Kyber Network Crystal and KNC Token: A Comprehensive Review

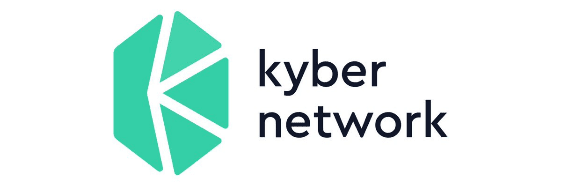

Kyber Network Crystal acts as a cross-chain liquidity aggregator, facilitating fast swap transactions for DeFi. Thanks to the Kyber Network, users of dApps, DEX, and DeFi solutions can tap into a multitude of liquidity pools to exchange assets with minimal fees.

Established in 2017, the project leverages the robust Ethereum blockchain. The global headquarters of the Kyber Network reside in Singapore.

KyberSwap draws liquidity from numerous DEXs including Uniswap, Sushi, Curve, QuickSwap, Pancakeswap, Traderjoe, Pangolin, SpookySwap, SpiritSwap, VVS Finance, Velodrome, GMX, and many more. Moreover, KyberSwap supports more than 13 networks like Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, Solana, BitTorrent, Oasis, Fantom, Cronos, Velas, Aurora, zkSync Era, and others.

Kyber Network serves as a liquidity supplier for participants in the DeFi market. Source: kyber.network

Effectively, Kyber Network Crystal introduces a solution to the liquidity challenges confronting Web3 and DeFi projects. It empowers developers to concentrate on the creation of decentralized products and services without the constant worry of orchestrating digital asset conversions across diverse blockchain platforms.

The Architects of the Kyber Network

Loi Luu, a prominent figure in the Kyber Group, serves as the Chairman. He is known for developing Oyente, the first open-source vulnerability analyzer for Ethereum smart contracts, and for co-founding SmartPool.

Victor Tran, a computer science graduate, holds the position of CEO at Kyber Network. His prior roles include the CTO at Clixy and 24/7 Digital Group, and he has spearheaded numerous projects in Vietnam.

Yaron Velner, currently the CEO of B.Protocol, was formerly the CTO at Kyber Network until October 2019. Despite stepping down from this position, he remains involved as an advisor and co-founder.

Exploring the Kyber Network Ecosystem

KyberSwap, a liquidity platform and DEX, gives traders the ability to switch between assets from various blockchains. It also offers liquidity providers the opportunity to deposit assets and earn rewards from staking and yield farming activities. Remarkably, it is one of the few DEXs where you can purchase over 100 digital assets using several fiat currencies (including payment methods like Visa/Mastercard/Google Pay/Apple Pay).

Purchasing crypto with fiat on a DEX is not a common opportunity, but it's certainly available here. Source: kyberswap.com

The Dynamic Market Maker (DMM) protocol ensures optimal capital use and high yields for liquidity providers by taking current market conditions into account.

The next-generation AMM Elastic protocol boasts of concentrated liquidity pools, customizable price ranges, low transaction fees, and an anti-sniping feature that safeguards the interests of liquidity providers.

Kyber DAO, a decentralized autonomous organization, is steered by its members who use their KNC tokens to vote on proposals concerning the project's future evolution. As a result, KNC owners are given the chance to partake in managing the platform while also earning rewards from a share of the transaction fees.

KNC Token and Its Tokenomics

KNC is the native token of Kyber Network Crystal, serving dual purposes. It functions as a utility token, being used for internal project transactions and rewards for users, and as a governance token, granting voting rights within Kyber DAO.

The total issuance amounts to over 252.3 million KNC tokens, with slightly more than 181.6 million KNC currently in circulation. Token issuance is dynamic, permitting KyberDAO participants to vote on supply increases or decreases. This facilitates rewards for developers and new users, while also helping to maintain appropriate liquidity levels.

During various ICO stages, 61.06% of tokens were sold, amassing investments worth $52 million. Further, 19.47% of tokens were distributed to founders, advisors, and early investors, with the remaining 19.47% secured in a reserve fund.

The KNC token holds the 190th position in CoinMarketCap's rankings, based on a market capitalization of $139 million.

Auditing

KyberSwap and KyberDAO platforms, as well as the KNC token, have been audited by Chainsecurity and Hacken. Both audits concluded that all components of the Kyber Network ecosystem are secure.

Where to Buy and Store KNC

KNC tokens are available on a variety of centralized exchanges such as Binance, WhiteBIT, Coinbase, Huobi, OKX, Kraken, Bitstamp, and others. They can also be found on several decentralized exchanges, including PancakeSwap, DFX Finance, and of course, KyberSwap. KNC can be stored in most wallets supporting Ethereum network assets, including but not limited to Metamask, Ledger, Trezor, Torus, Krystal, and Trust Wallet.