OpenSea NFT trading volume drops 98%

OpenSea NFT trading volume has seen a significant drop in its daily trade. The audience is concerned about whether the bubble popped or is it yet another bearish NFT trend.

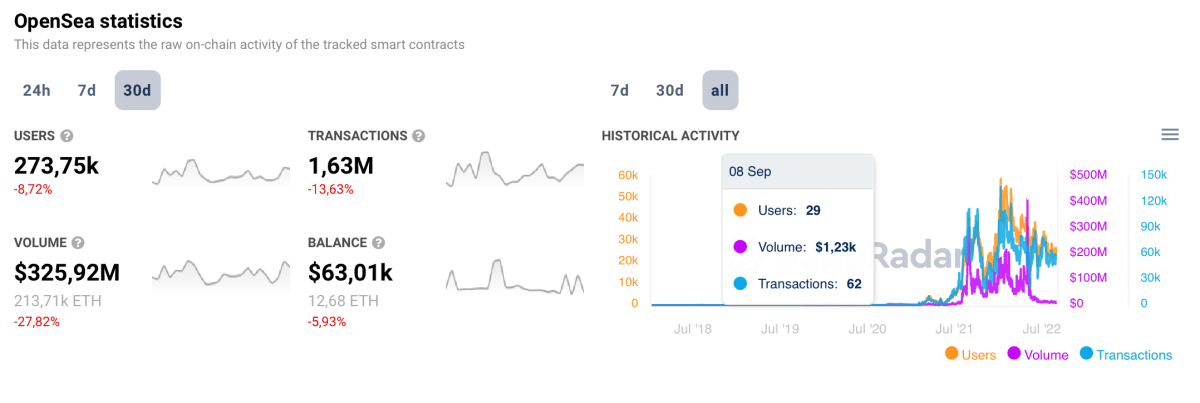

Despite the overall bearish tendency of the markets, crypto fans faced one more disappointment. In May, OpenSea reported $2.7 billion in NFT trading volume transactions, but a week ago, the marketplace recorded just $9.34 million in trading volume. The company recorded a decrease of 30% in transactions compared to the number of transactions in May. It took four months for the OpenSea NFT trading volume to drop to 98%.

Source: DappRadar

Regarding the most popular NFT collection, Bored Ape Yacht Club, according to open data, its floor price fell by 53% - 72.4 ETH compared to 153.7 ETH in April. You can read more information about Bored Ape in our recent article.

After DappRadar published their statistics report, an OpenSea representative responded that the company disagreed with DappRadar’s methodology of valuing their volume, noting that the 98% drop due to the crypto winter phase compared with the platform’s highest trading performance day was illogical. He also noted that it is more appropriate to evaluate the asset activity in correlation with the overall ETH market trend.

By that measure, the monthly OpenSea NFT trading volume fell by 60% from May to August, and it continues to further decline in September. It is most likely that the bearish ETH market might be one of the main reasons why NFTs are showing a poor performance in statistical data.

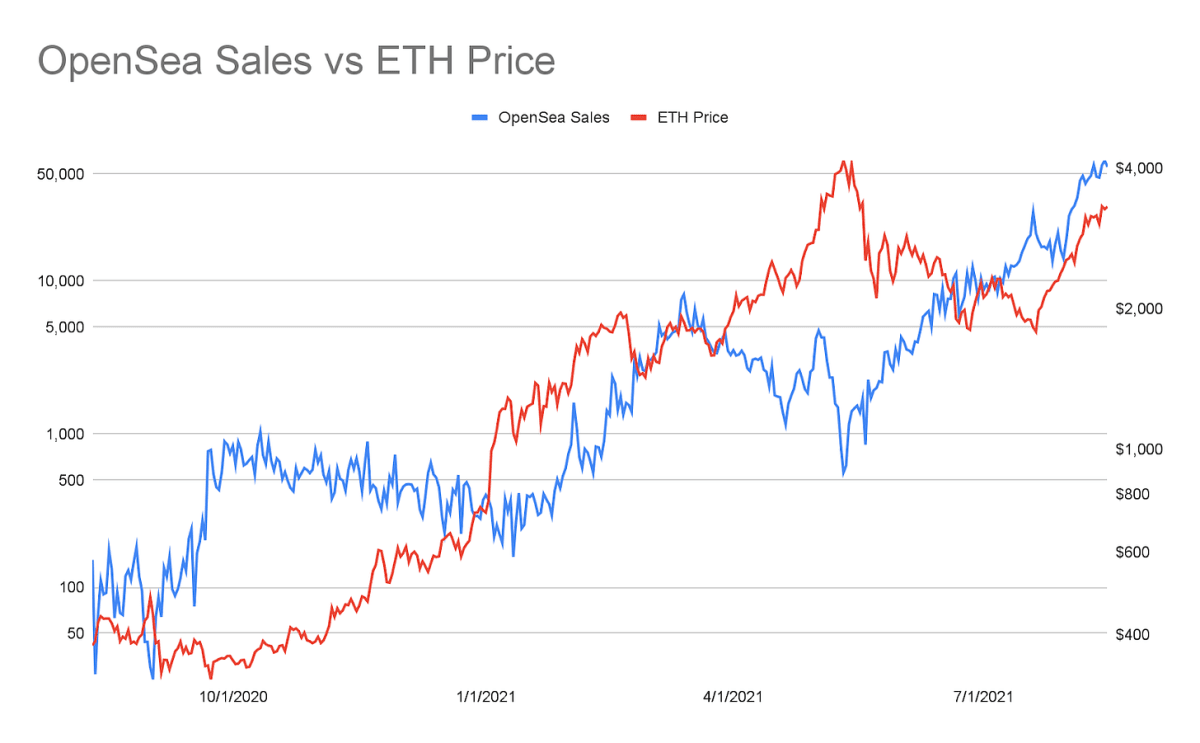

NFT prices are highly correlated with the currency price of the blockchain on which they are based. So, for instance, a digital collection created on Ethereum also means that the NFT price will fall if ETH’s price drops.

Correlation between ETH and NFT sales

At the same time, OpenSea's management is not particularly worried about the current state of affairs. They declare that the OpenSea platform is oriented toward a long-term implementation of NFTs in web3, and such critical moments are expected in the early stages. Therefore, OpenSea is looking forward to the future development of NFT technologies.

Besides this, many skeptics are pushing the idea that NFTs are a bubble which is about to pop, or, in fact, already popped. However, NFTs force people to create new ways of interacting with the network, see millions of opportunities, and investigate the reality of web3. The excitement and noize around non-fungible tokens are easily explained – each new phenomenon becomes noticeable mostly due to the hype.

NFTs are bringing new interest and a ‘new aesthetic’ to art with a potential to bypass a lot of the traditional gatekeepers and vetting processes of the physical art world, says Charles Stewart, CEO of Sotheby’s.

The way crypto enthusiasts and big capitals are integrating and exporting the NFT is very encouraging. Therefore, it makes the audience think that it is not just fun and games, and indeed not a crypto bubble, but a step into a new reality.