Top 7 Applications in the LayerZero Ecosystem

With each passing month, the LayerZero ecosystem rapidly expands, drawing nearer to the release of its own token and an airdrop for early adopters.

In July 2023, transactions on the LayerZero network exceeded the 50 million mark. The ecosystem boasts a wide range of NFT and DeFi projects, along with robust credit protocols and cross-chain bridges. In this feature, we shed light on the most popular applications on LayerZero, which might offer users an edge in obtaining LayerZero's airdrop.

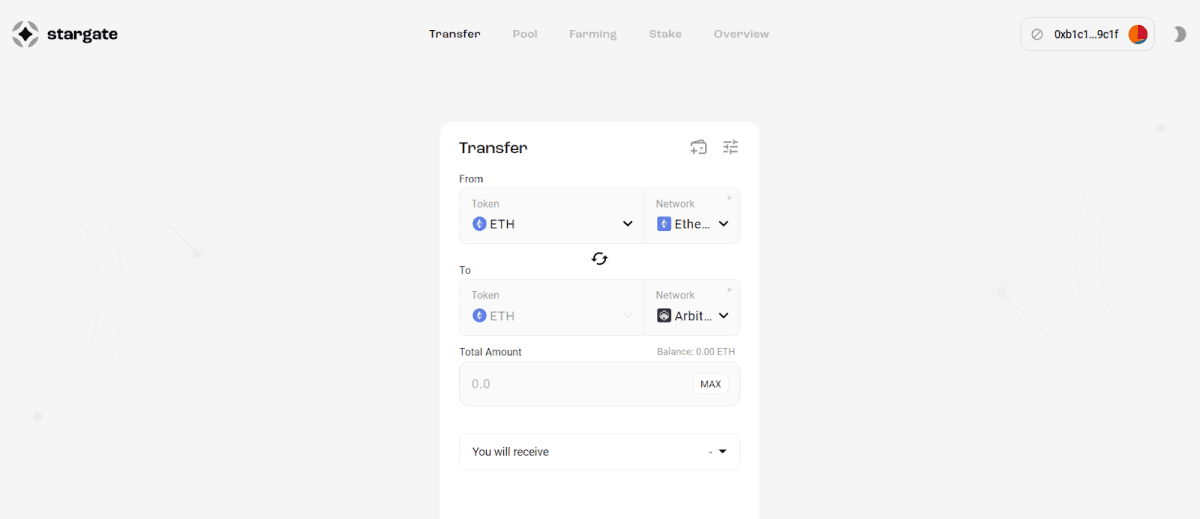

Stargate Finance

This hybrid protocol combines the functionalities of a decentralized exchange and a cross-chain bridge. With Stargate Finance, users can:

- Transfer assets between 11 EVM-compatible chains.

- Swap tokens.

- Participate in liquidity farming and stake stablecoins with an 8% annual return.

- Earn through staking the platform's native STG token at a 21% annual rate.

Stargate Finance's interface (stargate.finance)

The platform boasts a Total Value Locked (TVL) of $350 million and processes up to 100,000 transactions daily.

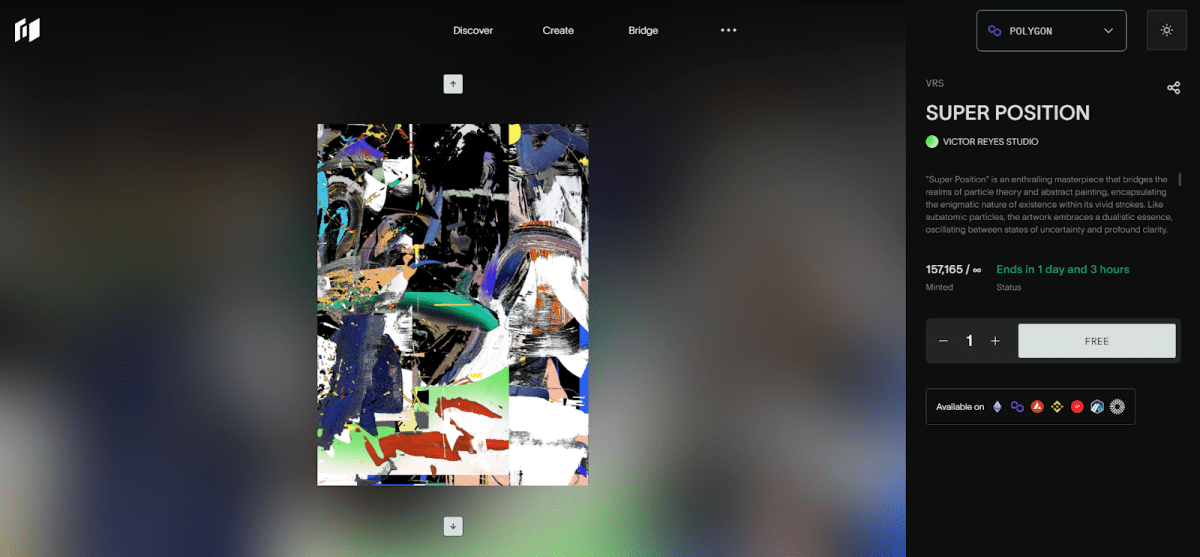

Holograph

This platform is designed for creating and managing NFTs across multiple blockchains, facilitating the transfer of these tokens between networks. On their official site, users can purchase the protocol's signature NFTs or craft their own collections, with the flexibility to transfer them to another network if desired.

The cost of transactions is contingent upon the selected network, with prices ranging from $0.1 to $50.

Holograph’s interface (app.holograph.xyz)

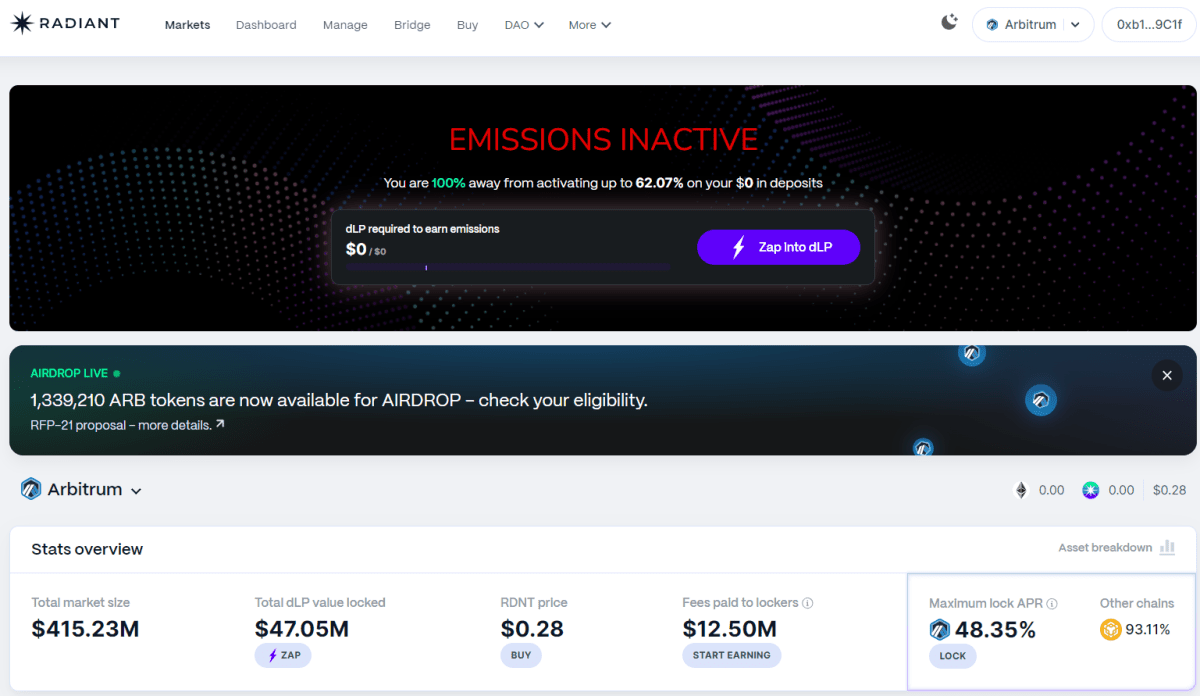

Radiant

Radiant is a cryptocurrency lending protocol available on the Arbitrum and BNB Chain networks. Users of this platform can obtain stablecoin loans by using cryptocurrency as collaterals, stake their coins with an annual return of 40-80%, utilize a cross-chain bridge to transfer RDNT tokens, and more.

Currently, the platform has over $400 million in total value locked.

Radiant’s interface (radiant.capital)

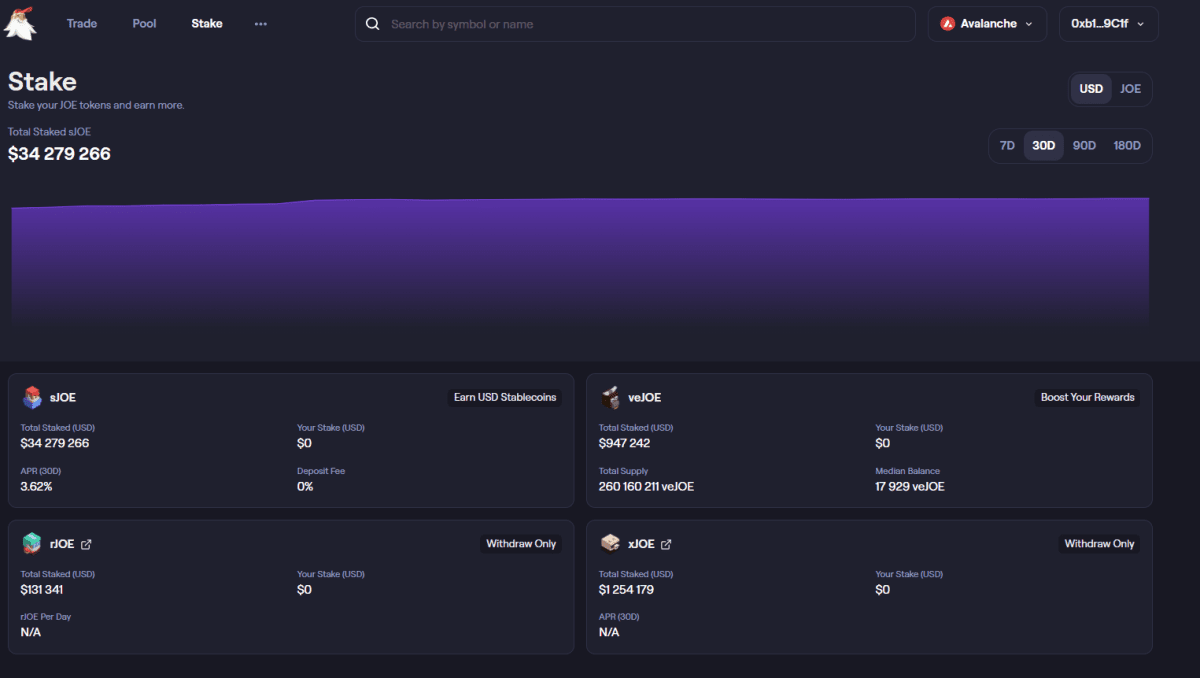

TraderJoe

TraderJoe operates as a decentralized platform across the Avalanche, Arbitrum, BNB Chain, and Ethereum networks. Features of the DEX include:

- Token exchanges/

- Farming opportunities for both standard tokens and stablecoins;

- Participation in the DAO and decision-making through Joe token holding.

TraderJoe also offers a lending protocol, allowing users to lend or borrow using ETH, AVAX, or BTC as collateral.

Staking on TraderJoe (traderjoexyz.com)

Rage Trade

Rage Trade is a decentralized platform designed for leveraged token trading, exclusively available on the Arbitrum network for now.

The platform primarily utilizes the USDC stablecoin and is currently undergoing enhancements to introduce more trading functionalities.

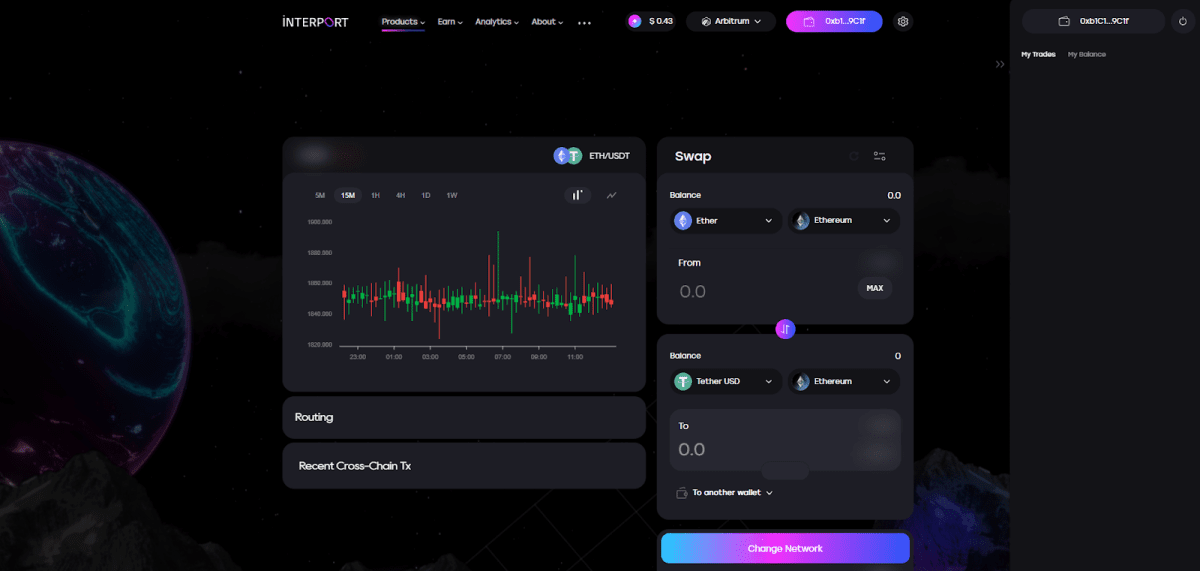

Interport

Interport serves as a cross-chain protocol, facilitating seamless transfers between various networks. It supports seven EVM-compatible chains, including Polygon zkEVM, zkSync, and Arbitrum. On Interport, users can earn a 4% annual return by staking USDT, and farm liquidity using the native ITP token.

With daily trading volumes exceeding $1.3 million, Interport boasts a user count of over 65,000.

Interport’s interface (app.interport.fi)

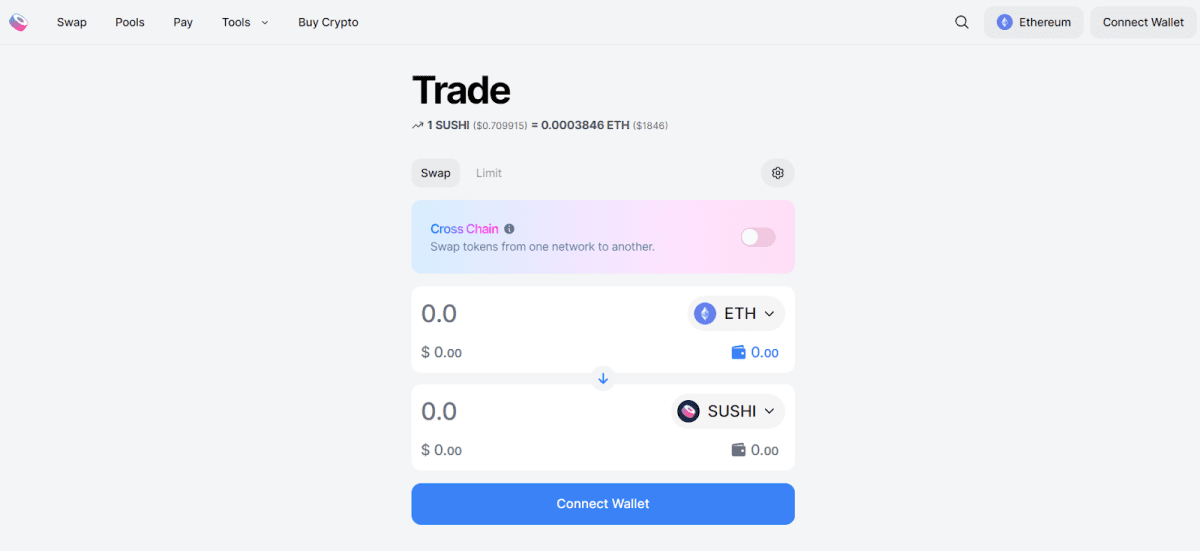

Sushi Swap

This renowned decentralized platform is compatible with a wide range of popular EVM blockchains, spanning over 20 networks. Users can explore a detailed guide on our official website.

Sushi Swap allows its users to swap tokens, stake the native SUSHI token and multiple stablecoins, and buy cryptocurrencies via an in-built fiat gateway. The SUSHI token's market capitalization is valued at $136 million, as of this article's date.

Sushi’s interface (sushi.com)

Recommended