Technical analysis of BTC, ETH, and TRX. 08/06/23

Analysis of the current state of Bitcoin (BTC), Ethereum (ETH), and Tron (TRX).

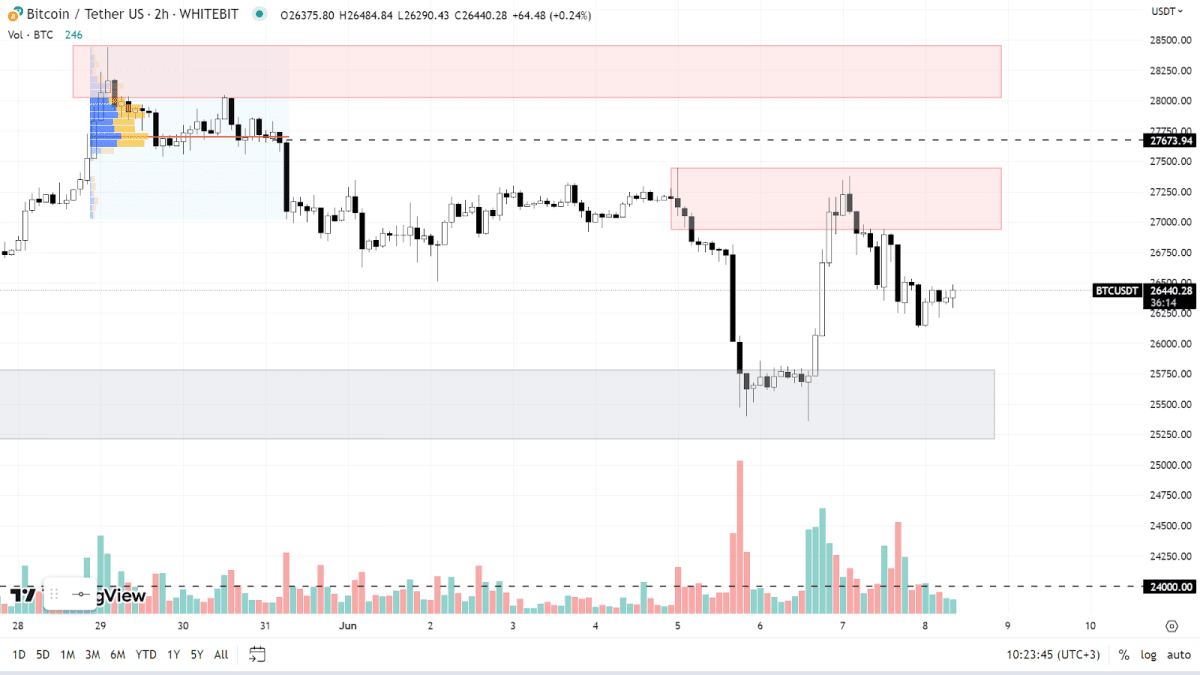

Bitcoin

On the H2 timeframe, the flagship cryptocurrency is currently trading between the support zone of $25,000-$25,700 and the resistance zone of $26,900-$27,400. If the downward momentum persists, we could potentially see a breach of the current support, leading to a drop towards the $24,000 level.

Seller orders have been sighted around the $27,700 point and within the $28,000-$28,500 range. Anticipated market conditions suggest that the asset's price movement will predominantly exhibit a sideways pattern until the next week. The volatility might see an uptick following the upcoming FOMC meeting, which is set to discuss interest rate policies.

BTC chart on the H2 timeframe

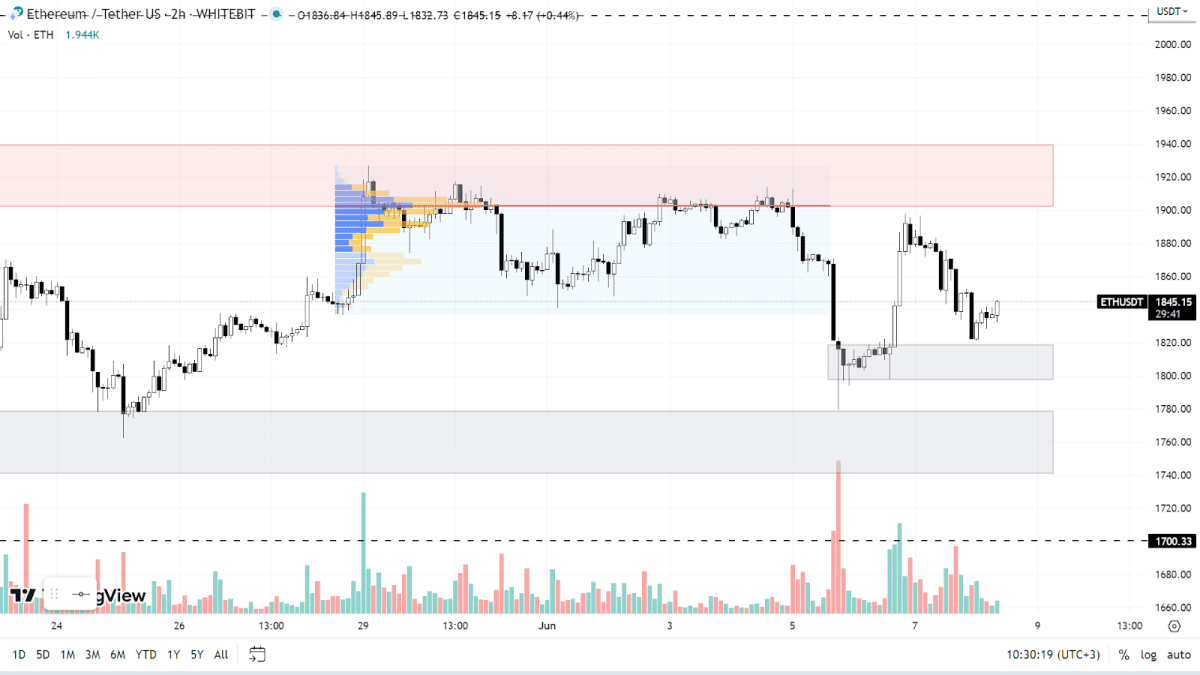

Ethereum

ETH is currently trading within a horizontal channel, finding support in the range of $1,741-$1,778 and facing resistance in the $1,903-$1,940 zone. Moreover, the buyers have crafted an intermediary zone at $1,798-$1,818, which could instigate a price response.

If the value dips below this range, the "psychological level" of $1,700 is expected to serve as the subsequent support level. Above the existing resistance, there's another hurdle set up at the $2,017 level.

ETH chart on the H2 timeframe

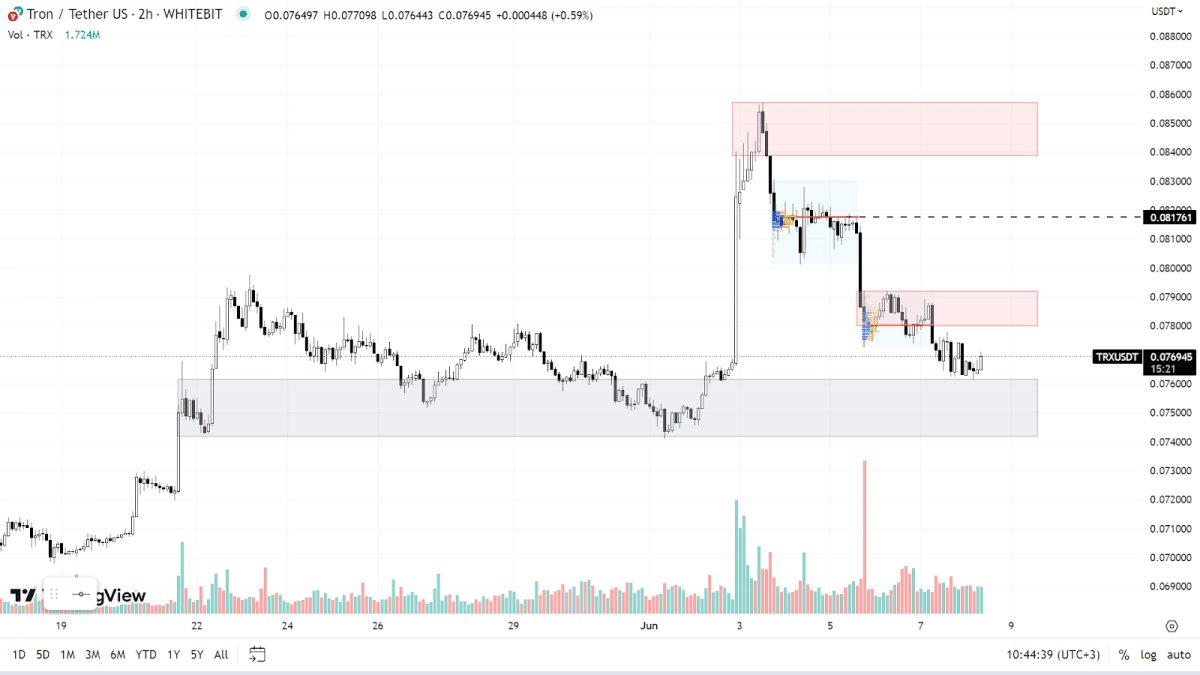

Tron

On the higher timeframe, TRX is continuing its upward movement that initiated back in November 2022. A correction phase is playing out on the H2 timeframe after the asset's explosive rise on June 2. Currently, the support zone is resting between $0.074 and $0.076.

Immediate resistance can be found within the $0.078-$0.0791 range. Further up, we see buy orders congregated at the $0.081 mark and scattered within the $0.0838-$0.0857 zone. It's advisable to keep an eye on BTC's behavior before plunging into any TRX-related trades, considering their substantial correlation.

TRX chart on the H2 timeframe

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. These are solely the opinions of the GNcrypto editorial board regarding the market situation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the movement of price between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K - $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended