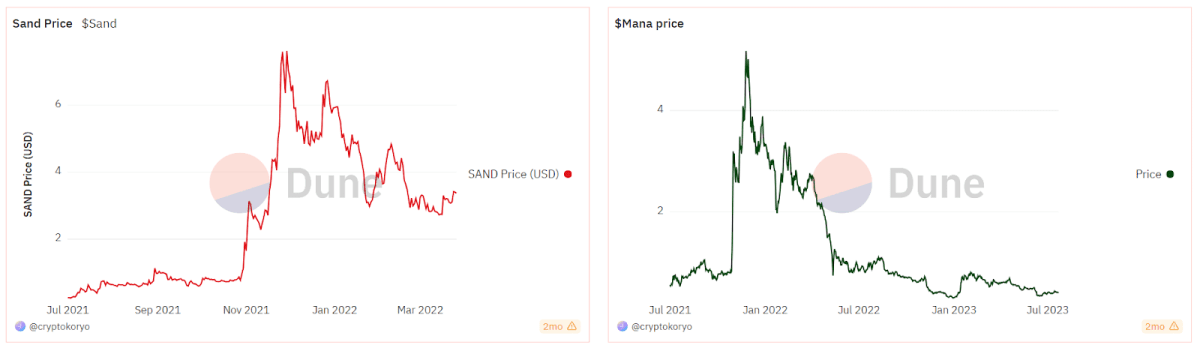

A declining trend is also evident in native tokens of the metaverse sector, including MANA and SAND. Their value has consistently deteriorated since 2021, with a decreasing influx of new users.

MANA and SAND Price Trends (dune.com)

As the cryptocurrency market continues its bearish run and diminishes in profitability, a significant number of seasoned players are exiting the GameFI sector. This departure is leading to a slump in both native token prices and the overall TVL trading volume.

Token Sales of GameFI Projects

Analytical platform Cryptorank sheds light on the state of new GameFI projects that recently undertook their public token sales, whether through IDOs or ICOs. Of the 108 projects launched from June to September, only 25 belonged to the GameFI niche.

The profitability landscape of these token sales is quite concerning. The majority of these tokens did not meet the hopes of early backers, leading to a loss post-token sale. Nonetheless, a select few startups, including the meme coin Shiba Saga (SHIA), Norma in Metaland (GRAM), and GameSwift (GSWIFT), showed promising results. It's worth noting that GameSwift was introduced during an IEO on Bybit.

Profitability Stats of GameFI Project Token Sales (cryptorank.io)

GameFI Challenges

The primary issue confronting the GameFI sector is its inadequate readiness for the shifts towards a bearish market. Here are the main reasons why GameFI has lost its momentum, and why P2E platforms have struggled to retain their early popularity:

- Lack of a Finished Product. In the token sale and cryptocurrency boom, many startups jumped the gun. They introduced their native tokens and raised investments often before they even had a clear game development plan.

- Pyramidal Economic Model. The lion's share of Play-to-Earn projects remain in vogue only as long as there's a steady stream of new users. When this flow diminishes, no new liquidity is infused. This leads both the native game token and internal game items or assets to undergo severe inflation.

- Funding Shortages. A significant portion of the funds raised through ICOs, IEOs, or IDOs has already been spent, leaving scant resources for the development and enhancement of games and associated platforms.

- GameFI's Crypto-Centric Nature. Many GameFI projects are driven by blockchain enthusiasts rather than gaming experts. This usually results in games that don't resonate with broader audiences. Additionally, while crypto-enthusiasts may be drawn to GameFI, the general public often views cryptocurrency with suspicion or finds it overly complex.

The Future of GameFI

The success of GameFI hinges on addressing its current issues. A new wave of startups is emerging that focus on creating a compelling Web3 game before launching their tokens or NFTs.

The expected resurgence in cryptocurrency value will likely intertwine with several trends, encompassing both the virtual social realm and the tangible economic sectors. This suggests that in the subsequent bull market, the spotlight will likely fall on SocialFI, Real World Assets, and GameFI initiatives. However, the viability of P2E token sales remains uncertain, as restoring user trust proves challenging.

In conclusion, the prevailing bearish phase in the cryptocurrency market could serve as an opportune moment for the inception of quality gaming products, initiating meaningful development, and drawing funding from private investors.