USDC: Circle has released a new annual report.

The digital dollar is driving the next evolution of money, payments, and finance. Thus begins Circle's annual report on USDC stablecoin.

Circle is a global financial company launched in 2013 as a platform that allows businesses and customers to use digital currencies to make payments worldwide. Circle is now a leading cryptocurrency-focused financial technology company, and its USDC token is the world's leading regulated stablecoin that continues to snowball into new markets.

Since our founding, Circle has been animated by the idea that a new global economic system could be built on an internet-native foundation – open, global and interoperable public internet infrastructure for the storage and transmission of valueJeremy Allaire, CEO of Circle.

USDC reserve

Circle manages the USD assets that back the stablecoin. The company has redeemed more than $213 billion worth of USDC since its launch. In 2022, it confirmed its solvency with stress tests within the industry when users massively exchanged tokens for USD.

USDC collateral consists of two parts:

1) 80% of the reserves are held in 3-month US Treasury bonds. These are the most liquid and price-stable assets in the world. By February 2023, the company promises to transfer them to the Circle reserve fund managed by BlackRock.

2) The remaining 20% is held in cash across eight regulated US partner banks.

All reserves are held in segregated accounts, separate from Circle's operations, and, under US law, are not transferable to creditors in the event of the company's bankruptcy.

USDC regulation and audit

Circle operates under US licenses and is registered with the US Department of Treasury. The company complies with KYC, anti-terrorist financing, money laundering requirements, including compliance with US sanctions. In addition, it has licenses in the UK, Bermuda, and preliminary approval from Singapore.

Every month, Circle receives a public certificate of reserves and monthly attestations from Grant Thornton, an accounting and auditing firm, publicly reporting the results to the US Securities and Exchange Commission (SEC). From this time on, Circle and USDC reserves will be audited by Deloitte, a Big Four audit firm.

As regulations evolve, Circle intends to adjust its policies to increase transparency in its operations. After all, every year, stablecoins cause more and more discussions in the field of public policy. The main explanation is that stablecoins rapidly develop while being firmly connected to the real economy, people, and finances.

USDC use cases

The current market cap of USDC is 45 billion dollars. The company notes that they achieved these results thanks to close cooperation with the community, developers, and innovators in digital currencies. Over the years, there has been an increase in the quality of the token ecosystem:

1) USDC is officially available on eight blockchains with different features: Ethereum, Algorand, Avalanche, Flow, Hedera, Solana, Stellar, and Tron. The token is also the dominant digital dollar on other blockchains that use wrapped tokens (a copy of the cryptocurrency pegged to the value of the original token).

2) Cryptocurrency wallets (Trust Wallet, MetaMask, Trezor, etc.) actively support USDC, enabling people from more than 190 countries to use the token for commerce or savings.

Currently, 15% of USDC transactions are wallet-to-wallet transfers, which Circle qualifies as payment transactions due to their similarity to commercial transfers. This percentage is quite high, especially compared to 2% in traditional financial systems, and suggests that USDC already has a significant amount of genuine economic transactions.

3) More than 200 protocols have integrated USDC, making it possible to use the stablecoin for charity, lending, buying NFTs, and blockchain gaming.

4) Circle has a strategic partnership with Robinhood, while Stripe and Twitter support payouts with USDC to content creators. In traditional commerce, Circle has partnered with Checkout, Mastercard, Visa, and Worldpay.

In addition to partnering with other companies, Circle released products and services for developers:

1) A fully functional set of Web3 services. This will allow developers to reduce costs, risks, and complexity in developing smart contracts.

2) Protocol for transferring data between blockchains (it will help to create a seamless bridge for USDC transactions).

3) Support for Apple Pay, allowing customers to quickly pay for purchases from smartphones in blockchain projects. Payment is made in USDC.

The Circle Impact program was created to improve three key areas of focus: the development of financial literacy, the cultivation of financial inclusion, and the provision of humanitarian assistance. Under this program, the company organized assistance to Ukrainians in cooperation with MoneyGram, allowing internally displaced persons to receive help from the UN and cash it in 4,500 different points throughout Ukraine.

Circle is a lucrative partner because the company makes cheap, fast, and corruption-resistant payments available to organizations like the UN, helping them better track payments and ensure that funds reach recipients. According to various estimates, USDC saves an average of 2% on each donation.

Circle remains committed to creating a global and open financial system and expanding USDC opportunities in the future as it sees great potential for the digital dollar.

USDC prospects

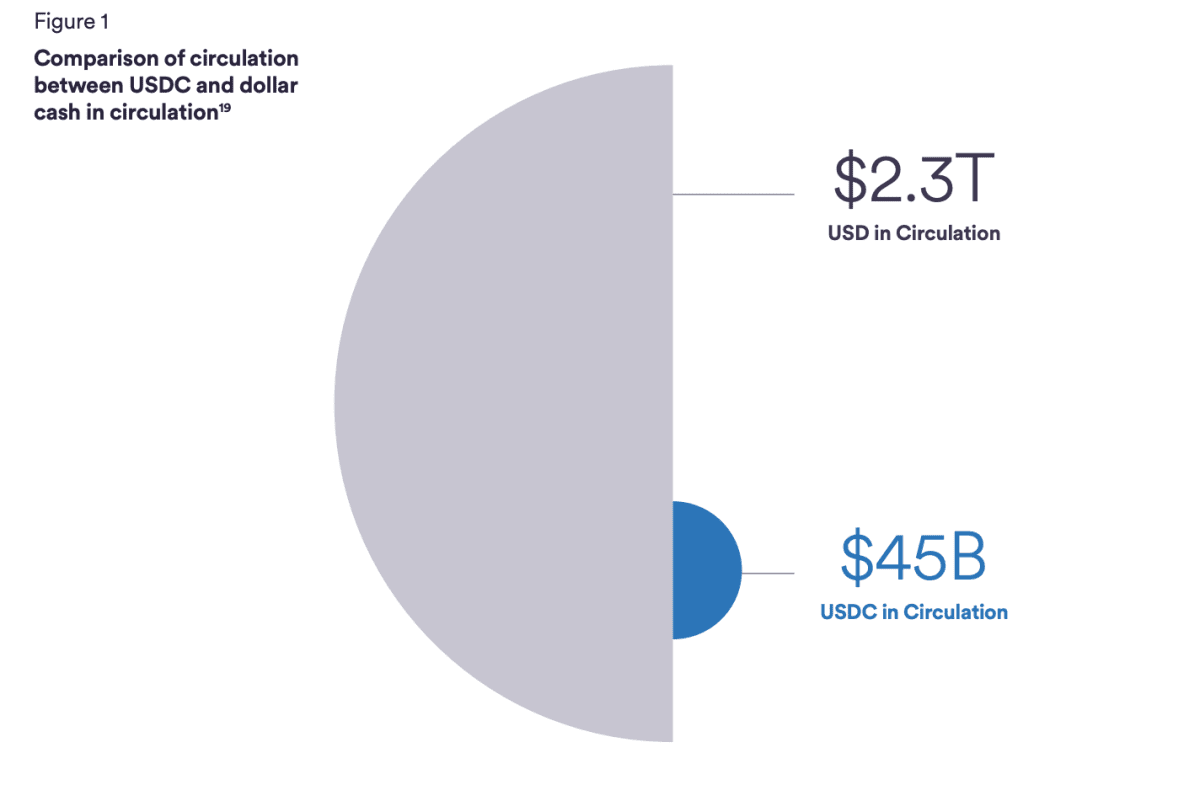

USDC’s circulation is significant ($45 billion), but compared to the total circulation of "physical" US dollars, which is about 2.3 trillion, the potential remains enormous. USDC circulation growth averages more than 860% per year. During the same time, the number of "physical" dollars worldwide increased by 8%.

Circle highlights the main reasons why USDC’s circulation will increase:

1) The rise of e-commerce and payments. E-commerce accounts for 21% of retail sales but is expected to grow to 26% by 2026. Merchants are also seeing the trend, with over 85% expecting digital currency payments to become ubiquitous in the next 5 years.

2) Problems of cross-border payments and money transfers: high fees and low speed. Tokenized currencies such as USDC solve these problems.

3) USDC is programmable money. In 2022, over $2.7 billion, or about 60% of transactions on Ethereum, were related to smart contracts. A high percentage indicates the use of USDC in new financial applications focused on innovation, security, and efficiency using blockchain technology.

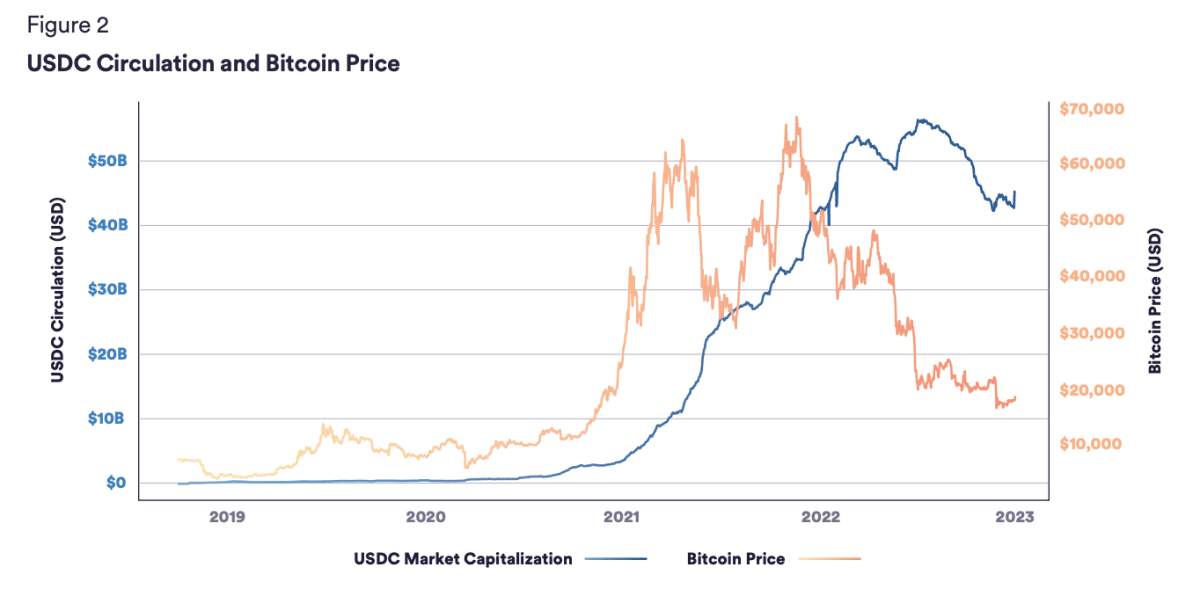

4) USDC is a non-speculative asset. USDC capitalization does not depend much on fluctuations in other crypto prices.

Although stablecoins are something new and unknown to most people, the trend is evident. In the coming years, people will increasingly use digital currencies on open blockchains, and USDC will play a larger role in the global economy.

Recommended