IMF Assesses Nigeria's Digital Currency: Key Takeaways

The International Monetary Fund (IMF) has issued a report on Nigeria's central bank's digital currency, thoroughly describing the project's accomplishments and difficulties while providing numerous recommendations.

Although the government acknowledged the initiative's failure six months ago, eNaira continues to function, as Central Bank Digital Currencies (CBDCs) remain a significant focus for many countries. This is particularly true in Africa, where a majority of individuals lack access to traditional banking systems. As a result, Nigeria became the second country globally to introduce a public digital currency with the aims of enhancing financial accessibility, reducing commissions from third-party services (sometimes reaching 10% of the transaction amount), and increasing economic transparency.

What is eNaira?

eNaira is the Central Bank of Nigeria's digital currency, officially introduced in late 2021 for wholesale (banks) and retail users (individuals). It operates on a distributed ledger technology (DLT), with all transactions being processed in real time. Such technologies potentially enable the project to fully replace cash and mobile money, as CBDCs are much more resilient to hacking, allowing the government to combat financial crimes more effectively.

How is eNaira used?

Despite anticipated problems with the throughput of the distributed ledger, the IMF examined eNaira over a year and confirmed that it has been operating consistently without major delays, disruptions, or security issues. This can be associated with the low load due to a lack of broad CBDC adoption:

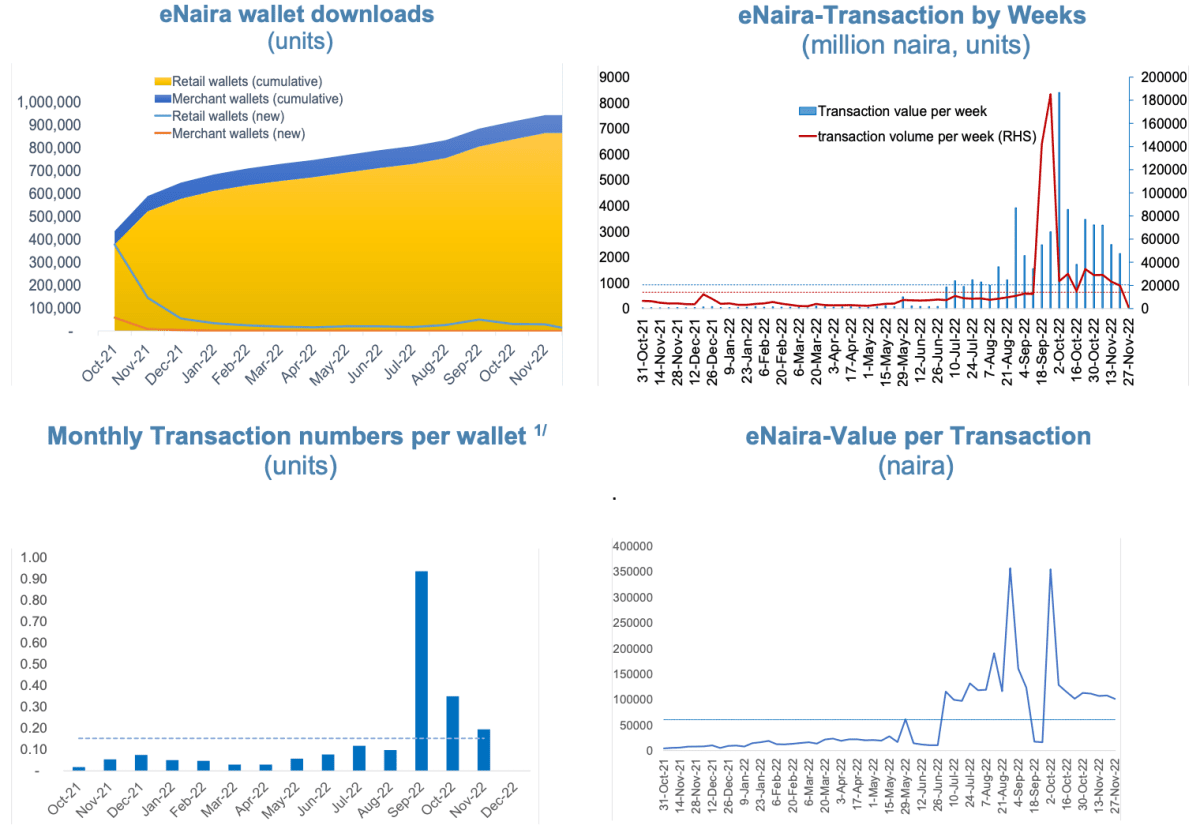

1. The number of retail wallets swiftly reached 500,000 but soon after the growth decelerated, and a year later, the figure was only 860,000 accounts (less than 1% of Nigeria's bank accounts). Trading accounts (POS terminals) experienced an even more drastic decline, decreasing four-fold to below 100,000.

2. User activity, barring some unexplained surges, averages about 14,000 transfers per week. This suggests that a majority (over 98.5%) of wallet holders do not use eNaira.

eNaira usage rate. Source: IMF official report.

Despite the grim statistics, the IMF insists on the project's continuation. The Fund argues that the slow acceptance of digital currency is not surprising, particularly given the transition period with restrictions from Nigeria's Central Bank. As such, it proposes that the authorities devise a comprehensive product development strategy, encompassing a series of specific tasks.

IMF Recommendations

The International Monetary Fund (IMF) ardently advises against compelling the use of digital currency among citizens (through limitations on cash withdrawals and high charges for alternative payment methods), advocating instead for a freer competitive landscape that can inspire trust in the product. Despite the Nigerian government's parallel efforts to increase the usage of Central Bank Digital Currencies (CBDCs), such as incentivizing supermarkets and providing scholarships, the IMF has shared its own suggestions, finding the current approach to be somewhat lacking:

1. Enhance cross-border transfers by generating wallets for international financial institutions, which would increase the speed and decrease the costs of these transactions.

2. Formulate partnerships with digital asset operators, at least in the area of fund exchange.

3. Expand the enticing incentives for using eNaira, particularly within social services. This approach could open up access to the financial system for the country's impoverished population without the need for coercive measures.

4. Enforce strict compliance with Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) measures, as the influence of CBDCs could potentially become unpredictable amidst increasing demand and Nigeria's existing risk assessment framework, which has numerous deficiencies.

Conclusion

The IMF essentially asserts that the project is still in the nascent stages of development, a time when most users tend to ignore it and favor other methods of payment, including cryptocurrencies. Should the Nigerian government heed these recommendations and dedicate all their efforts towards constructing a robust promotional strategy, while simultaneously discarding unpopular decisions, eNaira has the potential to evolve not just as an alternative local payment method, but also as a regional one.