How to list your token on an exchange?

After creating your own token, you need to list it on an exchange. This will give value to the coin and allow users to trade. And higher demand logically leads to a price increase.

In the previous article, we explained how to create your token in cheap and fast ways.

To set a price for a coin, it must be listed on a trading platform. You can do that on a centralized or decentralized exchange. In the first case, the listing will cost more but will provide ease of trading for users. The second method is cheaper but has problems with security and mobility. We will describe each method in more detail.

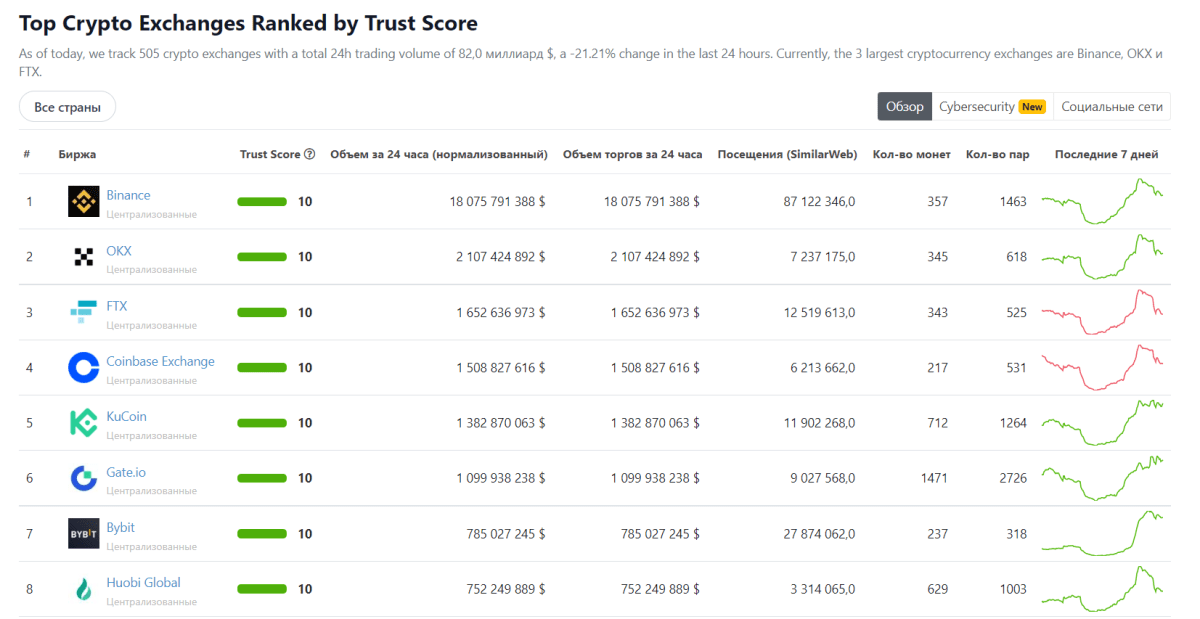

Centralized exchange – is a platform for trading cryptocurrency, where transactions are processed on internal servers. That is, to buy Bitcoin, the user needs to keep the funds on the exchange. Such exchanges are Binance, KuCoin, WhiteBIT, OKX, and others. A complete list of centralized exchanges can be found on Coingecko and Coinmarketcap in the appropriate section.

А ranking list of centralized crypto exchanges (Coingecko)

These are large platforms with a good trading volume and many users. To add your token, you need to fill out a listing request, which can be found on a particular page of the exchange’s website. The cost of listing may vary from $10,000 to $500,000.

It should be understood that exchanges make money on commissions. Therefore, if your coin already has large trading volumes on other platforms, the exchange may offer a free listing because it will improve its liquidity and increase its earnings.

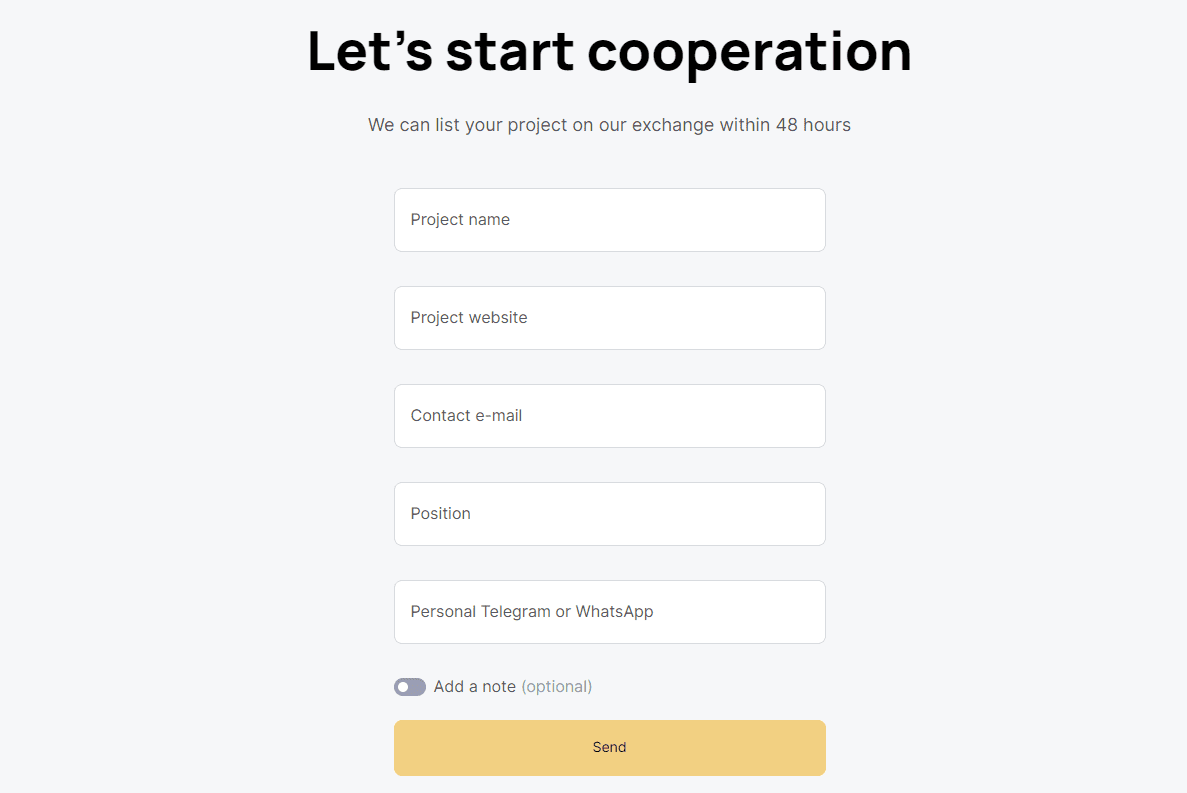

А request to list a token on an exchange (WhiteBIT)

However, money is not everything. The platform will have to ensure that the project is of high quality and is developing according to its stated goals. It is necessary to prepare a presentation, tokenomics, a Whitepaper, a website, social media, and some blocks of information that will demonstrate the seriousness of the intentions.

Decentralized exchange is a platform where you can exchange tokens without providing access to your own funds. The user connects a wallet and makes an exchange of one token for another. In this case, it is necessary to hold a blockchain token to pay the network’s fee.

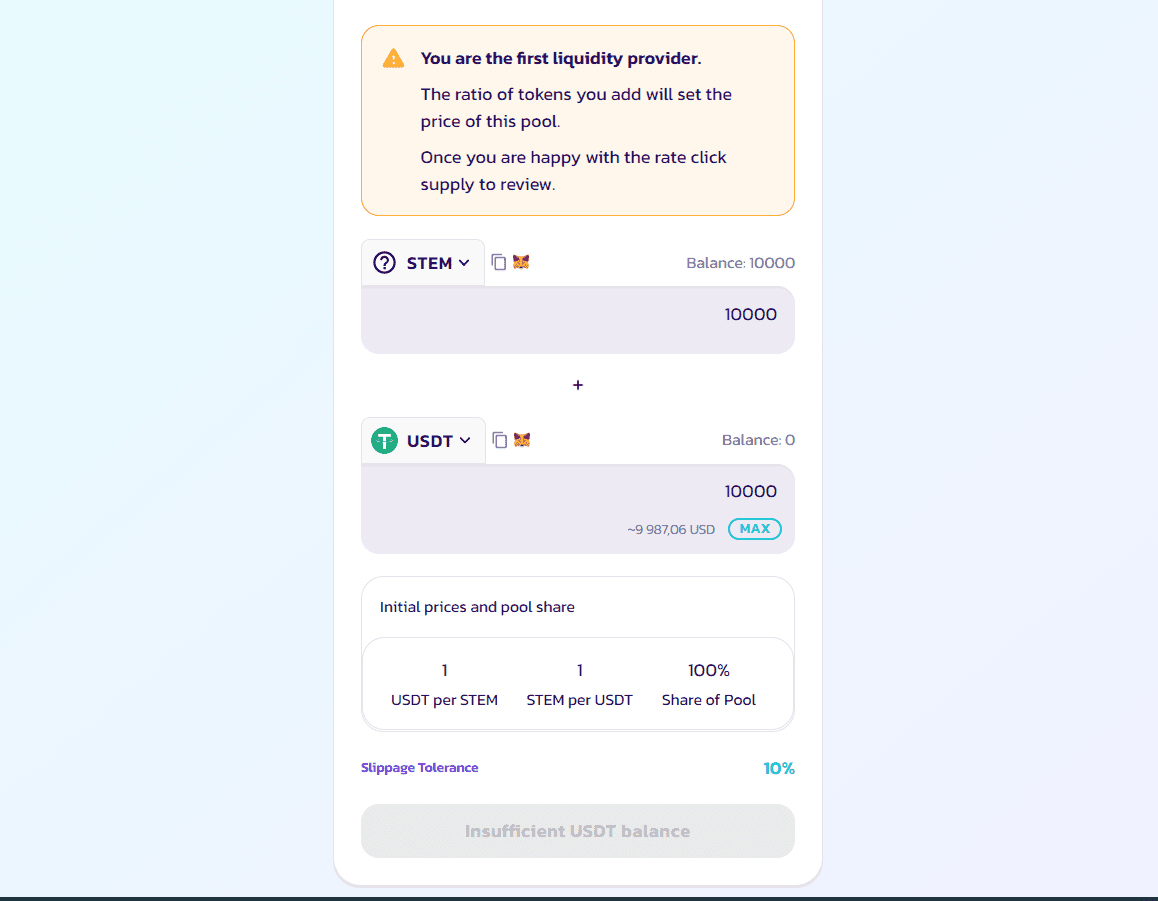

DEX (decentralized exchanges) is an excellent choice for listing a young token. To give a coin a price – it is enough to add liquidity to the exchange, i.e., to back your token with existing crypto (most often, USDT or USDC stablecoins). For example, you add 10,000 USDT and 10,000 of your coins to liquidity, so the price of 1 token will be $1.

Аdding liquidity and token listing on the DEX exchange (Pancake Swap)

After adding liquidity, anyone can connect their wallet, find your token, and start trading.

The main disadvantages of listing on a DEX:

Which type of exchange to choose for your token is up to you.

A DEX is suitable for small projects that are just starting out and don’t have much money. A centralized exchange is a complex but more reliable option, providing good marketing and increasing the volume of trades. It is an excellent option for projects that scale and expand their capabilities, attracting new traders.

Recommended