How mining difficulty affects BTC price?

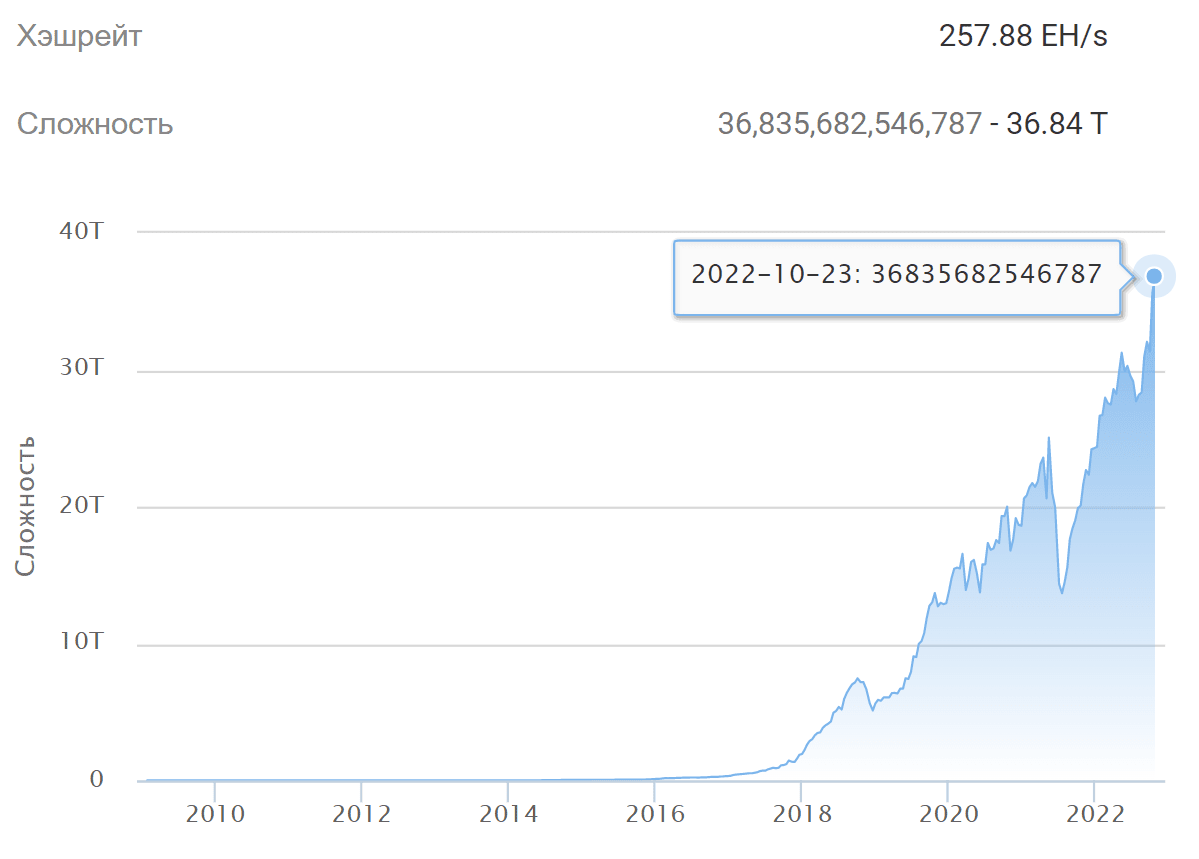

The Bitcoin mining hash rate hit an all-time high of 263 EH/s on October 24

Bitcoin's mining difficulty is adjusted roughly every two weeks based on the power of the network. This process is integrated into the BTC code in order to stimulate miners to put in more computing power at the required speed and not to exaggerate the amount of mining rewards.

The last Bitcoin is expected to be mined sometime around the year 2140. The hashrate, or combined computational power, will be changed by that time, as the mining difficulty can be adjusted either higher or downwards, depending on the number of miners and their total hashing power in the mining network.

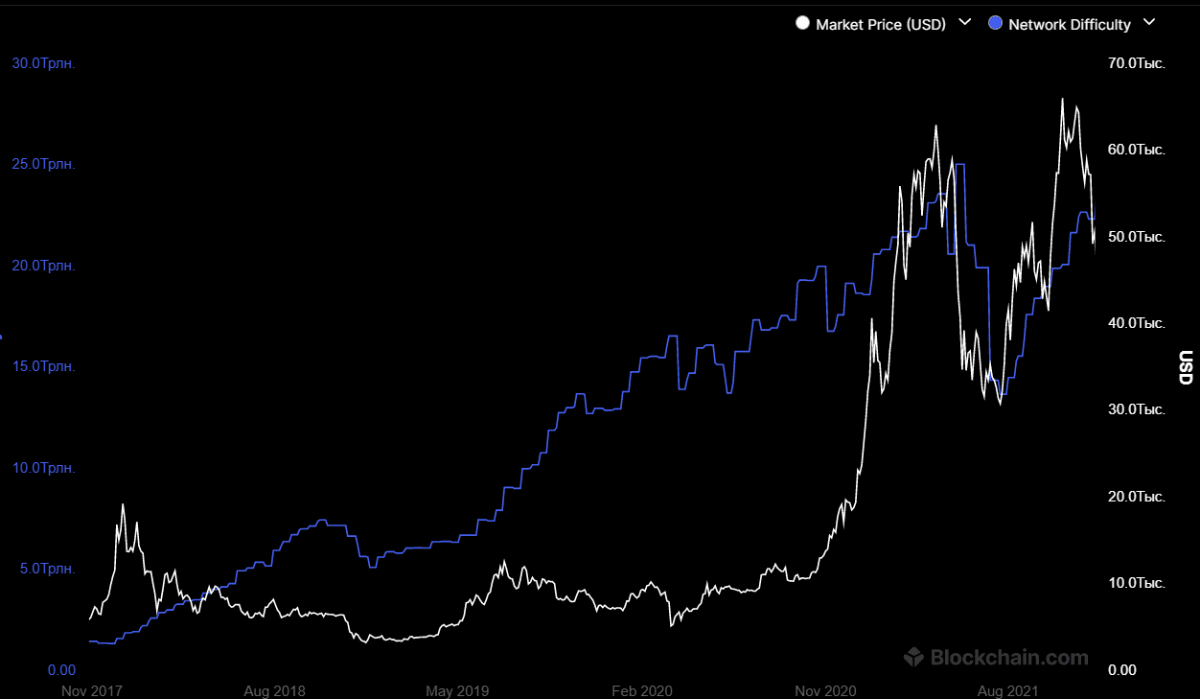

There was a correlation between the BTC price and the mining difficulty indicator until January 2020. This is quite logical, as when the Bitcoin price was actively rising, more and more people wanted to mine it, and when the price was falling, people sold equipment and left the business, as they didn’t want to mine BTC and work in conditions of insufficient profit.

Correlation between the BTC price and the mining difficulty indicator (Blockchain.com)

The BTC hashrate has been growing almost non-stop since the beginning of February this year. All-time high, or ATH, a term that refers to the highest historical price, is updated with each new recalculation, despite the fact that Bitcoin price has fallen by 56% since the beginning of the year.

Miners are constantly increasing their mining capacity instead of stopping mining and selling ASICs devices, as they see the potential for BTC to rise in price.

BTC mining difficulty (btc.com)

Based on this, Bitcoin miners face shrinking profitability taking into consideration the total used computational power (hashprice).The indicator is at the level of $66,000 per 1 EH/s. Simply put, Bitcoin mining is now unprofitable, as costs are too high and rewards are too low for profitability.

At the same time, there are more and more miners, and mining difficulty is increasing. This means that miners do not expect quick profits, but hold BTC so they can make good profits once the next bull market arrives.

Theoretically, such an approach could have a positive impact on BTC price, as a decrease in supply causes an increase in demand. But it is so until the miners decide to sell their BTC at an attractive price. If there is any FUD or total negativity in the market, miners can sell off their mined Bitcoins following moments of market panic, which will cause a strong price decline and liquidation cascades.

Recommended