The UST and LUNA Crash: One Year Later and Its Lasting Impact

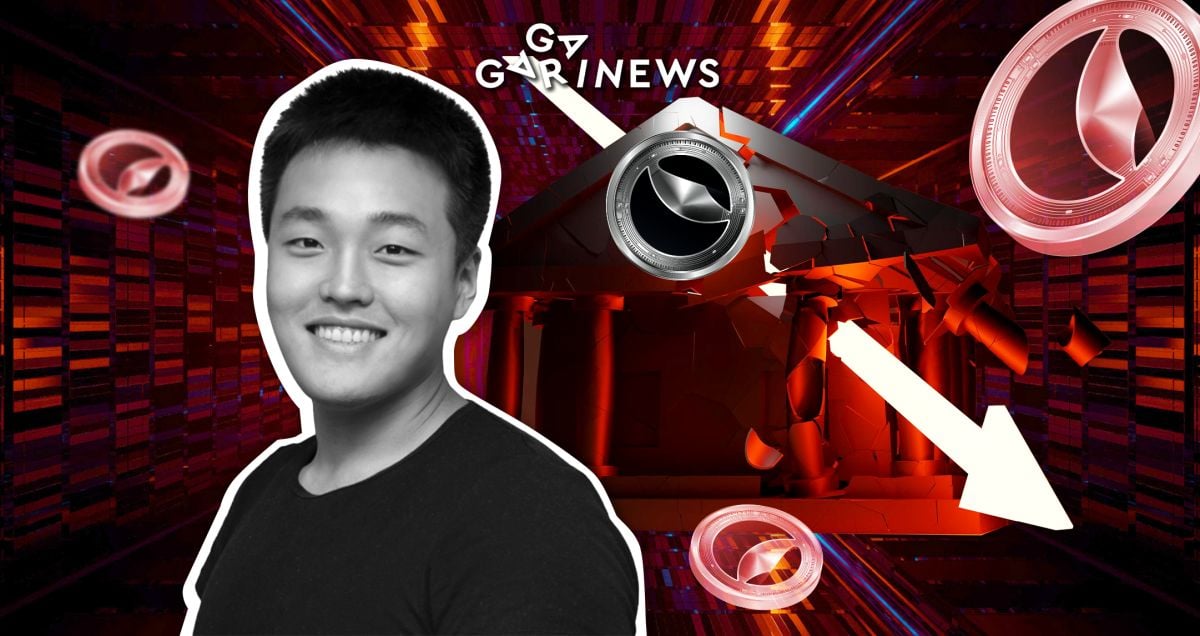

One year ago, the crypto world witnessed the dramatic collapse of the UST stablecoin and LUNA token, which has left an indelible mark on the market. The creator of the Do Kwon project, who had confidently promised to restore the UST peg to the US dollar, is now synonymous with the debacle that shook investor confidence and contributed to the intensification of the bearish market.

UST, an algorithmic stablecoin backed by LUNA tokens, enjoyed immense popularity before its downfall. The LUNA token had even secured a position among the top 10 most capitalized cryptocurrencies worldwide. However, the project's creator failed to deliver on his assurances, leading to the catastrophic collapse of UST and LUNA.

A year later, the crypto market is still grappling with the consequences of this event. Market sentiment has been considerably dampened, as investors remain wary of similar projects and question the reliability of stablecoins. This skepticism has hindered the growth of new algorithmic stablecoins and put pressure on existing ones to demonstrate their resilience.

The UST and LUNA crash also served as a stark reminder of the risks and volatility associated with the crypto industry. Regulators worldwide have since increased scrutiny of the sector, leading to tighter regulations and the implementation of more stringent compliance measures. The incident highlighted the need for proper oversight and investor protection in the rapidly evolving world of digital assets.

Despite the setbacks, the crypto market has shown its ability to recover and adapt. Numerous projects have emerged in the aftermath, implementing more robust safeguards and learning from the mistakes of their predecessors. The UST and LUNA crash may have left a lasting impact, but it has also served as a pivotal learning experience for the industry. As a result, the market is gradually regaining its footing, and investors are cautiously optimistic about the future of digital assets.

A year later, the crypto market is still grappling with the consequences of this event. Market sentiment has been considerably dampened, as investors remain wary of similar projects and question the reliability of stablecoins. This skepticism has hindered the growth of new algorithmic stablecoins and put pressure on existing ones to demonstrate their resilience.

The UST and LUNA crash also served as a stark reminder of the risks and volatility associated with the crypto industry. Regulators worldwide have since increased scrutiny of the sector, leading to tighter regulations and the implementation of more stringent compliance measures. The incident highlighted the need for proper oversight and investor protection in the rapidly evolving world of digital assets.

Despite the setbacks, the crypto market has shown its ability to recover and adapt. Numerous projects have emerged in the aftermath, implementing more robust safeguards and learning from the mistakes of their predecessors. The UST and LUNA crash may have left a lasting impact, but it has also served as a pivotal learning experience for the industry. As a result, the market is gradually regaining its footing, and investors are cautiously optimistic about the future of digital assets.

Recommended