Trading volume: a key indicator of DEX reliability

Many market participants prefer to use decentralized exchanges to avoid relying on intermediaries and to store their cryptocurrency independently. One method for selecting a trustworthy platform is to examine its volumes.

Trading volume is a key indicator of DEX reliability.

DEXs, also known as Decentralized Exchanges, are blockchain-based trading platforms for digital assets. The benefits of decentralized exchanges include the ability to exchange cryptocurrencies between users directly, without the use of intermediaries, through their smart contracts.

It is best to use an exchange with a high trading volume. This indicator shows that a large number of users are confident, providing good liquidity with their trades. To begin with, it enables you to purchase cryptocurrency without experiencing significant price changes. Furthermore, the presence of high volumes indicates that a diverse range of assets is represented on the exchange, providing users with more options.

Therefore, if a platform has a low trading volume, this may point to its unpopularity or a small selection of trading assets. Furthermore, low volume indicates low exchange liquidity, making it more difficult for a trader to buy or sell a large amount of an asset without significantly affecting the market price.

To calculate volume indicators, you simply add up the volume of all "contracts" over a specific period of time.

Since there are buyers and sellers in the market, a contract is created when one buys from the other.

If market participants traded apples, the volume would be determined by the number of apples bought and sold.

For instance, the seller places five apples up for sale, and a buyer shows up and purchases five apples. A contract is formed between them, and the volume will be equal to 5 apples.

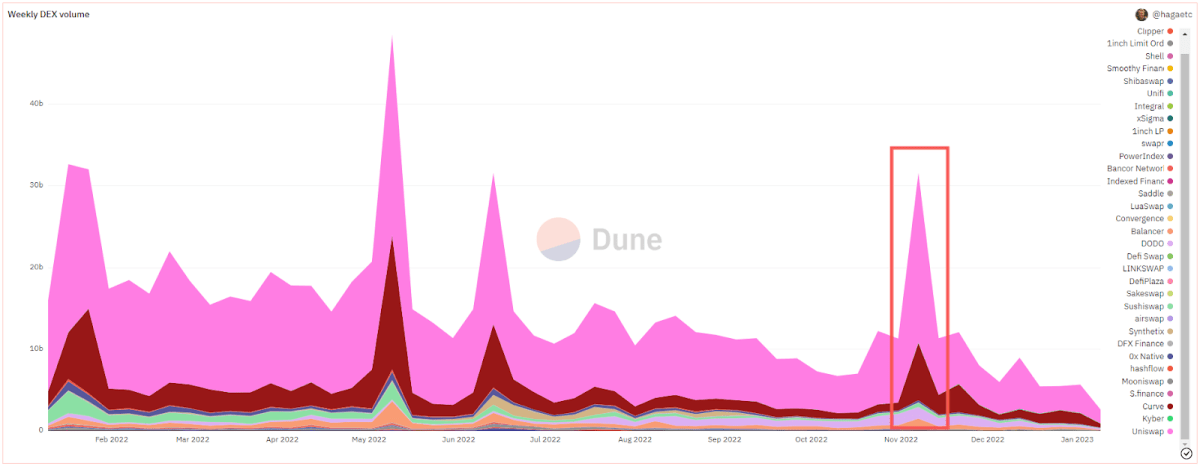

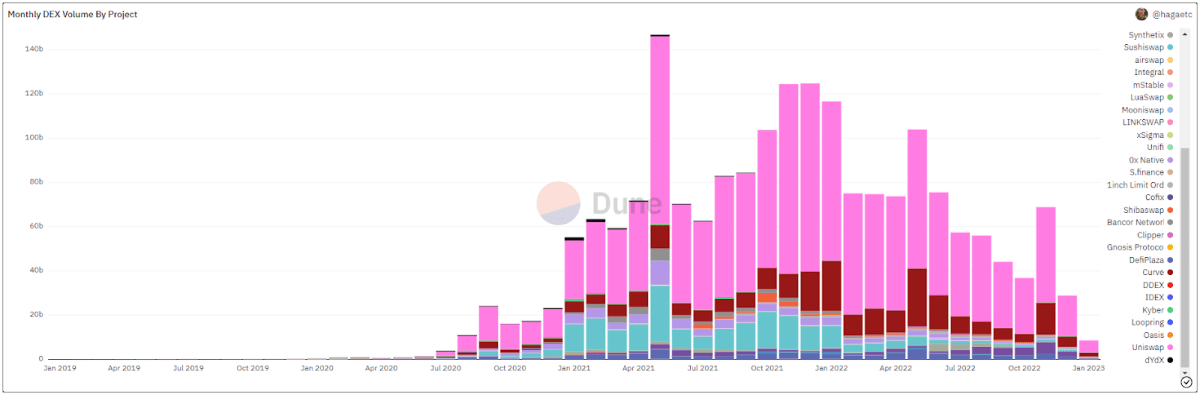

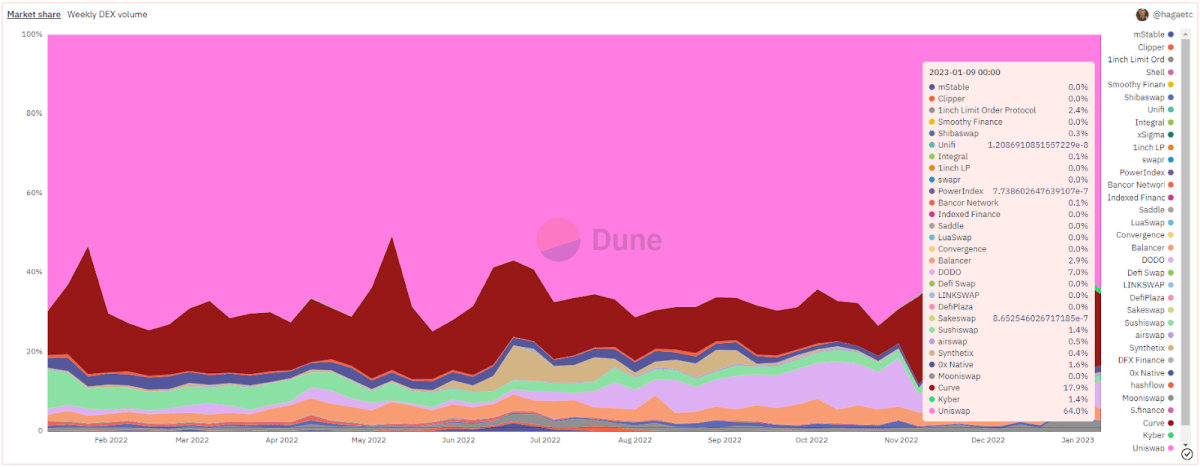

Of course, the volume may vary depending on market cycles or collapses in the cryptocurrency market. During the FTX crash, for example, volumes on the DEX nearly doubled. They totaled $65 billion in November, a 93% increase over the previous month. This is explained by the fact that the collapse of the largest centralized exchange raised investors’ concerns about the security of their assets. As a result, they began to shift in large numbers to decentralized platforms that allowed them to store their keys independently.

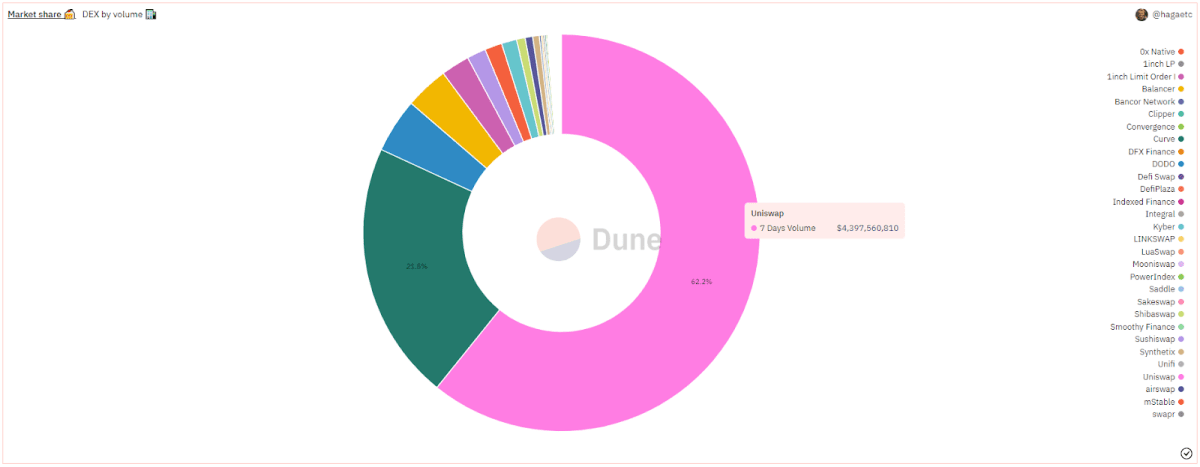

The leader in terms of volume among decentralized exchanges is Uniswap, Curve is in second place, and Dodo is in third (according to Dune Analytics).

For a long time, Uniswap has held a dominant position, with a market share far exceeding that of other platforms.

The year 2022 was not an exception, with Uniswap holding steady throughout the year. At the same time, the company is actively developing the ecosystem and attracting new investments, allowing it to become the largest decentralized platform.

As a final point, we would like to emphasize that there are many different aspects to consider when evaluating an exchange. Other metrics, like security, fees, and overall user experience, can offer insightful data about the platform.

In spite of this, crypto traders who value anonymity and decentralization frequently choose DEXs. And many enthusiasts believe that DEX is the next trend in the crypto industry.

Recommended