How Does Multisig Works and Protect Your Assets?

As threats to digital assets evolve, multisig technology provides a highly effective security layer. By requiring multiple signatures for transactions, it significantly reduces risks such as hacking and access loss.

Multisig — How It Protects Your Crypto

Multisig, short for multisignature, is a cutting-edge cryptographic technology that provides enhanced security for cryptocurrency transactions. While standard transactions rely on a single private key for authorization, multisig raises the bar by requiring multiple keys, creating a robust defense against unauthorized access.

A digital signature, created using a wallet owner’s private key, acts as a digital seal of approval. This signature confirms ownership and authorizes the execution of blockchain transactions.

Digital signature essentials:

- Authentication: Validates the origin of the transaction, confirming it comes from the wallet’s owner.

- Integrity: Protects against data manipulation, ensuring the transaction remains intact.

- Non-repudiation: Binds the signer to the transaction, removing the possibility of denial after signing.

Multisig in Action — Balancing Security and Control

Multisig doesn’t just improve control; it adds a robust layer of security by reducing the risks tied to losing one key. Here’s how it operates in real-world scenarios.

The Power of Multiple Keys

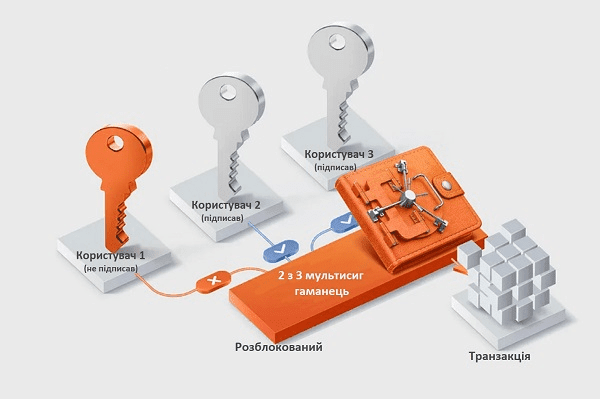

With multisig, transactions require several private keys to proceed. Take a "2-of-3" scheme: three keys are created, but only two are needed to approve a transaction. These keys are distributed among different users or devices for enhanced security.

Imagine a corporate wallet where two of three executives must sign off on a transfer. This structure ensures no single person can act alone, providing both protection and accountability.

Collaborative Asset Management

With a multisignature wallet, several individuals or entities can jointly oversee assets, a feature that proves especially useful in businesses where transaction approvals require collective agreement. This setup helps prevent fraud since no single person can move funds independently.

Multisig wallets also promote openness by granting all participants access to transaction details, while ensuring accountability, as every signer plays an active role in the process.

Picture this: a startup with three founders sets up a "2-of-3" multisig wallet, giving each of them a key. For any transaction to go through, at least two founders must give their consent. This ensures collaborative management and safeguards against unauthorized actions.

A Shield of Security

With a multisignature wallet, security takes center stage, ensuring your assets are protected even if a key is compromised. A single key alone isn’t enough—transactions require multiple keys to proceed, preventing unauthorized access. Even in the face of a breach or theft, your remaining keys stay secure, and if you lose a key, you can still access your wallet with the others, depending on the setup.

Imagine this: you set up a 2-of-3 multisig wallet, storing one key on your computer, one on your tablet, and one on your smartphone. If your computer is hacked, the intruder won’t be able to access your funds without an additional key. This system offers a robust safeguard, drastically reducing the risk of loss.

How Multisignature Functions in Crypto Transactions?

Multisignature, or multisig, is a widely adopted security measure in blockchains like Bitcoin and Ethereum, enhancing safety and control over asset transfers.

The process works as follows:

Building the Wallet: A multisig wallet generates multiple private keys that can be shared among different people.

Setting the Rules: A signing scheme defines how many approvals are needed. For instance, with "2-of-3," two keys are required to greenlight a transaction, while "3-of-5" ups the security by demanding three.

Signing Off: Each participant contributes their signature. The transaction only goes through when the necessary number of signatures is in place—making it impossible for one person to act alone.

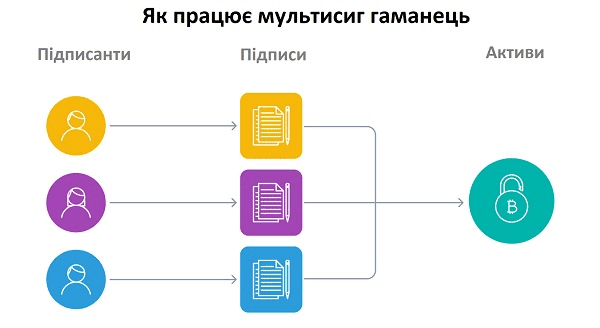

The multisignature system requires every participant to add their signature, ensuring a safe and trusted transaction. Source: itstatti.in.ua

Applications of Multisignature Across Blockchains

Bitcoin: On Bitcoin’s blockchain, multisig transactions are powered by P2SH (Pay-to-Script-Hash) scripts. These scripts lay out the rules for how many and whose signatures are needed to validate a transaction. For instance, a "2-of-3" scheme means the transaction won’t proceed until at least two of the three participants have signed, ensuring secure and shared control.

Ethereum: Ethereum handles multisig through smart contracts—programmed instructions that execute automatically under set conditions. In a multisig setup, the smart contract defines the number of required signatures to complete a transaction. This setup makes it possible to craft intricate asset management strategies, where decisions about funds or other assets require input and agreement from multiple participants.

The Various Types of Multisignature Wallets

Multisignature wallets rely on multiple approvals from key holders to complete a transaction. The number of required signatures depends on the type of wallet in use. Let’s take a closer look at how these wallets are structured.

M-of-N

Configuration In this setup, there are N private keys in total, but only M signatures are needed to validate a transaction. For example, with three keys, any two signatures can approve the operation. This model offers flexibility, accommodating situations where one or more participants may be unable to sign.

How It Works: The transaction is approved when two of the three users provide their signatures. Source: https://itstatti.in.ua/

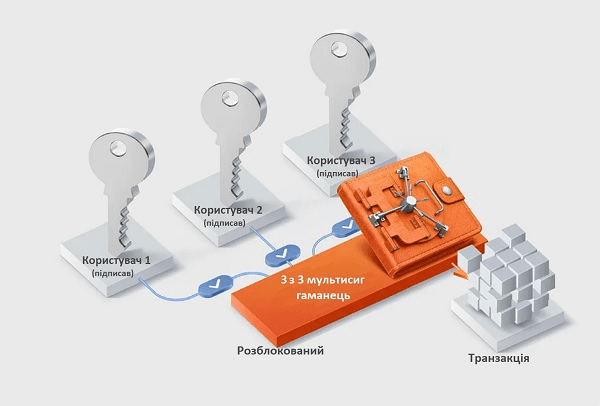

N-of-N Multisig Configuration

This approach requires all participants to sign off on a transaction for it to be executed. For example, in a system with three keys, all three signatures are necessary. This guarantees full agreement among participants and prevents any alterations without collective authorization.

3-of-3 Example: The transaction will only proceed when all participants provide their signatures. Source: https://itstatti.in.ua/

Why Multisig Matters for Security

Multisig offers an extra layer of protection against the risks associated with storing cryptocurrencies.

Here’s why it’s important:

Here’s why it’s important:

- Theft Resistance: A stolen key alone is useless without the required additional signatures, keeping your assets secure.

- Fraud Deterrence: For businesses, multisig guarantees that no single party can act independently to withdraw funds, fostering trust among partners.

- Access Resilience: Even if one key is lost, others can be used to regain control of your wallet, ensuring uninterrupted access.

The Pros and Cons of Multisig

Multisignature wallets come with some impressive advantages, the biggest being increased security. Since multiple signatures are required to authorize a transaction, it’s much harder for anyone to steal assets, even if one key is compromised. This is especially helpful for organizations that rely on shared control of assets, like when financial decisions need group approval. Plus, multisig reduces the chances of losing access to your funds—schemes like “2-of-3” ensure transactions can still be authorized if one key is misplaced.

Though multisignature wallets provide enhanced security, they are not without their challenges. Setting one up can be daunting for newcomers, as the process often requires technical expertise. The stakes are even higher when multiple keys are lost, potentially leading to irretrievable assets in the absence of recovery mechanisms. Additionally, the lack of universal support across cryptocurrency platforms can be a significant barrier for users who wish to integrate multisignature into their financial routines.

When Is Multisig the Right Choice?

If you’re looking to boost security and control over your crypto assets, multisignature wallets are a great option. For solo users managing their personal finances, a standard wallet with a single signature might do the job. But if you’re dealing with large sums alongside others, or in a business setting where shared accountability is key, multisig is a must-have.

It’s perfect for partnerships, ensuring everyone has access to the assets but must agree on big decisions. Families can also use multisig wallets for shared control of funds between spouses or relatives. And for companies, multisig makes it easier to manage corporate wallets by requiring multiple approvals for expenses.

This system offers an extra layer of defense against unauthorized transactions, significantly reducing the risks posed by potential hacks or accidental wallet access loss.

Multisignature is a robust tool for protecting cryptocurrency holdings, and its widespread adoption highlights its effectiveness.

By integrating multisig into your wallet setup, you enhance its security and adopt a responsible approach to asset management. If you haven’t started using this technology, now is an excellent time to explore and implement it.