How to use the Golden Cross and Death Cross in trading?

The Golden Cross and the Death Cross are simple chart patterns that even inexperienced traders can use. Moving averages (MAs) are used in both patterns to determine a trend change.

To understand how the Golden Cross (GC) and Death Cross (DC) work, you should first learn about the moving averages.

A moving average (MA) is a technical indicator used by traders to see the average price movement over a certain period. It is used to determine the trend direction, as well as the support and resistance levels. There are various types of MAs, but the 50-day and 200-day MA (DMA) are the most accurate.

What is the Golden Cross?

This cross appears on a chart when the 50 DMA crosses above the 200 DMA. It is regarded as a powerful indication that the asset price will rise further.

An MA with a short time frame will react much quicker to price changes than an MA with a long look-back period. The shorter MA rises more quickly and crosses the longer MA when the market starts a sustained upward movement.

There are three phases of forming the golden cross.

1. Downtrend: the 50-day moving average moves below the 200-day moving average.

2. Trend reversal: the 50-day moving average crosses up through the 200-day moving average.

3. Continuing uptrend: the shorter MA moves above the longer MA, moving away from it.

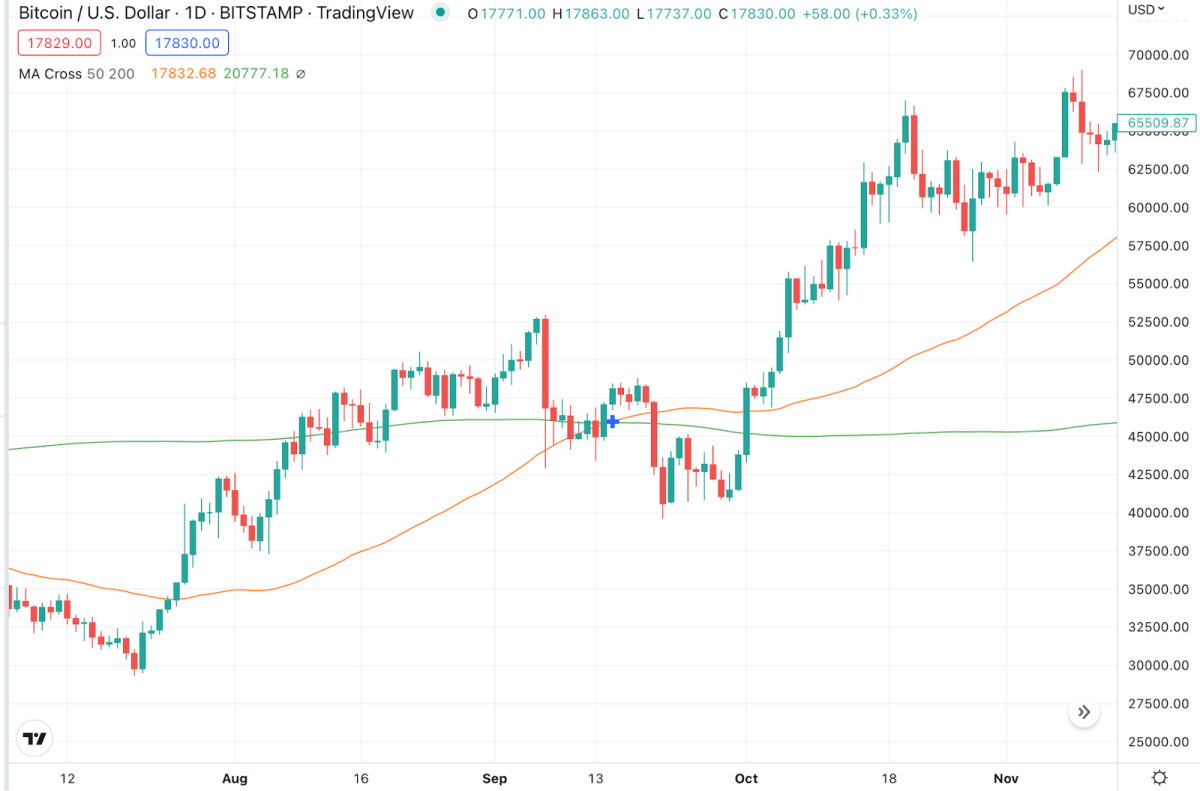

Golden crossing on the Bitcoin chart appeared in September 2021, a few months before BTC reached an all-time high of about $69,000.

Golden crossing on the Bitcoin chart appeared in September 2021, a few months before BTC reached an all-time high of about $69,000.

The golden cross on the Bitcoin chart. Source: Tradingview

What is the Death Cross?

The death cross occurs when the 50-day MA crosses below the 200-day MA. This is an indication that the downtrend will continue.

Simply put, the death cross, in direct contrast to the golden cross, is a strong bearish market signal.

The death cross can also be divided into three phases:

1. Uptrend. The shorter MA is above the longer MA during an uptrend.

2. Trend reversal. The price reverses and the 50-day moving average falls above the 200-day moving average.

3. Stable downtrend. The downtrend continues, and the 50-day MA remains below the 200-day MA for an extended period of time.

The death cross appeared on the Bitcoin chart in January of this year, when the price of BTC fell to $45,000. Since then, the 50-day MA has not yet crossed above the 200-day MA.

The death cross appeared on the Bitcoin chart in January of this year, when the price of BTC fell to $45,000. Since then, the 50-day MA has not yet crossed above the 200-day MA.

The death cross on the Bitcoin chart. Source: Tradingview

How to use the Golden Cross and the Death Cross in trading?

These signals are typically used to confirm a trend reversal. Traders can make a long-term investment in an asset if they notice the formation of a golden cross on the chart. If a death cross appears on the chart, and it can be a good time to sell the asset.

However, experienced traders understand that any indicator, including the MA crossover, can be misleading. As with other indicators, the longer the time frame, the more reliable the signal is. When compared to the crossover of the 50-day and 200-day moving averages, the crossover of the 1-hour and 5-hour moving averages is a very weak signal.

However, experienced traders understand that any indicator, including the MA crossover, can be misleading. As with other indicators, the longer the time frame, the more reliable the signal is. When compared to the crossover of the 50-day and 200-day moving averages, the crossover of the 1-hour and 5-hour moving averages is a very weak signal.

It is also important to keep in mind that moving averages are lagging indicators. They reflect market trends from past price information only. If one of the crosses appears on the chart, it indicates that a significant price movement has already occurred and that it is best to wait for a correction before entering a position.

Using additional indicators, such as RSI or stochastics, traders can assess the reliability of a signal before entering a trade.

Recommended