THETA and IMX Altcoin Analysis for November 1, 2023

Bitcoin maintains its position above $34,000, with minimal volatility evident on the BTC chart. Here’s an analysis of the market situation for Theta Network (THETA) and ImmutableX (IMX) as of Wednesday, November 1.

Theta Network (THETA)

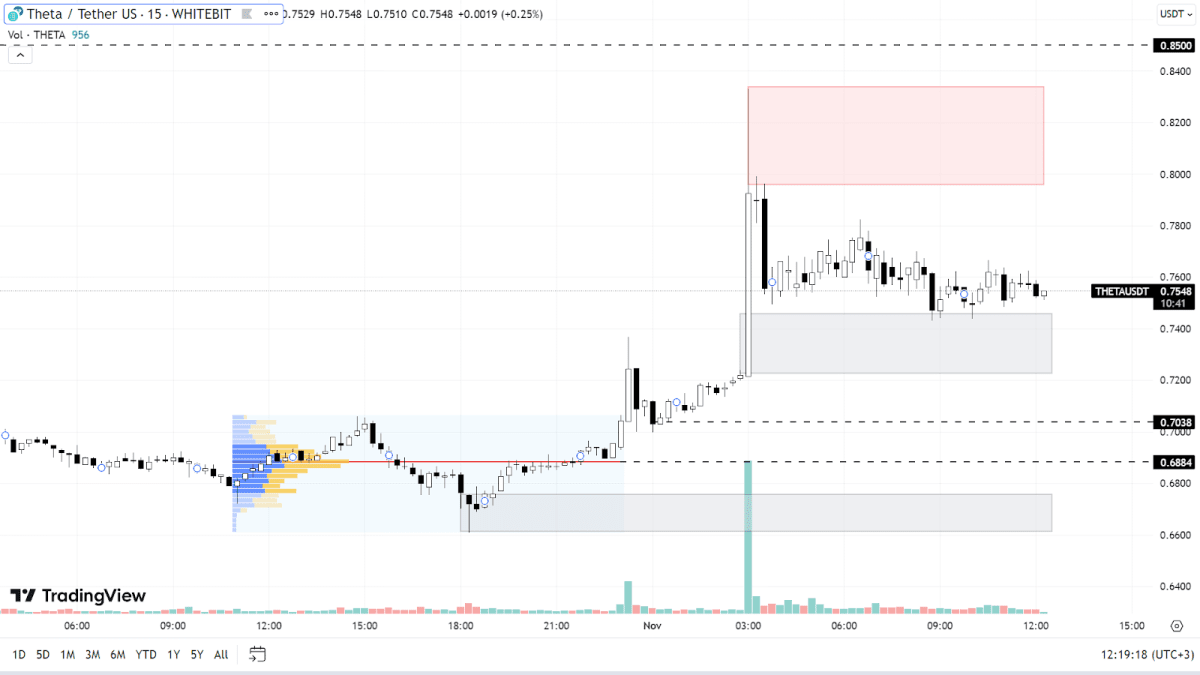

Since October 19, THETA has increased by 50%, primarily due to the upward trend on the BTC chart, which remains a driver for the entire cryptocurrency market. Last night, the price of THETA surged by 15% once again, setting a new local high at $0.833.

Buyers still have a greater influence on the Theta Network price than sellers, making a continued upward scenario a priority. The next targets for buyers could be the resistance levels at $0.85 and $0.87, although it would be preferable to see some stabilization of the rate in a sideways range between the support zone of $0.723–$0.745 and resistance of $0.795–$0.833.

In case of a correction, THETA could drop to levels of $0.703, $0.688, and the narrow demand range of $0.660–$0.675. All of these marks are part of the upward trend, so testing them could be a logical step before moving to new highs.

THETA chart on the M15 timeframe

ImmutableX (IMX)

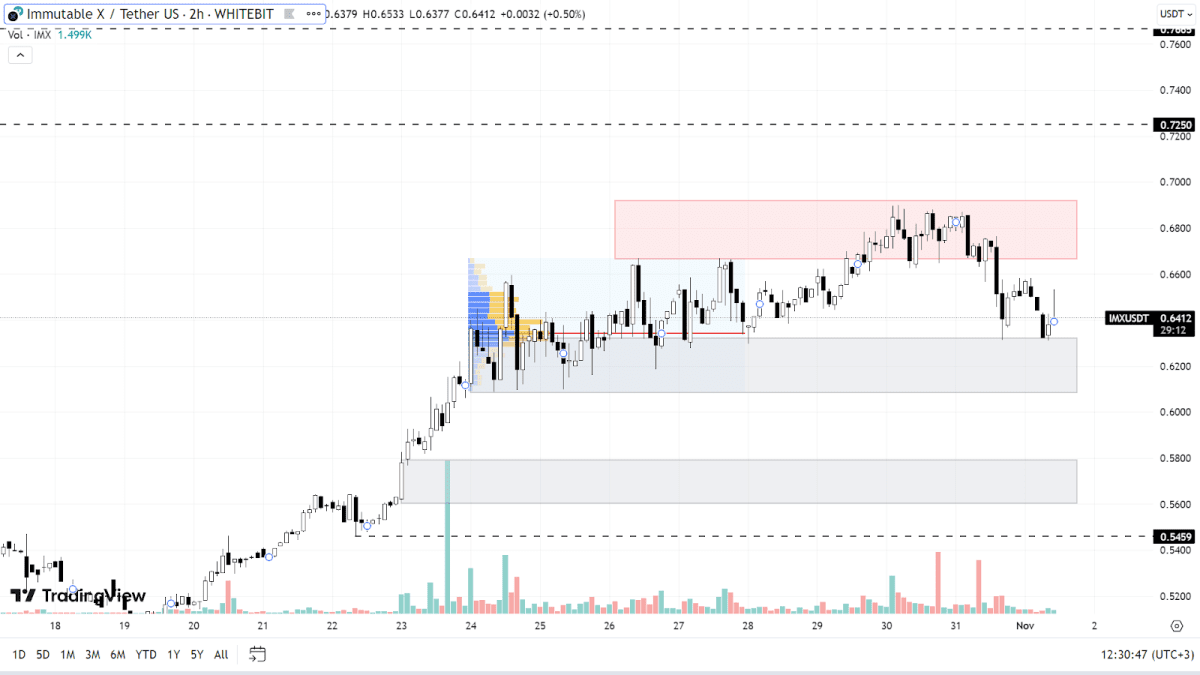

Unlike other altcoins, the momentum on the IMX chart hasn't been as pronounced, presenting an opportunity for substantial future growth. Since October 19, the asset has increased by 30%, a relatively modest gain compared to other alternative cryptocurrencies.

At present, the IMX price is caught between a support zone of $0.608 and $0.632. If the uptrend continues, IMX's price could potentially reach $0.725 and $0.766, levels that were hit during ImmutableX’s surge on September 21.

Should the BTC chart depict a downturn, IMX could retest the support zone at $0.560-$0.580, as well as the $0.545 level. These marks may need to be tested as a technical correction before any further increase.

IMX chart on the H2 timeframe

Today, a series of major economic events is expected, including the release of U.S. crude oil inventory data and the Fed's decision on interest rates. These developments are poised to have a substantial impact on the value of the U.S. dollar and, in turn, affect the cryptocurrency market.

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the price movement between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K – $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended