GMX review. The largest DEX's token on Arbitrum

Recently, Arbitrum has overtaken Ethereum in terms of daily transactions, showcasing the tremendous potential of this L2 solution. Despite not having its own token, Arbitrum has captured attention with its largest DEX platform, GMX, operating on the network.

What is GMX?

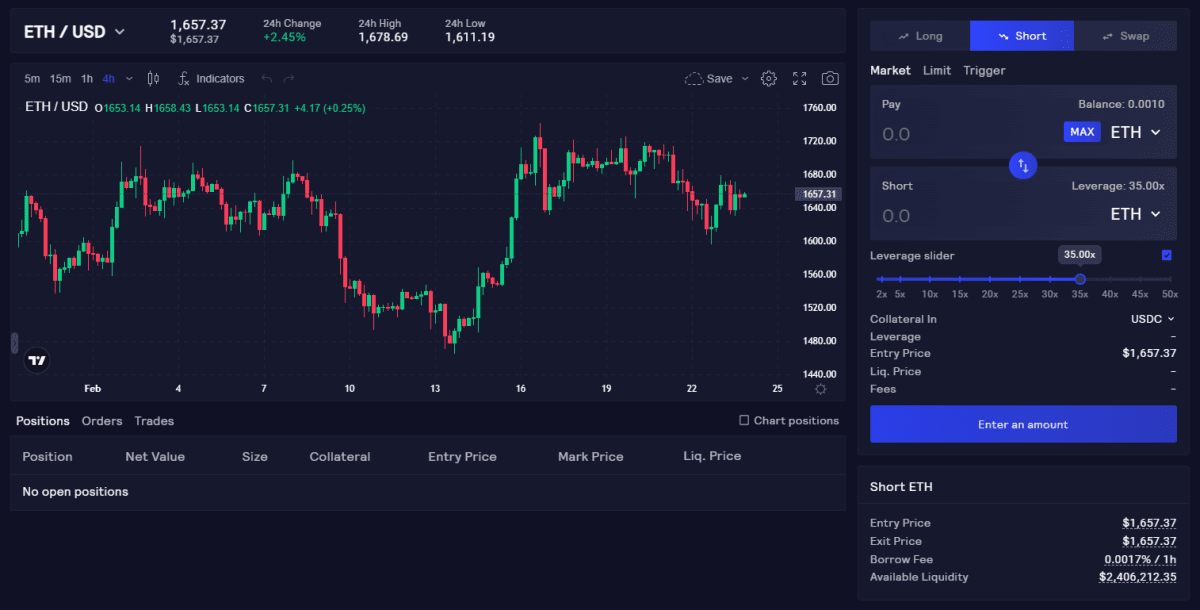

GMX is a decentralized exchange (DEX) that enables cryptocurrency trading in both the traditional way and through perpetual contracts with up to 50x leverage. This cutting-edge DEX launched on the Arbitrum network in September 2021 now also offers support for Avalanche.

Currently, GMX has a limited selection of tokens available for trading, including popular options such as WETH, UNI, WBTC, LINK, and stablecoins. The market prices of these cryptocurrencies are determined using Chainlink oracles, which gather data from other major exchanges.

GMX interface Source: app.gmx.io

GMX has a liquidity pool called GLP (GMX Liquidity Provider), which consists of the aforementioned tokens in varying proportions, with stablecoins accounting for approximately half of the pool. GLP can be staked with an annual interest rate that is updated weekly and typically amounts to around 20%. It depends on the fees that the platform charges its users for transactions. 70% of those fees contribute to the annual interest rate, and staking profits can also depend on trading results (profit or loss).

As liquidity is supplied and withdrawn from GLP, GLP tokens are constantly minted and burned to rebalance the assets in the pool.

GMX token and its use cases

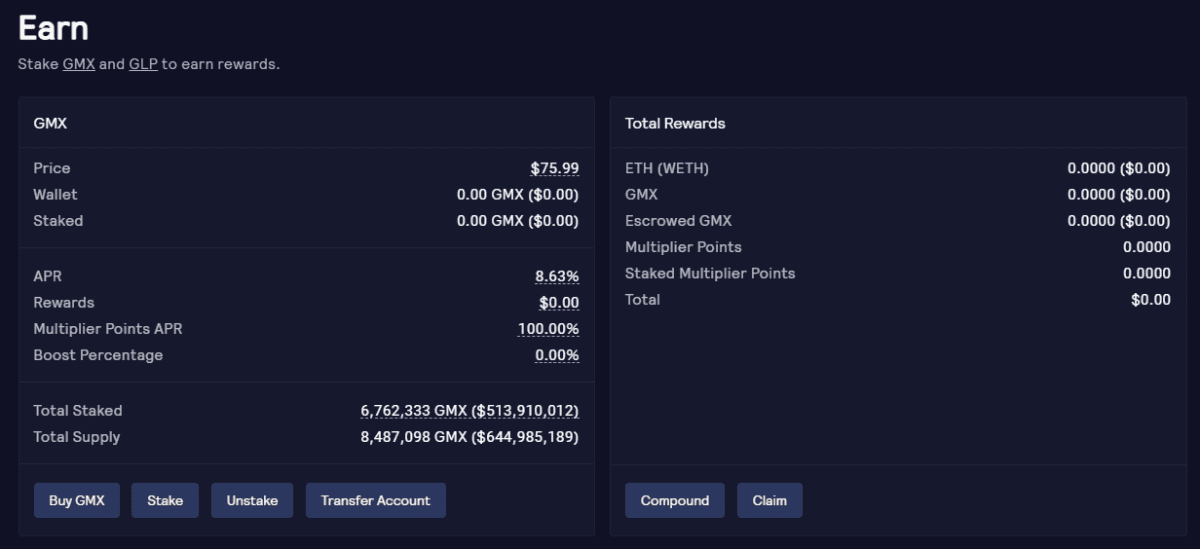

GMX is not just the name of the exchange, but also the name of its token. The token serves as both a management tool, providing users who stake GMX with voting rights on the platform's development, and a reward multiplier, increasing the percentage rate. It's like a Swiss Army Knife, with multiple functions for traders and stakers alike.

In addition to staking GLP, users can also stake GMX. The interest rate for staking GMX is formed from 30% of the platform's collected fees, with rewards paid out in either ETH or AVAX, depending on the chosen network.

GMX Staking Program Source: app.gmx.io

GMX has a maximum supply of 13.25 million tokens, which can be increased through voting if there is a need to boost liquidity for launching new products.

If you're interested in acquiring GMX, you can find it on several centralized exchanges, including Binance, OKX, Huobi, Kucoin, and others.

If you're interested in acquiring GMX, you can find it on several centralized exchanges, including Binance, OKX, Huobi, Kucoin, and others.

How to add GMX to Metamask?

To add the GMX token to Metamask, you will need to select the option for manual token import and enter the contract address:

- 0xfc5a1a6eb076a2c7ad06ed22c90d7e710e35ad0a (for the Arbitrum network);

- 0x62edc0692BD897D2295872a9FFCac5425011c661 (for the Avalanche network).

Prospects and pitfalls

The price of the GMX token primarily depends on the performance of the decentralized platform. While GMX provides traders with basic tools and a simple, user-friendly interface, there is room for expansion in terms of functionality and trading pairs beyond the current four cryptocurrencies and stablecoins. This presents an opportunity for the platform's continued growth and development.

The GMX token boasts an intriguing utility model, but its issuance is not entirely limited, which could potentially have a negative impact on its future price.

The GMX token boasts an intriguing utility model, but its issuance is not entirely limited, which could potentially have a negative impact on its future price.

GMX is not just riding the decentralized finance wave; it's making some serious waves of its own with a clear-cut earning model. And with low-cost transactions and perpetual contracts for leveraging trades, it's no wonder traders are diving in headfirst.