SEC Transit Gloria Mundi: Why Is Atkins Better Than Gensler?

How will the leadership change at the U.S. Securities and Exchange Commission (SEC) affect the crypto industry? Could it lead to more lenient regulations? Analytics firm PitchBook has released a comprehensive report addressing these critical questions.

Cautious Optimism and High Hopes

After his win, Trump nominated Paul Atkins, a veteran of the George W. Bush administration and a dedicated Republican, to serve as Chairman of the U.S. Securities and Exchange Commission (SEC).

Atkins brings extensive experience, having previously served as an SEC Commissioner from 2002 to 2008. His deep understanding of regulatory frameworks and the inner workings of the SEC has raised expectations in the crypto community for a shift in approach.

Many hope his leadership will move away from the “regulation by enforcement” strategy championed by outgoing Chair Gary Gensler.

Incoming SEC Chairman Paul Atkins. Source: CNN

Atkins’ nomination has also been well-received within the SEC. Hester Peirce, a Commissioner known for her strong support of digital assets, praised his candidacy as the ideal choice.

She wrote on X:

Paul Atkins is renowned for advocating reduced regulatory burdens and promoting financial innovation while adhering to free-market principles in his approach to policymaking.However, since his appointment, Atkins has not yet made any public statements about the SEC's future direction or potential regulatory changes, leaving uncertainty about his stance.

Alex Marinier, founder and general partner of venture firm New Form Capital, expressed cautious optimism about Atkins’ appointment.

According to Marinier, actions under Gary Gensler, including the ongoing lawsuit against Coinbase over alleged sales of unregistered securities, forced startups and venture firms to look for opportunities outside the U.S.

Despite the optimism surrounding Atkins’ appointment, challenges remain.

Efforts by Atkins to ease tensions between the SEC and the crypto industry will require support in the Senate, where he is likely to face resistance from Democrats.

Alex Marinier’s insights are supported by data from PitchBook, which highlights a sharp decline in venture investments within the cryptocurrency sector during Q3 2024.

Total deal volume fell by 31.1% compared to the previous quarter, reaching $1.7 billion, while the number of deals dropped by 25.3% to 392. This decline came unexpectedly, given the positive momentum seen earlier in the year. Experts attribute the downturn primarily to macroeconomic pressures, although regulatory challenges—such as ongoing scrutiny of Coinbase—also played a role.

PitchBook’s earlier report, “Crypto Report: VC Trends and Innovation Spotlights,” identified infrastructure startups as the leading recipients of venture funding.

Notable deals included: $100 million for Celestia, a modular L1 platform, $80 million for Story Protocol, an L1 platform for intellectual property management, and $55 million for Chaos Labs, a provider of risk management solutions.

In 2024, company valuations saw a significant increase. Median valuations rose to $18.5 million at the seed stage (+55.8%), $60.8 million at the early stage (+154.8%), and $60 million at the late stage (+26.3%) compared to 2023. However, the average deal size at the late stage decreased by 6.2% to $6 million, highlighting a growing trend among founders to maintain greater control over their companies.

In Q3 2024, there were 20 venture capital exits, including CoinDCX’s acquisition of the crypto exchange BitOasis and Alchemy’s acquisition of the decentralized infrastructure platform Bware Labs.

These conditions are particularly favorable for infrastructure startups focused on cryptocurrency trading and custody services.

Such companies generate revenue from trading spreads and storage fees for crypto assets, positioning them as direct beneficiaries of a bull market.

Hoolie Tejwani, director and head of Coinbase Ventures, emphasized the importance and potential impact of regulatory changes in the U.S. under new leadership.

Regulatory changes are critical to the future of the crypto industry. Paul Atkins, appointed by Donald Trump to lead the SEC, could play a key role in determining how U.S. securities laws apply to crypto assets.

Equally significant is whether the Commodity Futures Trading Commission (CFTC) will finalize the classification of certain tokens as commodities.

Steve Brotman, founder and managing partner of Alpha Partners, believes that Atkins’ past criticism of the SEC’s aggressive policies suggests a potential shift toward a more balanced regulatory approach.

The overall trajectory of the crypto market and venture funding will depend on how Atkins and other regulators address critical uncertainties. Collaborative efforts in regulation could accelerate startup growth and potentially redefine the U.S.’s role in the global crypto ecosystem.

Traditional financial firms, which have long kept their distance from cryptocurrencies, may finally step into the DeFi space.

Will Ogden Moore, a research analyst at crypto investment firm Grayscale, predicts that cryptocurrencies are poised to enter the next chapter. Conservative policy changes, such as potential tax cuts under a Republican-led government, could weaken the dollar and boost demand for Bitcoin as an alternative monetary system.

Payment processors and Bitcoin custody services backed by venture capital are likely to benefit from these shifts. Moore highlights growth opportunities in decentralized finance (DeFi), tokenized assets, and blockchain-based businesses, which could drive broader adoption and innovation in the industry.

Fixed-income cryptocurrency trading also stands to grow, driven by reduced transaction fees, faster settlement times, and favorable exchange rates. These changes could profoundly reshape the U.S. crypto market, paving the way for long-anticipated participation from Wall Street.

In 2016, PitchBook was acquired by Morningstar for $225 million, facilitating significant growth and expansion. The company has since grown to over 3,000 employees, comprising experts in fintech, cryptocurrency, artificial intelligence, and more.

Alex Marinier, founder and general partner of venture firm New Form Capital, expressed cautious optimism about Atkins’ appointment.

According to Marinier, actions under Gary Gensler, including the ongoing lawsuit against Coinbase over alleged sales of unregistered securities, forced startups and venture firms to look for opportunities outside the U.S.

Many top teams have been pushed offshore since FTX,” Marinier said. “Hopefully, that trend will be reversed. … We’ll start seeing more and more teams being based in the US as these regulations become clarified,Marinier remarked, highlighting the crypto exodus during Gensler’s tenure.

Marinier also pointed out that Atkins is co-chair of Token Alliance, a leading lobbying group under the Chamber of Digital Commerce, which advocates for clear and balanced regulations for digital assets.

Despite the optimism surrounding Atkins’ appointment, challenges remain.

Efforts by Atkins to ease tensions between the SEC and the crypto industry will require support in the Senate, where he is likely to face resistance from Democrats.

Alex Marinier. Source: CNBC

There is, though, some PTSD that will probably take some months to dissipate,Marinier added, emphasizing the difficulty of rebuilding trust after a period of regulatory uncertainty.

Addressing the Decline: Venture Funding in the Crypto Industry

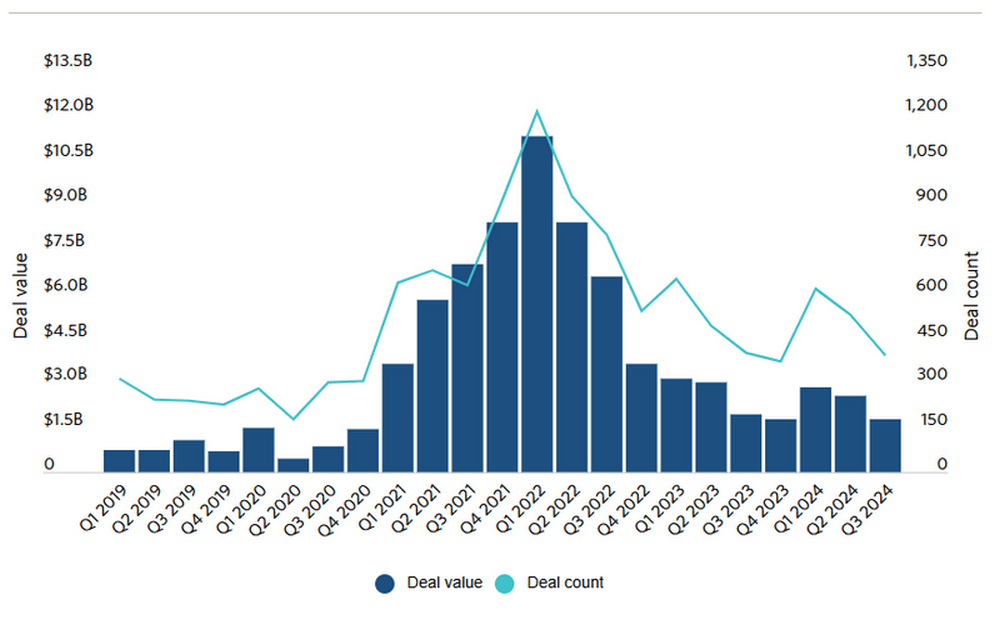

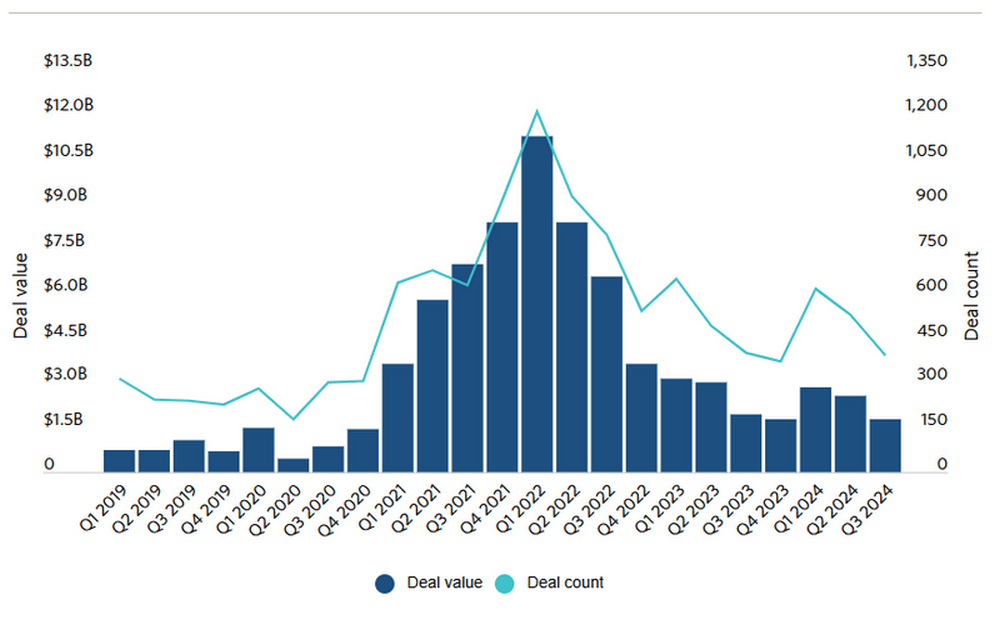

Alex Marinier’s insights are supported by data from PitchBook, which highlights a sharp decline in venture investments within the cryptocurrency sector during Q3 2024.

Total deal volume fell by 31.1% compared to the previous quarter, reaching $1.7 billion, while the number of deals dropped by 25.3% to 392. This decline came unexpectedly, given the positive momentum seen earlier in the year. Experts attribute the downturn primarily to macroeconomic pressures, although regulatory challenges—such as ongoing scrutiny of Coinbase—also played a role.

Global Venture Investments in Cryptocurrency. Source: PitchBook

PitchBook’s earlier report, “Crypto Report: VC Trends and Innovation Spotlights,” identified infrastructure startups as the leading recipients of venture funding.

Notable deals included: $100 million for Celestia, a modular L1 platform, $80 million for Story Protocol, an L1 platform for intellectual property management, and $55 million for Chaos Labs, a provider of risk management solutions.

In 2024, company valuations saw a significant increase. Median valuations rose to $18.5 million at the seed stage (+55.8%), $60.8 million at the early stage (+154.8%), and $60 million at the late stage (+26.3%) compared to 2023. However, the average deal size at the late stage decreased by 6.2% to $6 million, highlighting a growing trend among founders to maintain greater control over their companies.

In Q3 2024, there were 20 venture capital exits, including CoinDCX’s acquisition of the crypto exchange BitOasis and Alchemy’s acquisition of the decentralized infrastructure platform Bware Labs.

Robert Le Source: Bloomberg Technology

These deals highlight increased horizontal consolidation across the entire crypto ecosystem. We expect more consolidation among crypto exchanges, custodians, and infrastructure providers as the market matures and smaller players seek strategic exits,said Robert Le, senior analyst at Emerging Technology.

Infrastructure Crypto Startups Poised for Growth

In 2024, Bitcoin surged by 130%, while Ethereum gained 65%, reflecting strong overall growth in the crypto market. Following Donald Trump’s election victory, both assets jumped by over 50%, signaling heightened investor optimism.These conditions are particularly favorable for infrastructure startups focused on cryptocurrency trading and custody services.

Such companies generate revenue from trading spreads and storage fees for crypto assets, positioning them as direct beneficiaries of a bull market.

Hoolie Tejwani, director and head of Coinbase Ventures, emphasized the importance and potential impact of regulatory changes in the U.S. under new leadership.

We expect crypto startup creation and VC funding to be very active in 2025,he added.

Tejwani noted that achieving regulatory clarity could open up new opportunities for innovation and investment across the sector.

Hoolie Tejwani. Source: CNBC

Tejwani identified stablecoin-based payments, Web3 gaming projects, and decentralized finance as the most promising areas for growth. He also highlighted the intersection of the crypto industry and artificial intelligence as particularly exciting.

There are still many problems to solve and opportunities at the infrastructure and enabling-tool layers – so we will continue to invest in those layers as well,Tejwani added.

CFTC and SEC: Key Roles in Shaping the Crypto Market

Regulatory changes are critical to the future of the crypto industry. Paul Atkins, appointed by Donald Trump to lead the SEC, could play a key role in determining how U.S. securities laws apply to crypto assets.

Equally significant is whether the Commodity Futures Trading Commission (CFTC) will finalize the classification of certain tokens as commodities.

Steve Brotman, founder and managing partner of Alpha Partners, believes that Atkins’ past criticism of the SEC’s aggressive policies suggests a potential shift toward a more balanced regulatory approach.

Steve Brotman Source: Alpha Partners

[Atkins] has been critical of some of the previous SEC Chair’s initiatives, particularly those seen as overly aggressive towards Wall Street and the crypto industry. This suggests he may pursue a more industry-friendly regulatory approach,Brotman said.

Atkins will also face challenges related to the revival of the U.S. IPO market, driven by the Federal Reserve’s lowering of interest rates. Brotman emphasized that the market is closely monitoring for signs of a more supportive regulatory environment that could drive innovation and growth.

The overall trajectory of the crypto market and venture funding will depend on how Atkins and other regulators address critical uncertainties. Collaborative efforts in regulation could accelerate startup growth and potentially redefine the U.S.’s role in the global crypto ecosystem.

Wall Street Eyes Regulatory Risk Reduction

Traditional financial firms, which have long kept their distance from cryptocurrencies, may finally step into the DeFi space.

Will Ogden Moore, a research analyst at crypto investment firm Grayscale, predicts that cryptocurrencies are poised to enter the next chapter. Conservative policy changes, such as potential tax cuts under a Republican-led government, could weaken the dollar and boost demand for Bitcoin as an alternative monetary system.

Payment processors and Bitcoin custody services backed by venture capital are likely to benefit from these shifts. Moore highlights growth opportunities in decentralized finance (DeFi), tokenized assets, and blockchain-based businesses, which could drive broader adoption and innovation in the industry.

Fixed-income cryptocurrency trading also stands to grow, driven by reduced transaction fees, faster settlement times, and favorable exchange rates. These changes could profoundly reshape the U.S. crypto market, paving the way for long-anticipated participation from Wall Street.

PitchBook: About the Researchers

Founded in 2007, PitchBook is a leading provider of data, research, and analytics for private and public companies. The platform specializes in global mergers and acquisitions (M&A), private equity, and venture capital investments.In 2016, PitchBook was acquired by Morningstar for $225 million, facilitating significant growth and expansion. The company has since grown to over 3,000 employees, comprising experts in fintech, cryptocurrency, artificial intelligence, and more.

PitchBook’s Headquarters in Seattle. Source: PitchBook

PitchBook’s clients include venture capital and private equity funds, corporate development teams, investment banks, international consultants, and lenders.

To produce its comprehensive reports, real-time analyses, and forecasts, PitchBook engages top industry experts, government officials, and key opinion leaders.

Recommended