Vast Bank overview. How to use it and what are its features?

Crypto banking Vast Bank allows to make crypto transactions. Let's look at its features and capabilities.

Vast Bank became the first U.S. bank with the Federal Deposit Insurance Corporation (FDIC) insurance that allows you to buy, sell, and hold cryptocurrency assets directly with your bank account.

For over 35 years, Vast Bank has been a financial institution based in Oklahoma. According to them, the bank is centered around personal service, flexibility, and integrity. The CFO of Vast Bank claims that they are not about the number of active customers, their main goal is to be the best and keep up with the times. They’re not going to sell the company, either.

The IT director of Vast Bank believes that the bank must adapt quickly to customer preferences and changing market conditions, especially the high scale automation of processes, while delivering the maximum level of efficiency.

You’re not competing against other institutions. You’re competing against the customer’s expectations and experiences with non-financial, on-demand services. It’s all about understanding and implementing technology that seeks to improve and automate the use and delivery of financial services. In other words, fintech is shaping the industry,said Vast Bank CEO, Brad Scrivner.

How does the Vast Bank app work?

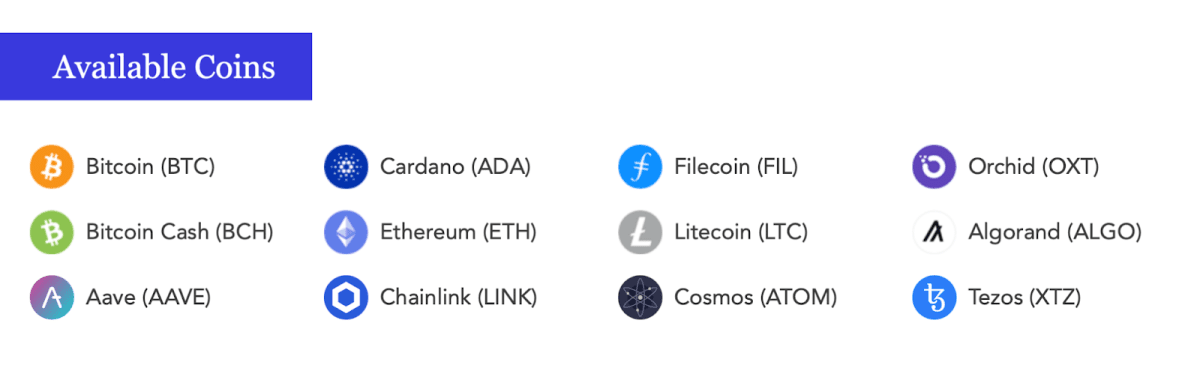

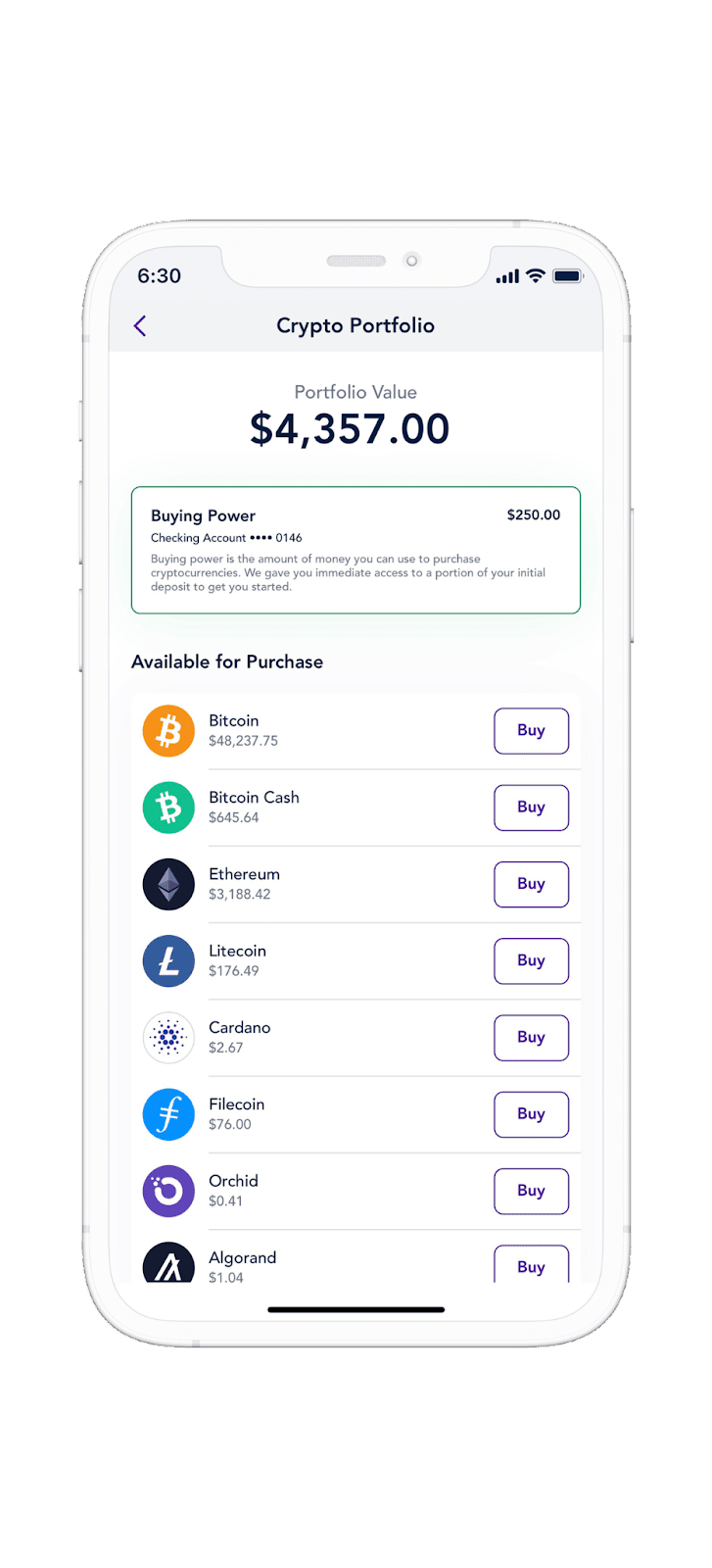

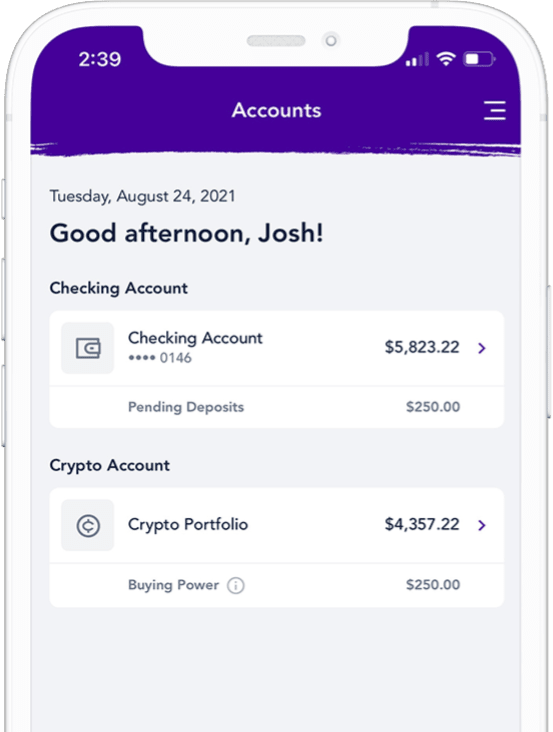

With the Vast Bank app, you can buy cryptocurrency in just a few clicks. When registering, You get two accounts - a checking account and a crypto account linked to it. Vast Bank charges a 1% fee for any transactions. Today you can purchase 12 coins with the app, but more coins are on the way.

Don’t forget that Vast Bank primarily offers a full range of banking services, including checking and savings accounts, loans, investments and deposit management services. And for users who want to be involved in the world of crypto, there are separate opportunities for crypto transactions.

Vast Bank Interface

How to buy cryptocurrency with the Vast Bank app?

As mentioned above, when registering in the app, you get access to two accounts at the same time: checking account and crypto account.

To buy cryptocurrency you need:

1. Transfer funds to your checking bank account. No minimum deposit or balance is ever required. The mechanics of the deposit is no different from other banks.

2. Transfer funds from your checking account to a crypto account. Crypto can be seamlessly purchased using your checking account funds and then safely stored in your crypto account.

3. Now all your crypto assets are fully available for transactions.

1. Transfer funds to your checking bank account. No minimum deposit or balance is ever required. The mechanics of the deposit is no different from other banks.

2. Transfer funds from your checking account to a crypto account. Crypto can be seamlessly purchased using your checking account funds and then safely stored in your crypto account.

3. Now all your crypto assets are fully available for transactions.

You can store them, send them to other e-wallets, or sell them at any time convenient for you.

Conclusion

Vast Bank is rightfully in the fintech market. Taking into consideration its membership in the FDIC, the project can offer many innovations to implement new functionality and cryptocurrencies. But never forget to follow the DYOR (Do Your Own Research) rule before using any crypto services. It will keep you and your funds safe!

Recommended