LSD: The Next Big Thing in Staking?

We dive into HashKey Capital's report on the burgeoning trend of liquid staking derivatives (LSD).

Following the Shapella upgrade, liquid staking derivatives have surged in popularity. Now, they're leading the pack among DeFi apps, boasting a Total Value Locked (TVL) of approximately $22 billion — a figure that eclipses the $15 billion held by decentralized exchanges. The appeal of LSD has been growing, with users often favoring it over traditional staking methods. This is primarily because it lacks restrictive measures like minimum stake amounts or lock-in durations, plus the enticing prospect of trading its derivative token. These features collectively pave the way for smarter capital allocation.

The LSD sector has emerged as one of the largest DeFi ecosystems, attracting numerous participants and creating multiple investment opportunities,— © Jupiter Zheng, HashKey Capital's Director of Research.

As of now, the ETH volume locked within LSD protocols slightly edges out that in standard staking, standing at 36% versus 31%. This burgeoning demand has spurred the creation of several protocols across diverse blockchains, from Ethereum to Polygon, BNB Chain, Solana, Hedera, and beyond. Nonetheless, Ethereum remains the mainstay, accounting for a whopping 94% of the TVL. On this platform alone, 13 projects each command a locked-in value north of $10 million. Notably, while several protocols like Ether.fi, Swell, and Stakehouse have yet to roll out their own tokens, and future airdrops for their active user base might still be on the cards.

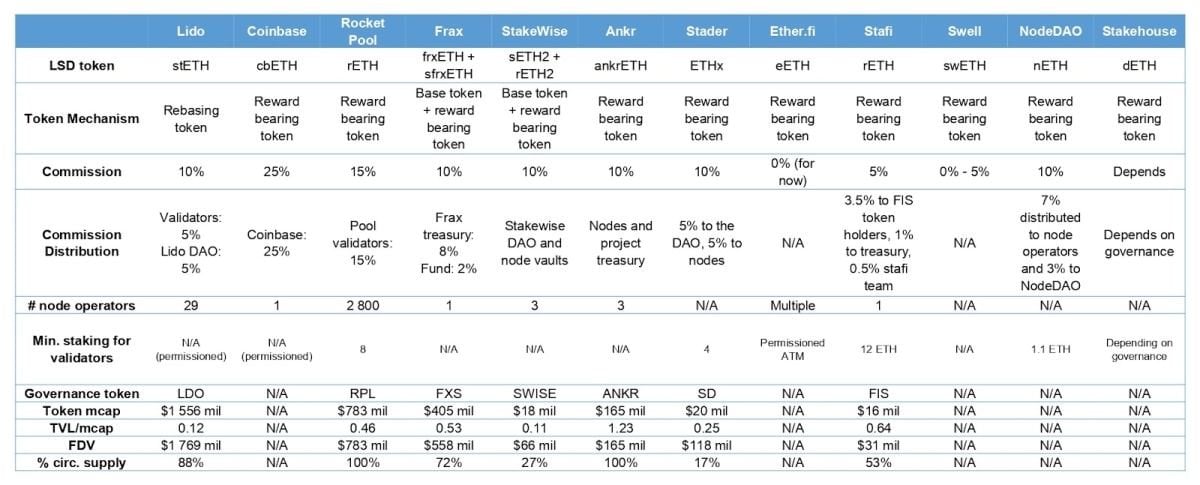

Key Insights into Ethereum's LSD Protocols. Source: HashKey Capital's Official Report

LSD protocols aim to further solidify their market standing. However, it's crucial to understand the pitfalls of such dominance: reduced competition, increased centralization, and potential risks to the security of a decentralized network. These challenges could erode trust in Ethereum and other PoS blockchains. One potential solution could be the deployment of Distributed Validator Technology (DVT), which entails operating nodes across several devices.

The Potential of Ethereum LSDs

HashKey Capital forecasts that within a few years, the percentage of staked ETH will rise to 45% of the overall supply, with the LSD market presence growing even more dominant. With the influx of new users, yields might decrease, but investors could counterbalance this by actively interacting with DeFi applications. In the near future, key factors for Ethereum's liquid staking protocols will likely be fee structures, decentralization levels, and security measures.