USDT: the largest stablecoin by market cap

USDT is the main stablecoin of Tether company, which is pegged to the value of the US dollar. The price of one USDT is always equal to $1 if historical small corrections up to $0.99–0.92 are ignored.

The digital currency is designed as a centralized stablecoin that protects crypto investors from volatility. USDT's main competitors are other large-capitalization stablecoins that are correlated with the US dollar. USDC and BUSD are two examples.

The Mastercoin (Omni) protocol, which was created in 2012 as a Layer-2 solution for the Bitcoin blockchain, served as a necessary condition for the establishment of the company Tether. Tether was later created by Mastercoin co-founders such as Brock Pierce, Craig Sellars, and Reeve Collins. They launched the first dollar-pegged cryptocurrency called Realcoin in 2014. Later, the stablecoin's name was changed to USTether and then to USDT.

Tether's home page.

Stablecoin was initially launched on the Bitcoin network via the Omni protocol, and then as an ERC-20 token on the Ethereum blockchain. USDT is also supported by platforms such as Algorand, Avalanche, Bitcoin Cash, EOS, Liquid Network, Polygon, Tezos, Tron, Solana, and Statemine. Their services include stablecoin issuance and redemption.

Jean-Louis (JL) Van Der Velde is currently serving as CEO of Tether. Tether is managed by iFinex Inc., a Hong Kong-based financial conglomerate that also owns the Bitfinex cryptocurrency exchange.

Basics of USDT tokenomics:

Basics of USDT tokenomics:

- Market capitalization: $67.8 billion (3rd place in the CoinMarketCap cryptocurrency rating);

- Circulating supply: $67.8 billion;

- USDT tokens don't have a maximum supply limit;

- The total supply: $73.1 billion.

Tether also issues stablecoins like EURT, MXNT, GBPT, and CNHT in addition to USDT. The company also provides a gold-backed XAUt token, with each token pegged to the price of one troy ounce of gold.

What backs Tether tokens' value?

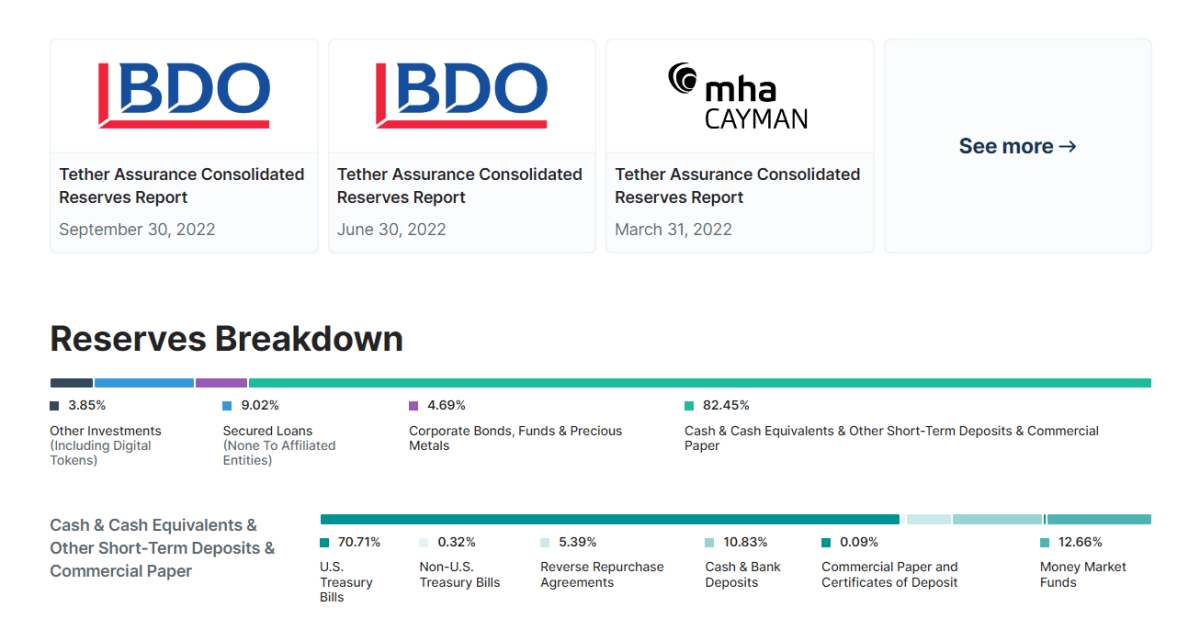

Tether reserves were confirmed for the second time in September 2022 by the independent audit firm BDO. The reserves are distributed in the following manner:

- 82.45% is in cash and its equivalents, short-term deposits, and commercial papers of which, 70% is in treasuries.

- 9.02% is secured loans.

- 4.69% is corporate funds, bonds, and precious metals.

- 3.85% is in other investments, including cryptocurrencies.

Tether's Reporting and Reserves section.

Benefits of using USDT

USDT is one of the methods of hedging and insuring against volatility on cryptocurrency exchanges. Therefore, a huge proportion of BTC trading is paired with USDT, as it is convenient, protects against market volatility, and has low commissions. Furthermore, the stablecoin serves as a safe haven for residents of countries where the national currency is devaluing. All of this enables USDT to be the best stablecoin. A stablecoin, in general, acts as a tightrope between traditional and digital currencies.

What problems did the company face?

Tether is a controversial player in the market. Many users and regulators have doubts that the digital currency will be adequately backed, even after Tether partnered with independent auditor BDO and raised the level of dollar reserves. However, others see it as FUD and do not succumb to provocations.

Essentially, the difficulties stem from the lack of a comprehensive audit, regulation, and state control that could provide any guarantees.

Despite the company's claims of 100% security, the stablecoin Tether was not even 80% backed by reserves until 2022. As a result in October 2021, the US Commodity Futures Trading Commission ordered the company to pay a $42.5 million financial penalty for making a false statement.

The New York Attorney General's Office filed a lawsuit against iFinex in 2019. The parent company of Tether has been accused of using reserves to cover $850 million in losses that the Bitfinex exchange "granted" to payment system Crypto Capital. As a result, iFinex paid an $18.5 million fine to the New York State Attorney General without pleading guilty.

Recommended