MATIC and LINK: Altcoin Analysis for September 21, 2023

Bitcoin maintains its trade with minimal volatility, hovering around the $27,000 level for a week now. Here's an in-depth look at the market dynamics of Polygon (MATIC) and Chainlink (LINK) as of Thursday, September 21.

Polygon (MATIC)

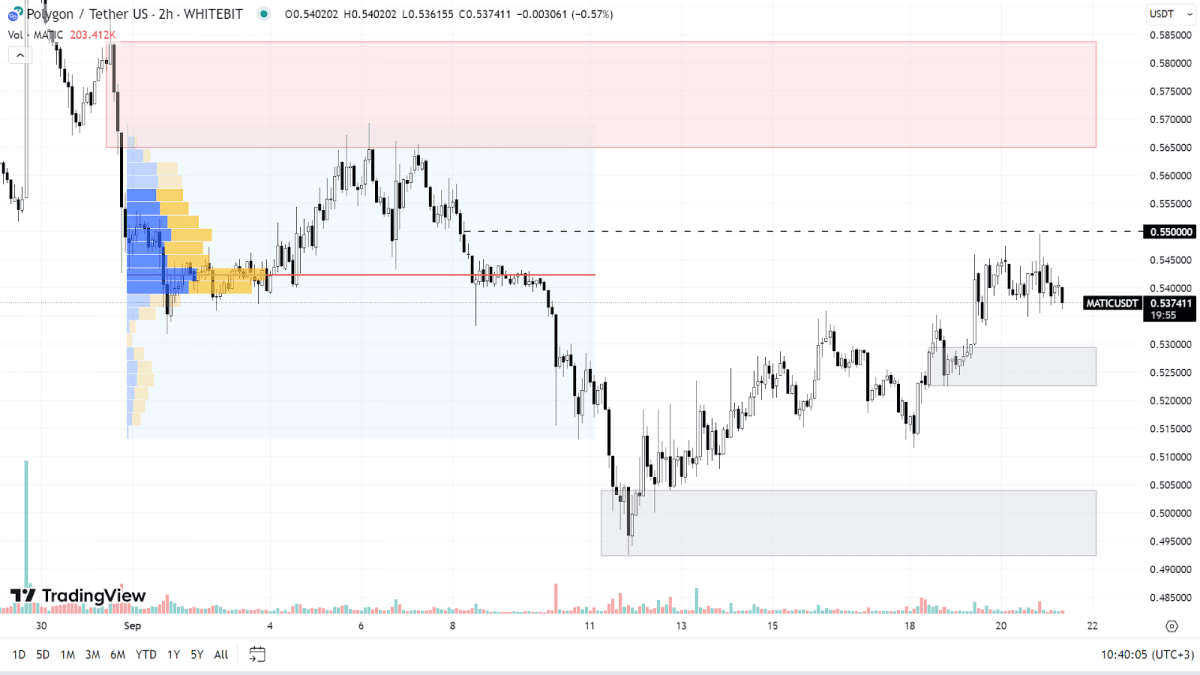

Both the global and local trends for MATIC continue to be bearish. Currently, the asset is trading near a $0.55 resistance level. If buyers manage to breach this level, a logical progression would be a test of the seller’s zone between $0.565 and $0.583. Securing a position above this range has the potential to shift the market trend to bullish.

Unless this occurs, further depreciation seems more plausible. Consequently, in the event of a deeper correction, MATIC could descend to support zones of $0.522-$0.529 and $0.492-$0.503. If the latter doesn’t hold, the asset may experience a renewed low, with the sellers potentially eyeing the $0.45 mark.

At present, the Polygon network is fervently preparing for a migration to a new blockchain, with the token set to be transformed into the POL coin. MATIC traders are probably anticipating updates regarding the launch of Polygon zkEVM. The transition to the new network might positively affect the asset’s price, but the primary challenge is to precisely determine the entry point, as any further fall in MATIC is intrinsically tied to the BTC trajectory.

MATIC chart on the H2 timeframe

Chainlink (LINK)

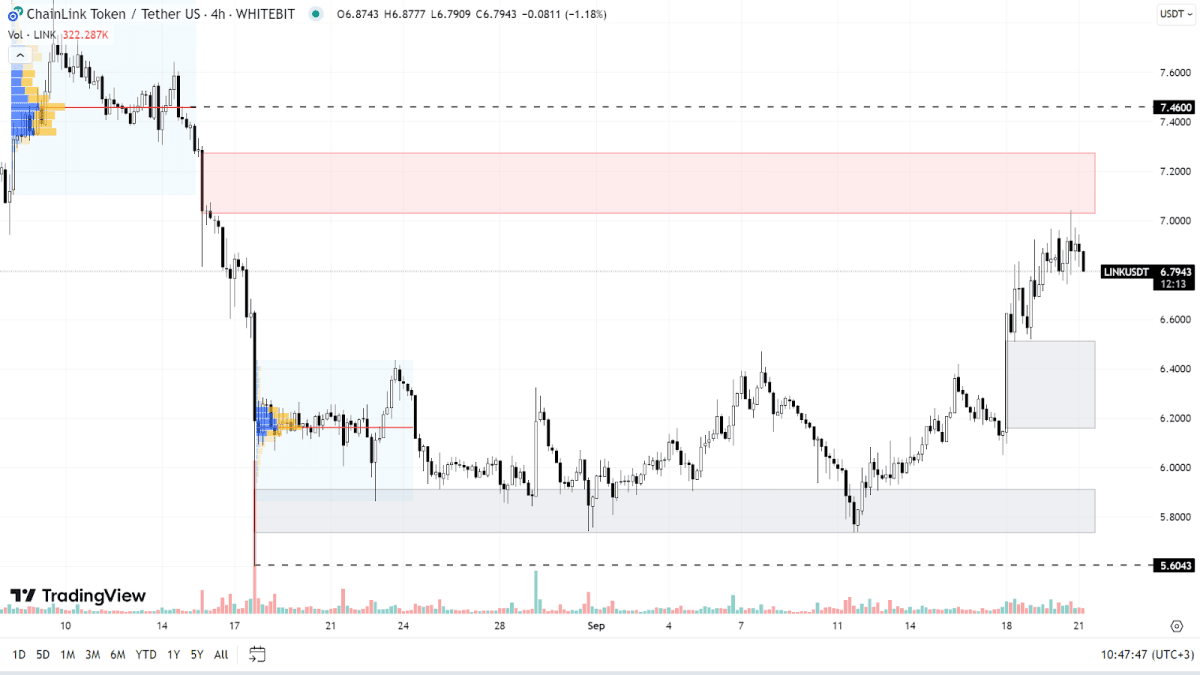

While LINK continues to trade within a bearish trend, the asset's chart reveals a positive trajectory. The asset has increased by 22% in ten days and currently hovers near the resistance zone of $7.03-$7.27. If buyers demonstrate sufficient strength and surpass this range, it's plausible for LINK to rapidly solidify above the $7.46 level, effectively concluding the local descending trend.

The current support zone is situated between $6.15-$6.51. Beneath this, buyers have positioned their orders within the range of $5.73-$5.91 and at the $5.60 level. A scenario where LINK retraces to renew lows and approaches the $5.25 mark appears to be unlikely at the moment.

LINK chart on the H4 timeframe

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. These are solely the opinions of the GNcrypto editorial board regarding the market situation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the movement of price between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K - $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended