Iran imported goods paid in crypto to circumvent sanctions

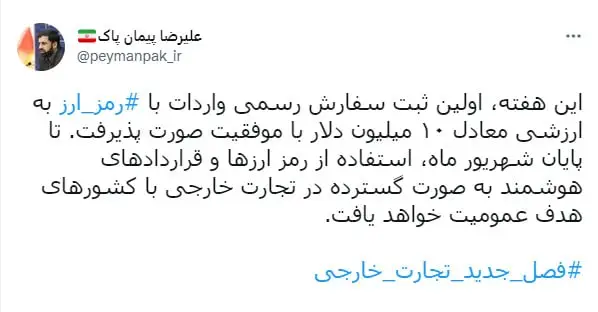

Iran’s Deputy Prime Minister of Industry, Mines and Trade, Reza Fatemi Amin, confirmed in his tweet that they conducted the first deal to pay for imports using cryptocurrency.

The cost of the delivery was $10 million, which suggests its test nature. It is not reported precisely what cryptocurrency was used, but it was likely a CoinMarketCap top-ten stablecoin. The Iranian counterparty is also unknown. According to some reports, the deal may have been a grain transaction.

According to the Iranian official, at the end of September, they expect that “the use of cryptocurrencies and smart contracts will be widespread in foreign trade with partner countries.”

It would be fine, but the list of “partner countries” is strictly limited due to U.S. sanctions against Iran, which makes trade with this state very toxic. This nuance could reignite the discussion about the criminalization of anonymous cryptocurrency payments. And we have yet to exhale after the Tornado Cash story.

Iran, until recently, was the leader in the number of sanctions imposed on its economy, keeping the grim company to another two not completely sane nuclear warhead holders (North Korea and the Russian Federation). Venezuela, which is drowning in hyperinflation, has also experimented with circumventing sanctions by using cryptocurrencies.

If we look at things positively, we can see a clear trend: the maximum interest in cryptocurrencies can be seen in countries with weak or developing economies. These are not necessarily bully states. In fact, we can mention the “little ones” like El Salvador or the Central African Republic.

So, let’s not dig too deeply into the possible consequences of this story. Some Chinese sages said long ago that a barn without mice is no good. Because where there is development and expansion of the “barn”, there will always be “mice”. They will not disappear completely if you fight against them. They will disappear only when the barn becomes empty. And this is definitely not about the modern crypto world, the true potential of which isn’t even 5% unlocked.

Regulators will sooner or later find more flexible models for dealing with the inevitability represented by “crypto”. Or crypto will simply throw them into the dustbin of history. We can only believe in the genius of Satoshi Nakamoto and that for every conditional and sanctioned Iran in the cryptocurrency market, there will be their own Black Rock with PayPal as a counterbalance.

Recommended