Hifi Finance: Crypto Project Reviewed

Hifi Finance is a lending protocol that allows users to lend and borrow crypto against tokenized real-world assets (RWA).

For an in-depth analysis of Real World Assets, please refer to our specialized article. The Hifi project offers the flexibility to use a diverse range of tokenized assets as collateral. This can include real estate, company stocks, bonds, consumer goods, and valuable items.

Let’s navigate through the Hifi Finance project, understanding its operational mechanisms, assessing the potential of the native HIFI token, and exploring Hifi's role in the emerging trend of RWA.

Origin

The project, initially named Mainframe, was founded in 2017, with its development and inaugural investment rounds starting in 2014. The protocol aimed to ensure security and privacy for transactions and message exchanges across the blockchain network.

At the end of 2022, Mainframe was rebranded to Hifi Finance. All users had the option to swap their MFT tokens for the new HIFI asset at a rate of 100 MFT per HIFI coin. This 100 to 1 exchange ratio allowed for a seamless asset transition without financial losses for MFT investors.

Presently, Hifi specializes in cryptocurrency lending, backed by RWAs. Doug Leonard serves as the CEO and leader of the Hifi Finance project.

Funding Rounds

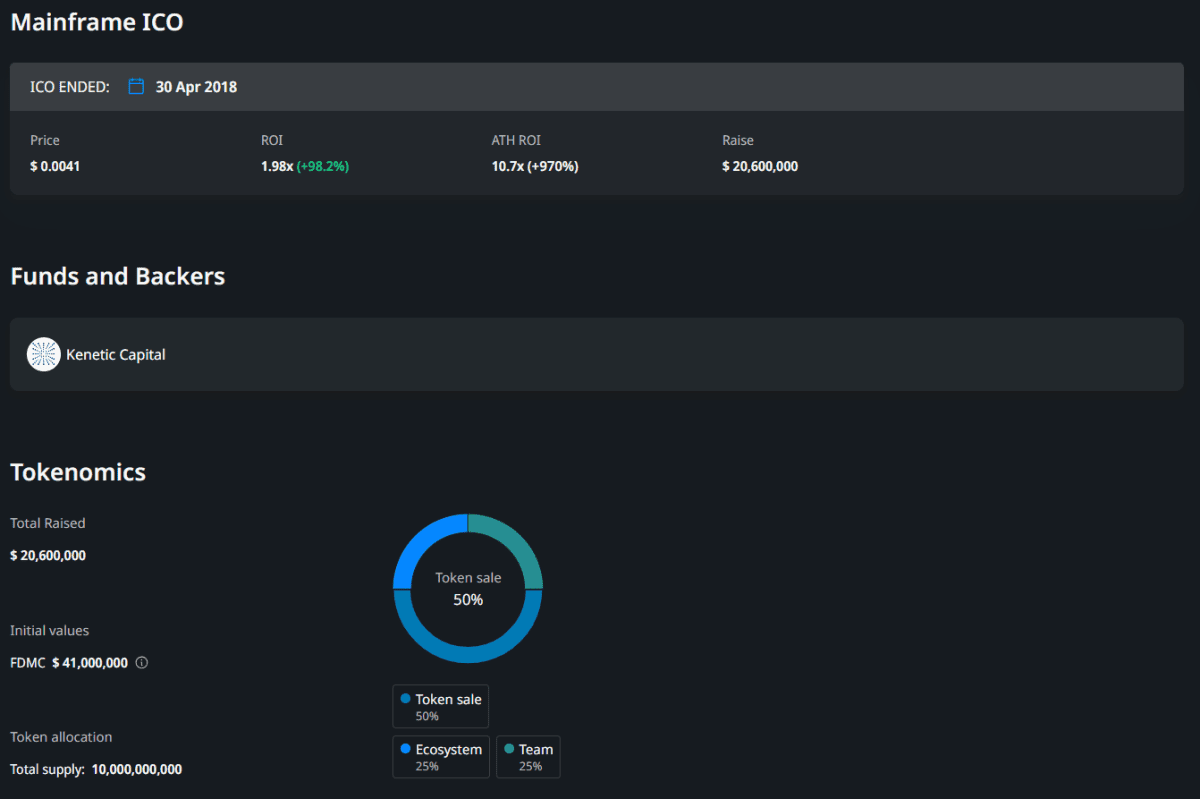

It is essential to trace back to the funding of Mainframe, as it laid the groundwork for Hifi. The protocol managed to raise $30.3 million through seven investment rounds, with significant backing from entities such as Zeroth.AI, Struck Crypto, AU21 Capital, Kenetic Capital, Sora Ventures, and BlockTower Capital. Additionally, on April 30, 2018, a successful Initial Coin Offering (ICO) was held, garnering an additional $20.6 million during the public sale.

Mainframe Investment Activity Details. Source: crunchbase.com

Mainframe ICO Details. Source: cryptorank.io

Thus, Hifi was set up with a strong foundation. The project itself, Hifi Finance, also conducted its investment rounds, raising a modest $120.5 million, with Techstars emerging as a key investor.

Investment in Hifi Finance. Source: crunchbase.com

Operating Mechanism of the Platform

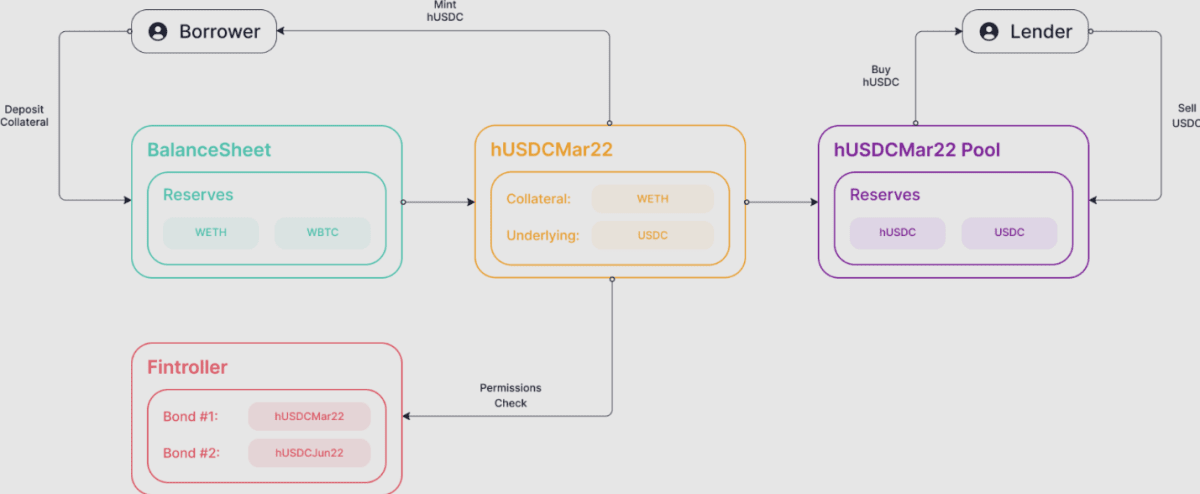

Built upon the Ethereum blockchain, Hifi employs ETH as a central asset in its lending operations.

Hifi offers users the opportunity to borrow against their tokenized assets, as well as the ability to lend their assets to the platform, earning a fixed interest rate as other users leverage them. The foundational principles of Hifi’s operation were outlined in the Mainframe Whitepaper.

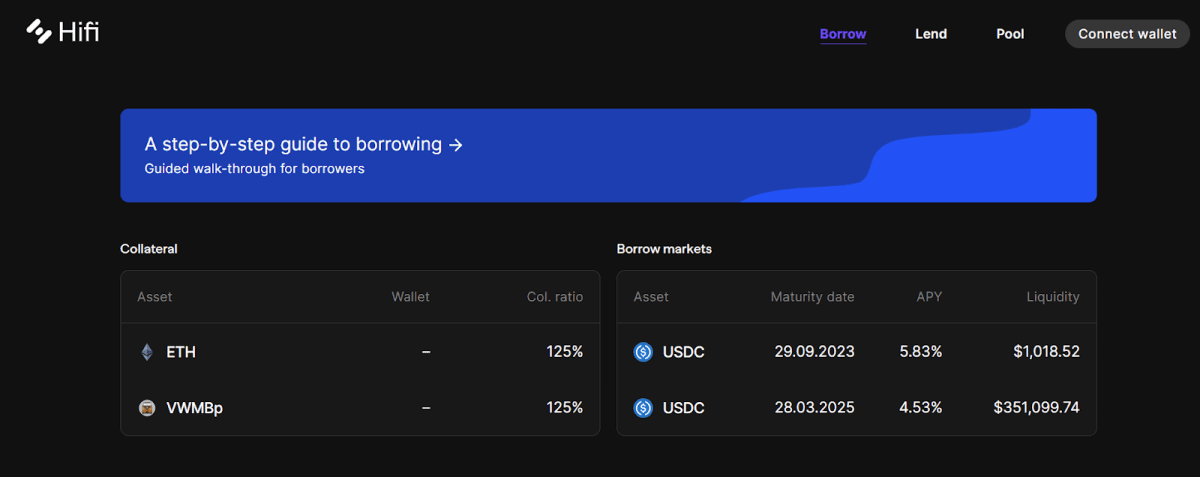

Key features of Hifi include:

- The ability to receive USDC and ETH by putting up your own assets as collateral.

- The necessity for each token to be over-collateralized to prevent devaluation. This means that to take out a loan in USDT, it needs to be over-collateralized by 125%.

- A large ecosystem that ensures the interconnection of various platform functions.

- The ability to create synthetic assets, hUSDT and hUSDC, which are tokenized stablecoins.

Operating Principle of the Hifi Finance Credit Protocol. Source: docs.hifi.finance

The protocol also supports various types and collections of NFTs through its internal Pooled NFT marketplace.

Interface of the Hifi Finance Lending Protocol. Source: app.hifi.finance

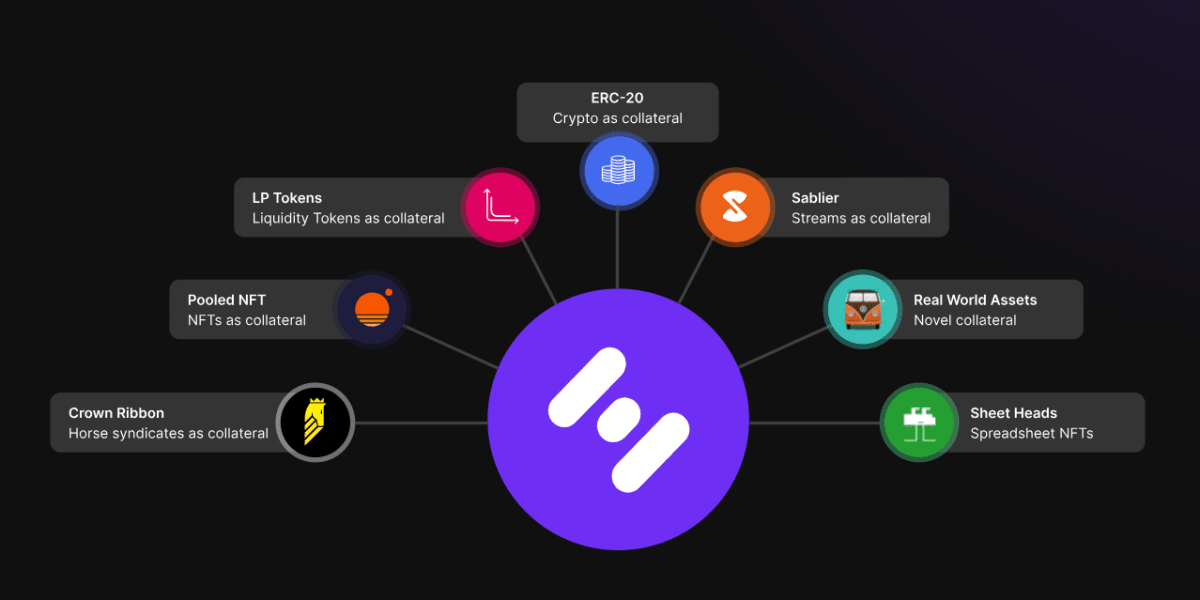

The Hifi Ecosystem

Hifi Finance has a developed ecosystem that includes an NFT platform, RWA protocol, electronic spreadsheet database, and the Crown Ribbon horse ownership contract project, among others. Each additional project within the ecosystem opens the door to new assets that can be used as collateral.

Hifi Finance Ecosystem. Source: hifi.finance

These ecosystem projects are gradually integrating with Hifi and are using the native token of the protocol as the main currency for transactions.

HIFI Token

Owning the HIFI token not only allows access to the main functionalities of the project but also provides privileges from its partners. Additionally, HIFI holders can participate in the DAO, influencing the protocol's governance decisions.

As of the time of writing this article, the HIFI coin has the following characteristics:

- Asset price: $0.68

- Market capitalization: $71 million

- Circulating supply: 105 million

- Maximum supply: 120 million

- Average daily trading volume: $28 million

- All-time high: $2.63

- All-time low: $0.25

The HIFI token is traded on exchanges such as Upbit, Mexc, Gate, KuCoin, HTX, and others. A complete list of available exchanges can be found on the CoinGecko and CoinMarketCap websites in the "Markets" section.

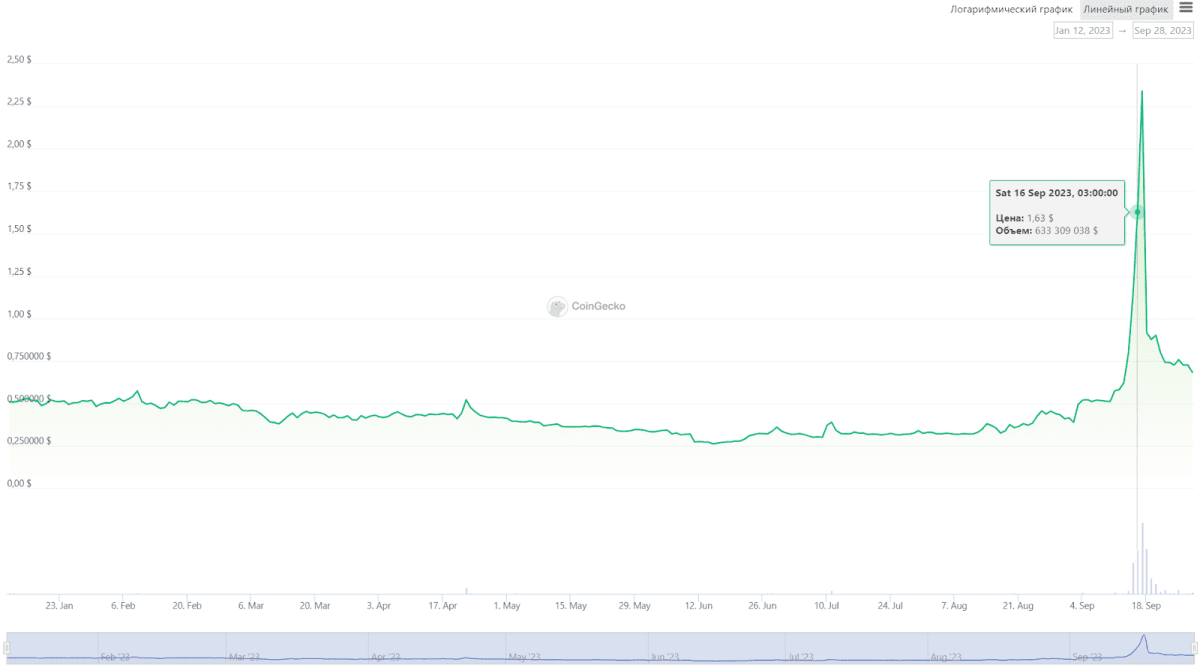

HIFI Price Dynamics. Source: coingecko.com

From September 14 to September 18, 2023, the asset experienced a 400% increase, setting a new all-time high at $2.63. At this peak, the average daily trading volume reached $800 million. This rapid growth was fueled by the launch of Sheety Bot—a bot in the Discord social network that tracks NFT activity across various platforms using artificial intelligence, creating arbitrage opportunities.

Final Words

The RWA trend is only gaining popularity, and large ecosystem projects ready to meet user needs can be leaders in this field for a long time. Hifi Finance is well-positioned to secure its place in the RWA sector.

Recommended