How Fear and Greed Drive the Crypto Market: Kraken’s Report

Did you know that 63% of cryptocurrency holders claim that the fear of missing out (FOMO) has negatively impacted their investment strategy? According to a recent report by Kraken, emotions continue to play a dominant role in crypto investor decisions.

FOMO and FUD: Emotional Drivers in Crypto Investing

Emotional decision-making often leads to significant financial losses for crypto traders and investors.

Kraken’s latest study highlights how two major emotional triggers — Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) — impact market behavior.

FOMO represents the anxiety investors feel when they believe they are missing out on a lucrative opportunity. Conversely, FUD refers to negative emotions like panic or skepticism caused by uncertainty or a lack of confidence in a cryptocurrency's future potential.

These emotions often correlate with greed and fear, captured by the widely used Fear & Greed Index. This metric provides a snapshot of market sentiment, offering insights into the psychological factors that drive the crypto market.

Emotions vs Market Realities

When unchecked, FOMO and FUD can lead to hasty, irrational decisions driven more by emotions than by a thorough analysis of market conditions.

This is supported by Kraken’s earlier DCA Strategy Crypto Survey. The survey revealed that 55% of respondents use dollar-cost averaging (DCA) strategies more frequently in cryptocurrency markets than in traditional markets. This preference is driven by the need to minimize the impact of emotionally charged decisions during periods of high volatility.

The survey also highlighted that emotional investments are common even among experienced traders. FOMO influenced 84% of crypto holders to enter the market, while FUD led 81% of investors to make impulsive, unplanned moves.

Fear and greed are driving forces in the crypto market. Source: Kraken Digital Asset Exchange, Facebook

The results of Kraken’s survey reveal a well-known but frequently overlooked truth among traders: despite ongoing discussions about the importance of making decisions based solely on a trading system, such advice often remains little more than theoretical when emotions take over.

Nonetheless, gaining a deeper understanding of these psychological factors can help refine strategies and mitigate the risks tied to emotional decision-making.

Fear of Missing Out Takes Center Stage

The survey revealed that most cryptocurrency holders are primarily concerned with the fear of losing potential profits on their current positions, while the fear of missing out on new opportunities appears less impactful.

Specifically, 60% of respondents cited missing out on a price rally as their greatest fear, stating that this concern “significantly” influences their market behavior. Additionally, 58% admitted to “often” making decisions based on this fear, while another 26% said it “sometimes” affects their choices.

The impact of FOMO on crypto investors Source: Kraken

In comparison, only 17% of participants admitted fearing they might miss a significant price drop (a sell-off) that could provide discounted buying opportunities. About 20% reported being equally worried about missing both upward and downward price movements. Just 3% of the 1,248 surveyed crypto investors claimed market volatility has no influence on their decisions.

Immediate Gains Take Priority

The study revealed a strong tendency among cryptocurrency investors to focus on short-term profits at the expense of long-term opportunities.

According to the survey, many investors still buy assets at peak prices, driven by market hype. At the same time, they often miss the opportunity to strategically accumulate assets during price dips, particularly through dollar-cost averaging (DCA).

This behavior increases the risk of missing out on potential profits if asset values rise over time.

Emotional Decisions and Their Portfolio Impact

A notable 63% of cryptocurrency holders acknowledged that emotional decision-making negatively impacted their portfolio performance. This highlights the risks of relying too heavily on market sentiment driven by fear and greed.

While market sentiment indicators can offer valuable insights, Kraken analysts emphasize the greater importance of employing systematic approaches, such as technical analysis.

Proven investment strategies—like candlestick chart patterns that reveal price behavior over specific timeframes or other technical indicators—enable investors to make informed decisions based on objective data rather than emotional impulses.

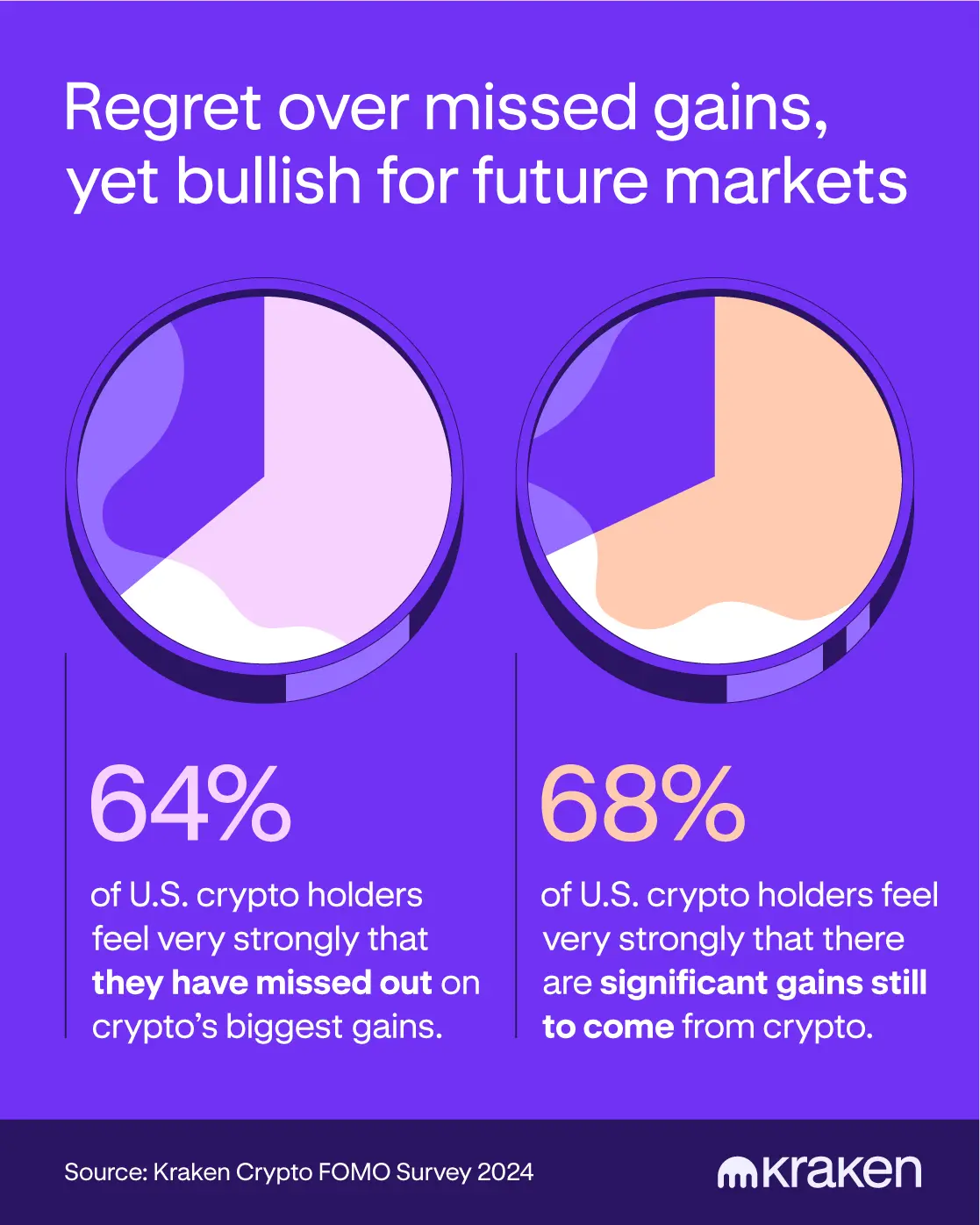

Cryptocurrency Holders Balance Regret and Optimism

The survey highlights a mix of regret and optimism among cryptocurrency holders. While many investors feel they missed out on early opportunities, a significant majority remain hopeful about the future potential of cryptocurrencies.

Balancing regret and optimism: crypto holders’ perspectives. Source: Kraken

According to the data, 64% of respondents believe they have missed the most lucrative opportunities in the crypto market. However, two-thirds of this group (68%) are optimistic that substantial profits are still attainable.

This sentiment is especially prevalent among investors aged 45 to 60. Within this demographic, 78% expressed strong regret over missed chances, yet 75% maintain confidence in the continued growth of cryptocurrencies.

The Older, the More Optimistic

The survey revealed varied sentiments across age groups:

- Ages 18–29: 41% feel they’ve missed the biggest opportunities, while 36% remain optimistic about future prospects.

- Ages 30–44: 54% believe they’ve lost their chance, but 49% still anticipate significant growth ahead.

- Ages 45–60: 78% regret missing early opportunities, yet 74% are confident in the potential for continued growth.

- Ages 60 and older: 67% express concerns about missed profits, but 73% believe there are still opportunities for substantial future gains.

Are Women Better Investors Than Men?

The survey highlighted notable gender differences in investment behavior and decision-making. Interestingly, male cryptocurrency holders were more likely than female holders to admit that emotions influenced their investment choices.

83% of men acknowledged making decisions driven by fear, uncertainty, and doubt (FUD), compared to 75% of women.

The gap widened further with the fear of missing out (FOMO), as 66% of men admitted acting on this emotion, while only 42% of women reported similar behavior.

Additionally, 70% of men expressed regret over missing significant opportunities, compared to just 48% of women.

These findings suggest that men may be more susceptible to impulsive decisions during market fluctuations and experience greater regret when their strategies fall short of expectations.

Despite this emotional disparity, investors across all age and gender groups remain largely optimistic about the future of cryptocurrencies. Many continue to believe that crypto will occupy a central role in the global financial system in the years ahead.

Navigating Between FOMO and FUD: The Role of Information Sources in Investment Decisions

The researchers explored how information sources influence the emotional decisions of cryptocurrency holders. The results revealed a strong correlation between the use of specific platforms and the prevalence of FOMO.

Emotional Impact

Survey participants shared their preferences for seeking trading opportunities, revealing various channels they rely on. Social media and influencers topped the list, used by 61% of respondents.

Other popular sources included news outlets, blogs, and podcasts (50%), as well as websites like CoinMarketCap and CoinGecko (47%). Recommendations from friends and family were mentioned by 24%.

Only 8% of respondents reported not actively searching for new investment opportunities.

The survey highlighted a strong correlation between reliance on social media and the negative impact of emotional decision-making.

Interestingly, among those who used social media for investment advice, regret was prevalent: 85% admitted that FOMO-driven, emotional decisions had significantly harmed their portfolios.

Balancing Risks and Valuable Insights

While emotional posts on social media often intensify FOMO and prompt impulsive decisions, these platforms also provide a space for sharing valuable knowledge and strategies that can assist investors.

To minimize risks, it’s important to critically assess the information consumed, ensuring its reliability and context. Remember, much of what circulates on social media is not pure "information" but subjective "interpretation," making most posts in your feed inherently biased.

Conducting your own in-depth research can significantly reduce the impact of emotional triggers. For a thoughtful approach to building your investment strategy, check out our comprehensive guide, "How to Analyze Cryptocurrency?"

Combating FOMO and FUD: Practical Strategies

A survey of over 1,000 U.S. crypto users revealed that 59% utilize the dollar-cost averaging (DCA) method as their primary trading strategy.

DCA involves making regular investments in assets, regardless of their current market price. This strategy helps smooth out the effects of market volatility and minimizes the risk of impulsive decisions during significant market fluctuations.

Tools to Mitigate Emotions in Crypto Trading

Several tools can assist investors in making more rational and strategic trading decisions:

- Custom Orders: Setting predefined buy, sell, or exchange prices eliminates the need for constant market monitoring. This feature simplifies trading and supports the development of disciplined, long-term strategies.

- Chart Pattern Screeners: These tools help identify key market patterns and provide insights into potential price movements. By relying on technical analysis, traders can avoid impulsive decisions driven by emotional reactions.

- AI-Driven Trading Bots: These bots automate trades based on analyzing large volumes of market data, removing the emotional component from investment decisions. However, it's crucial to assess the risks and advantages of AI bots before incorporating them into your strategy.

- Recurring Buys as part of the DCA strategy outlined above.

These tools, as highlighted by Kraken experts, encourage a disciplined approach to trading and help mitigate emotional influences, which is especially critical in the highly volatile cryptocurrency market.

Recommended