Their “break-even point” (about $30,000) seemed safe until very recently. And today, the price is several thousand dollars below this level. MSTR CEO Michael Saylor is probably the most dedicated bitcoiner in the world. He buys a lot, buys often, buys at any price, and never (literally) sells.

His answer to the question “What would be the first thing you would do if you woke up in 2030 after 8 years of a coma and saw that bitcoin was already worth $5 million?” became legendary: “I would buy more bitcoins.” This phrase is entirely consistent with the media image of Sailor.

Considering the sharp drop in quotes and capitalization of the crypto market (and, in particular, bitcoin), another problem has emerged: it turns out that MicroStrategy has a credit issued by Silvergate Bank for $ 205 million, which has been secured by bitcoin. It means that the company guarantees its credit obligations with collateral in the form of “physical” BTC tokens.

Moreover, the purpose of the loan was another purchase of bitcoins. Thus, de facto, such a purchase could not be called a merely spot one since it was made with the help of leverage, albeit not brokerage.

The drop in collateral value, of course, began to create additional risks for the company, as well as negative outlooks: there are talks about a margin call for MicroStrategy, bankruptcy, and the possible need to sell bitcoins for the first time to reduce the floating loss.

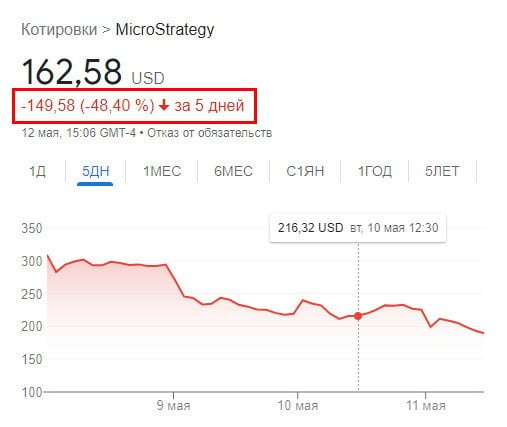

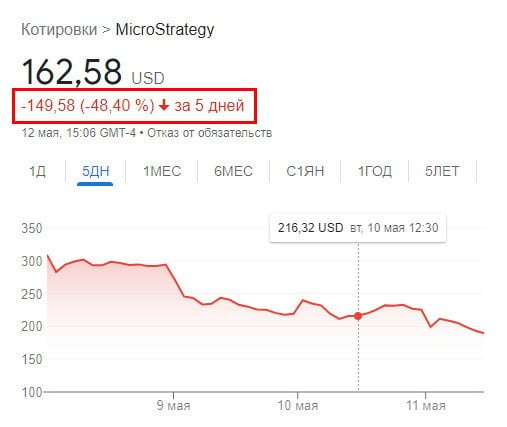

The stock market reacted negatively to the situation: MSTR stocks lost almost 50% of their value in just one week.

On May 10, Michael Saylor posted a message with a link to the company’s quarterly report on his Twitter. It reveals that requirements for collateral for loan imply the presence of assets frozen in the amount of $410 million, up to the price of $3562 for the one BTC.

Firstly, it follows from the message that Michael Saylor does not plan to get rid of his bitcoins under any circumstances. And secondly, even if conditions turn out to be so unfavorable that the market value of their bitcoin assets will be insufficient to cover the loan collateral, his company will be ready to provide other collateral.

Against the background of global pressure on the crypto market, such a signal is a clear “breath of fresh air.” Earlier, another billionaire, Elon Musk, also said that he did not sell his bitcoins.