Is the U.S. Gaining Monopoly Power Over BTC Mining?

The United States has dramatically expanded its share in Bitcoin’s global hashrate. Yet, Trump’s proposed control over the mining sector brings more questions than answers.

The Crypto Mining Landscape in America

In November, top American mining giants—Marathon Digital Holdings, Riot Platforms, Core Scientific, and Hut 8 Mining—produced Bitcoin valued at $366 million. After China’s 2021 restrictions on Bitcoin mining forced operations to move elsewhere, the U.S. has solidified its position as the global hub for mining activities.

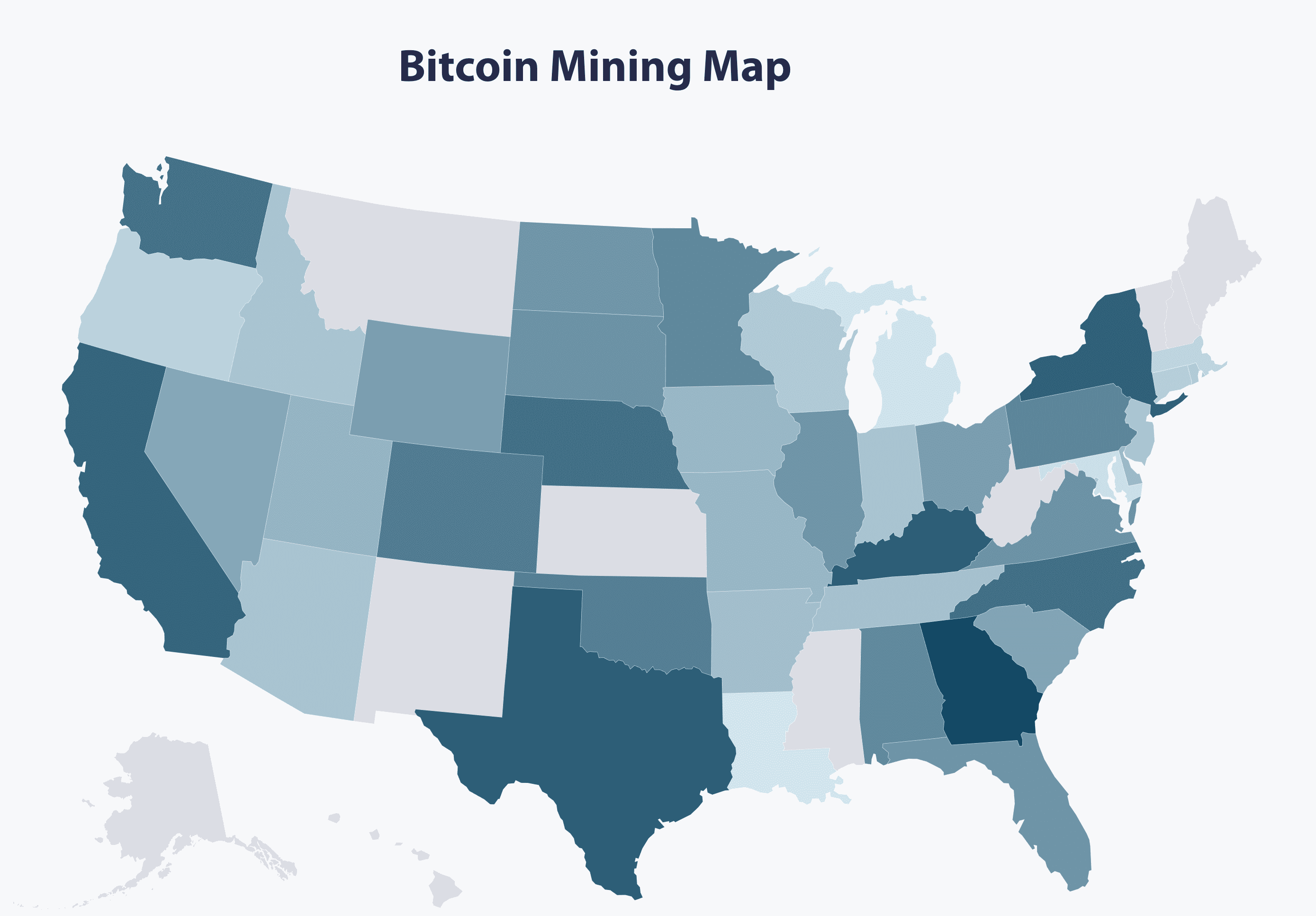

Georgia leads the pack with 30.7% of mining farms, followed by Texas (11.2%) and Kentucky (10.9%). On the flip side, states like Montana, New Mexico, West Virginia, and Mississippi have enacted bans on data center operations, hindering further development.

U.S. mining activity by state. Source: ccaf.io

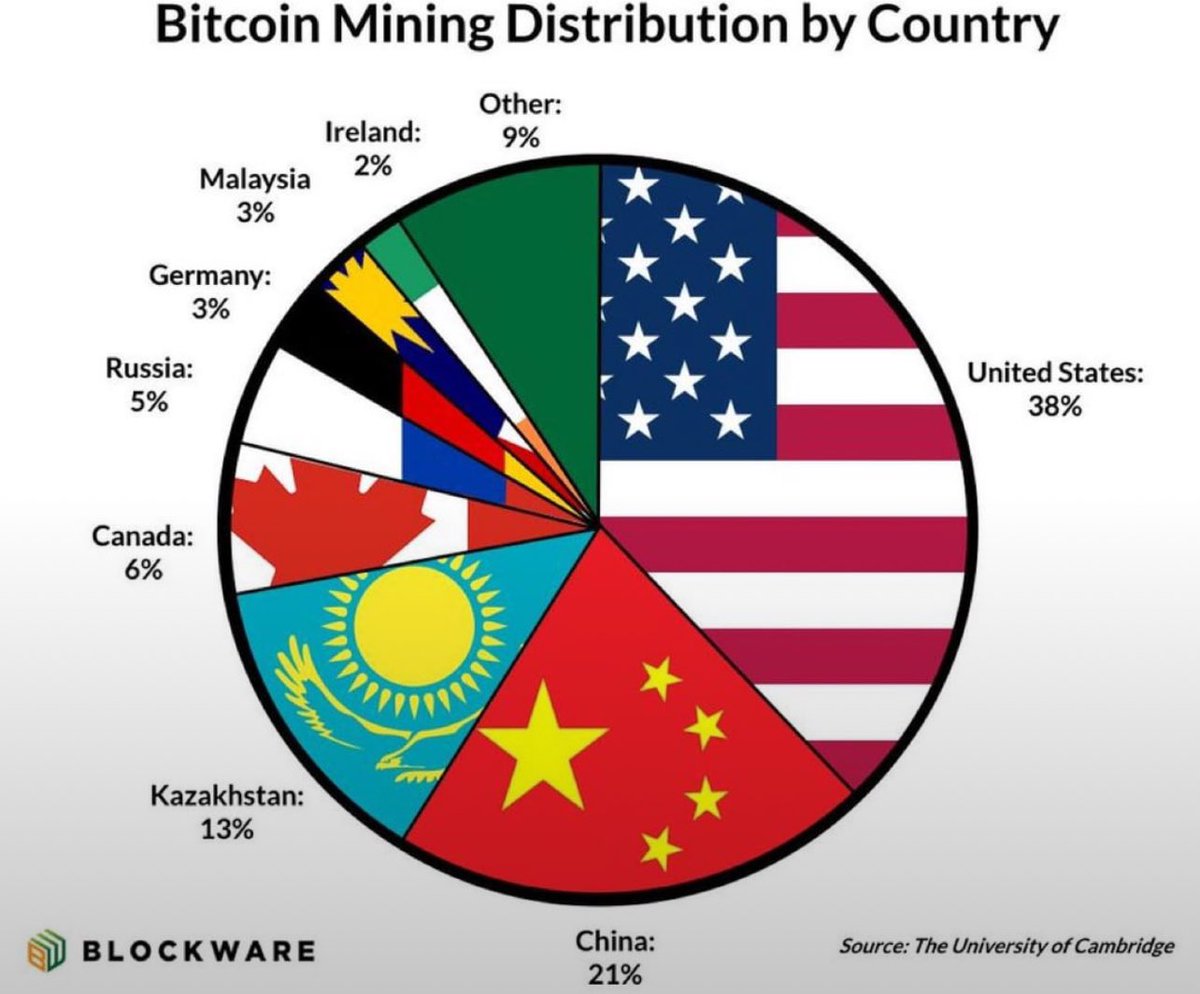

China is making moves to redefine its approach to cryptocurrencies, preparing to stake its claim in the financial streams of this growing market. In July 2024, Chinese mining pools were responsible for nearly 54% of the market, encompassing all proof-of-work cryptocurrencies.

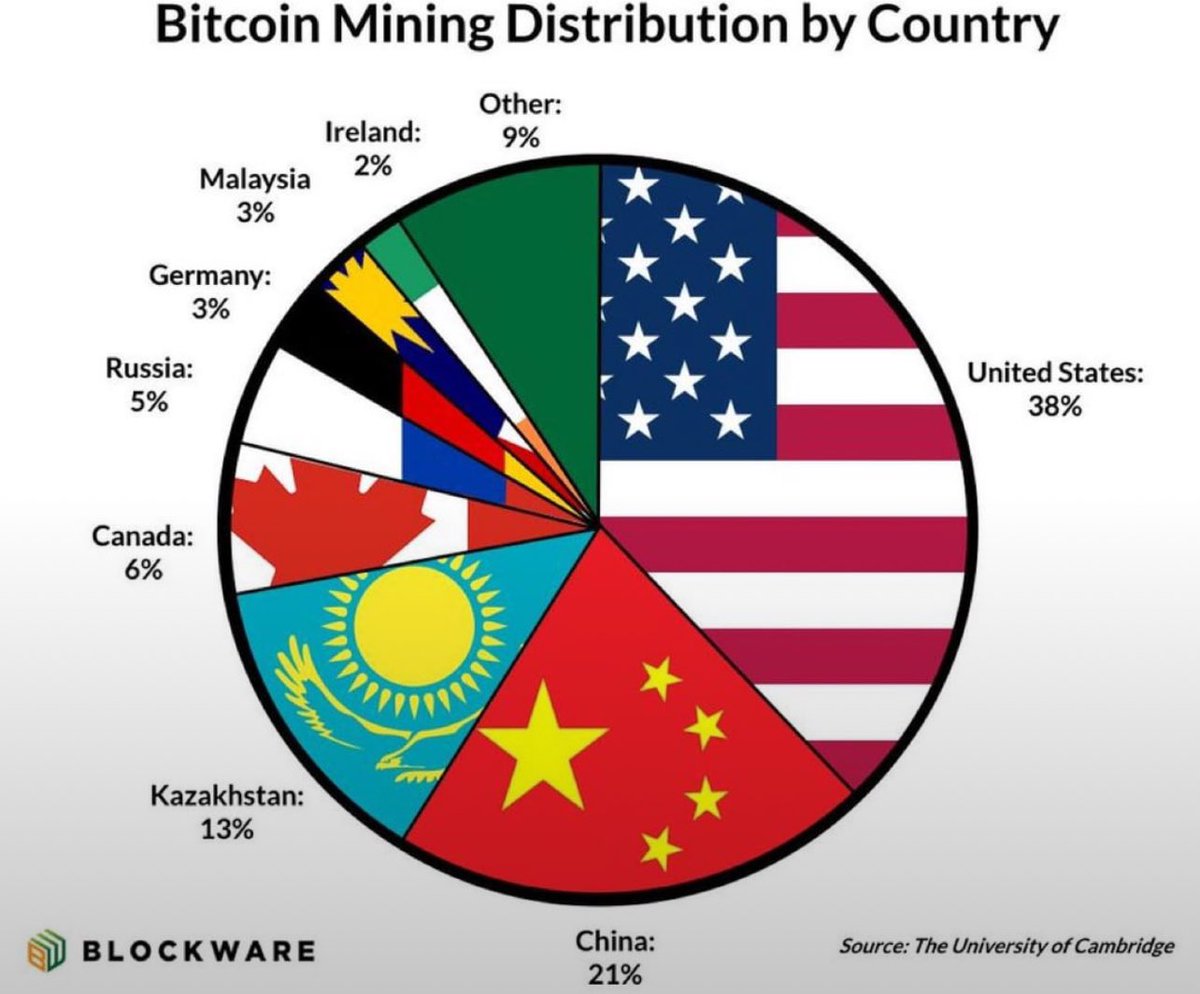

By December 2024, Blockware reported that the United States commanded *37.9% of the global Bitcoin hashrate. China placed second with 21%, thanks to industry leaders like Bitmain and Canaan Creative, which maintain data centers in both the U.S. and Ethiopia.

This ambitious proposal, he argued, would strengthen America’s financial resilience and safeguard against geopolitical instability. Peter Thiel, co-founder of MARA Holdings, endorsed the plan, proposing a national strategy for blockchain and cryptocurrency advancement. Central elements of the proposal include creating a federal Bitcoin reserve and asserting control over global mining operations.

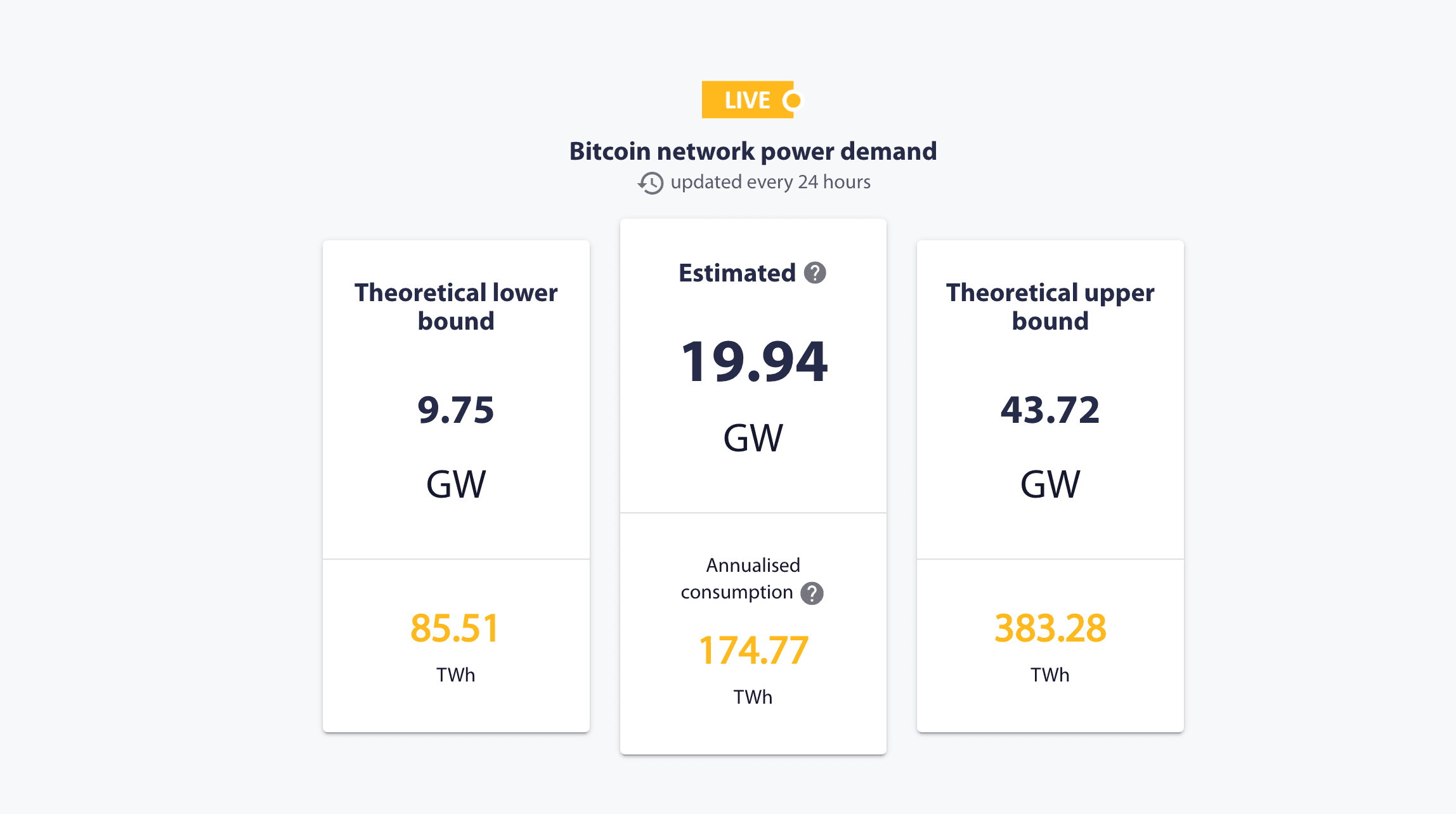

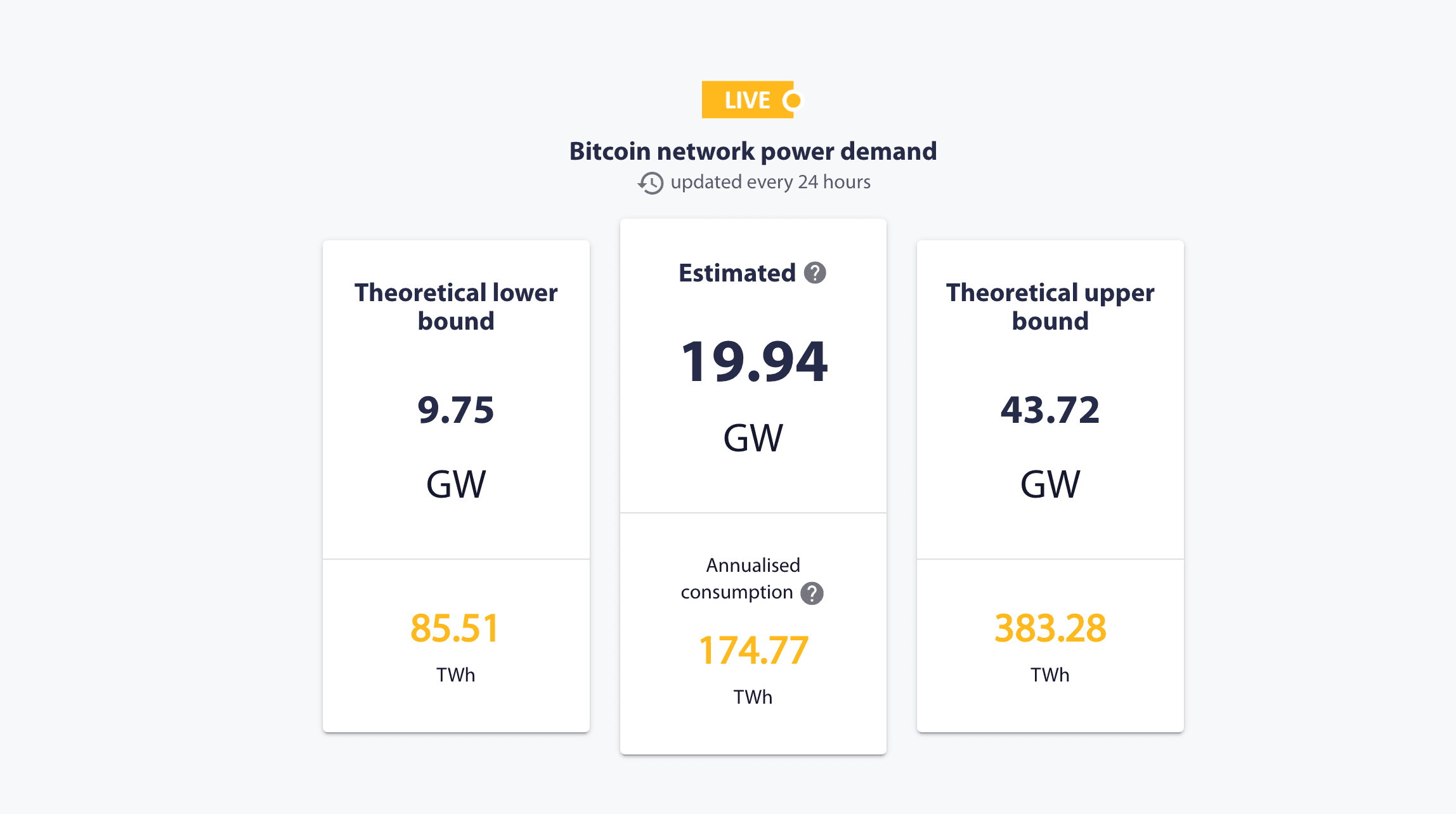

Currently, Bitcoin’s network demands 19.94 GW of electricity every day. Is the U.S. energy grid capable of absorbing this strain without threatening the broader economy?

However, the outlook among American mining companies is optimistic. Ro Shirole, Business Director of Blockmetrix, highlights the improving conditions for mining within the U.S. and emphasizes how government policy could further bolster the country’s appeal.

Across the crypto industry, there’s hope for a business climate that is more favorable than it was under the prior administration.

Kazakhstan holds the third spot in Bitcoin mining, with the city of Ekibastuz hosting BTC.KZ’s enormous mining farm, a key player in the country’s crypto sector.

The U.S. role in global BTC mining. Source: Blockware

Newly re-elected President Trump’s ambitions reach far beyond mere dominance—he aims for total control of global Bitcoin mining. The question remains: is such a scenario plausible?

U.S. Bitcoin Mining Dominance — Experts Question the Feasibility

The president-elect’s recent push to dominate Bitcoin mining has sparked a wave of skepticism. During a June 2024 meeting with CleanSpark, Riot Platforms, and Marathon Digital executives, he outlined plans to bring the mining of all remaining Bitcoins under U.S. control.

This ambitious proposal, he argued, would strengthen America’s financial resilience and safeguard against geopolitical instability. Peter Thiel, co-founder of MARA Holdings, endorsed the plan, proposing a national strategy for blockchain and cryptocurrency advancement. Central elements of the proposal include creating a federal Bitcoin reserve and asserting control over global mining operations.

Related: Fred Thiel and His Mining Empire

Barrier One — Limited Resources

Compass Mining’s CRO, Christopher Burnett, identifies critical challenges to U.S. dominance in Bitcoin mining. He cites a shortage of robust energy infrastructure, insufficient mining hardware, and the high cost of electricity as key factors holding back any attempt at monopoly.

Mining BTC is, by design, a decentralized process, heavily influenced by energy availability, market economics, and varying regulatory conditions worldwide.

At its core, mining is about gaining the right to add a new block to the blockchain and earning cryptocurrency rewards for doing so. As the industry has evolved, the process has become more challenging and energy-intensive.

The system’s decentralized design ensures open participation, leading to the proliferation of mining centers worldwide—in regions such as Kazakhstan, Russia, and Canada. This global spread is a key factor that hinders efforts toward monopolization.

Further reading: How Russia is Building a Shadow Crypto Mining Empire

Data from the U.S. Energy Information Administration (EIA) shows that by the end of 2023, the total installed capacity of U.S. power plants amounted to 1,280.54 GW.

The energy mix includes:

- Natural gas: 510 GW

- Coal: 210 GW

- Nuclear power: 100 GW

- Wind energy: 148.04 GW

- Hydropower: 102.14 GW

- Oil: 35 GW

- Biofuels: 10 GW

The issue isn’t confined to the United States—it applies to any country seeking dominance over an industry inherently decentralized, sustained only by a global network of distributed data centers.

Perhaps this is less a question and more a rhetorical observation.

Electricity consumption of the BTC blockchain. Source: ccaf.io

The Second Issue — Chip Shortages

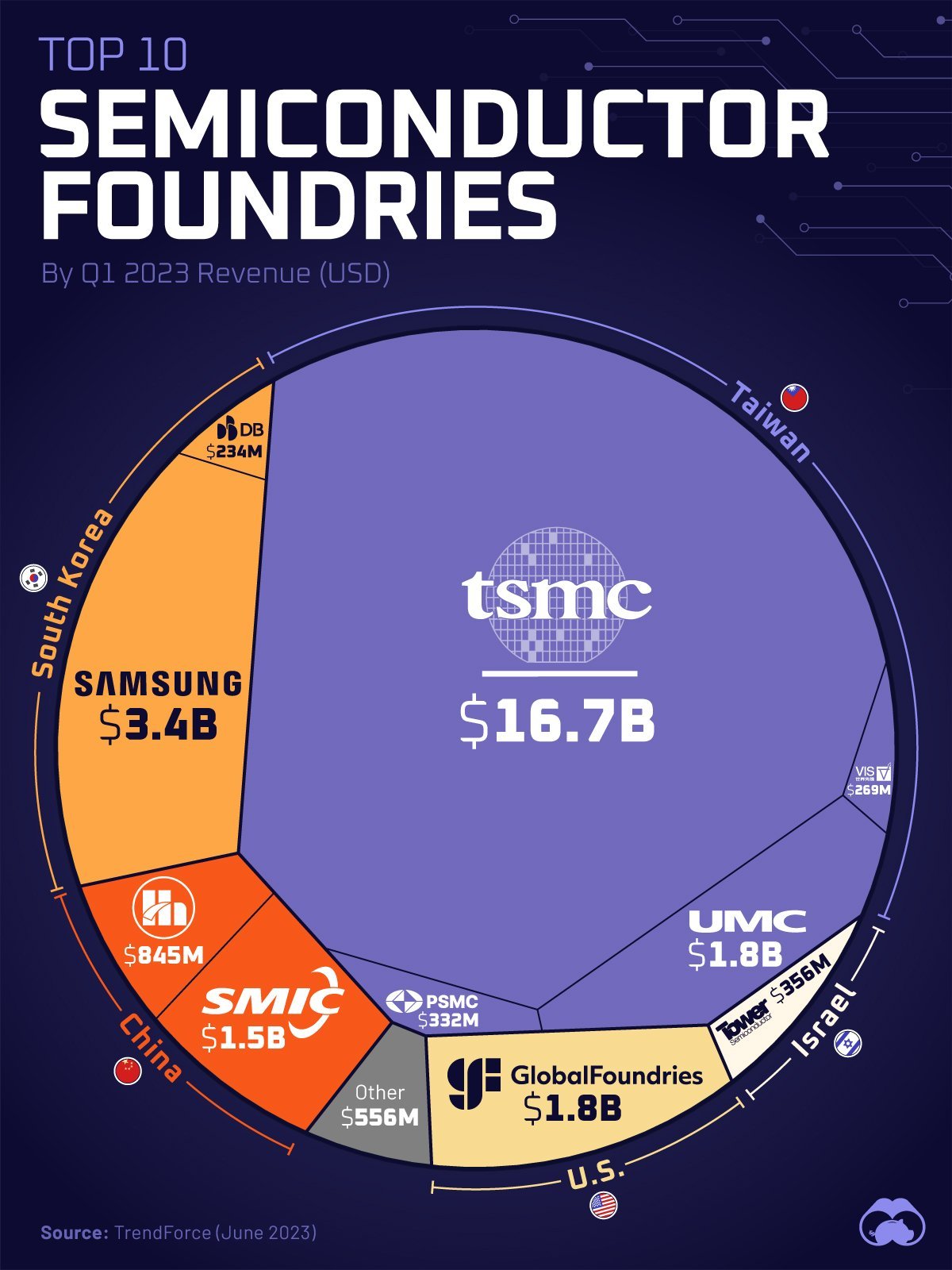

The U.S. mining industry faces a significant hurdle as domestic chip production lags behind the demand. Asian companies, particularly those in China and Taiwan, have long dominated ASIC chip manufacturing for mining, with South Korea accounting for a small portion of imports.

In response, the U.S. has been working to shift parts of semiconductor manufacturing to its own shores. This move is motivated by geopolitical factors, a push to reduce foreign dependence, and government backing for the development of the domestic semiconductor industry.

In response, the U.S. has been working to shift parts of semiconductor manufacturing to its own shores. This move is motivated by geopolitical factors, a push to reduce foreign dependence, and government backing for the development of the domestic semiconductor industry.

TSMC (Taiwan Semiconductor Manufacturing Company) stands out as a notable example of this movement. Although a Taiwanese company, TSMC has begun establishing production facilities in Arizona.

Its first plant is expected to be operational by the end of 2025, manufacturing chips based on N4C technology. This is a significant advance, yet these facilities won’t resolve the chip shortage overnight, even if the White House implements its ambitious goals.

Intel is also working to expand its semiconductor production in the U.S. While mining chips aren’t Intel’s specialty, its advanced technological capabilities could be redirected to support the mining industry if needed.

South Korea’s Samsung, a major player in the semiconductor industry, could potentially provide mining chips for the U.S. market. However, this would necessitate a significant ramp-up in its manufacturing capacity, a task that could take anywhere from one to three years to complete.

South Korea’s Samsung, a major player in the semiconductor industry, could potentially provide mining chips for the U.S. market. However, this would necessitate a significant ramp-up in its manufacturing capacity, a task that could take anywhere from one to three years to complete.

Chip Market Breakdown. Source: visualcapitalist

At present, Chinese companies like Bitmain and Canaan dominate the field. But if Donald Trump were to ignite a trade war with China, these firms might face serious challenges, including limiting their exports to the U.S.

The prospect of the U.S. achieving a dominant 51% share of the global hashrate seems far-fetched in the short term.

However, the outlook among American mining companies is optimistic. Ro Shirole, Business Director of Blockmetrix, highlights the improving conditions for mining within the U.S. and emphasizes how government policy could further bolster the country’s appeal.

Across the crypto industry, there’s hope for a business climate that is more favorable than it was under the prior administration.

Recommended