Use of bots in the crypto industry

The use of software bots to automate certain routine activities is gaining momentum. Bots are currently replacing humans in many ways and areas. Let's look at how bots are used in the cryptocurrency industry.

When it comes to bots, every trader immediately remembers trading crypto assets on exchanges or how robots have radically reformatted this area over the past few years. Five or six years ago, when analyzing DOM ask and bid orders, it was possible to accurately identify single orders placed by bots. Today the situation is entirely opposite. Now trading bots are so dominant in the market that it is difficult to find orders created by people in order books.

Over time, when the development of the crypto industry began to gain momentum, bots began to be developed not only for trading but also for other areas, such as the development of the crypto community, loyalty programs, education, etc. So far, trading bots continue to dominate and remain the most massive product. But this trend is gradually fading away.

Classic trading bots

Traders can’t trade without sleep and rest. In addition, they have families, businesses, and personal affairs, while remaining outside the market for a while. That is why creating automated services for trading crypto assets was only a matter of time.

Trading bots can work non-stop, 24/7. While working, they consider many conditions, parameters, triggers, and various price ranges for opening or closing positions. The speed of placing orders can reach tens of operations per second. Of course, a person cannot efficiently compete with robots, given such superhuman performance. Bots used for trading can take into account the trading system and strategy that the trader determines and lays down, considering the market situation and personal preferences. Based on AI, trading bots only improve results over time, considering errors in new transactions and statistics of previous transactions. Some investment and hedge funds have switched to algorithmic trading using trading bots.

Now the popularity of trading robots has reached such a level that every centralized exchange offers them as a regular service. A few years ago, there was a handful of such CEX exchanges, but now it has become the standard. The number of trading bots on the market is steadily approaching 4 million. We have already covered the top five trading bots for scalping.

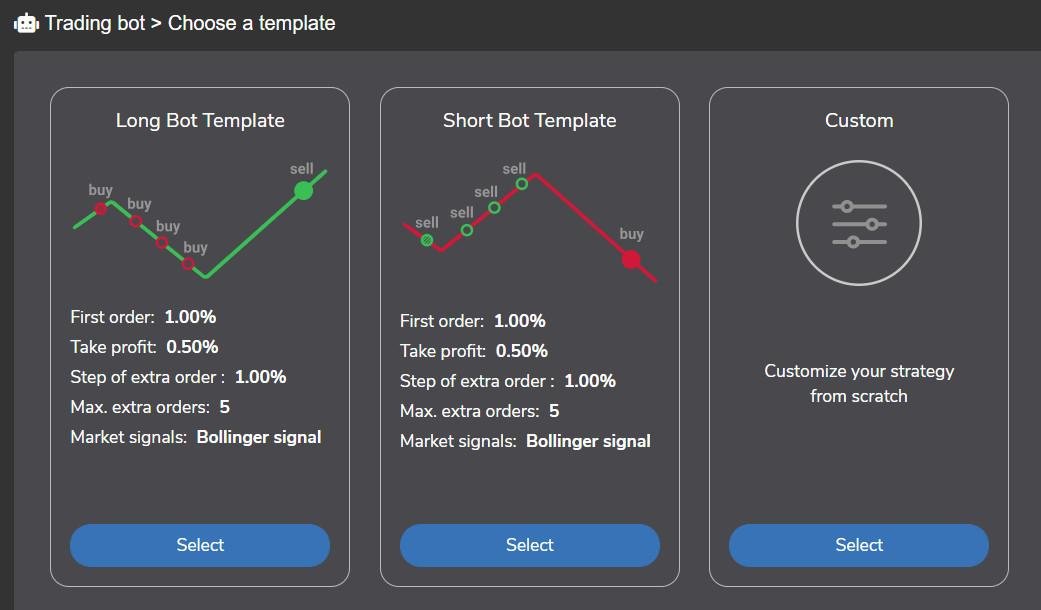

Choosing a template and strategy in the process of creating a bot

Arbitrage bots

The arbitrage bot is programmed to compare the value of a selected asset (or assets portfolio) while simultaneously monitoring many trading platforms and markets. It functions to implement a simple strategy – buy low and sell high. Profit appears on the exchange rate difference minus commission expenses. Using such a bot, its owner can take advantage of automated arbitrage for specific tokens or a portfolio of assets without wasting time on manual monitoring and comparison. All routine work is performed by the arbitrage bot.

Cryptocurrency lending bots

These bots provide passive income, allowing you to earn money by lending coins to margin traders at interest for trading with leverage. This type of robot is the safest and guarantees a stable, predictable, although not very significant, profit.

Market making bots

This is another subspecies of a trading bot that actively closes deals within the spread, bringing more profit. Market making bots are configured to sell assets at the asking price and buy at the bidding price.

Market making bots add orders to both order books, creating artificial liquidity. If competing offers appear in the order books, then such orders are instantly redeemed, after which the robot continues its work. Market making bots place multiple buy and sell orders in a grid pattern for quick profits. For example, if a particular asset is trading at $1, the bot will create a buy order at $0.99 and a sell order at $1.01. If both orders are executed, the bot owner will receive a profit of $0.02.

Airdrop bots

Such a bot is an excellent solution for expanding any crypto community. This applies both to a separate crypto project, coin, or token and to the whole ecosystem. Airdrop bot allows you to reward the community's most active members with a particular amount of cryptocurrencies using the addresses of custodial wallets. The distribution of remuneration can be addressed to a specific individual and a group of participants. Financial motivation can be implemented for any significant activity that helps to make the project more massive and popular, for example, the creation of advertising, content, a new service, or dApp. After the launch of an airdrop bot, the community, in most cases, increases significantly, and its members become more active, motivated, and loyal.

Poll/vote bots

A bot of this format allows you to vote for any initiative or proposal and provide the results of the vote. In fact, such a service has long become popular in the chatbot format but was mainly used unofficially. So far, several DAOs (decentralized autonomous organizations) are considering migrating the voting procedure from official forums to such a bot. Some projects are only being looked at, and some are already being tested.

Educational bots

Instead of spending a lot of time sitting over FAQs or reading lengthy manuals, an educational bot is a more effective tool for organizing the learning process for newbies or discovering a new topic. Advanced keyword bots provide all the information of interest, explain the meaning of a slang word or stock term, and are also capable of conducting full-fledged training and knowledge testing.

Recommended