Trading Basics: The Power of Moving Averages

If you’re aiming to interpret market trends accurately, moving averages are your go-to tool. We explore how this vital technical analysis instrument can guide you in identifying trends and making informed trading decisions. Learn the practical application of various moving averages.

Understanding Moving Averages

Price charts can sometimes appear as restless as ocean tides. To make sense of these constant shifts, traders use technical indicators available within trading platforms. The moving average stands out as one of the most effective tools.

A moving average is a line on the chart that showcases the average price over a selected timeframe. This indicator smooths out short-term volatility, enabling traders to concentrate on identifying more sustained market trends.

Why Do Traders Use Moving Averages?

Moving averages, or “MAs,” are essential tools that serve several functions in trading:

- Trend recognition: MAs offer a straightforward way to spot whether the market is in an upward, downward, or sideways trend.

- Trade signal generation: The intersection of two moving averages with different time settings can signal entry and exit points.

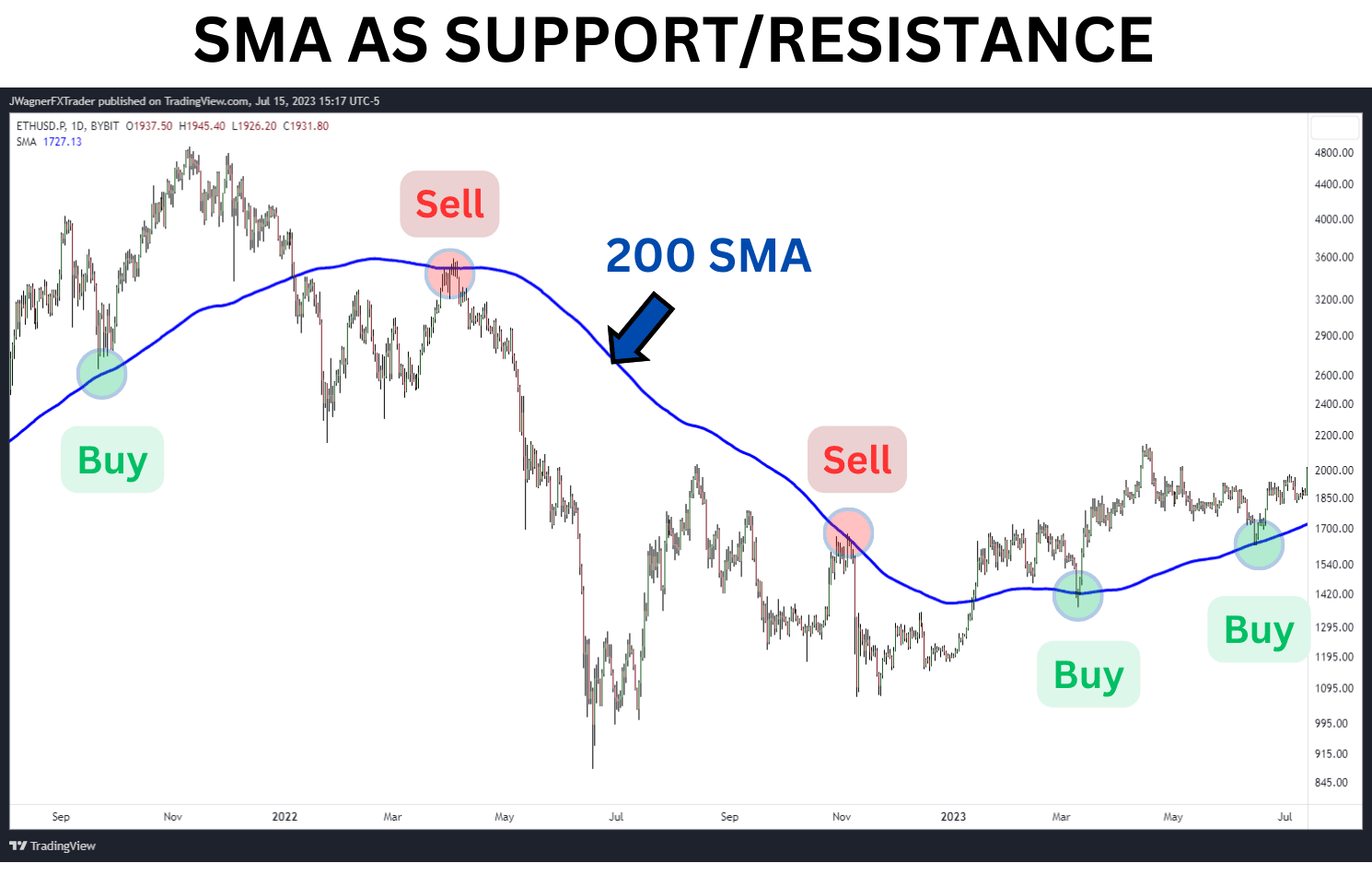

- Dynamic support and resistance: MAs frequently act as moving levels of support and resistance.

- Evaluating trend strength: The slope of an MA can indicate how robust a trend is.

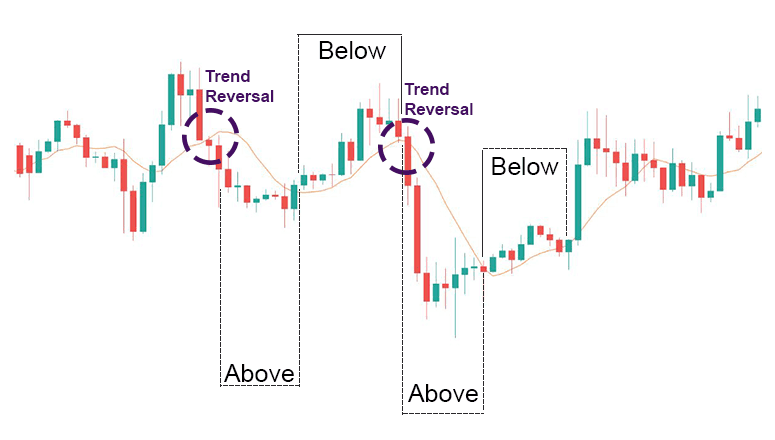

Note: A price crossing an MA can warn of an upcoming trend reversal. Source: Axi

Exploring the Types of Moving Averages

Three primary types of moving averages exist, each with specific features that cater to various trading needs:

- Simple Moving Average (SMA) – This straightforward average calculates the mean of closing prices over a set period.

- Exponential Moving Average (EMA) – Puts greater emphasis on recent prices, making it more reactive to the latest price changes.

- Weighted Moving Average (WMA) – Distributes different weights to prices based on their recency, enhancing the focus on current trends.

More on a topic: ADX indicator

The Mechanics of Moving Averages

Moving averages rely on historical price data to generate an average price over a chosen period. The principle remains consistent across all types: determining the mean value of an asset’s price for a given timeframe.

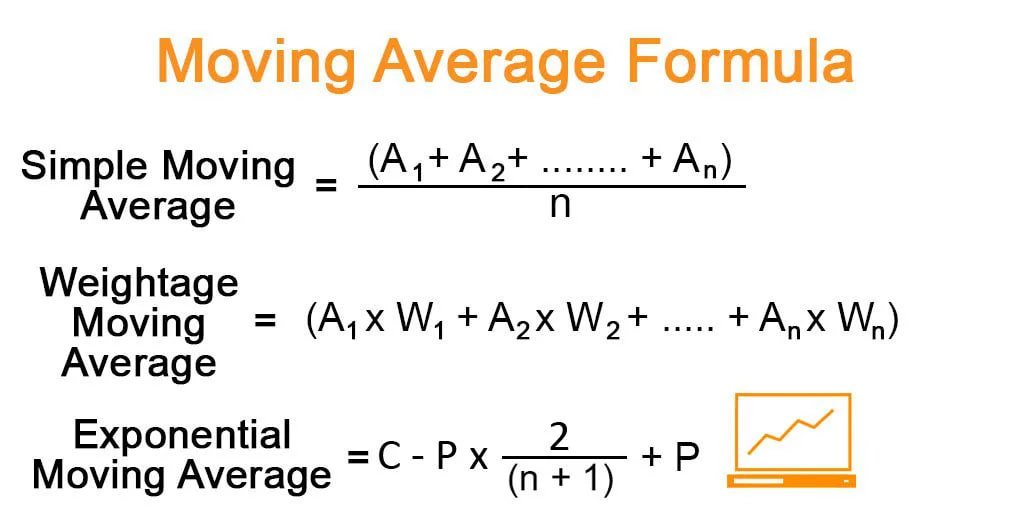

Formulae used to determine MA calculations. Source: educba

To calculate a Simple Moving Average (SMA), the sum of the closing prices over a specified number of days is divided by that number. For instance, a 20-day SMA would sum up the closing prices from the past 20 days and divide by 20.

Trading signals derived from SMA. Source: fxpipsguru

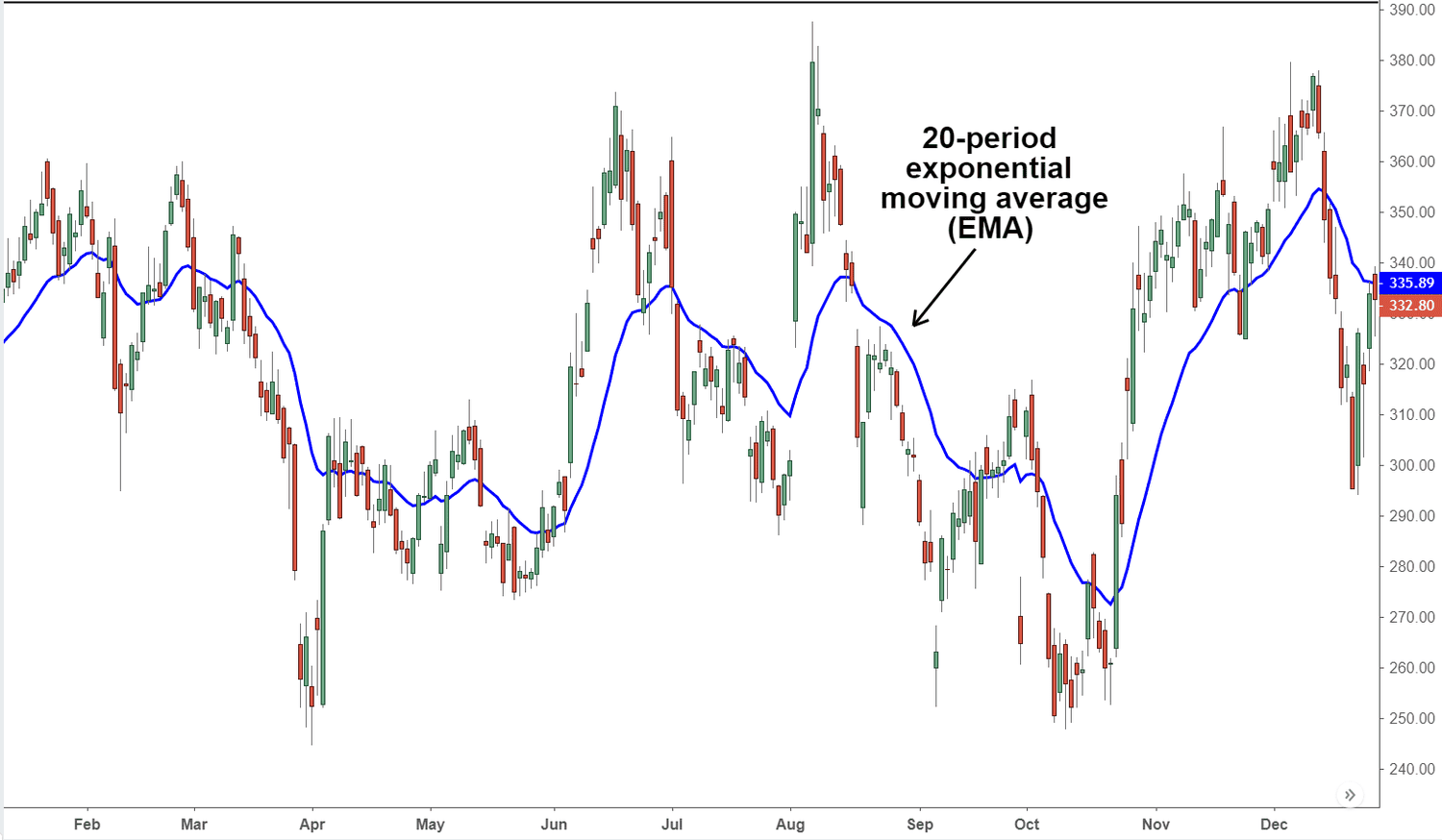

The Exponential Moving Average (EMA) differs from the SMA through its more detailed calculation, which includes an exponential smoothing factor.

This smoothing factor influences how responsive the EMA is to fresh data. The EMA follows price movements closely, resulting in a smoother curve that highlights the prevailing trend.

EMA excels in monitoring trend development over generating specific trading alerts.

EMA offers a smoothed price curve. Source: investopedia

The Weighted Moving Average (WMA) gives a higher priority to recent data, enabling faster market response.

WMA assists traders by both identifying trends and generating buy/sell signals.

In constructing a WMA, recent prices hold more relevance compared to older data points.

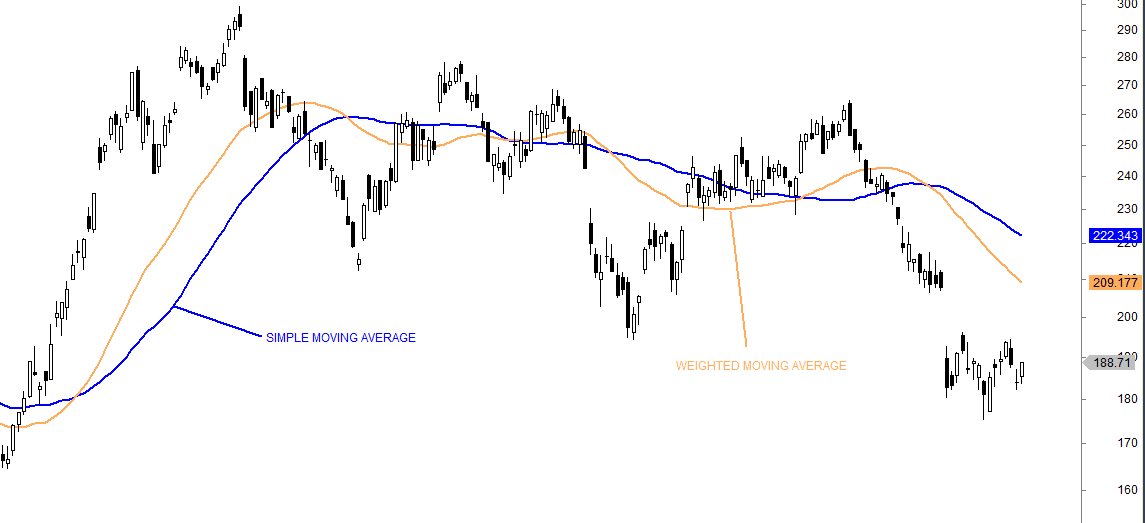

Chart illustrating 50-day SMA and WMA. Source: quantifiedstrategies

Depicting Moving Averages on Graphs

In charts, moving averages are represented by a smooth line that trails the price of an asset. The longer the period used for calculating the moving average, the smoother this line will be.

If the price is positioned above the moving average, it usually signifies an upward trend. The price below suggests a downward trend.

When the price oscillates slightly above and below the moving average line, this may suggest a sideways or neutral trend.

Utilizing Moving Averages: Effective Strategies

A popular approach to utilizing moving averages involves the comparison of two with different time frames: a long ("slow") and a short ("fast") moving average. For example, daily and weekly moving averages can be used together.

Trend Analysis. If the short moving average is positioned above the long one, it typically signals an upward trend. When the short moving average dips below the long one, it can indicate a downward trend.

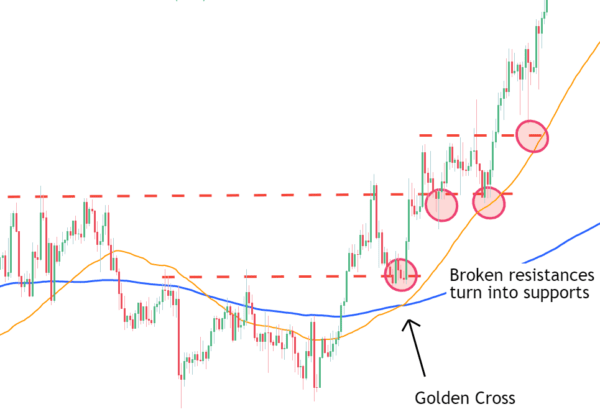

Generating Trading Signals. The Golden Cross is formed when the fast moving average crosses the slow moving average from below, hinting at a potential price rise. The Death Cross, meanwhile, is created when the fast moving average crosses down through the slow one, signaling bearish momentum and a potential selling opportunity.

Golden Cross on the asset's price chart. Source: Reddit

Take, for instance, the well-executed "Golden Cross" on Bitcoin at the end of October. This signal was a precursor to BTC achieving a record-high price in November.

Still, moving average crossover signals are not always precise. False breakouts can happen frequently, particularly in the unpredictable crypto market. To improve accuracy, it’s recommended to seek additional confirmation, such as candlestick pattern analysis or the use of other indicators.

It’s worth noting that moving averages are lagging indicators, regardless of their type. This implies that signals from moving averages can be delayed, which may limit their effectiveness for high-frequency trading.

Given that no single indicator is perfect, moving averages should be supplemented with additional tools (e.g., RSI, MACD) and supported by disciplined risk management strategies.

A worthwhile read: What is the RSI indicator?

Decoding Moving Average Signals

Moving averages deliver critical insights that help traders gauge market conditions.

Here are the primary signals that support comprehensive trading strategies:

1. Crossover of Moving Averages. The intersection of two moving averages with different timeframes can act as a trading signal for entry or exit. For instance, when a short-term MA crosses down through a longer-term MA, it may indicate the beginning of a downtrend and prompt selling. On the other hand, when a short-term MA crosses up through a long-term MA, it could signal a buying opportunity.

2. Moving Average Breakout. When the price breaks through a moving average, either upward or downward, it can validate an existing trend or suggest the potential start of a new one, depending on the prevailing market conditions.

3. Moving Average as a Support/Resistance Indicator. Moving averages can act as flexible support or resistance levels. When the price approaches a moving average, it frequently reacts by bouncing (creating potential for a rebound trade) or breaking through it (notifying traders of a potential shift and prompting position adjustments).

Integrating Moving Averages and Other Indicators for Improved Precision

Popular combinations include:

- Moving Averages with RSI. The RSI (Relative Strength Index) is a valuable metric for measuring the strength of a trend and spotting overbought or oversold conditions. When moving averages are paired with RSI, it can provide a more robust basis for making well-timed and reliable trade entries.

- Moving Averages Integrated with MACD. The MACD (Moving Average Convergence Divergence) reveals the spread between two EMAs. Using MACD alongside two moving averages with distinct periods can help eliminate false signals that might occur if used independently.

- Moving Averages and Bollinger Bands. Bollinger Bands form a channel around a moving average, providing a visual representation of market volatility. Using moving averages alongside Bollinger Bands helps identify optimal stop-loss and take-profit levels and enhances understanding of current market volatility.

Alternative combinations:

1. Moving Averages and Volume Metrics. Combining volume analysis with moving averages can validate the strength and momentum of a new trend.

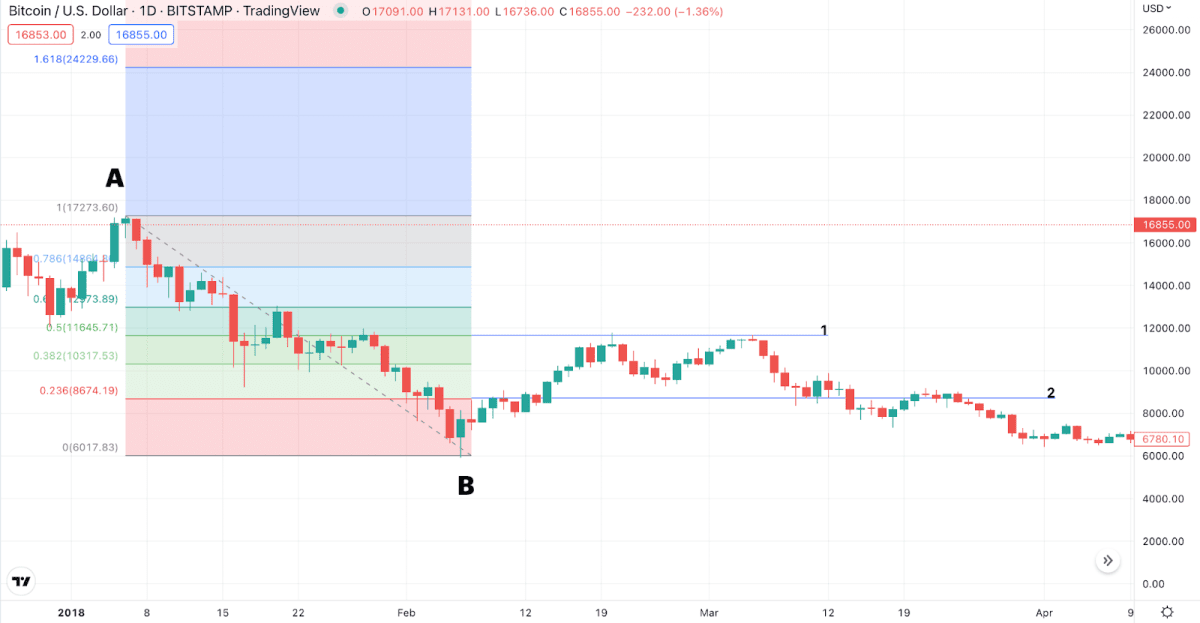

2. Moving Averages and Fibonacci Levels. Layering a Fibonacci grid onto moving averages assists in pinpointing potential trade objectives and reversal zones after corrections.

Fibonacci grid on bitcoin chart. Source: Tradingview

3. Combining Moving Averages and Candlestick Patterns. Pairing candlestick pattern analysis with moving averages helps traders avoid entering the market too early, reducing the risk of financial losses.

A blend of different indicators can weed out false signals and improve the chances of making successful trades. Still, no combination is foolproof. Ensure to use stop-loss orders and keep a close eye on whether the market's risk levels are acceptable.

How to Determine the Right Period for Moving Averages?

A critical aspect of employing moving averages is selecting the optimal period (e.g., a 5-day moving average that uses the last 5 days’ closing prices may not be effective for intraday trading).

Several factors play a role in this decision:

- Nature of the Asset. For highly volatile assets, such as cryptocurrencies, shorter periods are often needed to react swiftly to market changes. For assets with lower volatility, like gold or stock indices, longer periods may be more suitable.

- Chart Timeframe Compatibility. The chosen period should fit the chart’s timeframe. Longer periods tend to provide more valuable insights on daily charts, while shorter ones may be more effective on hourly charts.

- Investment Strategy. When your goal is to identify trends for long-term investments, longer moving average periods are preferable.

Benefits of multi-timeframe analysis include:

- Greater signal accuracy;

- Lower likelihood of false signals;

- Enhanced understanding of market behavior.

Selecting an appropriate timeframe is vital when using moving averages. Explore different periods to find the most suitable one for your trading style. Backtest combinations with historical data to assess their reliability.

Market conditions should always be taken into account. Short-term periods (lasting from minutes to an hour) are effective in highly volatile markets, as they adapt quickly to sudden changes. However, these can sometimes produce false signals during rapid market movements.

For sideways trends, longer moving averages (daily and above) are more suitable.

Bear in mind, technical analysis is reactive—it follows price trends but doesn’t forecast them. To make well-rounded trading decisions, consider integrating fundamental analysis, breaking news, and the prevailing social mood.

Recommended