People's wealth will be destroyed by inflation, says Arthur Hayes

Arthur Hayes, a well-known crypto entrepreneur and ex-founder of BitMEX, consistently voices his concerns about the issues currently troubling the industry. His prior forecast of a BTC price of $1 million no longer sounds as assertive as it once did.

Centralization

Hayes observes that a plethora of crypto companies and entrepreneurs have embraced the centralization of their businesses, sidelining the creation of decentralized protocols and projects. However, it's this very decentralization that forms the backbone of the crypto market's strength. Decentralized Autonomous Organizations (DAOs) serve as prime examples of this, according to Arthur.

On the flip side, structures rooted in centralization, particularly those orbiting charismatic individuals (such as the curly-haired Sam), often hold excessive sway on personal grounds. They lack the robustness necessary to weather market downturns, leading to investor losses and various industry setbacks, Hayes insists. It's worth mentioning, of course, that exceptions to every rule exist, and a decentralized project does not automatically guarantee secure investments or significant returns for crypto enthusiasts.

...a lot of people lost a lot of money as the market turned. But the decentralized solution still workedargues Hayes

Investments

Hayes zeroes in on the broader economic landscape, emphasizing the importance of safeguarding one's capital in the face of inflation. The refreshing alternative, he suggests, lies in cryptocurrencies. He views crypto as a means to retain purchasing power and potentially shield against the impacts of inflation.

The financial landscape has seen its fair share of extensive banking crises and bankruptcies in the past, each exposing weak points within the prevailing systems. Presently, traditional finance or 'TradFi' is virtually incapacitated by an overload of debt. Hayes cautions that governments persist in inflating more "bubbles", teeing up the next global crisis.

What is the problem that the United States financial system has? That problem manifests itself in other systems and other jurisdictions around the world. What's the problem of the US? They have too much debthe declares

Hayes predicts a pivot when people recognize the shortcomings of fiat currencies and feel the squeeze of inflation on their standard of living. They'll then seek solace in alternative assets, including cryptocurrencies.

Regulatory Policies

Hayes interprets the recent US regulatory interventions in the crypto market as maneuvers to maintain control. The objective is transparent: the government seeks a mechanism to stem capital flight from traditional finance.

It's straightforward, really. The government:

- Grapples with substantial debt levels

- Faces constraints in its production decisions

- Is keen on retaining its citizens' capital within its jurisdiction, staving off its flight abroad

(Despite these measures potentially depreciating the value of money in the medium term).

In Hayes' view, regulatory crackdowns create an atmosphere of despair, discouraging the pursuit of alternative assets outside of the traditional financial framework.

If you want to have above average results, then you're going to have to put above average effort into thinking about your financial futureencourages Hayes

Overconfidence or Its Absence

This is a pivotal element in the turbulence of the crypto markets. On one hand, misplaced trust abounds in centralized institutions and key influencers within the crypto sector. Individuals hold firm to the belief that these entities and high-profile figures will safeguard their assets. On the flip side, trust dissipates as quickly as it formed the moment market conditions deteriorate (money evaporating alongside it). These wild swings of trust and mistrust are detrimental to the long-term viability and progress of the sector.

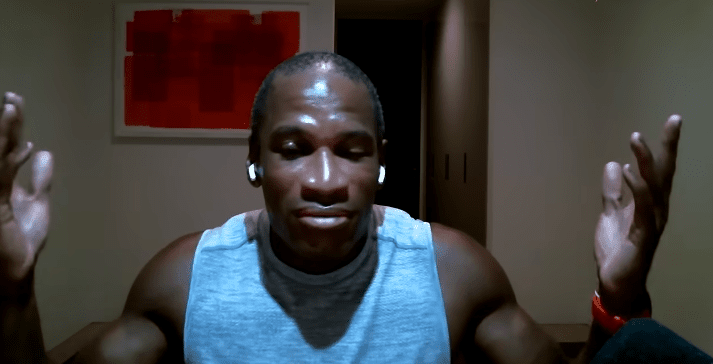

Challenges facing the crypto industry need to be tackled head-on. They cannot be swept under the rug. Source: Youtube

Fraud and Negligence

Hayes admits that certain figures and companies in the crypto sphere have indulged in fraudulent actions, demonstrated negligence toward their responsibilities, and so forth. The industry has thus been tarnished with a negative reputation, which can't be denied or overlooked.

The Million Dollar Prediction

Previously, it was Hayes himself who predicted that Bitcoin could surge to a value of $1 million in the current cycle. Now, he stipulates that this will be contingent on the trajectory of the US banking crisis. He believes that an increasing number of banks will confront challenges. The central bank is expected to reduce interest rates. This move will forge a bullish environment for crypto assets, including Bitcoin. Therefore, the prediction of 1 BTC equaling $1 million remains a viable prospect.

Recommended