Pump and Dump Schemes Complicate Crypto Mass Adoption

The crypto-verse is still rife with pump-and-dump schemes, and that’s a problem.

In a new blog post, the analytical company Chainalysis claims that 24% of tokens out of the 40,521 tokens launched in 2022 that got traction are likely typical pump-and-dump schemes.

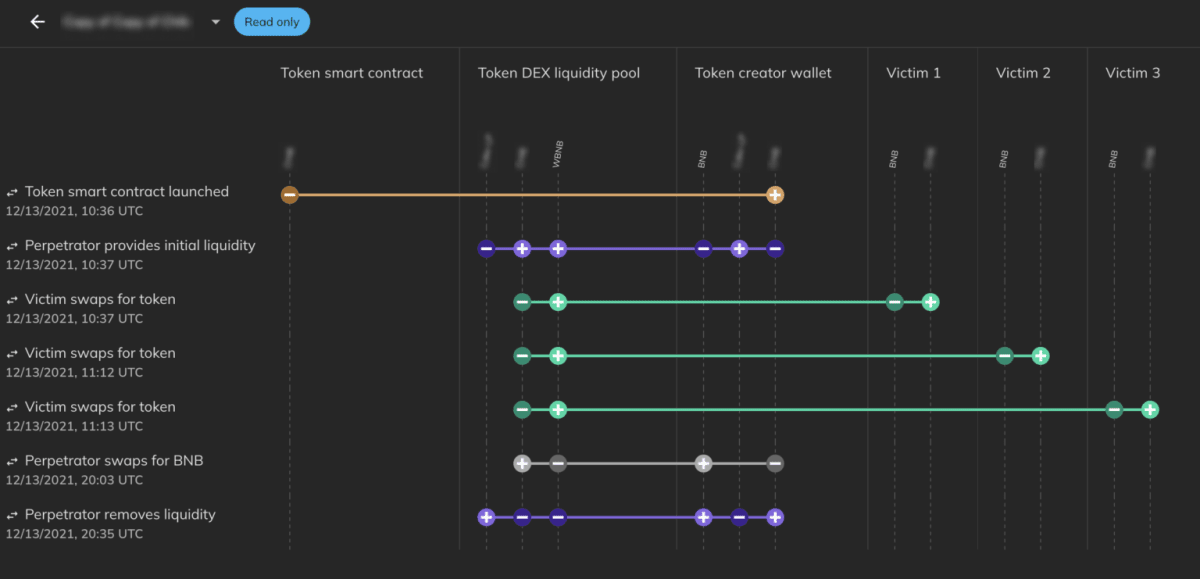

Noting that pump and dump schemes are common in the crypto world due to the “relative ease with which bad actors can launch a new token and establish an artificially high price and market capitalization for it “on paper” by seeding the initial trading volume and controlling the circulating supply”, the company illustrates what the typical scenario looks like with a graph (see below).

In it, the creator launched the token’s smart contract and funded a new liquidity pool for it on a popular decentralized exchange (DEX) in December 2021. Using social media to promote it, s/he attracted hundreds of victims who pumped the coin’s price within several hours. Then, s/he off all of his tokens, leaving buyers holding the bag, making just under $20,000.

Source: Chainalysis

Chainalysis does note that it could be the case that some teams in charge of token launches in 2022 wanted to make a healthy offering – yet simply failed to do so due to market forces and challenges stemming from less established infrastructure for market creation in the digital asset space.

Still, the most prolific suspected pump-and-dump token creator the company identified launched as many as 264 tokens in 2022.

“Many believe that cryptocurrency is approaching an inflection point that could spark mass adoption, but that could be difficult if the general public perceives cryptocurrency as rife with pump-and-dump schemes designed to prey on newcomers,” the company writes.

Previously, GNcrypto reported about three social media scams you should be aware of as well as popular scams on Telegram.