Top 5 Derivatives Decentralized Exchanges

Derivatives DEXs are decentralized platforms that empower users to leverage trade in futures, bypassing verification or other KYC procedures.

As the DeFi space blossoms, these platforms are gaining widespread traction. Many traders are attracted to futures trading, bypassing traditional exchange registration and instead, connecting their cryptocurrency wallets directly.

In this article, we'll uncover the five major derivatives DEXs and explore the bespoke tools they offer to their users.

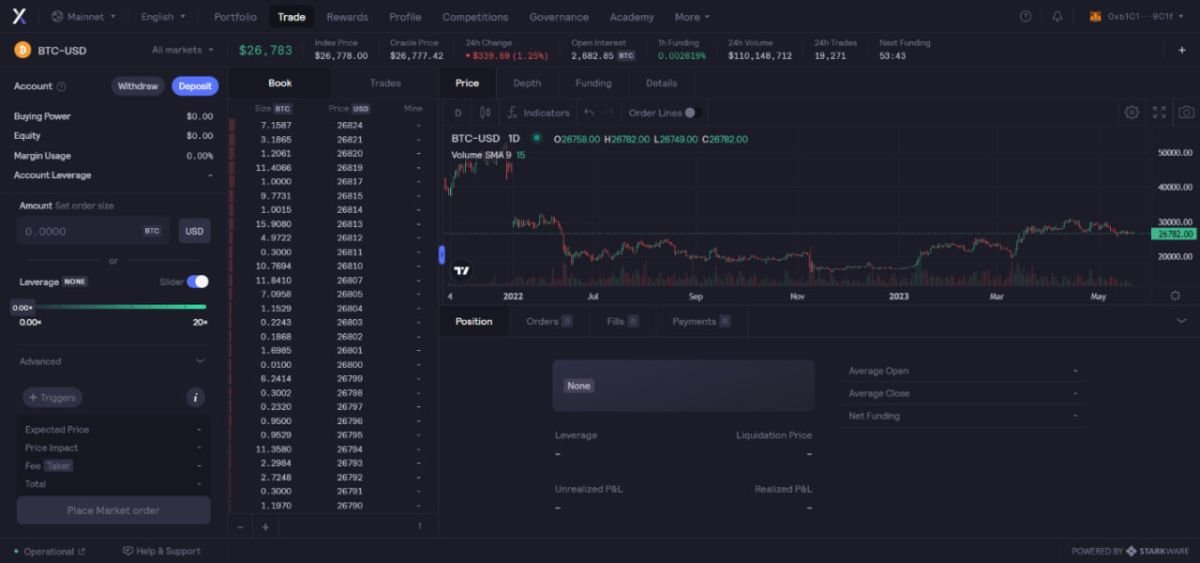

dYdX

One of the heavyweights among decentralized derivatives platforms on the Ethereum blockchain, dYdX boasts a range of key features:

● Enabling users to initiate leveraged futures positions;

● Building a cryptocurrency portfolio via an intuitive 'portfolio' tool;

● Earning rewards through DYDX token staking and internal transactions.

dYdX features an extensive array of cryptocurrencies, including BTC, ETH, SOL, LTC, TRX, MATIC, among others. Trading pairs exhibit high liquidity, and certain trading volumes have even eclipsed $100 million per day. The platform also allows a maximum leverage of 20X.

The dYdX platform interface. Source: trade.dydx.exchange

With StarkWare technology, dYdX eliminates transaction fees, executing deals on the blockchain via Layer 2.

Its native token, DYDX, launched in 2021, has a market capitalization of $320 million.

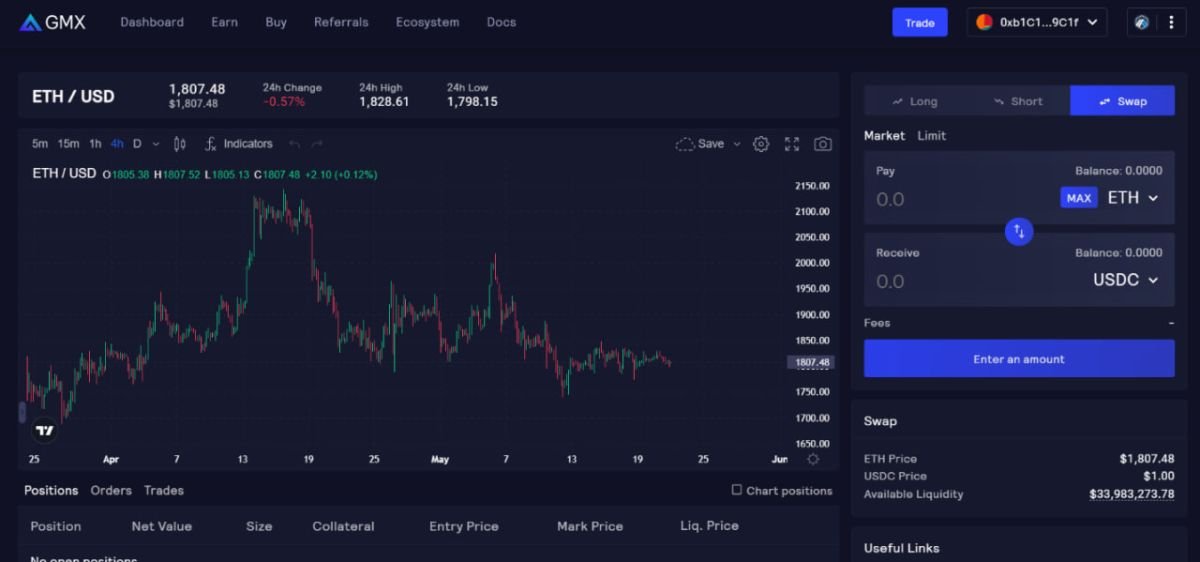

GMX

GMX is a decentralized platform on the Arbitrum network, a Layer 2 solution for Ethereum, and is also available on Avalanche.

Users can trade four cryptocurrencies - BTC, ETH, UNI, and LINK. Futures contracts offer a maximum leverage of 50X. GMX supports both derivative contracts and basic token exchanges.

The platform's native token, GMX, ranks among the top hundred market assets according to CoinGecko and CoinMarketCap, with a market cap of over $500 million.

The GMX interface. Source: https://app.gmx.io/

Synthetix Finance

This decentralized platform is a high-yield asset staking protocol. Within Synthetix, there are multiple affiliated platforms each offering a diverse set of tools:

● Kwenta — a DEX that facilitates leveraged trading of tokens up to 25X, offering enhanced deal liquidity.

● Dhedge — a hub for crafting automated yield farming strategies.

● Lyra — a decentralized marketplace for buying and selling cryptocurrency options.

By staking STX tokens, you can yield an annual return of 35%. The asset boasts a market cap of $744 million, and the average daily trading volume on Synthetix exceeds $60 million.

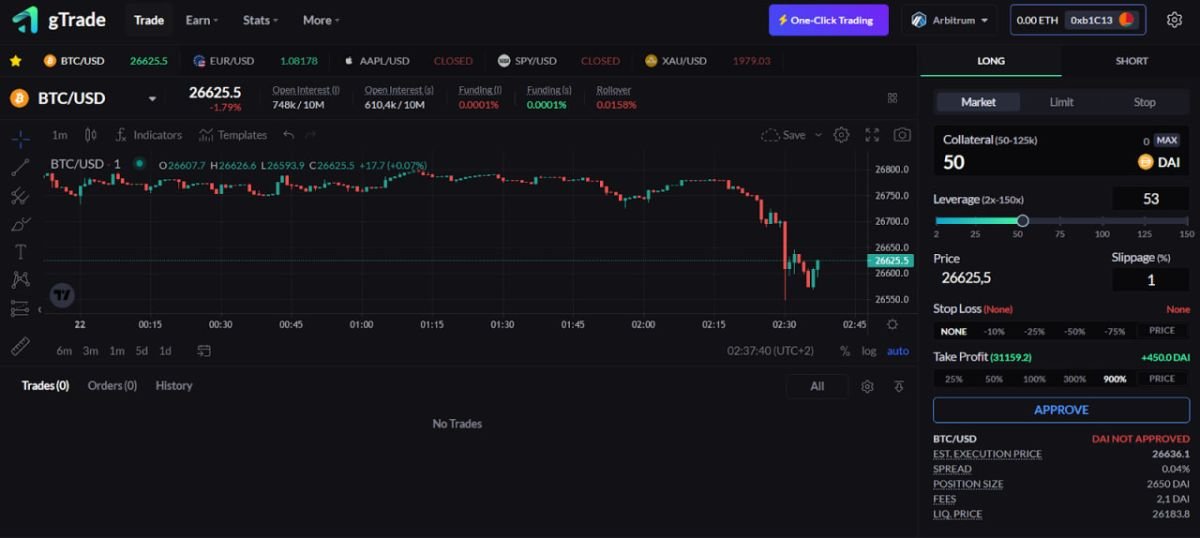

Gains Network

The Gains Network is a versatile DEX that provides staking, leveraged trading, and over-the-counter deals. On the Gains Network's trading platform, gTrade, you can access leverage up to 150X in the futures section. The DEX offers more than just cryptocurrencies; it includes trading pairs with gold, company stocks, and fiat currencies.

gTrade operates across the Polygon, Arbitrum, and Polygon Mumbai test networks. Traders can set limit orders, allowing them to buy and sell assets at predetermined prices. On average, the daily trading volume reaches around $3 million.

GNS, the platform's native token, is valued at $5, contributing to a total market cap of $150 million.

The working interface of the gTrade platform (https://gains.trade/)

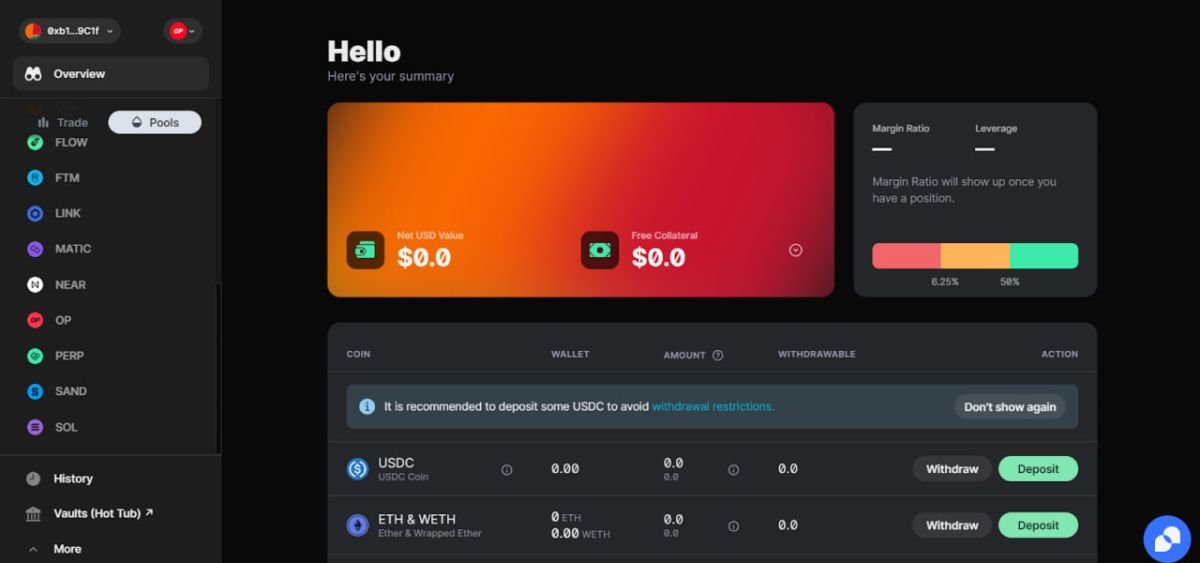

Perpetual Protocol

This decentralized exchange offers a platform where users can trade a variety of coins, engage in lending and borrowing activities, stake tokens, and even receive rewards in USDC and PERP. It operates on the Optimism blockchain, a Layer 2 solution of the Ethereum network, ensuring quick and low-cost transactions, often as cheap as $0.1.

Starting on the platform is a breeze — connect your wallet, deposit funds, and you're ready to go. Interestingly, Perpetual Protocol contributes some of its own funds as collateral for transactions, which traders can then use as margin. The platform supports a range of assets, such as BTC, DOGE, AAVE, ATOM, AVAX, NEAR, and several other cryptocurrencies. You can contribute any of these assets to boost liquidity and in return, you can garner increased rewards from farming.

The Perpetual Protocol interface. Source: https://app.perp.com/

The platform's native token, PERP, is currently traded on exchanges at around $0.58, with a market cap of approximately $42 million.