Independent Auditor Report Confirms Tether's Dollar Peg

Independent audit firm BDO has compiled a reserve report for Tether Limited's board of directors. This is a crucial step that every stablecoin issuer must take, but, unfortunately, not everyone follows this rule.

USDT is a stable cryptocurrency designed to maintain a 1:1 ratio with the US dollar. Tether Limited has endured numerous court hearings to demonstrate that its revenue is purely fee-based, and it has no ability to influence the stablecoin's value. To solidify their dollar-pegged strategy, the founders opted to seek an independent assessment of the company's financial condition.

The audit report, which scrutinizes the accounts of Tether Limited and its subsidiaries, was unveiled on May 10.

It covers key aspects such as:

- The sum of dollar reserves held by the company;

- Outstanding debts and receivables;

- The yield on treasury obligations;

- Current profits and losses.

Accounting, it appears, isn't a swift process. The report is based on data up until March 31, 2023. If software development was as slow-paced as accountancy, we would barely grasp the concept of Web2, let alone the intricacies of blockchain.

In March 2023, amid the turmoil surrounding USDC, Tether's founders assured that its reserves were a blend of fiat currencies, gold, and other assets, including bonds. This diverse portfolio has allowed them to maintain a consistent 1:1 ratio with the dollar. This claim has now been substantiated.

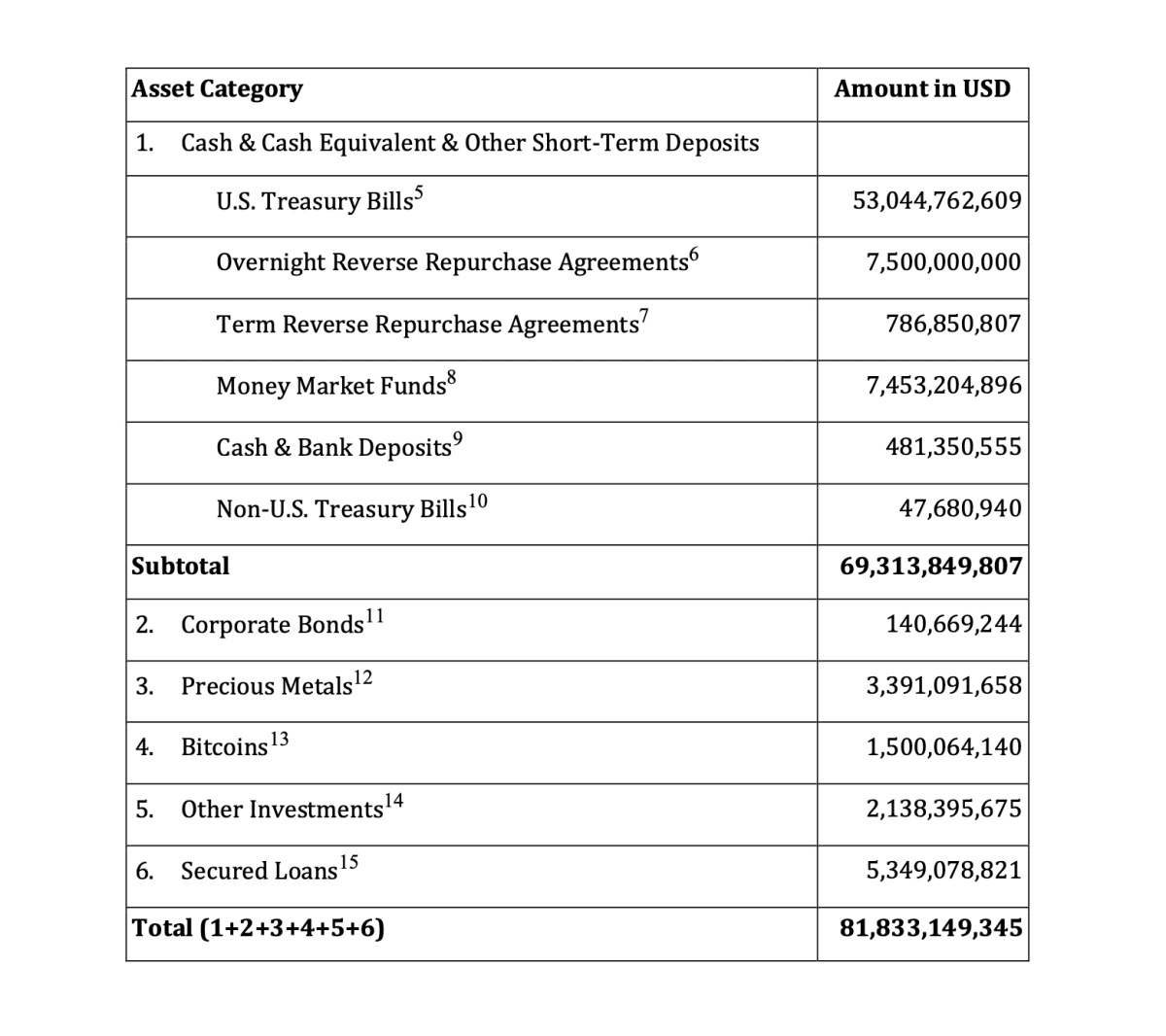

- The total reserves have swelled to $81.8 billion.

- Surplus reserves clock in at $2.44 billion. (This outperformed the project founders' quarter-end goal of $1.6 billion, exceeding their expectations).

- Cash or cash equivalents account for 85% of the reserves, which includes $3.4 billion stored in high-grade gold.

- 1.8% has been converted into Bitcoin.

- A sizable portion of the reserve ($53 billion) is safely stashed in US Treasury bills.

- Tether's first-quarter net profit reached $1.5 billion. (By contrast, BlackRock's shares were valued at $1.16 billion in the same quarter).

A detailed breakdown of Tether's reserve assets. Source: BDO

However, amidst these promising figures, there is a notable concern that captures attention: the substantial portion of reserves allocated to government treasury bills. Presently, these investments offer a quarterly yield of 5.2%, marking the highest rate witnessed in the past decade.

But given the looming global economic crisis and America's current struggle with inflation, this kind of investment could be seen as a high-risk move. This aspect significantly dents the credibility of USDT issuers' assertions that their income is purely derived from commission fees.

Of course, this observation didn't make it into the report.

Recommended